Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum AM's views on the economy, strategy and markets.

The CIO letter

The Fed vs. The Rest of the World

The Fed is undoubtedly the only institution capable of operating independently of decisions made by other monetary authorities. Consequently, the easing of the federal funds rate to 3.75%, bolstered by the announcement of $40 billion in monthly T-bill purchases, is expected to continue toward 3% due to the deterioration of the labor market. In contrast, several central banks, notably the Reserve Bank of Australia (RBA), appear to be considering a tightening stance. The Bank of Japan (BoJ) is finally acknowledging the weakness of the yen, while even the European Central Bank (ECB), through the voice of Isabel Schnabel, cou discussing a potential interest rate hike in 2026. The Fed's projected growth rate of 2.3% for 2026 seems to reflect an optimism that contradicts its monetary policy. Numerous sources of fragility exist within an economy primarily driven by AI, and according to our scenario, growth will likely remain below its potential. In the Eurozone, economic activity is finishing the year on a positive note. The recovery is set to continue into 2026, supported by public investments in Germany and sustained activity in the Iberian Peninsula. China is implementing an ambitious strategy to reduce overcapacity, which will limit growth to 4.5% next year.

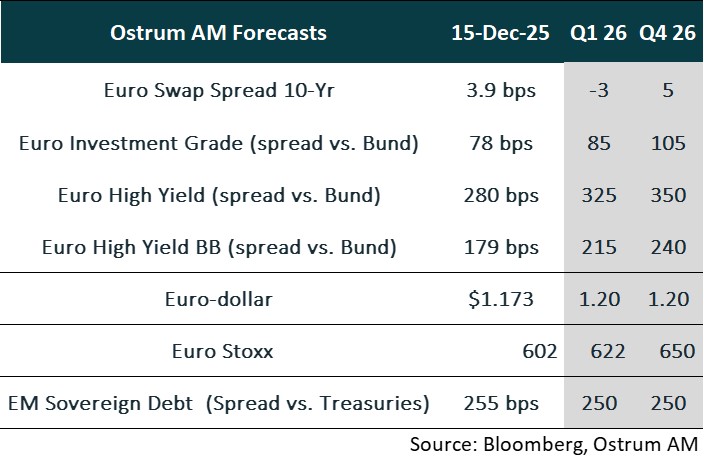

Despite concerns regarding the valuation levels of equities and spreads, the environment is expected to remain favorable for risk assets. The adjustment of the dollar in response to the Fed's rate cuts will support risk assets. Governments will aim to ease issuance on long maturities. A stabilization of the Bund at around 2.90% by March will facilitate a tightening of sovereign spreads, while the T-note is expected to hover around 4.10%. In the credit market, a moderate widening of spreads is anticipated, and European equities are expected to rise by 3% in the first quarter and by 9% over the entire year.

Economic Views

THREE THEMES FOR THE MARKETS

-

Growth

U.S. economic activity reveals two contrasting dynamics. The labor market indicates a significant slowdown, contrasted by the robust investment fueled by the artificial intelligence sector. Eurozone growth showed resilience in Q3 at 0.3% quarter-on-quarter, following a mere 0.1% in Q2. PMI surveys for November suggest a gradual recovery in European growth. In China, surveys point to a slowdown in activity linked to domestic demand. However, exports remain strong despite ongoing trade tensions.

-

Inflation

In the U.S., consumer inflation expectations remain above the Fed's target. Price components in both PMI and service surveys also remain elevated. The Consumer Price Index (CPI) is projected to hover around 3% in Q1 before easing due to a slowdown in rental costs. In the Eurozone, inflation is close to the ECB's target, standing at 2.2% in November. Consumer prices have decelerated to below 1% year-on-year in France, while remaining firmer in Spain at 3% year-on-year. In China, inflation continued to rise in November, reaching 0.7%, primarily driven by increasing food prices.

-

Monetary policy

The Fed has lowered its rates by 25 bps to a range of 3.5% to 3.75%, indicating that future decisions will depend on economic data. The Fed also announced the resumption of T-bill purchases at a rate of $40 billion per month, just twelve days after concluding its QT. The ECB is expected to maintain the status quo at 2% until the end of 2026, confident in achieving its medium-term inflation target of 2%. The PBoC will maintain an accommodative bias throughout 2026 through its reserve requirements and key interest rates.

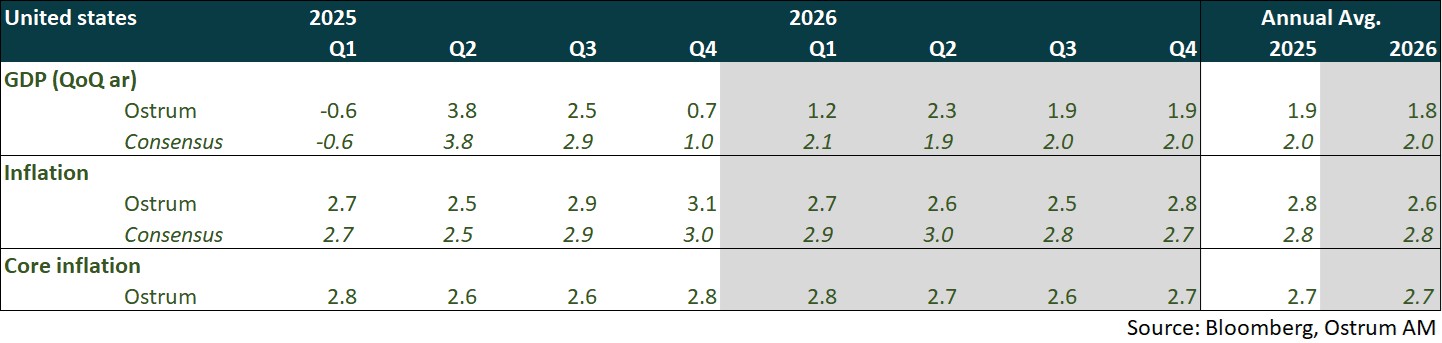

ECONOMY: UNITED STATES

Two Years Below Potential: Continued Deterioration of the Labor Market, Significant Risks to Real Estate, and Financial Bubble Threats.

- Demand: The GDP for the third quarter, which has not yet been published, is expected to exceed earlier projections due to a reduction in the trade deficit. However, the confidence shock and tariff burden will continue to weigh on household consumption and non-AI investment in the first half of 2026. Household credit quality is declining, but an increase in transfers to households could support consumption beginning in the second quarter. Housing investment will remain weak throughout 2026, while productive investment will largely be driven by AI (data centers, software, and R&D).

- Labor Market: Hiring is decreasing, and the unemployment rate is projected to remain above 4.5% in 2026, despite low participation due to constrained immigration. Job openings are trending downward, yet labor shortages persist.

- Fiscal Policy: Although the federal deficit has somewhat decreased in 2025, the situation remains concerning. The Supreme Court may rule tariffs illegal, potentially necessitating refunds of overcharges to importers. Transfers to households are likely in 2026 ahead of the mid-term elections.

- Inflation: The decline in oil prices and the reduction in rental inflation are expected to offset the impact of tariffs. However, the inertia in service prices (such as healthcare and auto insurance) will keep inflation above target in 2026.

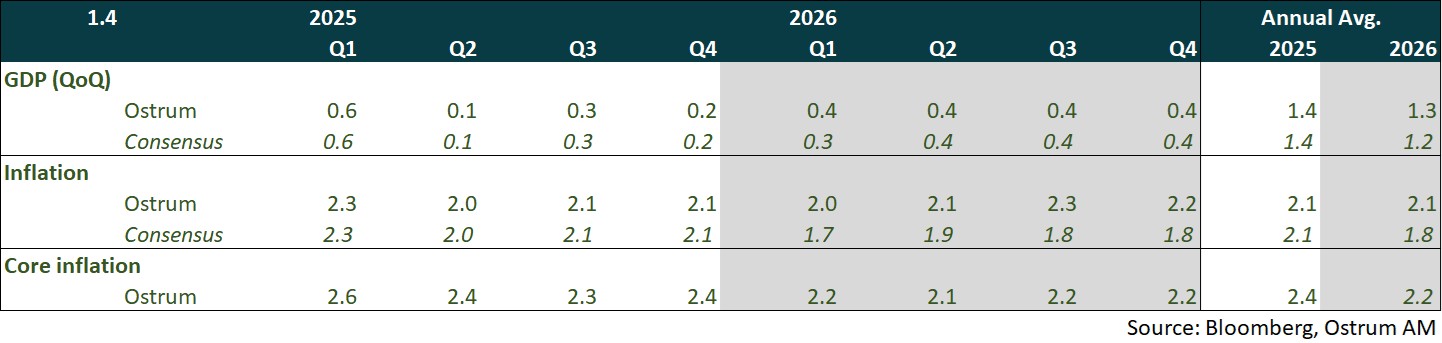

ECONOMY: EURO AREA

Strengthening of growth in 2026 driven by Germany (infrastructure plan and military spending) and continued robust growth in the peripheral countries. In France, growth will be very moderate due to the persistence of political and budgetary uncertainty.

- Domestic demand: Consumption is expected to be somewhat stronger due to gains in purchasing power (albeit more moderate) and a low unemployment rate that is likely to remain stable. Investment will be better oriented with the implementation of infrastructure and defense plans in Germany, the increase in military spending in Europe, and the payments from NextGeneration EU, primarily aimed at the peripheral countries, which will conclude at the end of 2026. In France, political uncertainty will continue to be a drag on growth (wait-and-see approach).

- External demand: The trade agreement between the eurozone and the United States, as well as the one-year truce between the United States and China, reduce uncertainty and help stabilize foreign trade.

- Fiscal policy: Germany, after years of fiscal prudence, is set to significantly increase its spending on infrastructure and defense. In France, the budget deficit is expected to remain high due to the divided National Assembly, which greatly limits the government's ability to act.

- Inflation: Inflation is expected to remain close to the ECB's target of 2%. Inflation in services is likely to moderate only gradually due to a slow adjustment of wages to inflation.

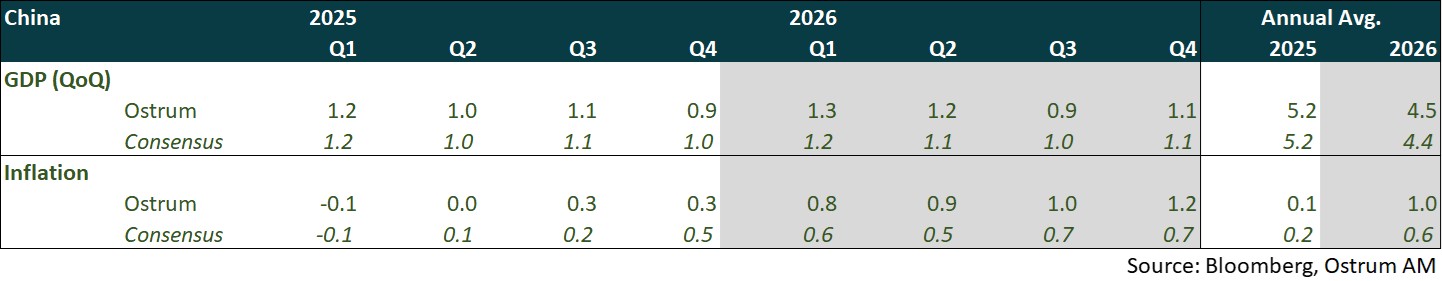

ECONOMY: CHINA

Economic activity is slowing down at the end of the year despite strong exports. The Politburo meeting on December 8 indicates an urgency to strengthen domestic demand in an increasingly hostile international environment towards China in 2026.

- Politburo Meeting and Central Economic Work Conference: The focus was placed on domestic demand, suggesting an increase in fiscal and monetary support next year.

- Net exports: Exports remain robust for November. Exports to Africa (28% year-on-year) and the EU (15% year-on-year) helped offset the decline in exports to the United States (-28% year-on-year). The trade balance has exceeded 1 trillion dollars since the beginning of the year.

- Consumption: There is a weakness in service consumption according to the official PMI and RatingDog surveys for November. The further decline in the real estate sector has weighed on household sentiment. Since November, the PBOC has been guiding the appreciation of the yuan against the dollar through its pivot rate. Is this the beginning of rebalancing Chinese growth towards consumption?...

- Investment: Investment remains sluggish, reflecting anti-involution policies and the hostile international environment towards China.

- Inflation: Inflation was at 0.7% year-on-year in November, a 21-month high, due to a rise in food prices of 0.3% year-on-year (versus -2.6% year-on-year). Inflation excluding food and energy remained at 1.2% year-on-year. The producer price index stabilized in November at -2.2% year-on-year, reflecting anti-involution policies.

Monetary Policy

Divergence between the Fed and the ECB

- The Fed is increasingly divided

On December 10, the Fed implemented its third consecutive rate cut of 25 basis points, bringing the federal funds rate down to the range of [3.50% – 3.75%]. This decision was driven by increasing downside risks to employment. While inflation risks remain tilted to the upside, the impact of tariffs is expected to be temporary. Significant divisions have emerged within the FOMC, with two voting members preferring to maintain the status quo and a third advocating for a 50 basis point cut. This member is Stephen Miran, who is aligned with Donald Trump and whose term expires at the end of January. After halting its balance sheet reduction since December 1, the Fed decided to purchase $40 billion per month in short-term securities (primarily T-bills) starting December 12, in order to maintain ample levels of bank reserves and limit tensions in the money market. Given the ongoing deterioration in the labor market and significant risks in the real estate sector, we anticipate three rate cuts in 2026.

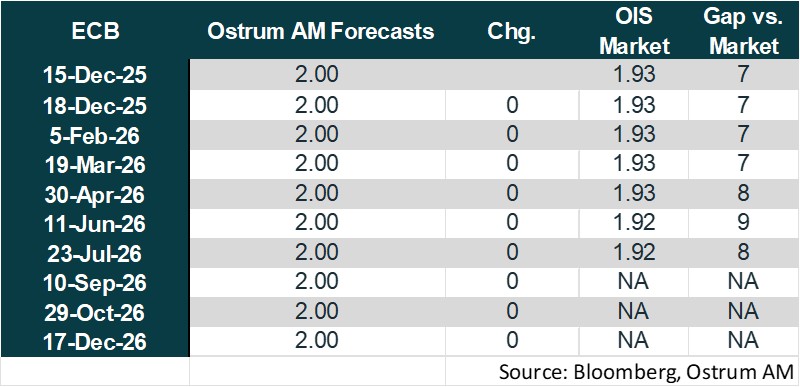

- Extended status quo of the ECB

The ECB kept its rates unchanged for the third consecutive time during the meeting on October 30. It believes it is in a comfortable position ("We are in a good place") due to resilient growth, a strong labor market, and inflation expected to remain close to the 2% target in the medium term. Downside risks to growth have diminished again following the trade agreement between the EU and the United States this summer, the ceasefire in the Middle East and the trade truce between China and the U.S. The ECB continues to emphasize that it will determine its interest rate policy on a meeting-by-meeting basis depending on the data. The balance sheet reduction continues through the non-reinvestment of maturing securities. We anticipate rates to remain unchanged until the end of 2026. A final rate cut would only occur in the event of a negative shock to growth.

Market views

- U.S. Rates: The Fed has responded to the deterioration in the labor market despite inflation remaining above target. Budgetary risk persists, but the end of quantitative tightening (QT) and the resumption of T-bill purchases are mitigating upward risks.

- European Rates: The ECB is expected to maintain the status quo at 2% until 2026. The 10-year Bund is projected to reach 2.90% by the end of Q1.

- Sovereign Spreads: Short-term political risks in France are easing, yet are expected to resurface later in the year. The trend of tightening BTP spreads is also likely to moderate throughout the year.

- Eurozone Inflation: Inflation expectations remain anchored around the 2% target.

- Euro Credit: Investment-grade credit spreads have tightened significantly, though a gradual widening is likely to occur.

- Euro High yield: Valuations in the high yield segment are expected to normalize over the year. However, the default rate remains contained and below the historical average.

- Exchange Rates: The Fed's easing and the ECB's status quo are likely to contribute to an increase in the euro towards $1.20.

- European Equities: Following a year of stagnant growth, earnings growth is projected to reach 9%. Valuation multiples are expected to remain around 16-17x.

- Emerging Debt: Emerging market spreads are likely to remain tight in the short term, thanks in part to the Fed's easing measures.