Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to podcast (in French only)

(Listen to) Axel Botte’s and Aline Goupil-Raguénès’ podcast:

- Review of the week – Financial markets;

- Theme – Markets await BoJ announcement.

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Markets anticipate a rate hike by the BoJ

- The BoJ is expected to raise its rates by 25 basis points to 0.75% this Friday, December 19, unless there is significant volatility in the financial markets following the release of U.S. employment report on December 16;

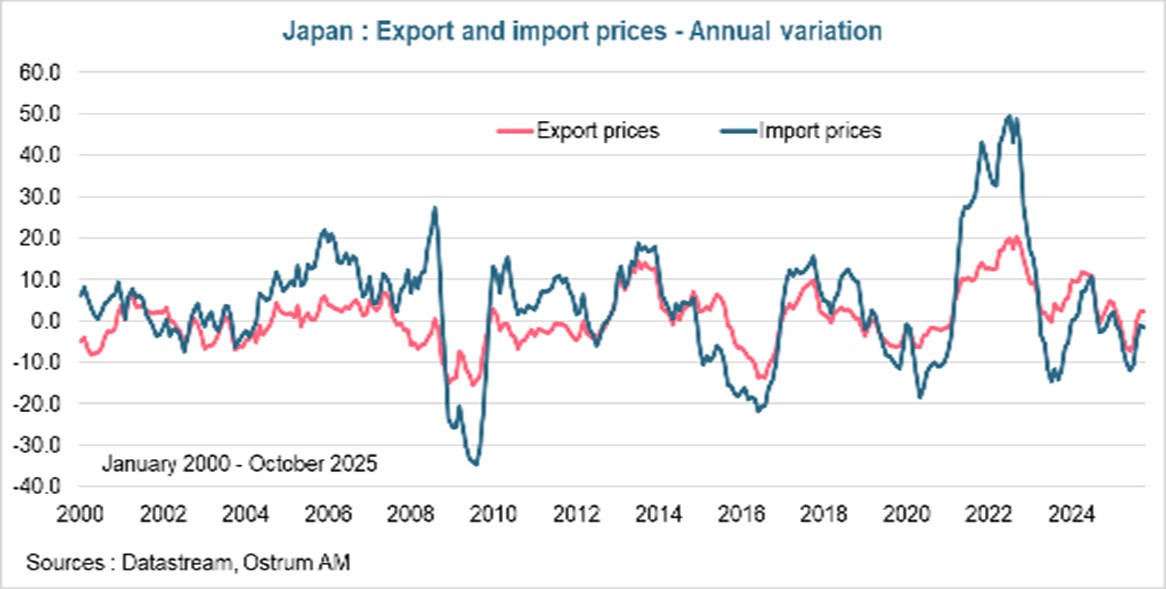

- The depreciation of the yen is a significant factor in the decision to act at this time. The rise in prices of imported goods is increasing price pressures, while inflation has been above the 2% target for the past three years;

- The BoJ will be bolstered in its decision by the results of its survey of business leaders indicating that they plan to raise wages for fiscal year 2026 at roughly the same pace as in fiscal year 2025;

- Despite this interest rate hike, monetary policy will still remain very accommodative, which should stabilize the yen, though it may not strengthen it;

- The pressures on Japanese long-term rates, particularly due to budgetary concerns related to the massive stimulus plan, could lead Japanese investors to repatriate some of their capital.

Towards an interest rate hike by the BoJ on December 19

The BoJ has almost pre-announced a rate hike on December 19.

Kazuo Ueda was very explicit on December 1, stating that the BoJ will weigh the pros and cons of an interest rate hike at its next meeting and will act accordingly. A similar statement preceded the rate hike in January 2025. Investor expectations intensified following the interview given to the Financial Times on December 9. Kazuo Ueda mentioned that the Japanese economy was resilient to the shock of U.S. tariffs and that underlying inflation would sustainably converge towards the 2% target.

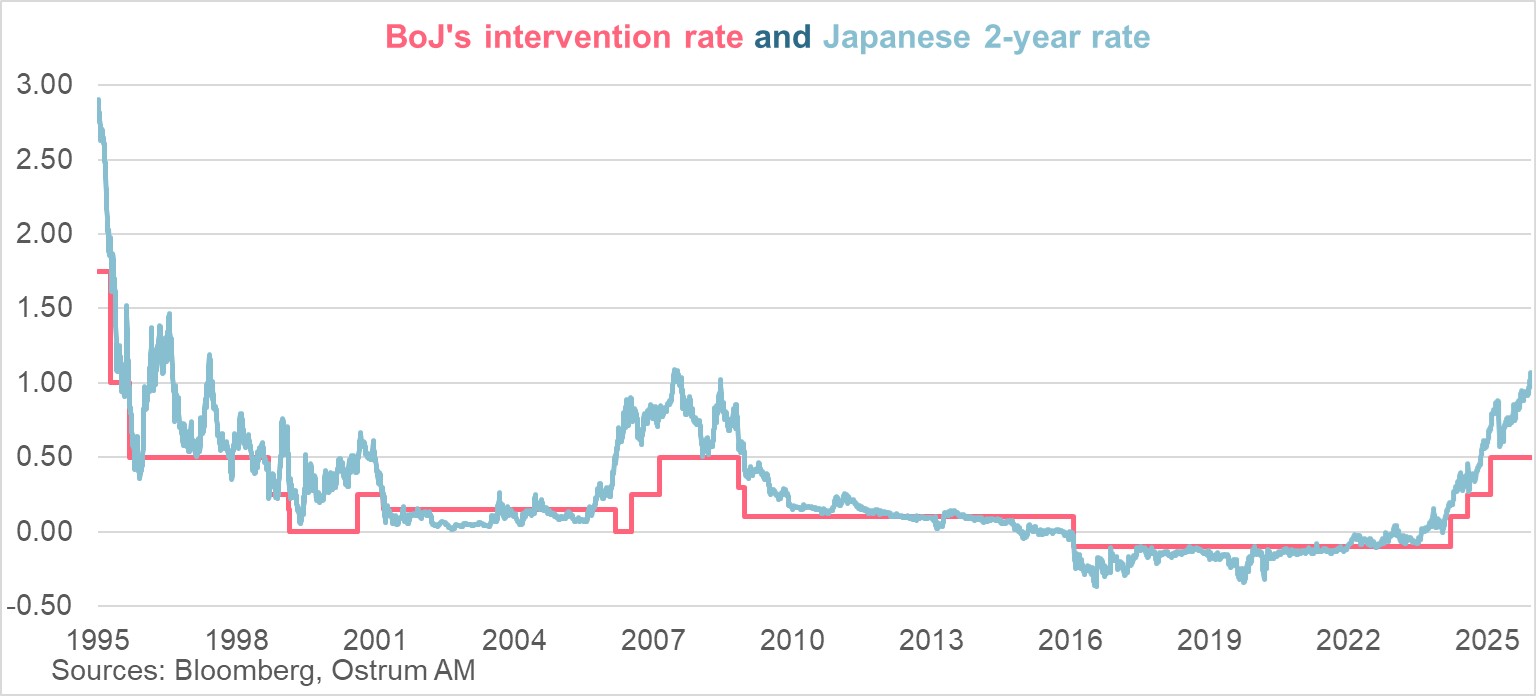

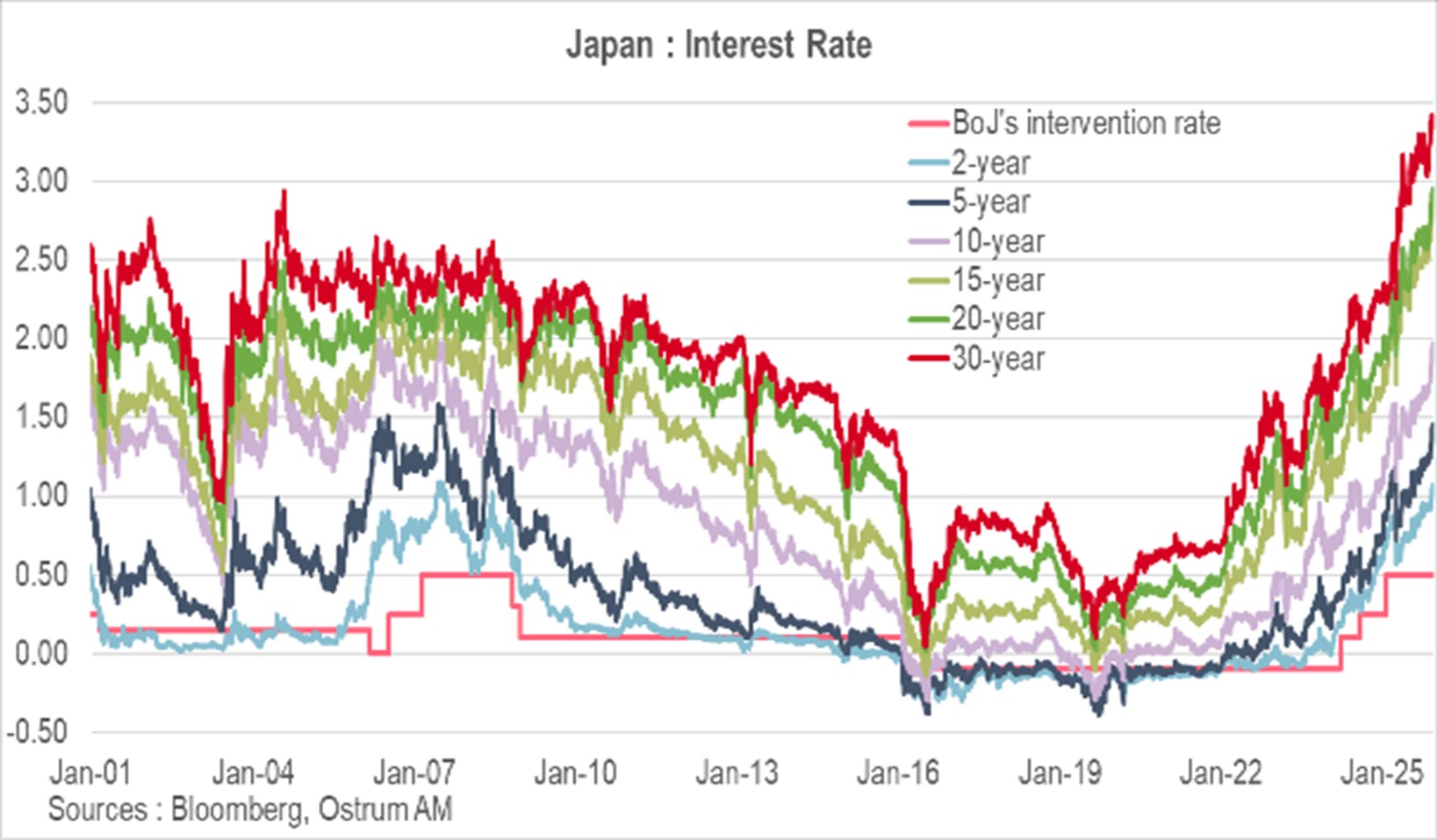

At 0.75%, the policy rate will reach its highest level in 30 years.

Markets are thus anticipating a nearly certain rate hike (97% probability) on December 19. A 25-basis point increase in the main policy rate to 0.75% would bring it to its highest level in 30 years. This outlook has generated tensions on the 2-year rate, which is more sensitive to monetary policy expectations. It has surpassed the 1% threshold, its highest level since July 2007.

Monetary policy will remain very accommodative

The normalization of monetary policy is happening very gradually.

After more than 20 years of deflation, the Bank of Japan is cautiously normalizing its monetary policy. It waited until March 19, 2024, to end its negative interest rate policy implemented in 2016, proceeding with its first-rate hike since 2007 (by 20 basis points to 0.10%). The rise in wages has made the central bank more confident in implementing a virtuous cycle between wages and prices that could lead to a sustainable return of inflation towards 2%. It subsequently raised its rates by 15 basis points on July 31, 2024, and by 25 basis points on January 24, 2025. The Bank remained on hold throughout the year due to uncertainty related to U.S. trade policy and its impact on the Japanese economy. While Japan faced the threat of reciprocal tariffs of 25% starting August 1, a trade agreement was reached, resulting in tariffs of 15% on Japanese goods exports to the United States, which, nonetheless, remains very high.

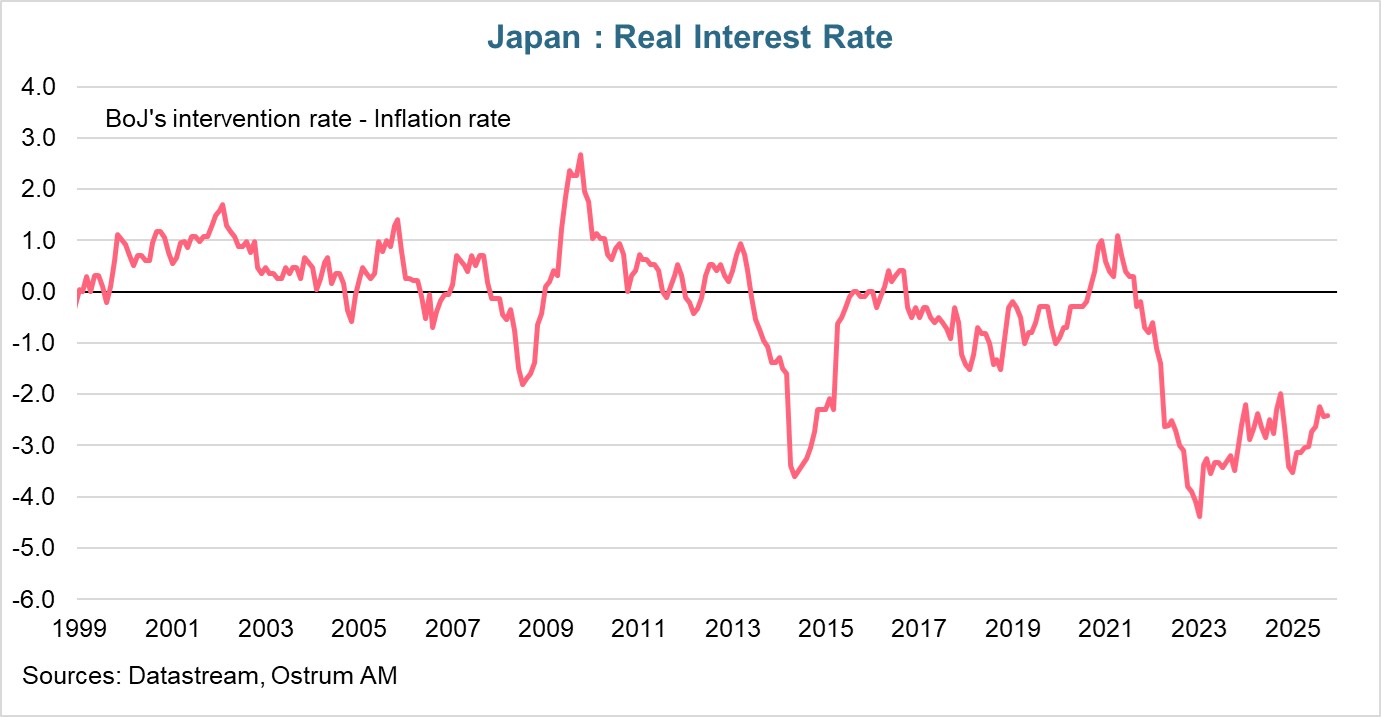

Despite the rate hike, the real interest rate will remain negative.

Despite the expected interest rate hike this week, monetary policy will remain very accommodative given the low level of real interest rates. The nominal intervention rate adjusted for inflation is negative: -2.4% in October 2025, due to an inflation rate exceeding the BoJ's target (2.9% in October). This suggests that further rate hikes from the BoJ are forthcoming to bring rates back to neutrality. In 2023, the BoJ indicated that the neutral rate was within the range of [-1%; 0.5%], which corresponds, assuming a return of inflation to 2%, to a nominal rate between [1%; 2.5%]. The BoJ is expected to reveal its new neutral rate estimates soon.

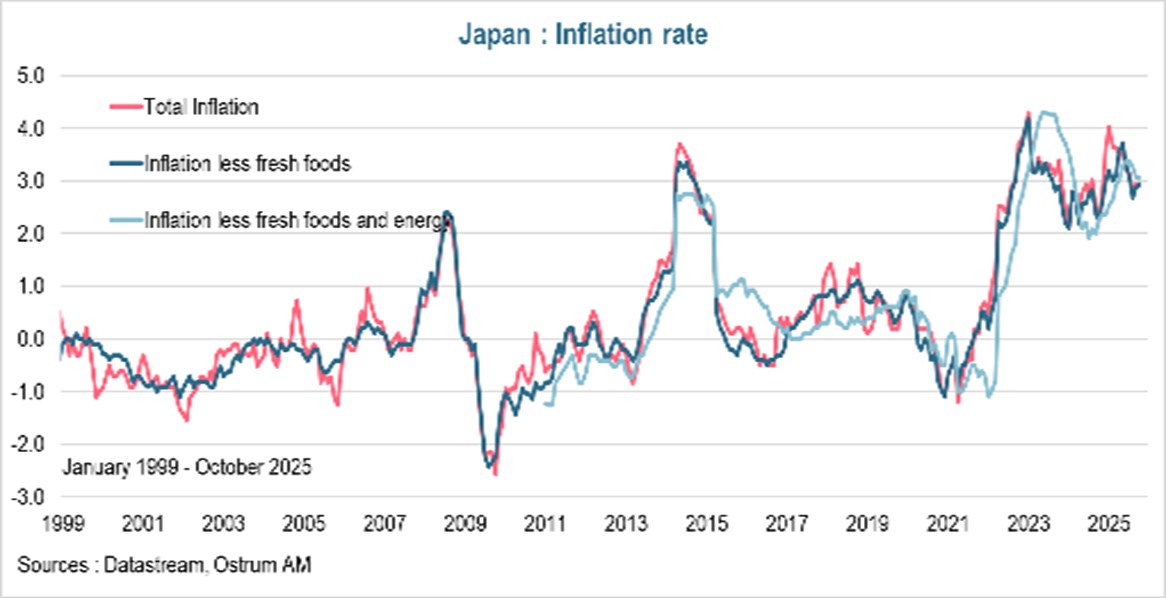

An inflation rate above the target for three years

After more than 20 years of deflation, inflation significantly accelerated in 2022 and has remained above the Bank of Japan's 2% target for the past three years. After peaking at 4.3% in January 2023 and 4% in January 2025, inflation settled at 2.9% in October 2025, with 2.9% excluding fresh food and 3.1% excluding fresh food and energy. Initially, this inflation was predominantly driven by the prices of imported goods. This was particularly reflected in the sharp increase in energy, raw material, food, and goods prices, following the strong post-COVID recovery and disruptions in supply chains. The prices of imported goods rose by nearly 50% year-on-year between June and September 2022, before sharply declining and turning negative from April 2023 onward, then stabilizing. Inflation is no longer primarily dependent on imported prices but rather on domestic factors.

Increase in wages

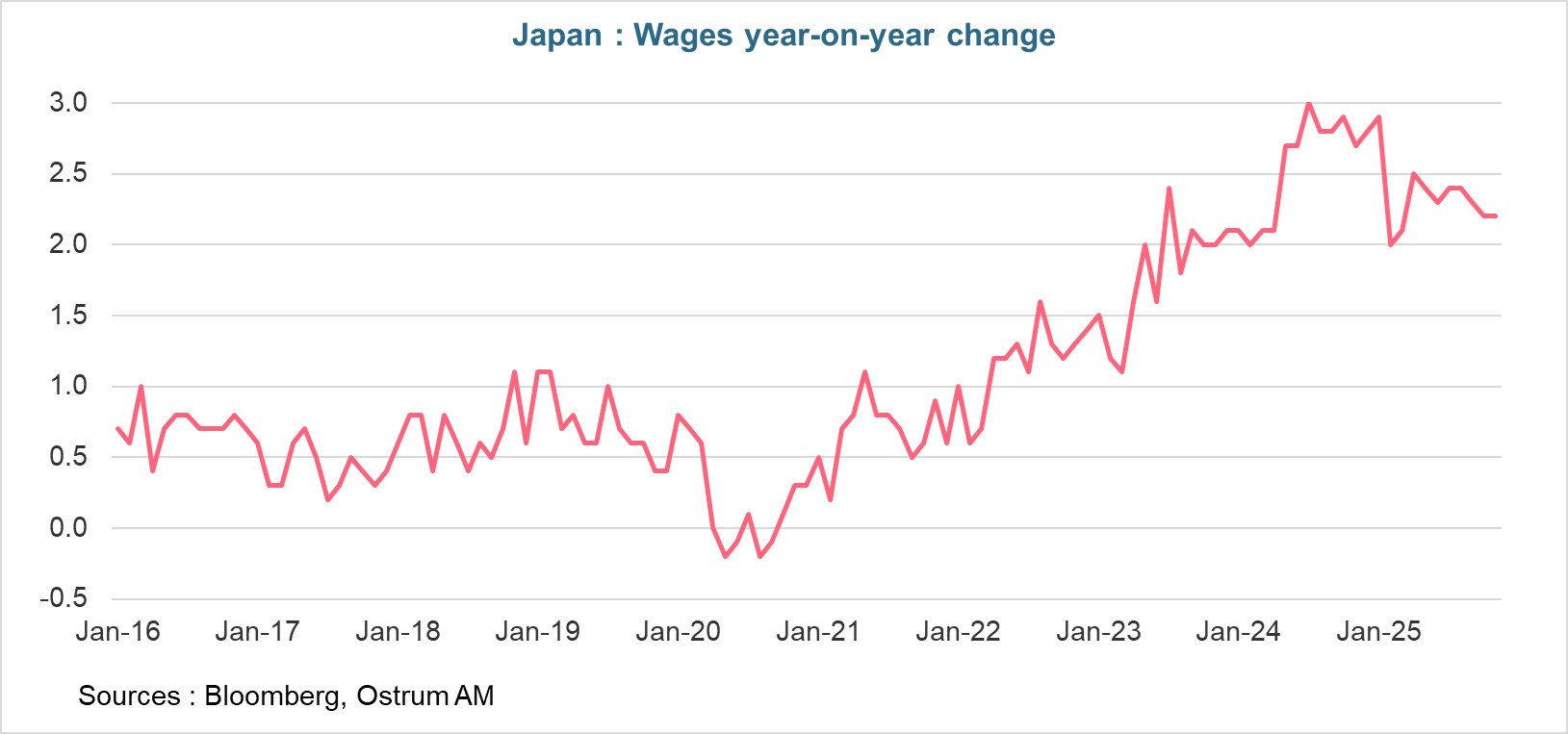

Domestic inflation is driven by the rise in wages, which experienced a shift beginning in 2023.

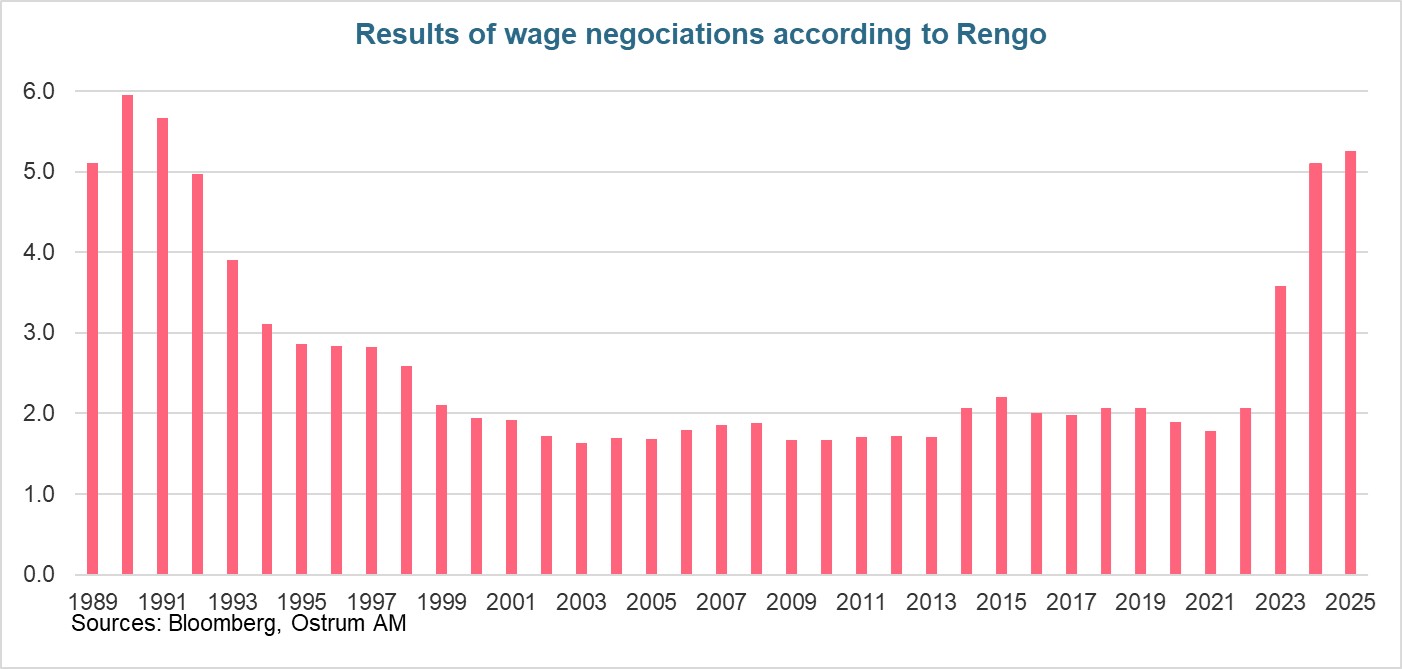

This stronger domestic inflation comes from the services sector, which is more labor-intensive and reflects the impact of wage increases. As shown in the following graph, representing the results of wage negotiations by Japan's main labor organization (Rengo), a turning point occurred in 2023. It ended 25 years of slow wage growth characteristic of the deflationary period. Wage increases averaged 1.9% per year from 1999 to 2022 (including seniority-related increases). This figure rose to 3.6% in 2023, 5.1% in 2024, and 5.25% in 2025. For 2026, the labor organization aims for a wage increase of 5% or more, similar to previous years.

Increase in profits and significant labor shortages.

After 25 years of price and wage stability, which became the norm for businesses, companies have changed their behavior. They are increasing their prices and wages without fearing a decline in their sales. The explanatory factors include a significant rise in their profits and substantial labor shortages.

The latest survey by the BoJ conducted among business leaders will reinforce its decision to raise rates this week. Companies expect to increase wages for fiscal year 2026 at roughly the same pace as this year, which bodes well for further strong wage growth.

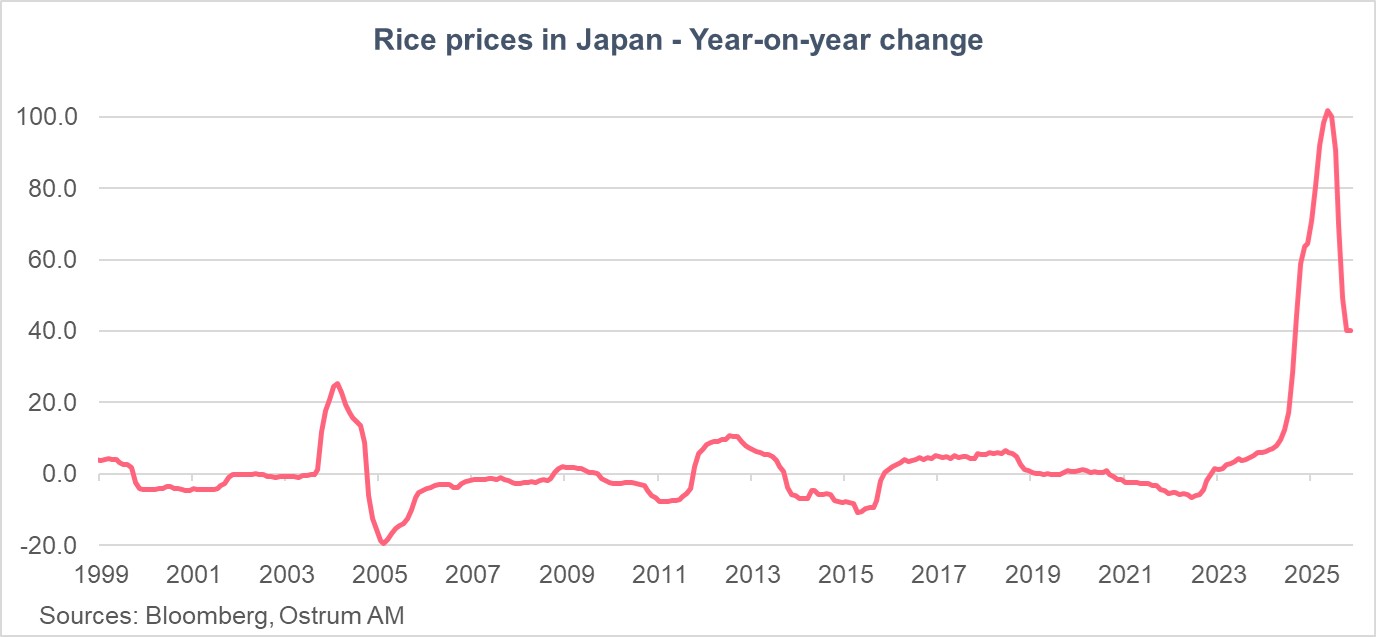

Strong rise in food prices, particularly rice

Rice prices doubled between May 2024 and May 2025 and continue to rise significantly.

Food prices have increased significantly, particularly the price of rice, which is a staple in Japan. The price of rice doubled between May 2024 and May 2025 due to poor harvests, precautionary purchases in April 2024 linked to the risk of an earthquake, and the stockpiling of rice by some traders in anticipation of continued price rises. Even the record influx of tourists is cited as a contributing factor. In February, the government released its strategic rice reserves (initially intended for natural disasters or poor yields) by auctioning them to wholesalers, and then in July, directly to major retailers. This helped slow the rise in rice prices, which, however, remains very high: +40.2% year-on-year in October 2025, contributing 0.35 percentage points to inflation. This significant increase in food prices has heavily impacted consumer confidence and was a key factor in the defeat of Shigeru Ishiba's government, which lasted barely a year.

Markets await the BoJ

Strong tensions in the bond markets

As we have seen, the prospect of a rate hike by the BoJ has generated tensions on the 2-year rate, which is more sensitive to monetary policy expectations, but also on the longer end of the yield curve, particularly on the 10- and 15-year rates. The 10-year rate is approaching the 2% level, a high not seen since 2007.

The 10-year rate is approaching 2%, a high not seen since 2007, primarily due to concerns related to the massive stimulus plan.

Long-term rates have been particularly affected by the election of the new Prime Minister, Sanae Takaichi, on October 21, followed a month later by the announcement of a vast stimulus plan amounting to 21.3 trillion yen (€118 billion), representing 3.35% of GDP, aimed primarily at helping Japanese citizens cope with inflation. The plan includes measures to mitigate the impact of rising prices on households through subsidies for electricity, city gas, and gasoline, as well as cash payments to households with children, along with medium-term investment support in fields such as AI, semiconductors, and strengthening defense capabilities. This plan will be financed through bond issuances, although the amount is expected to be lower than the 42.1 trillion yen issued for the fiscal year 2024.

The election of Sanae Takaichi and the announcement of her extensive stimulus plan have thus generated significant tensions in the long-term bond markets. The 20-year rate has reached its highest level since 1999, at 2.92%, while the 30-year rate stands at a peak of 3.37%. Despite these higher rates, recent days have seen sustained demand for long-maturity issuances.

Weakness of the yen

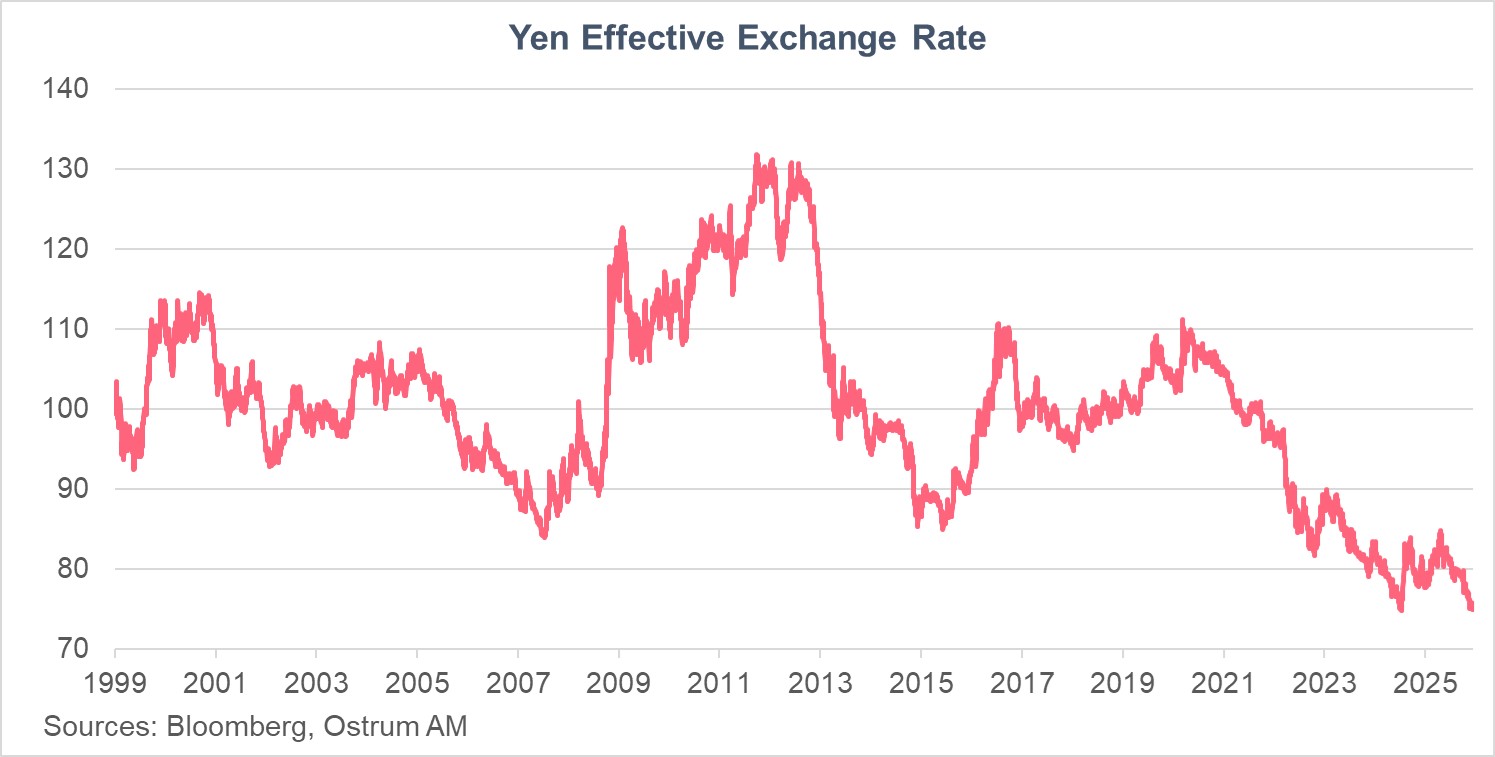

The yen is depreciating despite the rate hikes by the BoJ.

Despite the rate hikes by the BoJ, the yen has significantly depreciated against all currencies. However, the BoJ is the only major central bank that has raised its rates since March 2024, while the Fed and the ECB have lowered theirs during the same period. This reflects the fact that the BoJ's monetary policy remains very accommodative, and the central bank is expected to continue operating cautiously to ensure a positive dynamic between wages, household consumption, and inflation. Despite the forthcoming gradual rate hikes, monetary policy will thus remain accommodative in the coming months. In contrast, the Fed and the ECB have lowered their rates to make their monetary policy less restrictive. The ECB's rates have now returned to the neutrality threshold, and the Fed is expected to continue its rate cuts next year to achieve this.

This reflects the BoJ's monetary policy, which remains very accommodative compared to the ECB or the Fed.

The weakness of the yen is a factor advocating for a rate hike as early as this December. By increasing the cost of imports, the depreciation of the yen is likely to put further pressure on inflation. While it may not lead to a rebound of the Japanese currency due to a monetary policy that will remain very accommodative, the BoJ's decision should at least help stabilize the yen.

Risk of capital repatriation by Japanese investors

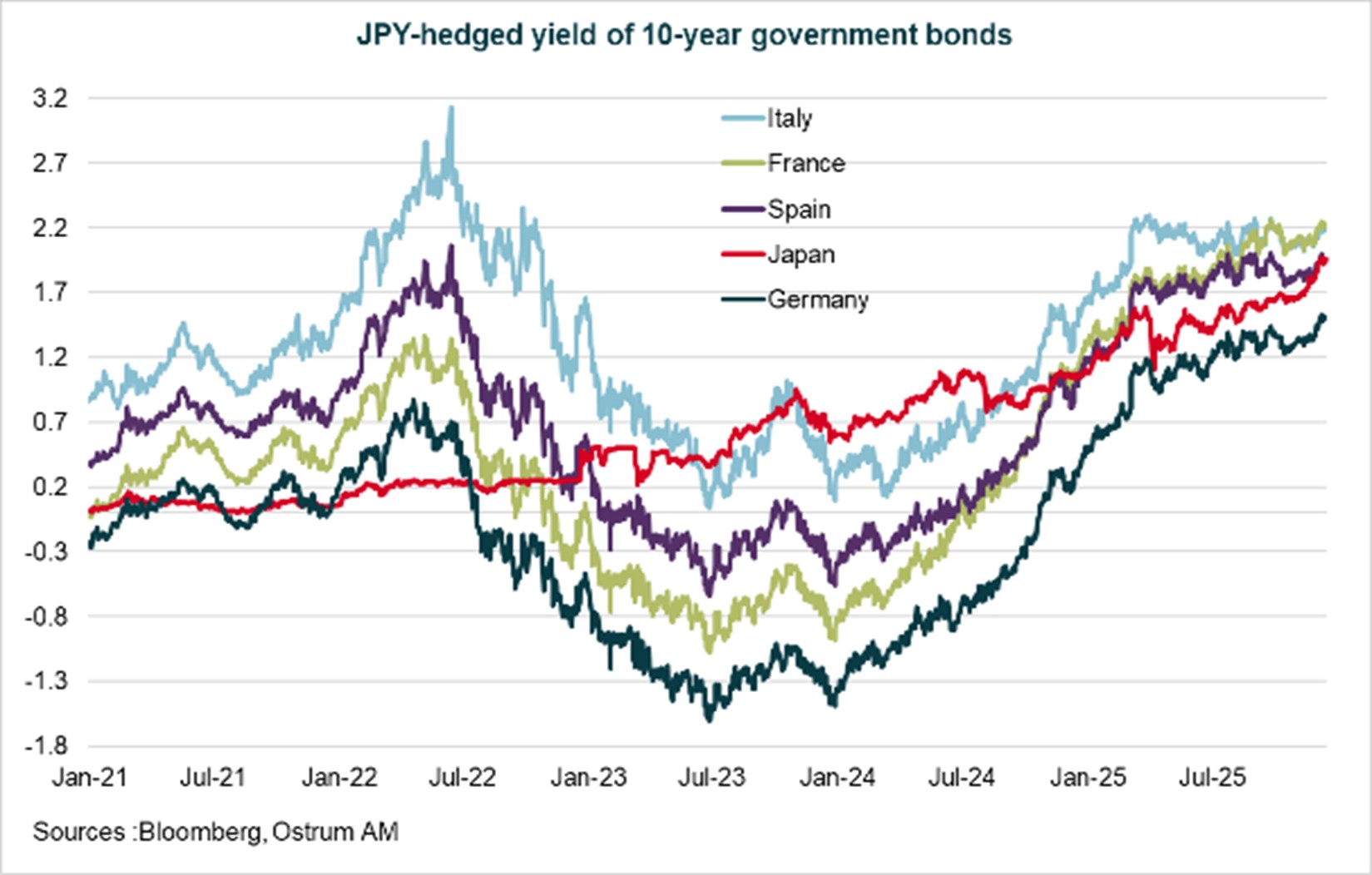

Only the 10-year Italian and French rates, when hedged for currency exchange, offer attractive yields for Japanese investors.

Given the tensions that have arisen in Japanese long-term rates, the Japanese 10-year rate, once hedged for currency exchange over a 12-month horizon, offers a yield higher than the German 10-year rate and comparable to the Spanish rate. Only France and Italy provide higher yields due to increased credit risk. The BoJ's rate hike, by stabilizing the yen against other currencies, could encourage Japanese investors to repatriate some of their capital.

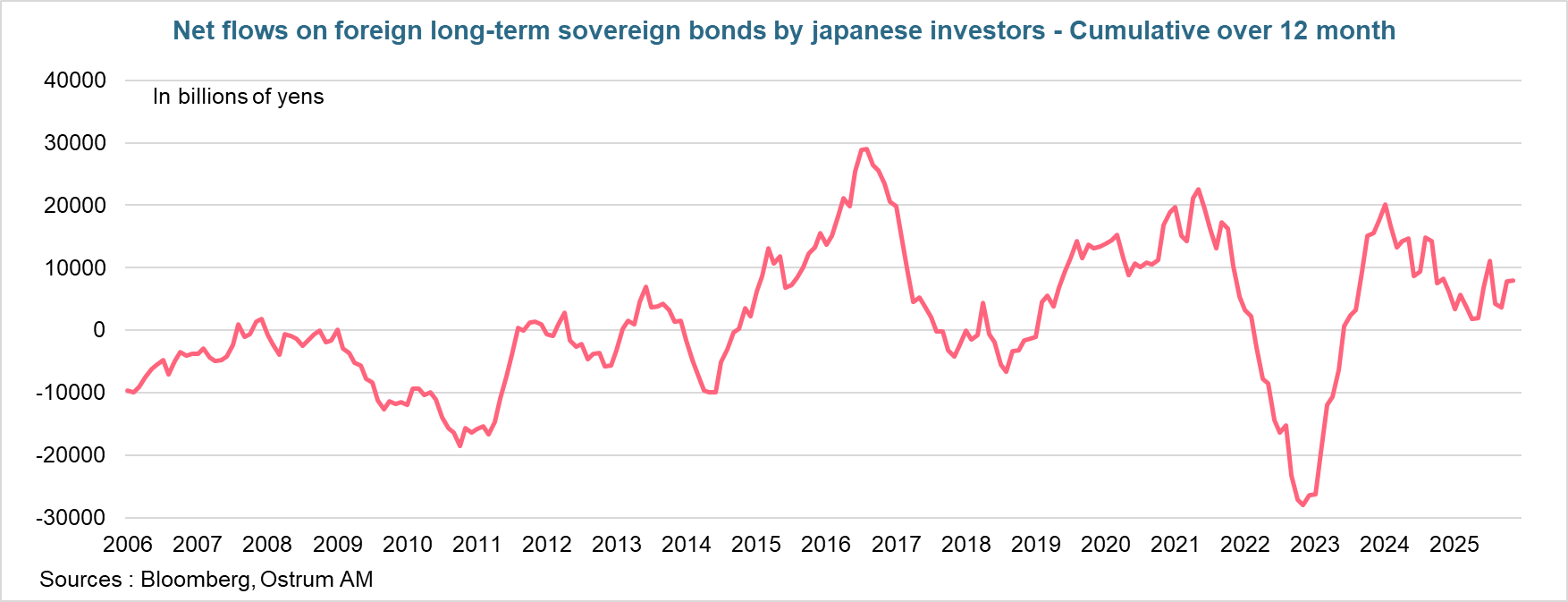

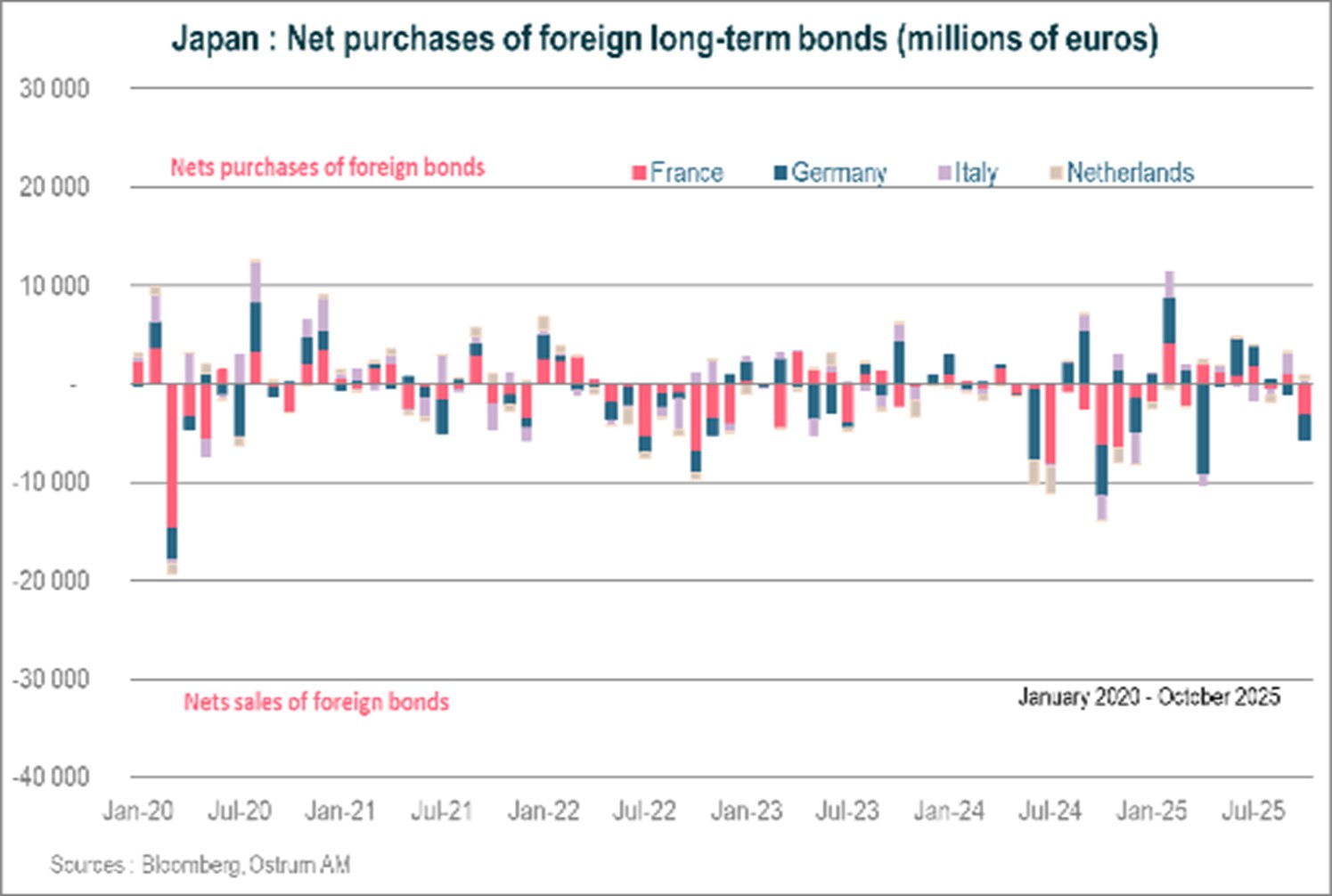

While there is a risk of capital repatriation by Japanese investors, this has not yet been reflected in the flow data.

However, current flows do not show this trend. The net flows of Japanese investors into foreign long-term government bonds remain positive, with a cumulative total of 7.864 trillion yen as of November. The right-hand graph illustrates the country breakdown of net purchases/sales by Japanese investors in the eurozone. It is noteworthy that after being net sellers of OATs from July 2024 to January 2025, due to concerns related to the dissolution of the National Assembly, Japanese investors returned to being net buyers of French debt in 2025. However, the cumulative total over 12 months remains negative at €4.6 billion in October 2025, after being -€27.9 billion in January 2025.

Conclusion

The BoJ is expected to raise its rates by 25 basis points on December 19, bringing its policy rate to 0.75%, unless there is significant volatility in the financial markets related to the U.S. employment report on December 16. Monetary policy will still remain very accommodative, which should stabilize the yen, though it may not strengthen it. The pressures on Japanese long-term rates, particularly due to budgetary concerns related to the massive stimulus plan, could lead Japanese investors to repatriate some of their capital.

Aline Goupil-Raguénès

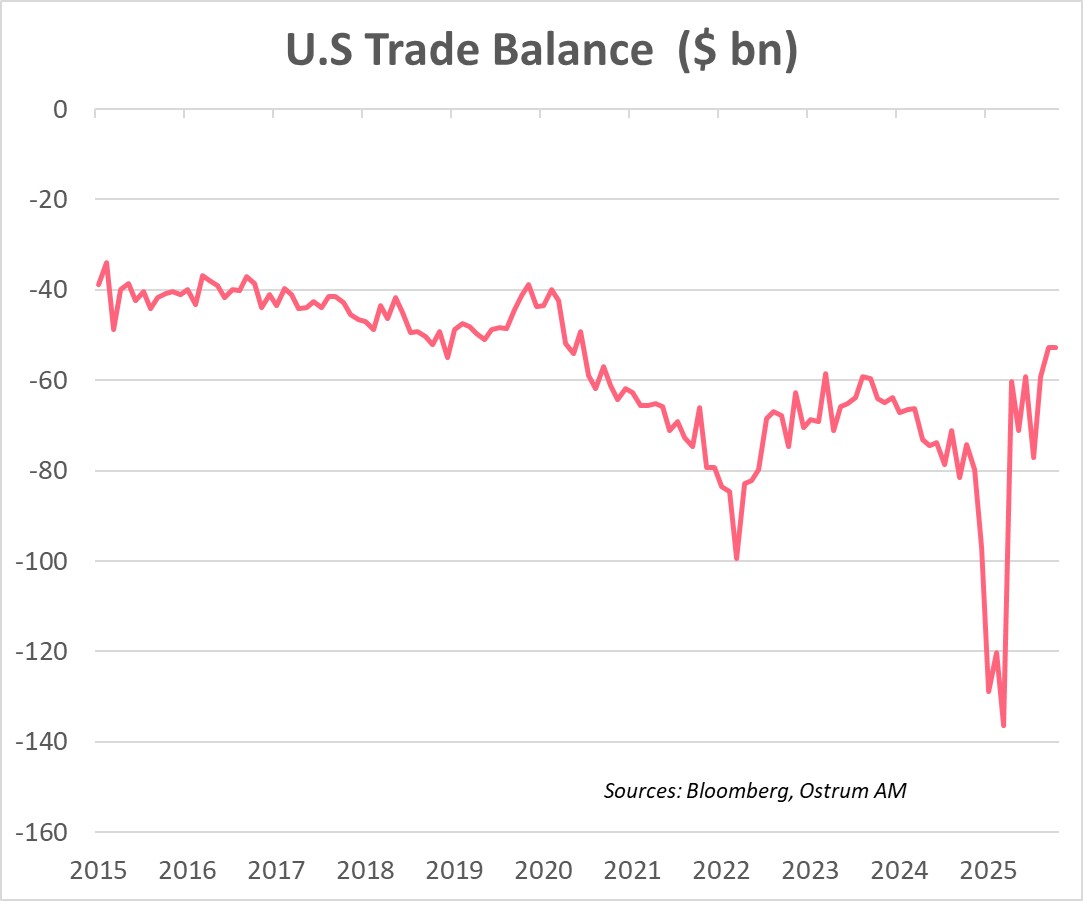

Chart of the week

The U.S. trade deficit narrowed by nearly 11% in September to $53 billion, the lowest level since June 2020. The rebound in exports by 3% year-on-year and a slowdown in imports to 0.6% year-on-year explain the reduction in the deficit.

The contribution of external trade to GDP for the third quarter is expected to be strong. The Atlanta Fed estimated third-quarter GDP growth at 3.5% on an annualized basis.

Figure of the week

1,000

China's trade surplus reached a record high of $1 trillion from January to November 2025, despite ongoing trade tensions.

Market review:

- Fed: Powell cuts rates and announces $40 billion monthly purchases of T-bills;

- Euro area: Activity better than expected ahead of the ECB meeting;

- Bonds: 10-year yields under pressure ahead of the German financing program announcement;

- Equities: Global stocks show a positive trend, with slight underperformance from the Nasdaq.

The Fed Against the Rest of the World?

An accommodative Fed appears to stand in contrast to the more hawkish rhetoric of other central banks. Long-term rates remain under pressure without significantly impacting risk assets.

The Federal Reserve continues to ease its monetary policy, while a growing number of central banks signal the conclusion of their rate-cutting cycles. The Bank of Japan is even poised to raise rates to combat the persistent weakness of the yen and inflation hovering around 3%. Despite these changes, long-term rates face downward pressure without imposing real harm on risk assets. Sovereign spreads are absorbing the rise in Bund yields, while equity markets predominantly trend upward. Nonetheless, the Nasdaq is affected by Oracle's outlook, with ongoing credit risk concerns weighing on investor sentiment.

The U.S. economy seemingly experienced robust growth in Q3, aided by a significant reduction in the external deficit. Technology investments are propelling economic activity, and the November employment report will provide insight into labor market dynamics. Recent ADP figures indicate a slight improvement, while household inflation expectations are also receding. Gas prices have reached their lowest point of the year, falling below $3.50 per gallon, due to a strong rebound in U.S. oil production (currently 13.8 million barrels per day). In this context, the Fed has cut its rate by 25 basis points to 3.75%, despite opposition from Goolsbee and Schmid, who advocated for maintaining the current monetary stance. With projected growth at 2.3% and inflation above target in 2026, it suggests a particularly accommodative monetary bias. This rate reduction is coupled with a new program of $40 billion per month in T-bill purchases, alongside the reinvestment of MBS rollovers in the short end of the curve. The objective is to establish a floor level for bank reserves around $3 trillion and alleviate recurring strains in monetary conditions. In the Eurozone, industrial activity is strengthening, contrasting with the dismal surveys in the sector. The ECB is likely to raise its growth forecasts for the following year after the meeting on December 18. In this context, Isabel Schnabel has even mentioned a potential rate hike next year.

Across financial markets, the global trend of rising long-term rates has tempered. Disappointing employment data from Australia has somewhat diminished expectations of a hawkish pivot from the RBA. In Japan, despite an imminent rate increase, long-term JGBs are witnessing solid demand. The T-note fluctuates between 4.10% and 4.20%, closing at the upper end of this range. Similar to the recent announcement by the UK DMO, a reduction in 30-year bond issuance in Germany could facilitate a tightening of the 10-30 year spread. The Finanzagentur will unveil its strategy on December 18. In the meantime, the Bund has risen to 2.87% without adversely affecting sovereign spreads. The OAT spread hovers around 70 basis points against the Bund following the vote on the social security budget.

Credit markets remain well positioned, with the spread on European investment-grade (IG) credit at 66 basis points. The iTraxx Crossover is trading below 250 basis points. Year-end gains appear to be supported by a decline in volatility indices, with the VIX retreating toward 15% as U.S. stocks approach their recent highs. The valuation of technology stocks remains a topic of debate, particularly following Oracle’s communications which dampened sentiment among Nasdaq investors.

Axel Botte

Main market indicators