Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Axel Botte’s and Aline Goupil-Raguénès’ podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Sovereign bonds: Peripheral countries will continue to outperform core and semi-core countries

- A 180-degree turn has taken place in the eurozone. Peripheral countries are experiencing stronger growth and a marked improvement in their public finances, in contrast to slower growth and rising budget deficits in core and semi-core countries. Ireland, Portugal, Greece, and Italy are in primary surplus;

- In Germany, the reform of the debt brake and the infrastructure plan will result in a significant increase in the public deficit starting in 2026 (to 3.6% and then 4.2% in 2027 according to the Bundesbank) and an increase in the debt-to-GDP ratio to 66.1% in 2027 (compared to 62.5% in 2024);

- The highest German issuances will thus contribute to narrowing peripheral spreads. They are also expected to tighten further due to the continued improvement in their public finances, the acceleration of NextGenerationEU disbursements, and investors' carry strategies;

- They should also benefit from the influx of foreign investors who are turning away from U.S. assets due to concerns over Trump's policies: trade war and, above all, a significant worsening of the U.S. public deficit;

- The Italian spread is expected to converge in the coming months towards the French spread, given the likely tensions on the latter during the autumn, when discussions on the 2026 budget take place, and the tightening of the Italian spread due to political stability and the government's willingness to bring the deficit below 3% of GDP in 2026.

Market review: Markets overlook signs of weakness

- U.S. job growth at 140k in May, however the drop in the participation rate is a source of concern;

- The ECB’s rate cycle is close to the end;

- U.S. 10-Yr yield hovers about 4.50 %;

- Risk assets remain upbeat.

(Listen to) Axel Botte’s and Aline Goupil-Raguénès’ podcast:

- Review of the week – Markets are regaining optimism despite mixed signals from the US labor market; the ECB believes that the monetary cycle is coming to an end.

- Theme – Sovereign bonds: Peripheral countries will continue to outperform core and semi-core countries.

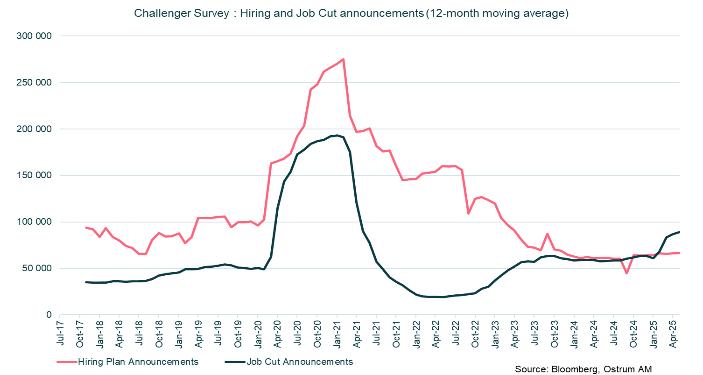

Chart of the week

Layoff announcements appear to be accelerating in the United States since the beginning of the year. These monthly announcements consistently total over 90,000, while the average has been around 60,000 since 2023. Public layoffs initiated by the DOGE are gradually giving way to job cuts in the private sector. The services sector is experiencing an increase in restructuring plans, particularly in retail. Budget cuts in education and the nonprofit sector are also leading to job losses. Meanwhile, announcements of hiring plans are decreasing, falling below the level of layoffs.

Figure of the week

10

According to the first report from the European Commission on trade diversification, the EU is facing a significant increase in imports of certain goods following the rise in U.S. tariffs. Imports of stainless steel bars and rods have increased more than tenfold since January, and prices have fallen by 86%, prompting calls for action from the Commission to limit this influx.

MyStratWeekly : Market views and strategy

MyStratWeekly – June 10th 2025