Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to Axel Botte’s podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: A round-up of central bank policies

- The Fed is gradually removing monetary restriction. Fed funds rates may decline to 4% by March. Donald Trump’s agenda may weigh on growth and raise inflation through tariffs. Should unemployment rise further, the employment part of the dual mandate will gain weight in the Fed’s decision making. The terminal rate of the easing cycle is forecasted at 3.5%.

- The ECB may have room to cut deposit rates to 2.25%. However, wage inflation is still posing upside risks to inflation. For this reason, the ECB may not be able to cut real rates in negative territory. The BoE is facing similar price stickiness whilst the Riksbank will keep cutting rates mirroring the ECB’s rate path.

- The BoC and the RBNZ will remain the proactive central banks against the backdrop of rising unemployment.

- The SNB is fighting upward pressure on the Swiss Franc with a 50-bp cut in December. Swiss interest rates may revert to negative territory in the coming years if need be.

- The Norges Bank is maintaining a hawkish status quo but is unlikely to tolerate NOK appreciation.

- In Asia, the growth challenges in China suggests that the PBoC will keep cutting interest rates. Conversely, the Bank of Japan will proceed cautiously with rate hikes.

Market review: Rate cuts fail to tame long-term yields

- The ECB lowers its growth and inflation forecasts and cuts its rate by 25 basis points;

- China's budget support plan disappoints the markets;

- A very negative week for bond markets. The T-note around 4.35%;

- Credit weathers the rate shock despite wider iTraxx Crossover spreads.

Axel Botte’s podcast

- Review of the week – Financial markets and the FOMC;

- Theme – Overview of monetary policies in 2025.

Chart of the week

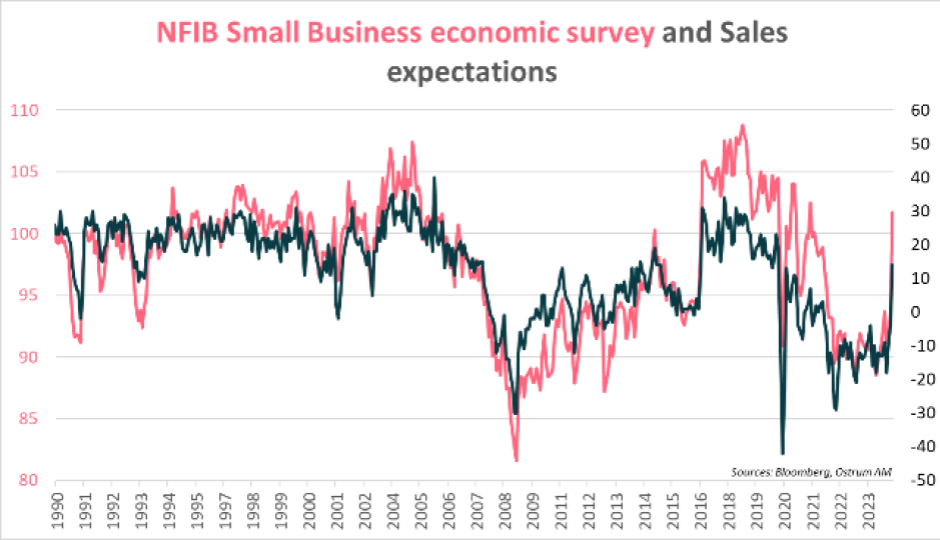

The NFIB survey from November seems to reflect a wave of optimism among US small businesses following Donald Trump's election. Revenue forecasts are showing a significant increase. Promises of tax cuts and deregulation resonate with SMEs.

The rise in tariffs is perceived as initially protective, even though all signs suggest that protectionism will be detrimental to both the American and global economies.

Figure of the week

4

as the number of Prime ministers in France and the number of interest rate reductions by the European Central Bank in 2024.