Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Aline Goupil-Raguénès’ and Zouhoure Bousbih’s podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: German Elections: The Necessary Reform of the Debt Brake

- The debt brake was the cause of the coalition's collapse. It will be at the center of discussions during the formation of the new government;

- This rule enshrined in law limits the federal government's new borrowing to 0.35% of GDP and prohibits borrowing for the federal states (Länder);

- However, after years of chronic underinvestment, Germany's investment needs are enormous in infrastructure, digitalization, and defense, especially given the pressures exerted by Donald Trump;

- The increase in public investment is likely to create a stimulus for private investment and generate productivity gains to offset the impending impact of the declining growth rate of the labor force;

- In light of the challenges to be addressed across the Rhine, a reform of the debt brake is necessary. It must be passed by a two-thirds majority in Parliament. A coalition of CDU/CSU with the SPD or the Greens could make this possible;

- This comes at a time when the EC has just proposed activating the safeguard clause to suspend the rules of the Stability and Growth Pact regarding investments in defense, in order to allow countries to increase their spending in this area.

Market review: Teflon markets

- Persistent inflation solidifies the Federal Reserve's status quo;

- U.S. retail sales plunge in January;

- The 10-year Treasury note falls below 4.50%, benefiting equity markets;

- Credit spreads tighten while volatility remains subdued.

Aline Goupil-Raguénès’ and Zouhoure Bousbih’s podcast

- Review of the week – Low volatility despite uncertainty over U.S. tariffs and peace in Ukraine?;

- Theme – German elections: The essential reform of the debt brake.

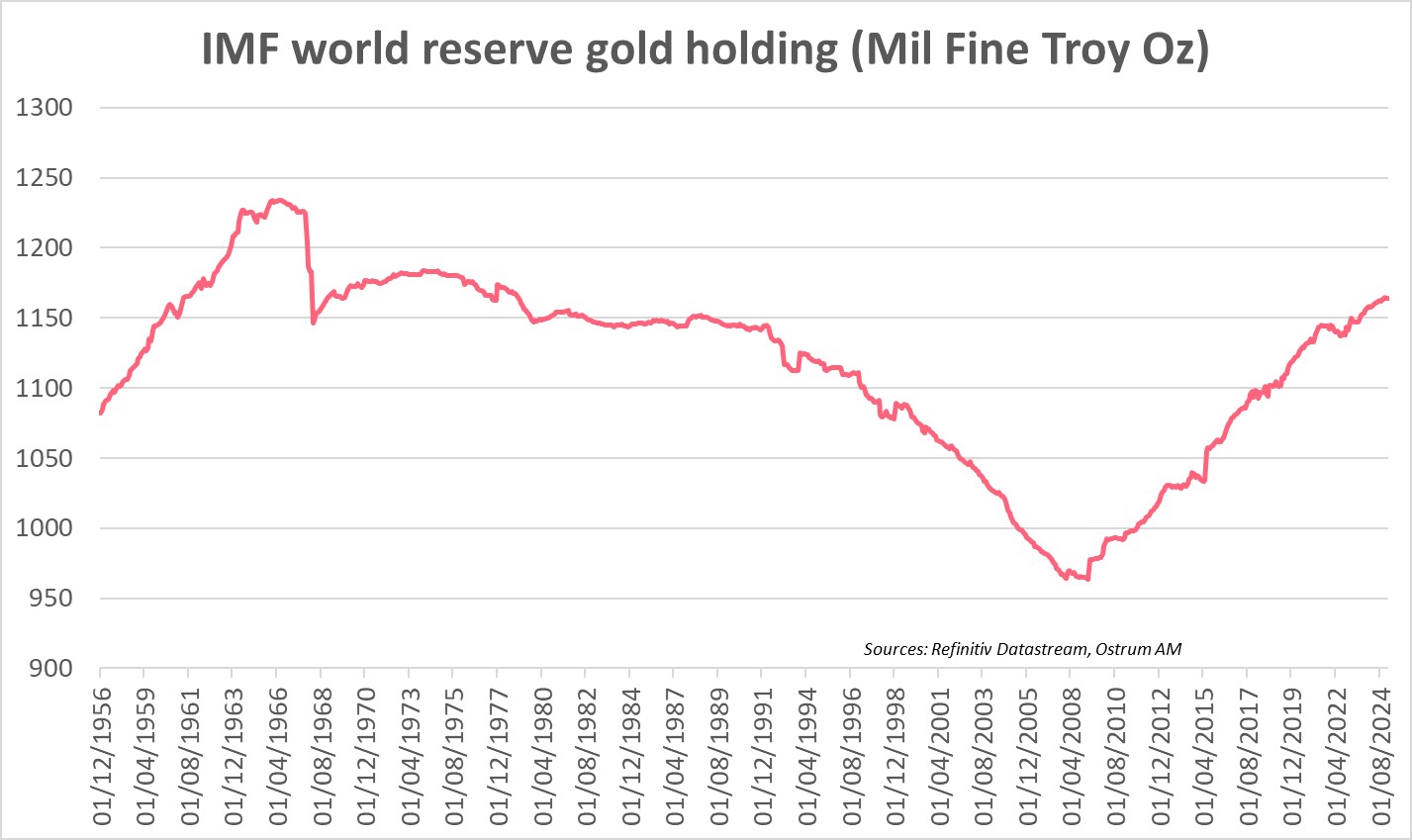

Chart of the week

Gold prices have increased by more than 10% since the beginning of the year, reflecting central banks' interest in the precious metal. Their net purchases in Q4 2024 reached a 10-year high. Since the freezing of Russian assets due to the war in Ukraine, central banks in emerging countries, particularly the PBoC, have diversified their international reserves toward gold at the expense of the dollar (Treasuries), whose share in foreign exchange reserves fell to 57.4% in Q3, the lowest since 1994. Chinese authorities also plan to ease regulations for insurers by allowing them to invest 1% of their total assets in gold. This is related to their difficulties in achieving their yield targets due to a lack of medium-to-long-term assets with stable returns. This announcement is expected to further boost the rally in the precious metal.

Figure of the week

21,000

Cocoa stocks have reached a historic low, dropping from over 100,000 tons a year ago to around 21,000 tons in the London commodities market. To meet the increased demand during Valentine's Day, chocolatiers have been forced to seek alternative ingredients.

MyStratWeekly : Market views and strategy

MyStratWeekly – February 18th 2025