Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Axel Botte’s and Zouhoure Bousbih’s podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: The dollar in the era of the Trump presidency

- A weak dollar is Donald Trump's obsession to restore the glory of the American manufacturing sector. However, since his election in November, the dollar has strengthened and is close to its historical levels.

- The strong dollar of 2025 bears similarities to the first term of R. Reagan (1981-1985), which led to significant global financial instability and the famous Plaza Accord.

- The significant deterioration of the United States' net investment position (80% of GDP) is a point of vulnerability for American financial markets.

- A strong dollar is inconsistent with concerns about the sustainability of American debt, as reflected in the rising term premiums.

Market review: The Elephant in the room

- Lower US and UK inflation prints trigger a rally in bond yields;

- US dollar eases as Waller signals that the Fed’s easing bias is intact;

- Credit and stock markets perform in the wake of lower long-term rates;

- Euro sovereign spreads tighten as Bund yields fall.

Axel Botte’s and Zouhoure Bousbih’s podcast

- Review of the week – Decrease in long-term rates with inflation, consumption in the United States;

- Theme – The dollar in the era of the Trump presidency.

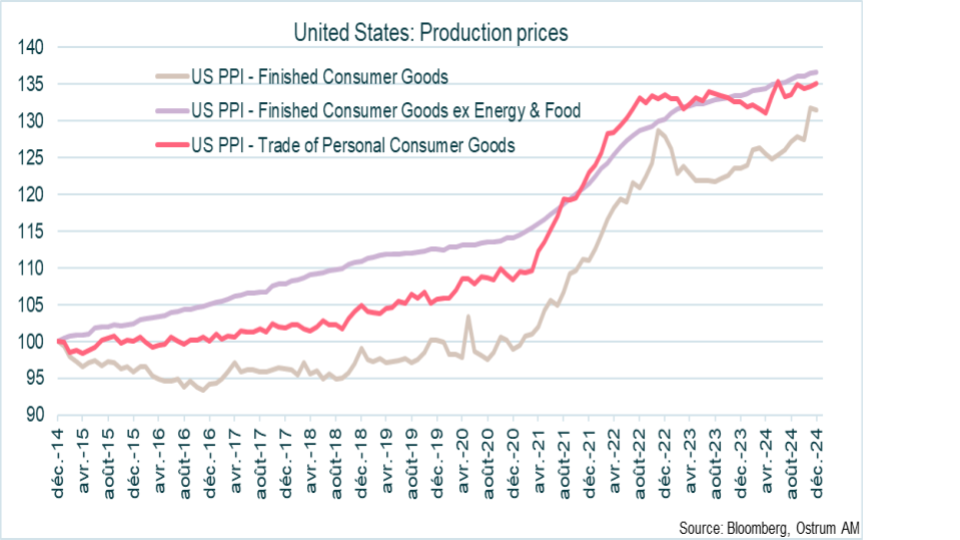

Chart of the week

The producer prices in the U.S. continue to rise at a steady pace.

The prices of US-made consumer goods have already erased the decline resulting from the improvement of supply chains in 2023 and are up 6.4% in December 2024.

The prices of trade services, indicative of the evolution of retailers' margins, have increased less and are expected to adjust upward, especially as the expected tariffs will raise the cost of imports. This increase in retailers' margins will translate into a rise in consumer prices.

Figure of the week

5

China has achieved its growth target of 5% this year, thanks to the upward revision of GDP growth for Q3 from 0.9% to 1.3% quarter-on-quarter, as well as a growth of 1.6% quarter-on-quarter in Q4. The stimulus is heading in the right direction.