Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Axel Botte's and Aline Goupil-Raguénès' podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: European bonds: Heading towards the risk-free reference asset

- To address climate change, ensure the digitalization of the economy and strengthen its defense, the European Union must make massive investments, totaling more than 5 trillion euros between 2025 and 2031;

- The majority will be funded through private investments, with a significant portion coming from public investments;

- Meeting these common objectives requires the participation of all countries. However, some countries have very limited budgetary leeway;

- The EU bonds must therefore rapidly become the risk-free reference asset within the EU.

Market review: A turbulent end to the first half of the year

- Yields rise as markets await French elections results;

- Some tensions on euro sovereign spreads;

- Breakeven inflation rates ignore the rebound in oil prices to $86;

- US equities continue to outperform European stocks.

Axel Botte's and Aline Goupil-Raguénès' podcast

- Topic of the week: Market News, US Growth, European Surveys;

- Theme: European bonds: Heading towards the risk-free reference asset.

Chart of the week

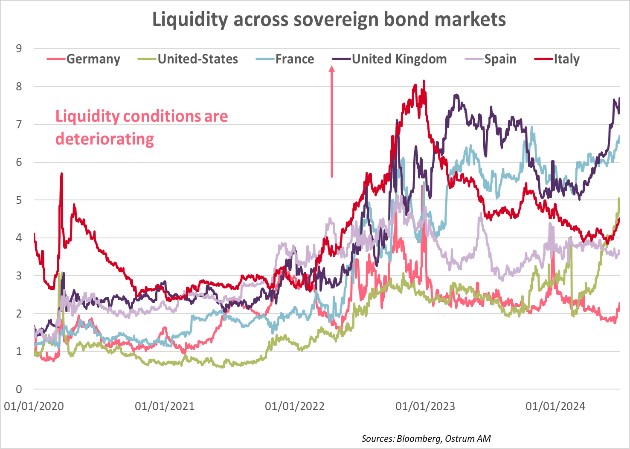

The main sovereign bond markets are usually highly liquid and most of the time more liquid than other markets during times of stress. This is essential to allow market participants to buy and sell securities easily without causing significant price movements.

However, the liquidity of some major bond markets has significantly decreased, as indicated by Bloomberg liquidity indices (an increase in the index signals a decrease in liquidity). This is particularly the case for the United States, the United Kingdom and France. This partly reflects the uncertainty related to central banks, especially the Fed, as well as uncertainty related to upcoming elections in France, the United Kingdom, and the United States, and their implications for fiscal policy.

Figure of the week

The 10-year Chinese bond yield has reached a 22-year low at 2.2%. Investors are anticipating the adoption of a more accommodative monetary policy by the central bank to support growth.

Source: Bloomberg

MyStratWeekly : Market views and strategy

MyStratWeekly – July 2nd 2024