Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Axel Botte’s and Zouhoure Bousbih’s podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: US elections: the key policy differences between Kamala Harris and Donald Trump

- The Presidential election appears extremely tight at the time of writing. Key states look like coin tosses as polls are within the margin of error;

- There are significant differences in policy views between Donald Trum and Kamala Harris. Corporate taxes could fall under Trump and rise if Harris gets into the oval office. Taxes on richer households (both inheritance and capital income) may also increase if Democrats win the election;

- Whatever the election outcome, deficits will stay elevated with higher risk of outsized fiscal slippage under Trump;

- Trump signaled its intention to raise trade tariffs by 60% on China and 10-20% elsewhere, making baseless claims that customs revenue would reduce deficits. This could be both inflationary and disruptive for global trade;

- Harris wants to strengthen NATO and keep supporting Ukraine against the Russian aggression whilst Trump has threatened to pull the U.S. support to NATO.

Market review: “Higher for longer”: the come back!

- High volatility in sovereign bond markets, reflecting fears of a resurgence in inflation.

- Decline in equity indices driven by the repricing of rate cuts by central banks.

- Widening of the BTP-Bund spread to 129 basis points due to zero GDP growth in Italy in Q3.

- Underperformance of Gilts following the presentation of the 2025 budget.

Axel Botte’s and Zouhoure Bousbih’s podcast :

- Review of the week – Financial markets, US and European 3rd quarter growth;

- Theme – US elections: latest polls and market scenarios.

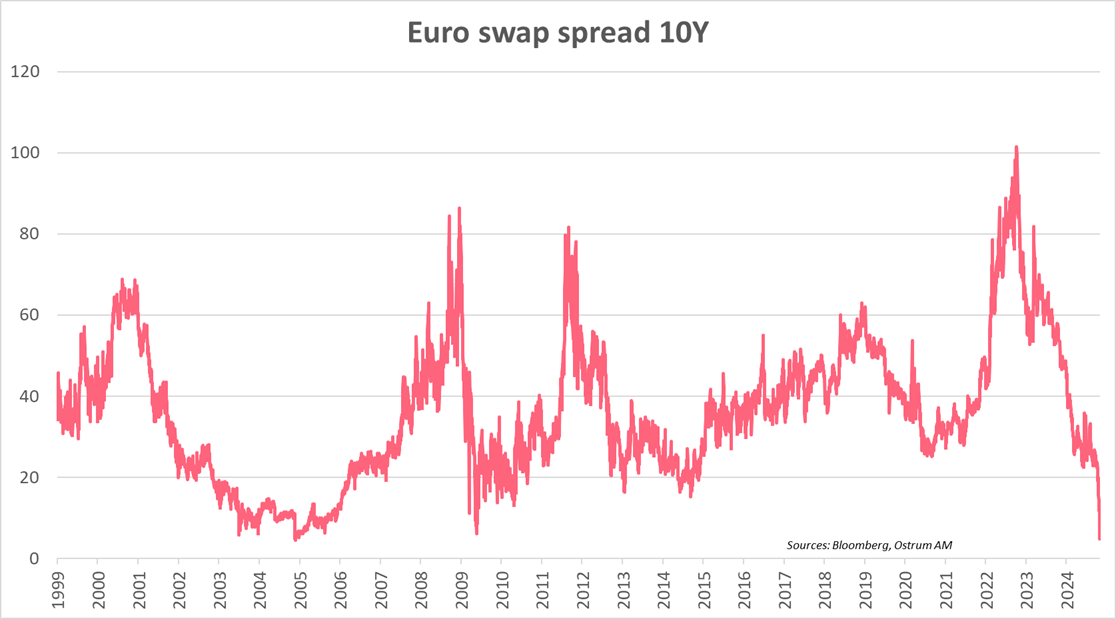

Chart of the week

The 10-year European swap spread has reached a low since 2000 at 4.75 bp, indicating a paradigm shift for financial markets: sovereign risk is now the focus, more than credit risk.

The tightening has accelerated following the presentation of the UK budget for 2025, indicating higher-than-expected funding needs.

Beyond the U.S. election, fiscal risk will continue to dominate financial markets in 2025, putting pressure on sovereign bond markets that will need to absorb significant issuances to finance high deficits.

Figure of the week

21.9%

It is the percentage of Americans who plan to take vacations abroad according to the latest Conference Board survey, marking a high since 2005. This is also a sign that American consumption remains robust.

MyStratWeekly : Market views and strategy

MyStratWeekly – November 5th 2024