Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Axel Botte’s and Zouhoure Bousbih‘s podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: China’s Stimulus: the return of the Dragon

- The persistence of weak activity threatened the achievement of the 5% growth target;

- The flurry of measures announced since September 24 has revived confidence in financial markets;

- The PBOC's new tool, the facility swap provides direct support to the domestic A-share market;

- However, volatility in Chinese stock markets remains high, reflecting dependence on the announcement of quantified fiscal stimulus;

- The press conference of the Ministry of Finance on October 12 highlighted structural priorities, such as real estate and local government debt, which are major obstacles to Chinese growth. And that's a good point!

Market review: The reflation dilemma

- US Ten-year note yields creep higher to 4.10 %;

- US CPI inflation above expectations at 2.4% in September;

- Credit and sovereign spreads weather the rebound in risk-free bond yields;

- Equities slightly up in the US, some profit-taking on Chinese stock marlets.

Axel Botte’s and Zouhoure Bousbih‘s podcast :

- Topic of the week – Capital Markets, Inflation and Application for US 30-year

- Theme – Chinese stimulus, part 2

Chart of the week

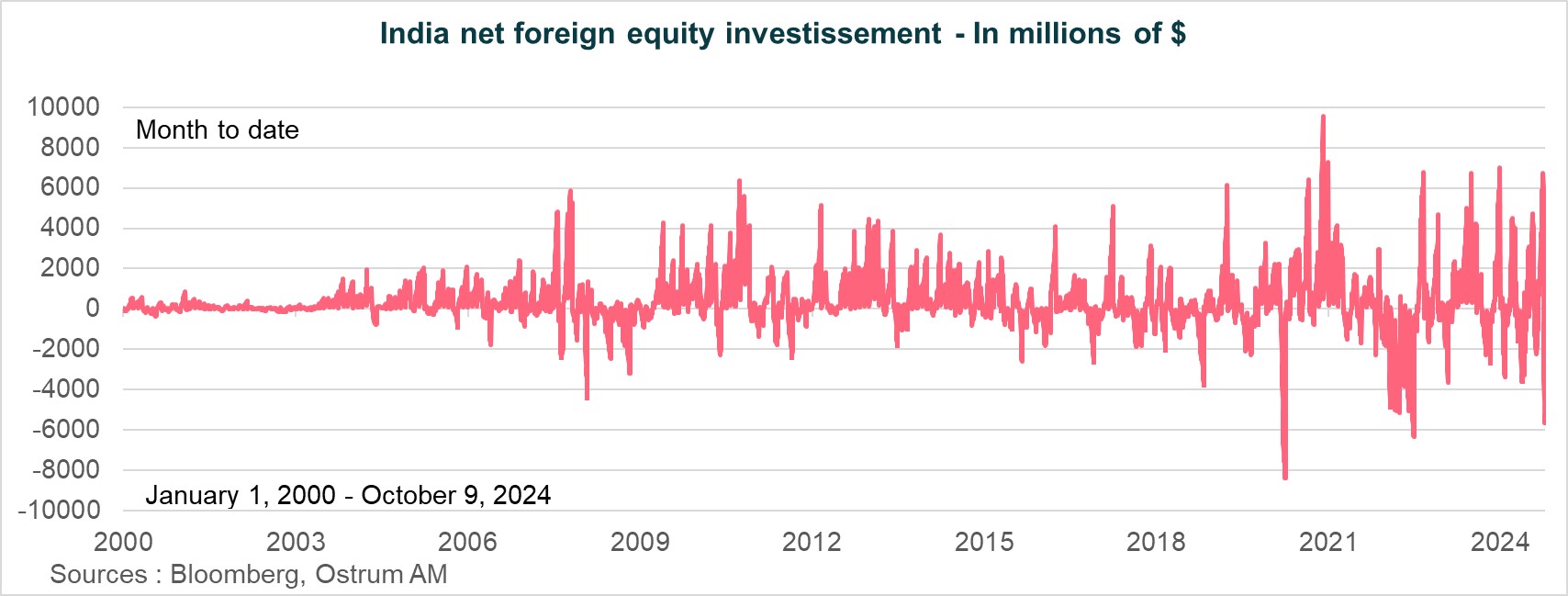

The Indian equity market experienced significant capital outflows last week, reflecting a shift in investment flows toward Chinese markets following the announcement of stimulus measures.

Since the beginning of October, over $5.66 billion have exited the Indian equity market, amounts comparable to those observed during the COVID-19 crisis and the outbreak of the war in Ukraine.

Figure of the week

75%

It’s the percentage of companies worldwide that have no women in senior executive positions!