Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Axel Botte’s et Zouhoure Bousbih’s podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Comparison of C. Lagarde to the 1920s: Be ready for change!

- The ECB President has drawn a parallel between the current period and the 1920s;

- The similarities are concerning: the resurgence of protectionism, AI as a significant technological breakthrough, disruptions in maritime routes, and China's rise as a global manufacturing powerhouse;

- However, the comparison ends there. A key difference from the 1920s is the abandonment of the gold standard, which grants central banks increased monetary flexibility, enabling them to respond swiftly and decisively during crises;

- This also allows governments to effectively intervene in order to safeguard jobs and support their economies;

- C. Lagarde's comparison to the 1920s underscores a new world order and an elevated risk of macroeconomic volatility. "We must be prepared for change!".

Market review: When China awakens

- China : bold monetary and fiscal measures revive recovery hopes ;

- Chinese equities surge ;

- Curve steepening continues as weak PMI and falling oil prices fan expectations of ECB cut this month ;

- France spreads under pressure before PM Barnier’s policy statement.

Axel Botte’s and Aline Goupil-Raguénès’ podcast

- Topic of the week – Inflation and Chinese stimulus;

- Theme – The Chinese stimulus.

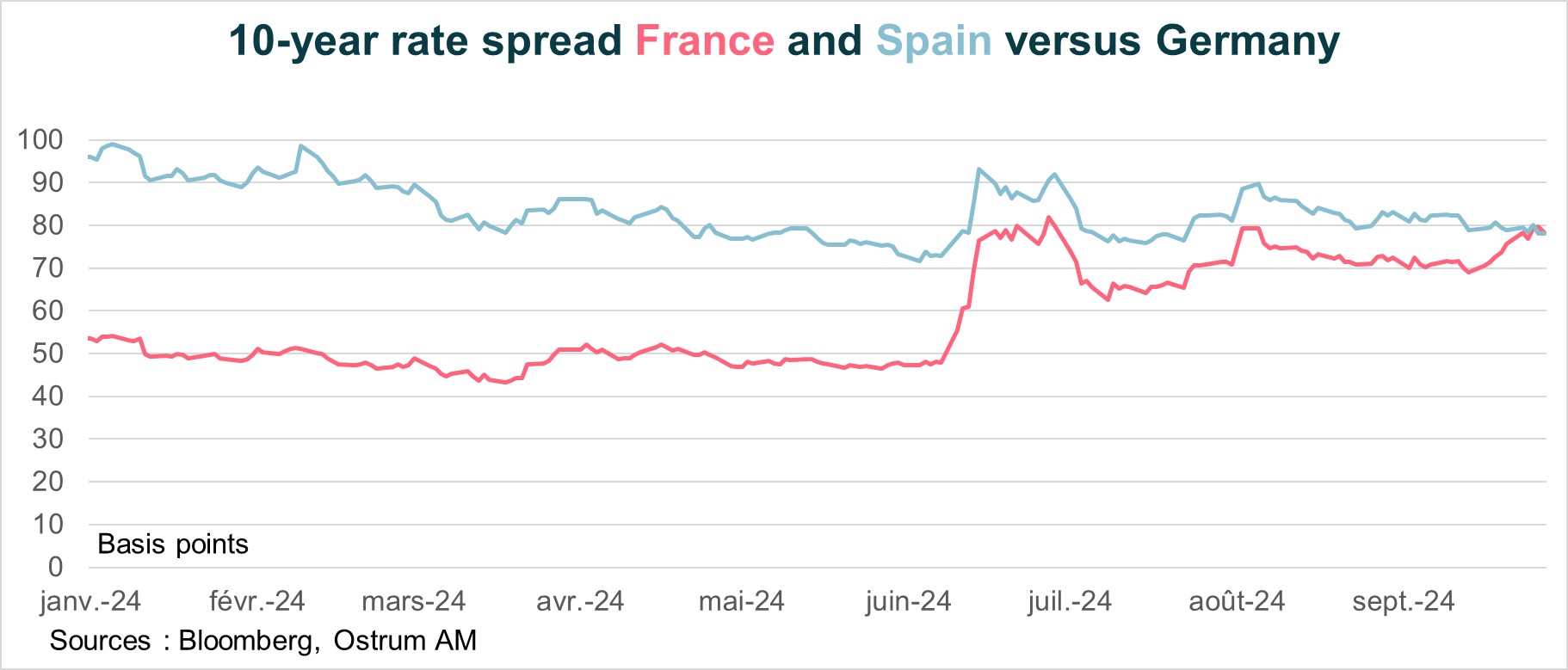

Chart of the week

For the first time since 2007, the spread of the 10-year OAT has exceeded the Spanish spread on Thursday, September 26.

This reflects investors' concerns regarding French public finances. France is expected to experience a significant budgetary slippage for the second consecutive year in 2024.

This justifies deficit reduction measures that are expected to be announced by the government during the week of October 9. The task proves to be complex, as the National Assembly is highly divided, putting the government at risk of a vote of no confidence.

Figure of the week

27%

This is the weekly performance of the Chinese stock market index CSI 300 since its low point on September 13. Announcements of monetary and fiscal stimulus from Chinese authorities have bolstered the rally in Chinese stocks and enhanced investor sentiment.