Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Axel Botte’s and Aline Goupil-Raguénès’ podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: The EU automotive sector in turmoil

- New car sales are sharply declining in the EU, and the outlook has significantly worsened. While cyclical factors are at play, structural factors are becoming increasingly significant;

- The automotive industry is undergoing its most significant structural transformation: by 2035, new cars must achieve carbon neutrality;

- EU manufacturers are lagging behind in the electric vehicle sector, particularly in terms of innovation;

- The EU is facing intensified competition from China, which has become the leader in this field. To protect itself from cheap Chinese imports, the EU has raised its customs tariffs;

- To remain a major player on the international stage, the automotive sector needs to quickly adapt to this new competitive environment. Mario Draghi's report specifically recommends developing a coordinated industrial action plan for the automotive industry at the EU level, covering all stages of the value chain.

Market review: ECB accelerates rate action

- The ECB cuts rates by 25 bps as expected as Christine Lagarde paints a gloomy picture of euro area activity;

- US retail sales point to 3%+ GDP growth in the third quarter;

- Credit and sovereign spreads weather the rebound in risk-free bond yields;

- US stocks up on bank earnings, European earnings hit by China and semiconductor industry outlook.

Axel Botte’s and Aline Goupil-Raguénès’ podcast :

- Topic of the week – US and Chinese growth in Q3;

- Theme – The European automotive sector in turmoil.

Chart of the week

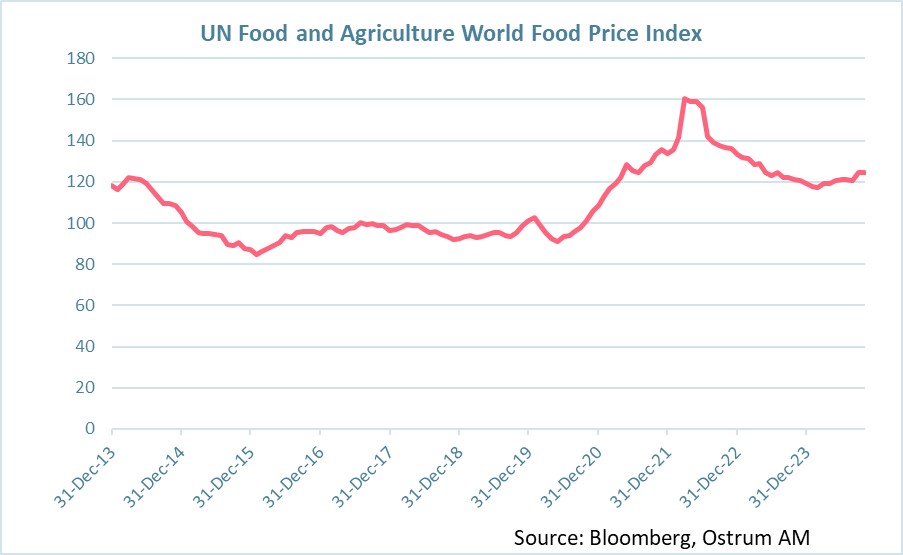

The FAO Food Price Index (FFPI) is a measure of the monthly change in international prices of a basket of food commodities. It consists of the average of five commodity group price indices weighted by the average export shares of each of the groups over 2014-2016.

Heavy rains and drought have taken a toll on crop yields in several regions of the world. Prices have also increased due to a recent pickup in fertilizer prices in the US.

Tentative signs of an upturn in food prices must be monitored as regards the inflation outlook.

Figure of the week

420

Global chip stocks erase $420 billion in market capitalization after ASML sales warning. The magnitude of ASML forecast cut was a major surprise for investors.