Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to Axel Botte’s podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: The outlook for the euro-dollar exchange rate

- The euro-dollar exchange rate is struggling to break through the ceiling of $1.12, despite a rebound of nearly 5% since April lows;

- Foreign direct investment in the eurozone have decreased, as the growth prospects in the United States attract international capital. This situation remains a hindrance to the appreciation of the euro;

- The balance sheet policy of the ECB and the likely halt of quantitative tightening by the Fed in the coming months will help support the euro against the greenback. More aggressive rate cuts by the Fed will also contribute to this;

- The year 2022 was marked by a sharp rise in import prices. The terms of trade no longer pose a downside risk for the single currency, especially as oil prices decline despite the international context;

- However, the demand for dollars remains strong, given the still timid positioning on the euro. The evolution of cross-currency swap bases also indicates demand for dollars by non-residents.

Market review: Time for the reflation trade?

- U.S. employment rose by 254k in September, with a decrease in the unemployment rate;

- Tensions in the Middle East caused a drop in yields followed by a rise in oil prices;

- The T-note is rising towards 3.95%, with the 2-year note gaining 30 basis points;

- Credit and sovereign spreads are tightening, while European stocks are falling.

Axel Botte’s podcast

- Topic of the week – Capital markets, US employment and economic conditions;

- Theme – Focus on the euro-dollar.

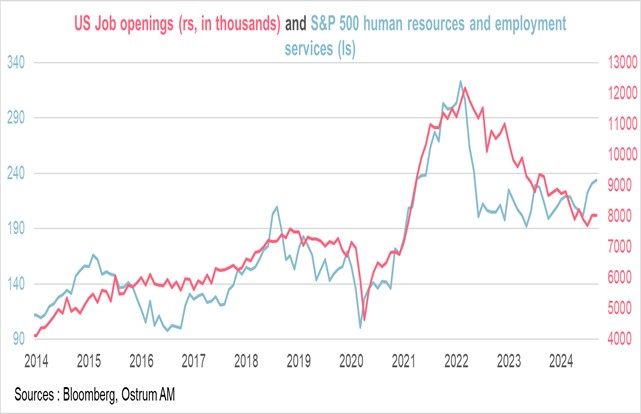

Chart of the week

The US labor market continues to surprise with its resilience. The job openings reported by the BLS’ JOLTS survey have risen back above the 8-million mark, a figure that exceeds the number of job seekers.

The stock performance of the labor market-related services sector appeared to foreshadow the recovery seen in job openings.

While the predictive nature of markets is questionable, the positive news regarding employment now seems to validate the rebound in the sector.

Figure of the week

60

The French government on Wednesday announced plans for around €60 billion in spending cuts and tax hikes next year in an effort to claw back the widening budget deficit and bolster investor confidence in the country.