Ostrum's SRI Crédit 12M fund offers an investment opportunity in the very short-term corporate bond market through SRI management.

For investors seeking regular and attractive returns, very short-term credit can offer the right solution: short-term rates in euros are at their highest level in 15 years.

“Our SRI Credit 12M strategy offers a clear complementarity with the monetary products widely used by institutional investors such as corporate treasurers, insurers, pension funds, health mutuals, and other provident actors. It allows these investors, as well as other more tactical asset managers and allocators, to benefit from the downward trend in interest rates, while enjoying a very reasonable risk profile due to the major portion invested in 'Investment Grade' companies and the thorough analysis work carried out by our Credit analysis teams”, says Matthieu Mouly Head of Business Development at Ostrum AM.

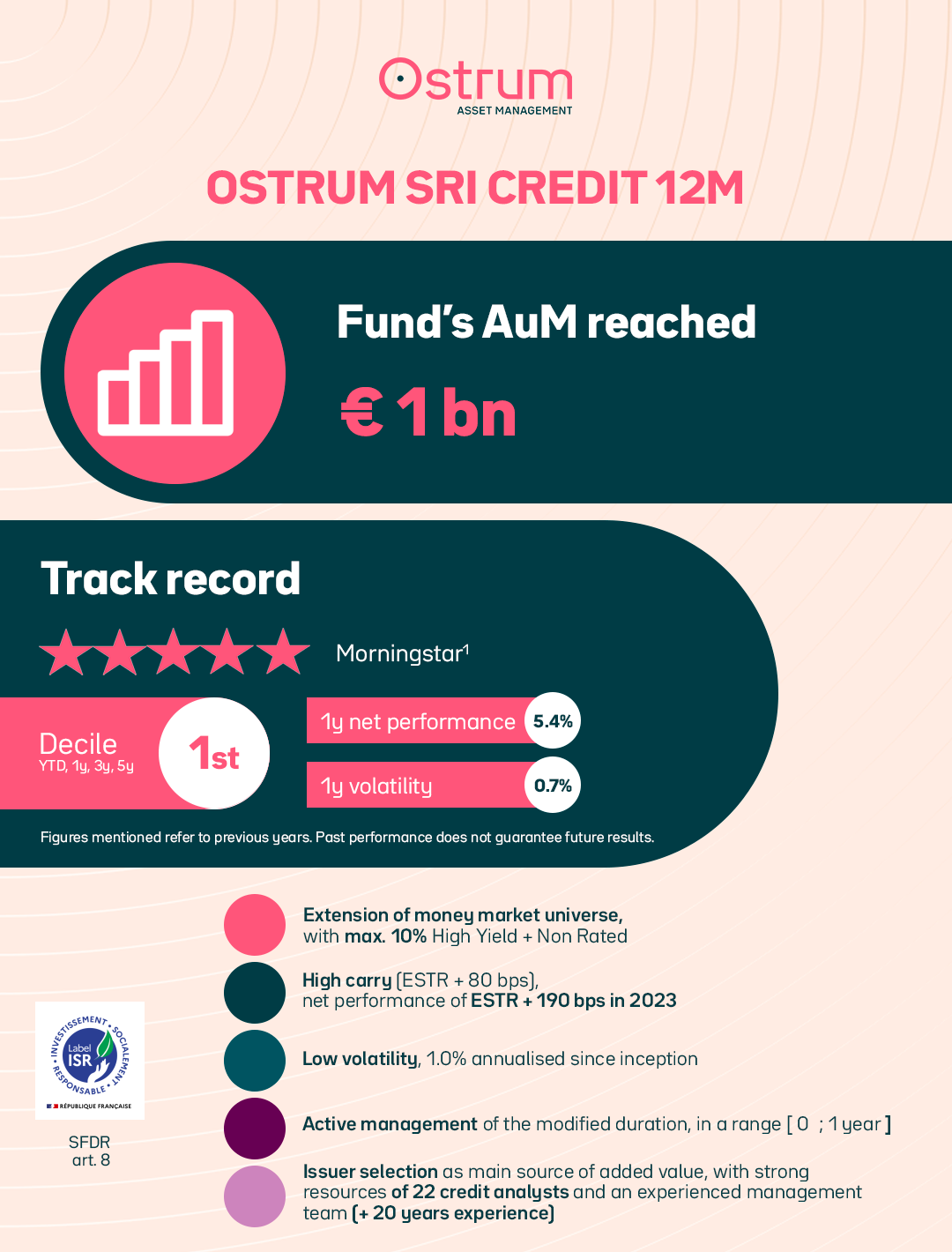

"We are very proud to have reached this milestone of €1 billion in assets under management, an important achievement for our SRI Credit 12M strategy. This strategy is in line with other monetary strategies, offering a similar universe, mainly Investment grade, with a longer maturity in a context of declining interest rates. Our goal as managers is to ensure a return higher than the ESTR while limiting bond market volatility. The fund's ranking over the past 5 years and its 5-star rating attest to the robustness of our active and sustainable management process", adds Fairouz Yahiaoui, money-market portfolio manager.

The figures cited and performances relate to past years. Past performance is not a reliable indicator of future performance.

All investment in a fund carries risks, including the risk of capital loss. For more information about this fund, please refer to the regulatory documentation available on this site.

Please refer to the fund's prospectus and Key Investor Information Document (KIID) before making any final investment decision. This fund is domiciled in France and authorized by the French Financial Markets Authority as an OPC. Natixis Investment Managers International is the management company and has delegated financial management to Ostrum AM.

Ostrum Asset Management – Asset management company regulated by AMF under n° GP-18000014 – Limited company with a share capital of 50 938 997 €. Trade register n°525 192 753 Paris – VAT : FR 93 525 192 753 – Registered Office: 43, avenue Pierre Mendès-France, 75013 Paris – www.ostrum.com