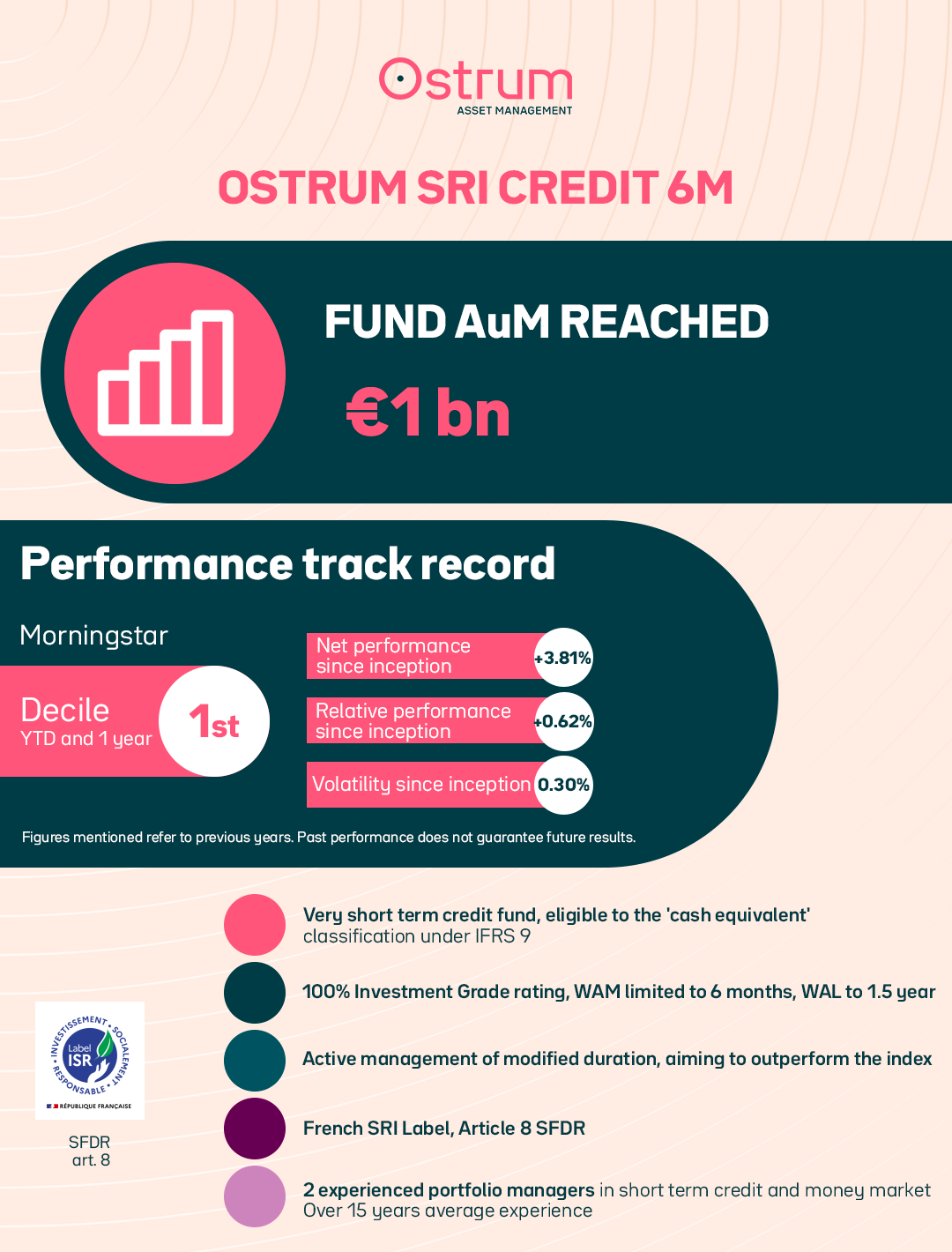

Ostrum AM's SRI Credit 6M fund offers an investment opportunity in the very short-term corporate bond market through SRI management.

“Reaching a milestone of 1 billion euros in assets for our SRI Credit 6M strategy underscores the trust our investors place in us. This strategy leverages solid fundamentals, allowing us to seize short-term opportunities in the bond market while prioritizing risk management. It effectively addresses the growing demand from investors seeking yield in a low-interest-rate environment.”, says Matthieu Mouly Head of Business Development at Ostrum AM.

“Hitting the 1 billion euros mark in assets is a clear indication of the rising interest in our SRI Credit 6M approach. We strive to deliver not only an attractive return but also transparency and social and environmental responsibility to our investors. Through our rigorous selection process and credit expertise, we aim to provide a favorable performance compared to money market strategies while adhering to criteria that can be viewed as 'cash and equivalents'.”, adds Fairouz Yahiaoui, Senior Portfolio Manager, Money Market & Short term credit.

The figures cited and performances relate to past years. Past performance is not a reliable indicator of future performance.

All investment in a fund carries risks, including the risk of capital loss. For more information about this fund, please refer to the regulatory documentation available on this site.

Please refer to the fund's prospectus and Key Investor Information Document (KIID) before making any final investment decision. This fund is domiciled in France and authorized by the French Financial Markets Authority as an OPC. Natixis Investment Managers International is the management company and has delegated financial management to Ostrum AM.

Ostrum Asset Management – Asset management company regulated by AMF under n° GP-18000014 – Limited company with a share capital of 50 938 997 €. Trade register n°525 192 753 Paris – VAT : FR 93 525 192 753 – Registered Office: 43, avenue Pierre Mendès-France, 75013 Paris – www.ostrum.com