Only 16% of young South Africans aged 18 to 24 say they are optimistic about their future, reflecting their concerns about the country's economic situation, including corruption and the labor market, where the unemployment rate has risen to 33% in Q1. This situation poses a challenge for the ruling African National Congress, as several polls show that the party is at risk of losing its majority in the upcoming general elections on May 29, for the first time since coming to power in 1994.

The emerging market Strategy view

The light at the end of the tunnel?

South Africa's GDP has returned to its pre-Covid-19 crisis level, but South African growth remains weak, hampered by multiple structural constraints: corruption, unemployment, and the deterioration of public services such as the distribution of clean water and electricity.

The South African economy avoided a recession last year, recording a modest growth of 0.6% thanks to the increase in commodity prices. Growth is forecasted at 0.9% for this year and 1.5% next year, according to the latest IMF projections. This expected improvement is linked to the impact of reforms and the improvement of electricity supply.

President Cyril Ramaphosa seeks to reconcile South Africa's climate goals by gradually reducing the use of coal (which accounts for 80% of the country's electricity) and increasing electricity production. Eskom, the national electricity company, has expanded its production capacity by using solar energy. During his visit last August, Xi Jinping pledged to support South Africa's electricity production by making an emergency donation of 167 million rand and a grant of 500 million rand.

Eskom recently stated that the energy crisis has been "fixed," alleviating concerns about the country's growth prospects. Eskom's troubles had also required financial support from the South African government, deteriorating public finances. The public debt-to-GDP ratio has increased from an average of 45% during the period 2011-2019 to 74% in 2023. It could reach 86% of GDP in 2029, according to the latest IMF forecasts related to financial support for state-owned enterprises, including Eskom.

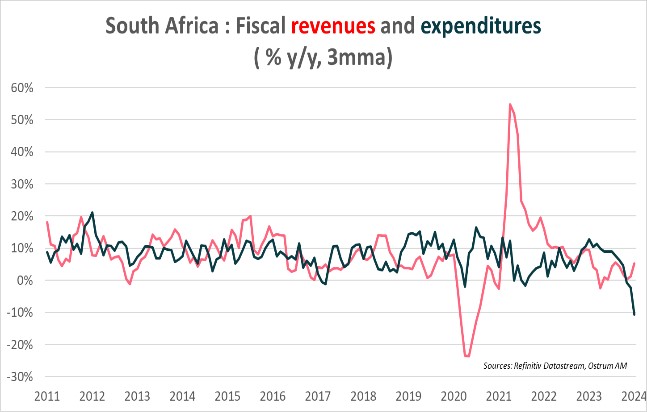

However, a reversal of the trend seems to be taking place. For the first time in 15 years, South Africa recorded a primary budget surplus of 0.4% of GDP in March 2024, linked to an increase in tax revenues and a significant decrease in expenses, as shown in the graph below.

Investors have long expressed concerns about the country's increasing debt, as the interest burden is significant, diverting funds from other areas such as education or health. The South African Treasury aims to stabilize the ratio at 75% by 2025/2026 by using the gold account and reserves to reduce debt servicing.

Despite these positive signs, challenges persist for the South African economy. The unemployment rate is high at 33% in Q1, reflecting the need to re-establish sustainable growth to create jobs. This is the focus of the elections on May 29th.

The Portfolio Manager view

The crossroads: A pivotal moment?

If presidential elections are naturally pivotal moments, for emerging countries, they can also be times when everything can be built or tipped over. In this regard, investors will be very attentive to the elections taking place in South Africa, where the balance of political power will likely be reshuffled. Why such a vigilance?

Mainly due to the lack of significant fiscal and budgetary leeway. These have been exhausted over the past decade, a phenomenon naturally exacerbated by the Covid-19 crisis. As a result, the country's GDP per capita in 2023 (approximately $6200 USD according to S&P) is still lower than that of 2010, while the gross debt has increased from 36% to 76% of the GDP over the same period! The stakes are substantial, and the need for structural reforms is greater than ever.

Crises and Opportunities

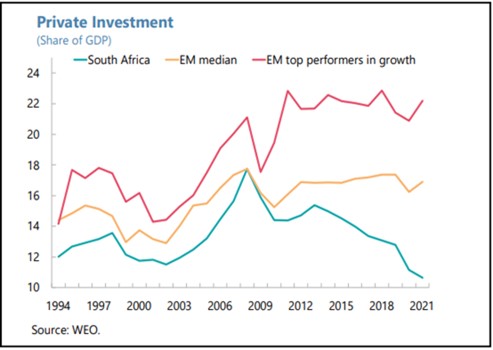

The country has already embarked on several initiatives, notably addressing the most pressing issue of the energy crisis it has been facing. South Africa also possesses a robust institutional framework that can be further enhanced. If the country can build on this momentum and implement additional reforms, it may address its chronic lack of private investments, which is crucial for regaining a positive and sustainable momentum.

The Financial Action Task Force (FATF) has already underscored the government's determination and efforts to remove itself from its grey list. Transforming these efforts and swiftly exiting the list would send a particularly clear signal.

South African international and local debt

These challenges are also vividly illustrated in the interest rate yield curve of the country's international debt, which is one of the steepest in the emerging debt asset class. As for the local debt (the country has deep and developed local markets), it also displays a steep curve, but also particularly high and attractive real interest rates. These market segments (long-term international and local debt) would be the first to benefit from a smooth and constructive political transition.