Corruption and organized crime, at the heart of this presidential campaign, constitute significant obstacles to Mexican growth. Investors will be closely monitoring the country's fiscal outlook, crucial for maintaining its “Investment Grade” status.

The emerging market Strategy view

Mexico: At a Crossroads

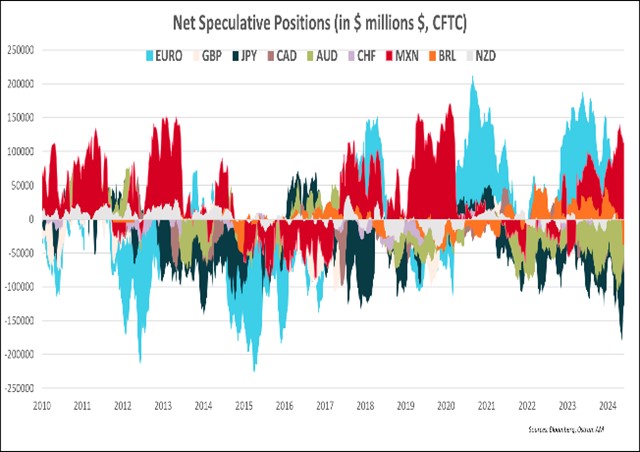

The Mexican peso is the currency among emerging market countries that has recorded the best performance (27.7%) against the dollar since the beginning of 2022! Its real interest rate of 6.35% (policy rate-inflation rate) is attractive in carry trade strategies, reflected in the strong buying position of investors in the currency (see graph below).

However, this is also a strong factor of instability for the Mexican peso. Despite political risks, both domestically (presidential elections on June 2) and externally (upcoming US presidential election), the Mexican peso has shown extraordinary resilience against the US dollar. What could reverse this trend?

The question revolves around fiscal policy. Unlike other emerging market countries, especially those in the region, Mexico is characterized by its fiscal discipline. Its “Investment grade” status (Baa2/BBB/BBB-) is highly dependent on its fiscal outlook and thus the election outcome. The increase in public spending in view of the elections suggests a rise in budget and public deficits, putting its sovereign rating at risk. The leading candidate, C. Sheinbaum, close to the current president and leading in the polls, has tried to reassure by mentioning the continuation of the current Finance Minister Ramirez while reiterating fiscal prudence. A victory for opposition candidate X. Galvez, appreciated by investors for her liberal policy on the energy sector and tax reform, would also be a favorable outcome for investors.

Externally, Mexico is at the heart of the US trade war. Mexico has quickly replaced China as the top source of imports to the US, linked to the American automotive industry, which imports a near-record number of cars. To benefit from tariff exemptions in the US market, foreign direct investments from China have increased by about $225 million per year, almost quadrupling the average annual investment of the previous decade from 2007 to 2016. However, the US remains the main source of FDI for Mexico, limiting the economic impact of an escalation in trade tensions.

The main risk therefore lies in economic activity. The slowdown in growth in Q1 2024 (1.9% y-o-y, after a 3.2% growth in 2023) and persistent inflation at 4.7% above the 3% target would make the debt trajectory unsustainable, putting Mexico's “investment grade” status at risk. This is the main challenge for the new president. The credibility of the Mexican central bank in its fight against inflation is also key to ensuring macroeconomic stability and therefore that of the peso.

The Portfolio Manager view

The presidential election should not undermine the positive trend of local debt and the Mexican peso

While security and the fight against organized crime seem to be at the heart of the Mexican presidential campaign (election on June 2), investors are more concerned about the economic and fiscal policy that will be pursued by the next government.

C. Sheinbaum, the candidate of the Morena party and designated successor to L. Obrador, leading in the polls, highlights the very positive economic record of the current government and advocates for continuity in economic policy. Her main opponent X. Galvez, leading a center-right coalition, points to the government's failure in combating crime and corruption. Her proposals for the economy and upcoming reforms also do not worry investors.

Regardless of the election result, the new government will be expected to outline its fiscal policy. Mexico enjoys an “investment grade” rating, notably due to the strength of its public accounts and institutions, its controlled debt (debt-to-GDP ratio of 50%), and its rigorous fiscal policy. However, the recent deterioration in its fiscal deficit (expected to be close to 6% of GDP in 2024), exacerbated by sustainably higher refinancing costs, raises questions about the medium-term debt trajectory. The continued high level of state support for the oil company Pemex ($44bn, or 3% of GDP, between 2019 and 2023) could be called into question after 2025. The energy policy of the new government will have implications for future bond issuances, the fiscal deficit, and even the sovereign external debt rating.

Mexican local debt remains highly attractive, benefiting from high nominal and real interest rates, significantly higher than US rates, the beginning of a cycle of central bank rate cuts, and strong fundamentals. A 2% growth is expected in 2024, thanks to oil revenues and the relocation of American manufacturing industry to Mexico. Domestic consumption is strong, supported by rising wages.

The independence of the central bank and absence of external vulnerability (significant foreign exchange reserves) reassure investors and support FDI. In this context, driven by the resilience of US growth, the Mexican peso continues to appreciate against the US dollar: +7% in 2024 (as of May 23), following a historic performance of 30% in 2023.

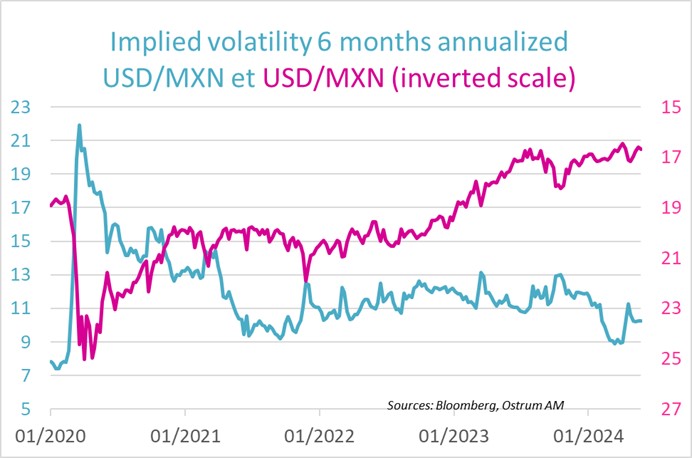

The Mexican currency benefits from remittances from Mexican workers in the US (which have doubled in 5 years) and foreign investment flows in the automotive, energy, and IT sectors. Purchases of local bonds denominated in Mexican pesos also provide support. This significant appreciation of the peso has been accompanied by a sharp decrease in volatility, although still higher than pre-Covid levels.

The American presidential election in Novem¬ber, especially as the free trade agreements with Canada and Mexico (USMCA) are set to be reviewed in 2026, will likely bring more volatility to the Mexican peso than the June 2 election, especially if the return of the Republicans to power in the US is confirmed.