Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum AM's views on the economy, strategy and markets.

The cio letter

On a knife edge

The announcements regarding tariff rates continue to unfold, fueling considerable volatility across financial markets. These tariffs are bound to reduce global trade. The suspension of some tariffs for a 90-day period coincides with an increase of customs duties applicable to China, now at 145%, a fact largely overlooked by the markets in hopes of a favorable outcome in upcoming negotiations. Concurrently, the unpredictability of U.S. economic policy imposes a significant risk premium on dollar-denominated assets. Even Treasuries, recognized as the safest and most liquid asset globally, are not immune to this trend. A sharp rise in long-term rates has compelled Donald Trump to soften his rhetoric. Additionally, the U.S. staggering deficit, which stands at 8% of GDP, exacerbates the vulnerability of the T-note. In this environment, the leveraged loan market has been shut highlighting the risk of credit crunch, which would likely lead to a recession. Against this backdrop, China is opting for dialogue with Europe and its regional partners rather than negotiations with Washington. Its response is expected to intensify through targeted import and export restrictions. Consequently, global growth will be significantly hampered.

Uncertainty reigns supreme in the financial markets. The emergence of American credit risk this year marks a pivotal shift, benefiting the Bund and the yen as they reclaim their status as safe havens. Central banks continue to pursue easing measures, as the risks to growth overshadow the inflationary impact of U.S. tariffs, especially with oil prices adjusting downwards by $10. Outflows from high-yield funds have brought valuations back around their five-year average. Equity valuation multiples are likely to face pressure amid heightened volatility and operational and margin risks induced by U.S. tariffs. The messages conveyed during quarterly earnings reports will carry particular significance.

Economic Views

THREE THEMES FOR THE MARKETS

-

Monetary policy

In response to the deteriorating growth outlook and the risks to financial stability, central banks have expressed their readiness to act. The increased risks of recession and deterioration in the labor market will lead the Fed to lower its rates. The ECB lowered its rates by 25 basis points on April 17 and left the door open for further rate cuts due to the risks of weaker growth. In China, the PBOC is prepared to take measures to make its policy more accommodative.

-

Inflation

The dramatic increase in US tariffs will quickly be reflected in inflation in the US. The impact will be partly offset by the significant drop in oil prices, reflecting fears of a global recession, and a slowdown in demand. US inflation stood at 2.4% in March and 2.8% for core. In the Eurozone, inflation was 2.2% in March and 2.4% for core inflation. The suspension of the EU's retaliatory measures for 90 days implies a moderation of inflation in the short term due to reduced demand, falling oil prices, and the appreciation of the euro. In China, deflation persists with an inflation rate of -0.1% in March.

-

Growth

The trade war initiated by Trump will weigh on global trade and growth, particularly affecting that of the United States. US growth is expected to be below its potential by 2025, with a significant risk of recession in the event of a "credit crunch." In the Eurozone, growth will be very weak due to the impact of rising tariffs and increased uncertainty affecting investment, employment, and consumption. China, the main target of Trump, will take measures to limit the impact of the prohibitive US tariffs (145%) on its growth.

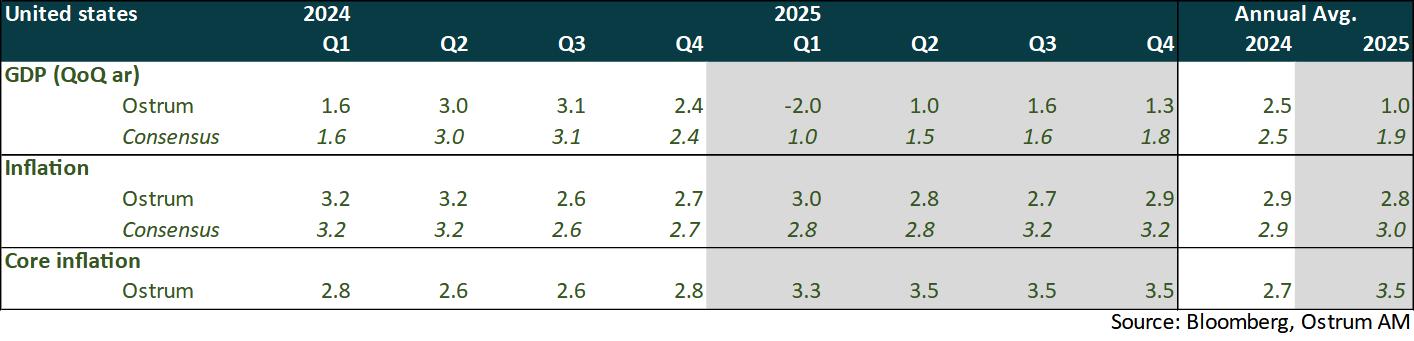

ECONOMY: UNITED STATES

Growth is below potential with a significant risk of recession in the event of a credit crunch.

- Demand: Consumption of durable goods is expected to contract in the first half of the year. Productive investment has been slowing since the beginning of 2024, and uncertainty is detrimental to spending. The trade deficit has deteriorated significantly, leading to a negative contribution from trade. GDP is likely to be negative in the first quarter, followed by a "mirror" drop in imports in the second quarter. Beyond that, growth is expected to remain below potential.

- Labor Market: The resilience of the labor market is surprising, but the risk of recession is significant. An increase in unemployment to around 4.5-5% by the end of the year is probable.

- Fiscal Policy: The budget is still under discussion. The proposal implies an additional drift. The seasonal surplus in April is likely to be lower than expected, making the timing of a technical default uncertain. The increase in tariffs will have an immediate effect on activity and import flows, with the net effect on revenues being ambiguous.

- Inflation: Inflation remains above target. Rents are expected to decelerate in 2025, and the decline in oil prices keeps overall inflation below the core index. Tariffs on imported goods have an immediate effect on inflation.

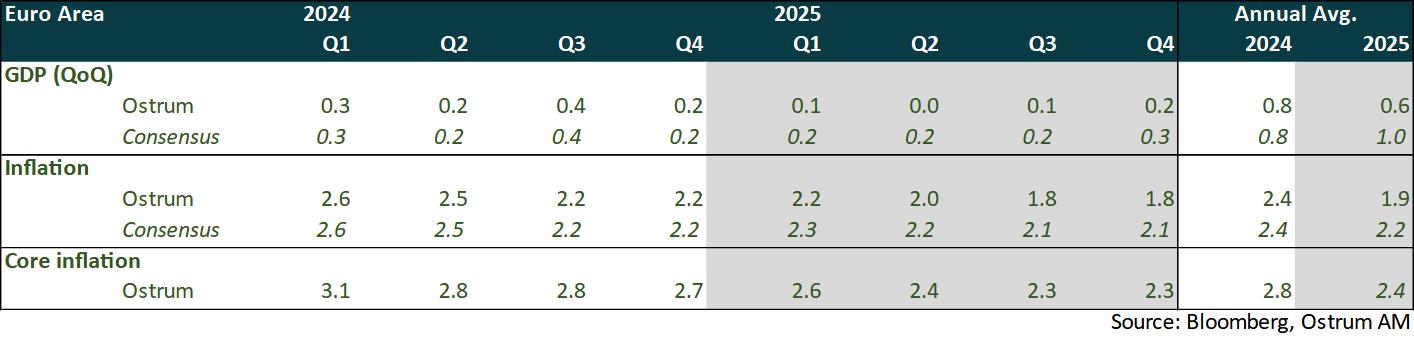

ECONOMY: EURO AREA

The dramatic increase in US tariffs against all of its trading partners leads us to revise down our growth outlook for the Eurozone.

- Global trade is set to slow significantly, impacting overall economic activity, particularly in the Eurozone.

- Domestic Demand: It is expected to be more limited due to the impact of rising uncertainty on the behavior of business leaders and households. They will become more cautious, which will weigh on investment, employment, and consumption, offsetting the anticipated effects of increased purchasing power and the ECB's monetary easing.

- Fiscal Policy: The €500 billion infrastructure fund in Germany and the reform of the debt brake will only impact German growth and that of the Eurozone starting in 2026. In 2025, the scope for maneuver is limited.

- Inflation: It will depend on the EU's retaliatory measures. In the short term, the 90-day suspension of the EU's retaliatory measures (in response to the 25% tariffs on steel and aluminum) will result in more moderate inflation due to the recent decline in oil prices, the appreciation of the euro, and reduced demand. Regarding the increase in base tariffs, since April 5, and potentially reciprocal measures, beginning of July, the EU is primarily seeking to negotiate. It is expected to take steps to limit the influx of Chinese products in response to the prohibitive US tariffs.

- Downside risks to growth in the event of an escalation in trade tensions.

ECONOMY: CHINA

The prospect of a slowdown in global trade induced by the new US trade framework leads us to revise our forecasts.

- We are revising our growth forecast down to 4.6% for 2025, indicating a slowdown starting in the second quarter.

- The main motivation for this revision is the slowdown in global trade induced by reciprocal tariffs. Strong uncertainty is expected to contract global investment. The circumvention of US tariffs is now limited, as (almost) all countries are taxed at a base rate of 10%.

- China is severely affected by these new tariffs, with Chinese products now subject to a tax of 145%. This includes the 20% tariffs (2x10) implemented in January and February, along with 34% in reciprocal tariffs, before the latest round of escalation took tariffs up to 145%. These tariffs are expected to be permanent for China, unlike those for other countries.

- The anticipated slowdown in US consumption starting in the second quarter is also expected to affect demand for Chinese products. Since a recession in the US economy is not our scenario, this limits the impact on Chinese growth.

- The deterioration of the international environment could weigh on the confidence of households and businesses, exacerbating deflationary pressures, which has led us to revise our inflation forecasts downward.

- Recent measures to support domestic demand, including the consumption plan and the resumption of negotiations on free trade agreements with Japan and South Korea, as well as the Regional Comprehensive Economic Partnership, are encouraging.

- Furthermore, China has the means to strengthen its measures to support domestic demand.

Monetary Policy

Central banks are plunged into the uncertainty of Trump’s policies.

- THE FED IS READY TO ACT IF NECESSARY.

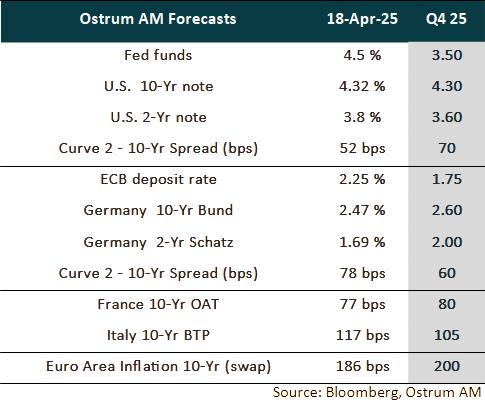

The Fed is in an uncomfortable position. The dramatic increase in US tariffs will lead to higher inflation and a rising unemployment rate due to a significant slowdown in growth. In the face of high uncertainty, Jerome Powell indicated on April 16 that the Fed must keep long-term inflation expectations well anchored. In this context, he believes that the central bank is well-positioned to wait for more visibility on the impact of the policies pursued by the White House on growth and inflation. On April 11, following the turmoil in financial markets, Susan Collins, President of the Boston Fed, stated that the Fed was ready to act if necessary to ensure financial stability. To prevent the US economy from entering a recession, we anticipate a 100 basis point cut in Fed rates by the end of the year. Furthermore, the Fed could slow the pace of balance sheet contraction or even suspend it until the debt ceiling issue is resolved. - CONTINUATION OF RATE CUTS BY THE ECB.

While some members of the ECB were in favor of taking a pause in the rate-cutting cycle that began last June, the shock to global trade and the increased uncertainty generated by the sharp rise in U.S. tariffs led the ECB to implement its seventh rate cut of 25 basis points on April 17. Christine Lagarde emphasized the numerous downside risks to growth due to the intensification of trade tensions while indicating that the net impact on inflation was highly uncertain. In this context, future monetary policy decisions will rely more than ever on upcoming data. Given the deterioration in growth prospects and the risk of more moderate inflation in the coming months, we anticipate two more rate cuts of 25 basis points by the end of the year. The ECB may also further reduce the pace of its balance sheet contraction and/or conduct additional targeted longer-term refinancing operations (TLTRO). - THE PBOC OPTS FOR A GRADUAL DEPRECIATION OF THE YUAN – RATE CUTS BY THE RBNZ.

The People's Bank of China (PBoC) is allowing the yuan to gradually depreciate against its basket of currencies, which helps to partially offset the impact of the sharp increase in tariffs. The decline of the yuan supports Chinese exports, a key driver of growth. This depreciation is gradual to avoid triggering massive capital outflows that could weaken the Chinese economy. The Reserve Bank of New Zealand (RBNZ) decided to cut its rates by 25 basis points to 3.50%, on April 9, in response to the significant rise in US tariffs. This development deteriorates global growth prospects and poses a downside risk to New Zealand's growth and inflation outlook. The RBNZ has stated that it is ready to lower rates further if necessary.

Market views

Asset classes

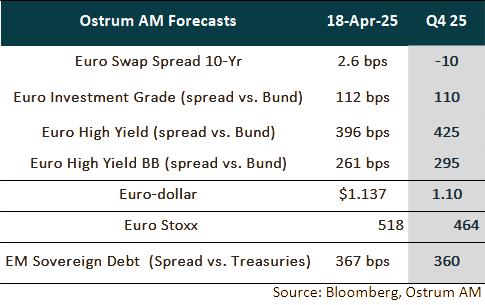

- U.S. Rates: Tensions surrounding American debt are leading to a risk premium that will likely keep long-term rates around 4.30%, despite the Federal Reserve's easing measures.

- European Rates: The European Central Bank (ECB) is expected to lower its rate to 1.75%. The 10-year Bund is factoring in a more ambitious fiscal policy in Germany while benefiting from reallocations from the dollar to the euro.

- Sovereign Spreads: Sovereign spreads are anticipated to remain stable as we approach the end of the year. Italy's budget consolidation has been positively acknowledged by S&P, which has reaffirmed its BBB+ rating.

- Eurozone Inflation: The decline in oil prices has weighed on inflation. However, a moderate increase in breakeven inflation rates is likely.

- Euro Credit: Investment-grade credit spreads are currently tight. In the absence of a recession, a tightening of these spreads is likely.

- Euro high yield: Valuations in the high-yield sector are expected to normalize over the course of the year, with the default rate remaining low.

- Exchange Rates: Growing skepticism towards the dollar has driven the euro higher. The single currency is nevertheless projected to fall back to $1.10 by the end of 2025.

- European equities: Tariffs are expected to exert pressure on margins, while increased volatility is likely to compress multiples, leading to a forecasted decline in the market. The market outlook is however highly uncertain.

- Emerging Market Debt: Emerging market spreads are poised to benefit from the Federal Reserve's monetary easing, despite the adverse effects of tariffs.