The world is holding its breath ahead of the US elections on November 5. The outcome will be positive or negative for emerging market currencies, depending on the political choices implemented.

The emerging market Strategy view

Tariffs: A Major Concern for Emerging Markets

The immediate concern for emerging markets is U.S. trade policy, linked to the outcome of the presidential election and especially to the recomposition of Congress. Since the onset of the trade war against China initiated by the Trump administration in 2018, global supply chains have been restructured to circumvent the rising tariffs on Chinese goods.

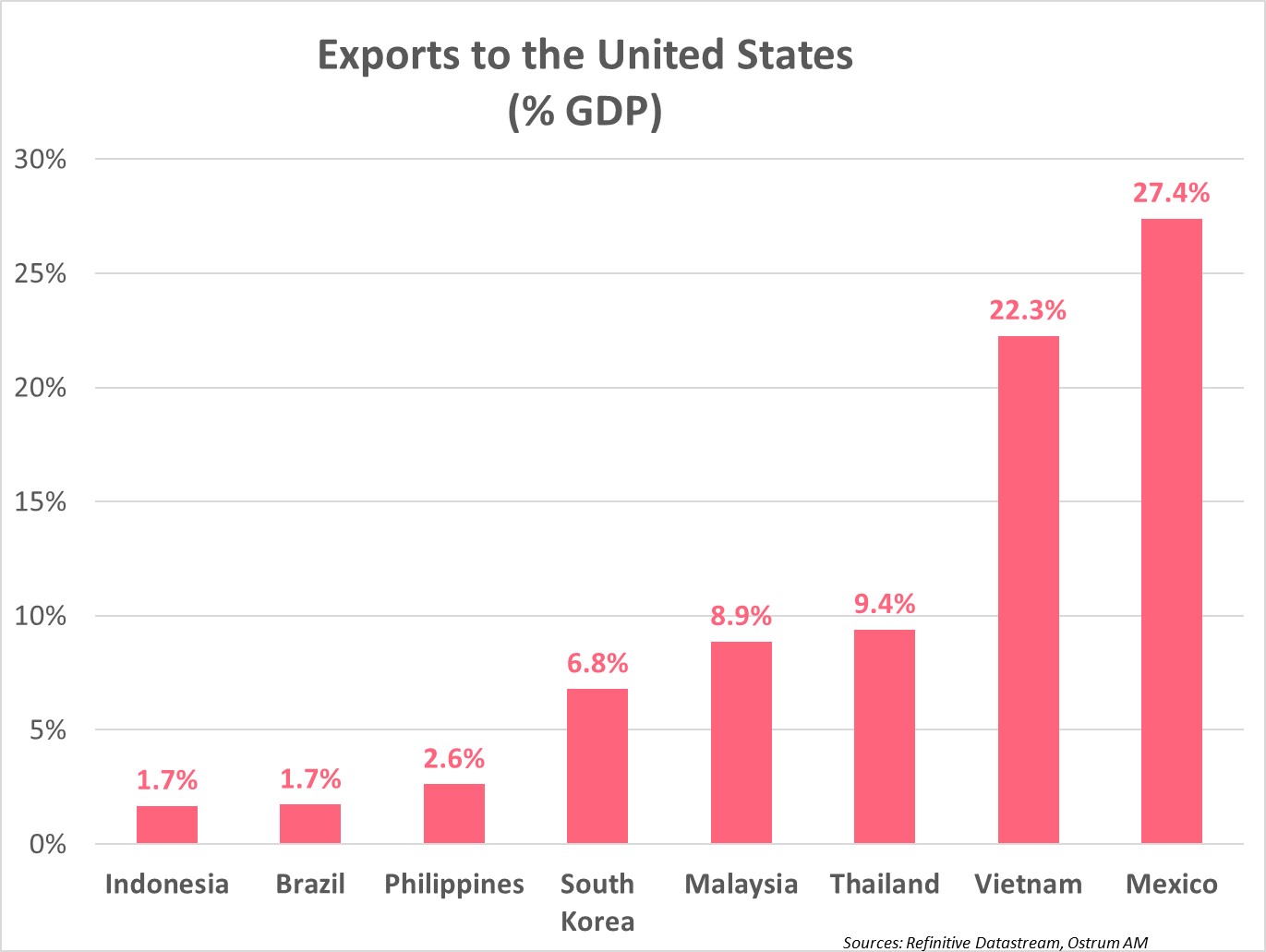

This reconfiguration of global trade has benefited several countries, including Mexico and various Southeast Asian nations such as Vietnam, Malaysia, and Thailand. The adjacent chart illustrates the share of exports to the U.S. as a percentage of GDP.

Mexico appears to be the most vulnerable in the event of tariffs being imposed on its exports, which account for 27.4% of GDP, particularly in the automotive and agricultural sectors. However, this threat is not immediate. In fact, Mexico signed the United States-Mexico-Canada Agreement (USMCA) on September 30, 2018, replacing the North American Free Trade Agreement (NAFTA), with terms set to be renegotiated in 2026.

Vietnam, whose exports to the U.S. represent 22.3% of its GDP, has quickly become an alternative manufacturing hub to China, but it could face a decline in global demand if trade tensions escalate.

Malaysia (8.9% of GDP) and Thailand (9.4% of GDP) also depend on their exports to the U.S. Furthermore, South Korea is highly integrated into global value chains, particularly in the semiconductor, automotive, and electric battery sectors. The U.S. and China are its main trading partners.

Consequently, the currencies of emerging markets primarily exporting to the U.S. appear to be the most vulnerable to the imposition of tariffs.

Nevertheless, we remain constructive on the emerging markets currencies, as the global environment—characterized by a Fed rate cut cycle and Chinese stimulus—is positive, and current exchange rate levels are attractive.

The Portfolio Manager view

The US Dollar is Expected to Remain Volatile as the Presidential Election Approaches

Regardless of the next U.S. president, the trade war is likely to intensify, especially if the Republican camp secures victory; a significant increase in tariffs on all imported goods is central to Donald Trump's agenda. Recent polls suggest he has a slight lead over Kamala Harris, making it unsurprising to see the US dollar appreciating against the currencies of its main trading partners, particularly China, Europe, and Mexico. Terms of trade are one of the key determinants of a currency's value, and this adjustment seems to have already begun.

In China, the yuan's exchange rate is controlled by the central bank, which aims to prevent its currency from depreciating unilaterally against the US dollar due to concerns over capital outflows, even as the Chinese government seeks to stimulate growth with a new stimulus plan. The People's Bank of China (PBOC) also manages the currency's value relative to a basket of currencies, including the euro and major Asian currencies. The stability of the yuan against this basket is what matters most. Additionally, China has an extra "buffer" to limit the depreciation of its currency against the US dollar: the sale by Chinese exporters of their accumulated USD earnings, which have been historically high after three years of strong growth in Chinese trade surpluses. An acceleration of this conversion, similar to what occurred this summer ($37 billion converted in August) following the massive unwinding of carry trades on emerging market currencies funded in yen, would partially offset the negative impact on the yuan from rising US tariffs.

Mexico is also targeted by Trump to prevent Chinese companies operating in Mexico from accessing the US market. However, its situation is different from that of China.

The Mexican peso, an extremely liquid currency, has suffered from a resurgence of political and fiscal risk following the presidential election in June and the controversial judicial reform vote. In July, the unwinding of long positions on the Mexican peso funded in yen, after the Bank of Japan raised rates and the Federal Reserve announced a pivot, led to a further downward adjustment of the Mexican currency. Positioning has become more neutral today; in terms of valuation, at around 20, it has returned to its long-term average. These technical and valuation factors, along with high real and nominal rates, provide support for the Mexican currency, not to mention the constantly increasing remittances from Mexican workers in the US and historically high foreign exchange reserves, which limit the currency's external vulnerability.

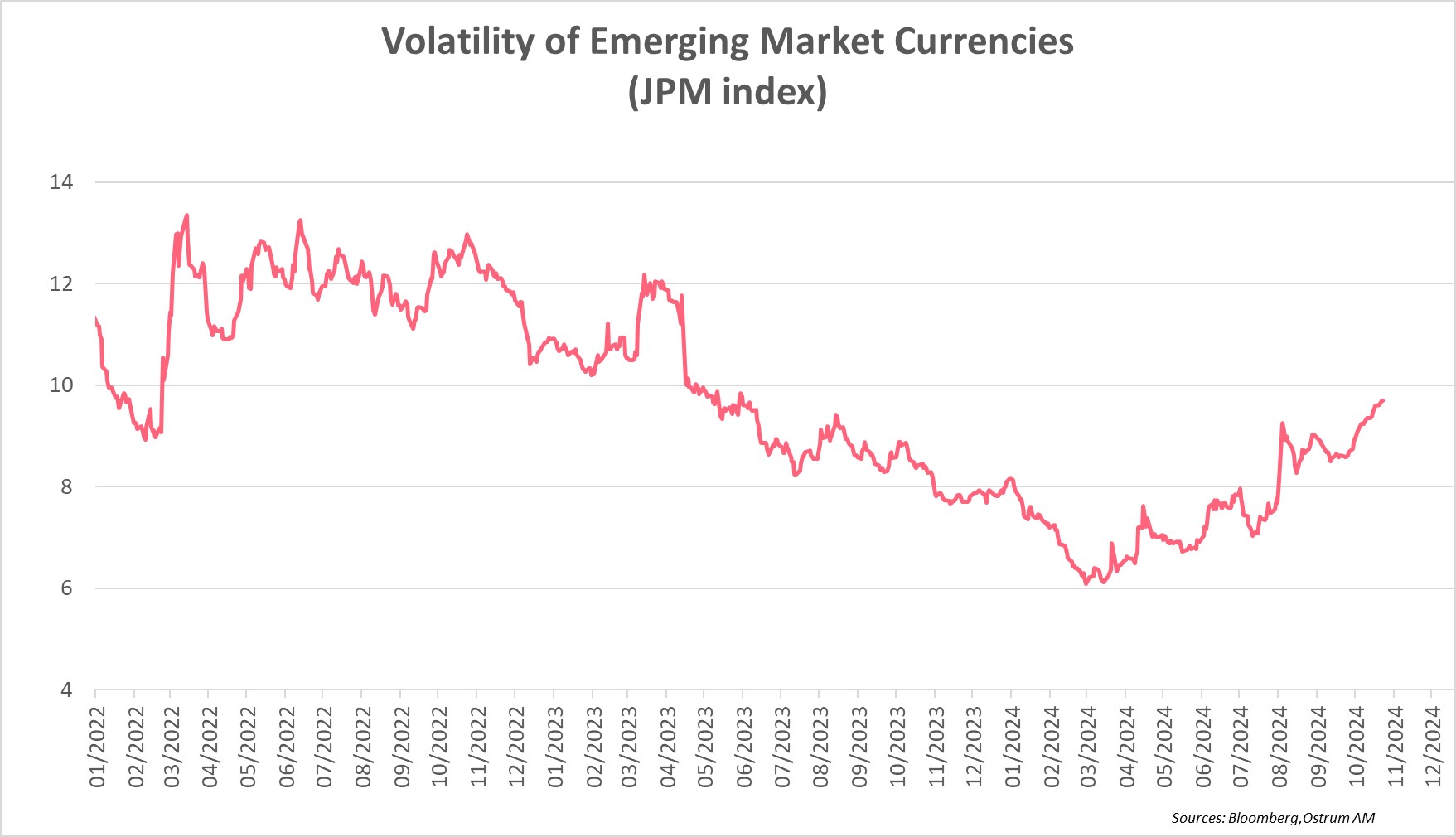

Volatility in emerging market currencies, which has risen sharply since summer, is expected to remain high as the US presidential election approaches.

Beyond this short-term volatility, the narrowing interest rate differential between the US and the rest of the world, linked to the Federal Reserve's rate-cutting cycle, should lead to a reallocation of short-term savings in US dollars towards emerging assets that provide higher yields. This is likely to contribute to the appreciation of emerging market currencies from an attractive valuation level.