Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to Axel Botte’s podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: The EU under the test of the trade war

- Despite the suspension of reciprocal tariffs, the average effective tariff rate in the United States is at its highest since 1901, at 28%, primarily due to the massive tariffs imposed on Chinese products;

- European goods are subject to a 10% tariff, which is ten times higher than the rates that previously applied. In addition, there are 25% tariffs on cars, steel, and aluminum. Other tariffs could be announced soon, particularly on semiconductors and pharmaceutical products;

- Given the prohibitive tariffs between China and the United States, the EU is at risk of facing a significant influx of highly competitive Chinese products. The EU has indicated that it will take measures to limit this;

- Beyond forming partnerships with other countries, it is essential for the EU to strengthen the European single market, which still faces significant tariff barriers. These are estimated to be equivalent to tariffs of 44% on goods and 110% on services, according to the IMF;

- Given that European countries primarily trade among themselves, removing these barriers to intra-zone trade would significantly enhance productivity and growth in the EU.

Market review: Coming up for Air

- U.S. retail sales bounce in April;

- Euro area: ECB cuts rates by 25 bps as expected;

- Calm back in U.S. Treasury bond market: T-note around 4.30%;

- Equities: equity rebound in Europe despite the technology sector’s underperformance.

Axel Botte’s podcast:

- Review of the week – On the brink of a crisis of confidence;

- Theme – The EU under the test of the trade war.

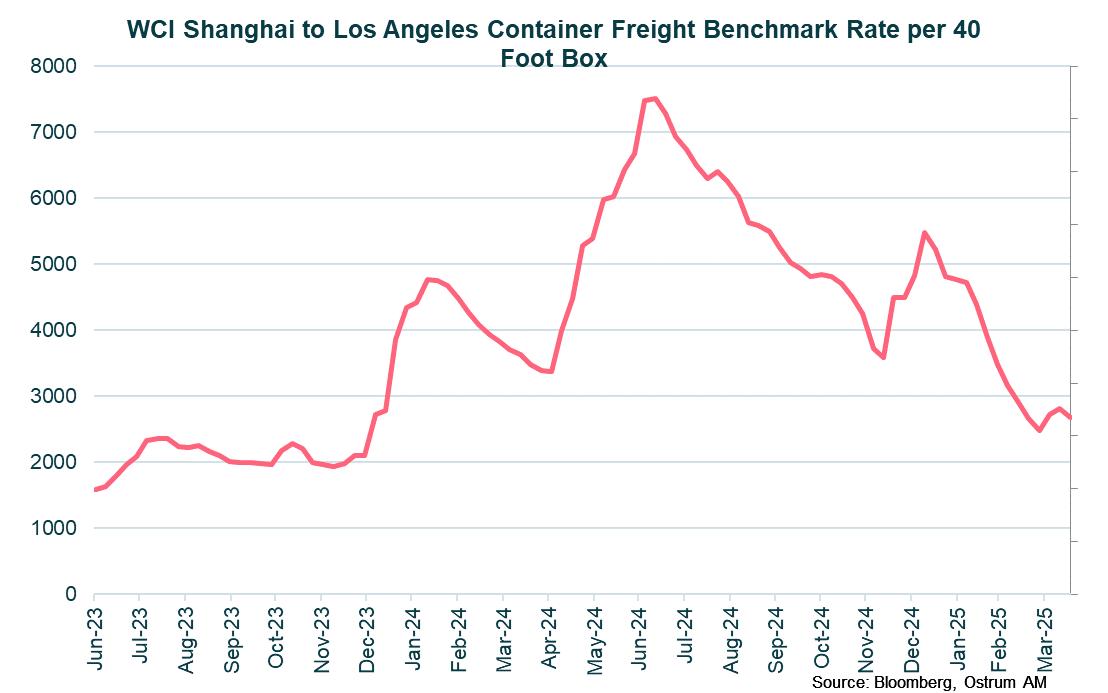

Chart of the week

Tariffs, in effect since Mid-March, are already weighing on global trade. Container rates are down since February. But in a further escalation to the trade war, the Trump administration plans to impose fees on Chinese-built and -owned ships docking in the US, as well as non-Chinese shipbuilders, to support the US shipbuilding industry.

The fees would be based on the volume of goods carried, with Chinese vessels to be assessed $50 per net ton after six months, increasing incrementally over three years.

Figure of the week

7

Last week, the ECB proceeded with its 7th rate cut since June 2024. The deposit rate was brought down to 2.25 %.