Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Axel Botte’s and Aline Goupil-Raguénès' podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Trump triggers a global trade war

- The United States has triggered an unprecedented global trade war in just over 100 years to end the trade imbalance, reindustrialize America, and finance the maintenance of the tax cuts enacted by Trump during his first term;

- The United States has announced universal tariffs of 10% on imports of goods, supplemented by reciprocal tariffs for 56 countries and the EU (which can reach up to 50%), and has instituted tariffs of 25% on automobiles;

- China responded firmly. The EU initially wishes to negotiate while preparing retaliatory measures if necessary. It has a new tool since the end of 2023: the anti-coercion instrument;

- Donald Trump is not willing to negotiate at the moment. Additional tariffs are expected to be announced on semiconductors, pharmaceuticals, wood, automotive parts, and critical metals;

- These tariffs represent a significant shock to international trade that is likely to weigh strongly on global growth. All countries will emerge as losers, with the United States being the first, where the risk of recession has significantly increased.

Market review: The Misunderstood Genius Syndrome

- U.S. tariff hikes sent markets into a tailspin;

- U.S. job creation at 228k in sharp contrast to ISM employment readings;

- T-note yields plunge below 4%;

- Stock markets down around 7 to 10% last week.

(Listen to) Axel Botte’s and Aline Goupil-Raguénès’ podcast:

- Review of the week – A turbulent week in financial markets;

- Theme – Trump triggers a global trade war.

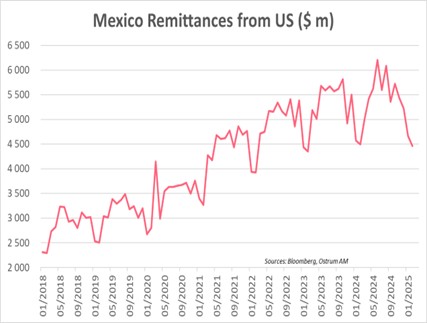

Chart of the week

In addition to its tariff policy, the Trump administration aims to reduce immigration from Latin America, particularly Mexico. As of 2023, the number of Mexican immigrants in the United States stood at 10.9 million, with illegal immigration likely adding several million to this figure.

The jobs held by Mexicans in the U.S. generate significant income for the Mexican economy. Annual remittances to Mexico are projected to reach approximately $64 billion for 2024, accounting for about 3.5% of Mexico's GDP. A slowdown in remittances, which have decreased by 0.8% year-on-year, is expected to weigh on Mexico's economic growth.

Figure of the week

5.3

The U.S. stock market S&P experienced a loss of market capitalization of $5.3 trillion between the close on Wednesday, April 2, and the close on April 4, following the announcements of reciprocal tariffs by the U.S. and retaliatory measures from China.