At end of 2024, the Eurozone monetary policy was still rather accommodative with gradual interest rate cuts.

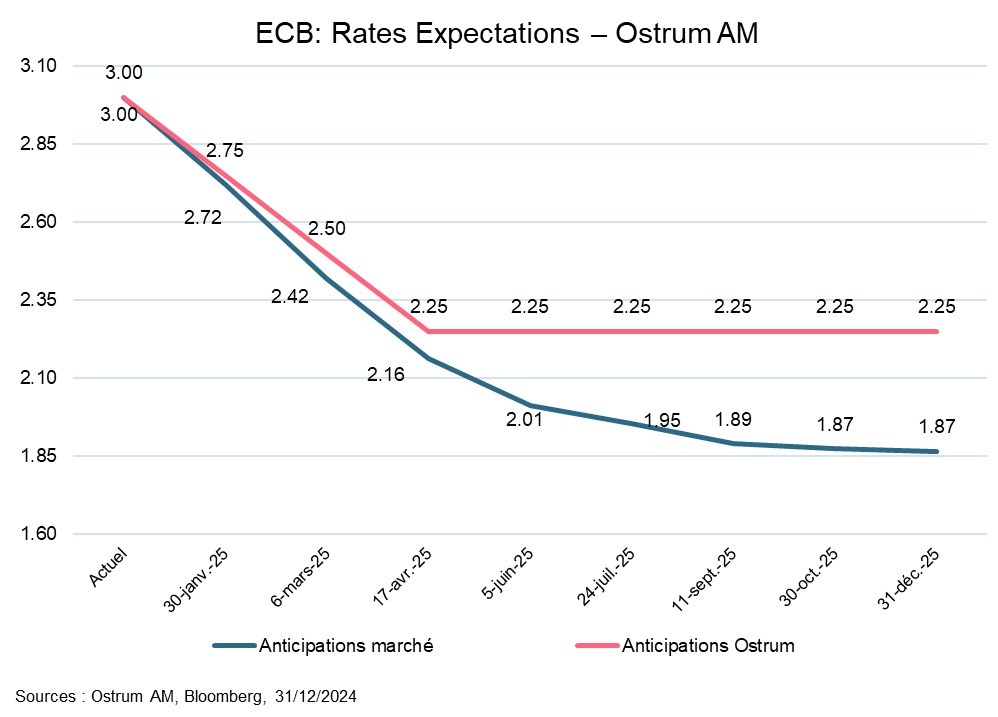

After peaking at 4% in 2023, European Central Bank (ECB) rates reached 3% and are expected to fall further in 2025.

The macroeconomic environment still demonstrates a degree of resilience, especially in the United States with the US economy still on a favourable trend. Growth is very positive despite US Federal Reserve (Fed) rates still above 4%.

In the Eurozone, the trend is less favourable, but companies are still showing positive results despite two years of high rates. Inflation, meanwhile, has fallen sharply since the post pandemic peak of almost 10% and appears to be returning to levels close to 2%. There has also been a slight recovery linked to energy prices and inflation in services and wages, which seem to be holding up at higher levels.

Finally, default rates are likely to remain below their historical average, while Technicals remain strong with large inflows, which should continue to support spreads in the credit asset class in 2025.

With short term interest rates above 3% early 2025, investors still seem to prefer short-term solutions such as money market investments, given that volatility is very close to zero in a context of considerable instability in interest rate expectations.

Fairouz Yahiaoui, money market portfolio manager and leader expert, says: " Expectations of interest rate cuts by the market at the end of 2024, at 1.5% by the end of 2025, seemed a little pessimistic. Consequently, for money market strategies, we have favoured floating rate bonds so that we do not see a negative re rating in the event of a rise in rates on the short end”.

The market now predicts only three rate cuts in 2025, down from six few weeks earlier, suggesting that cash yields are likely to stay higher for longer. The market is expecting them to remain above 2% for the coming months and years, which is why we believe that money market investments remain an attractive asset allocation option. On the other hand, long-term yields have risen sharply since the end of 2024.

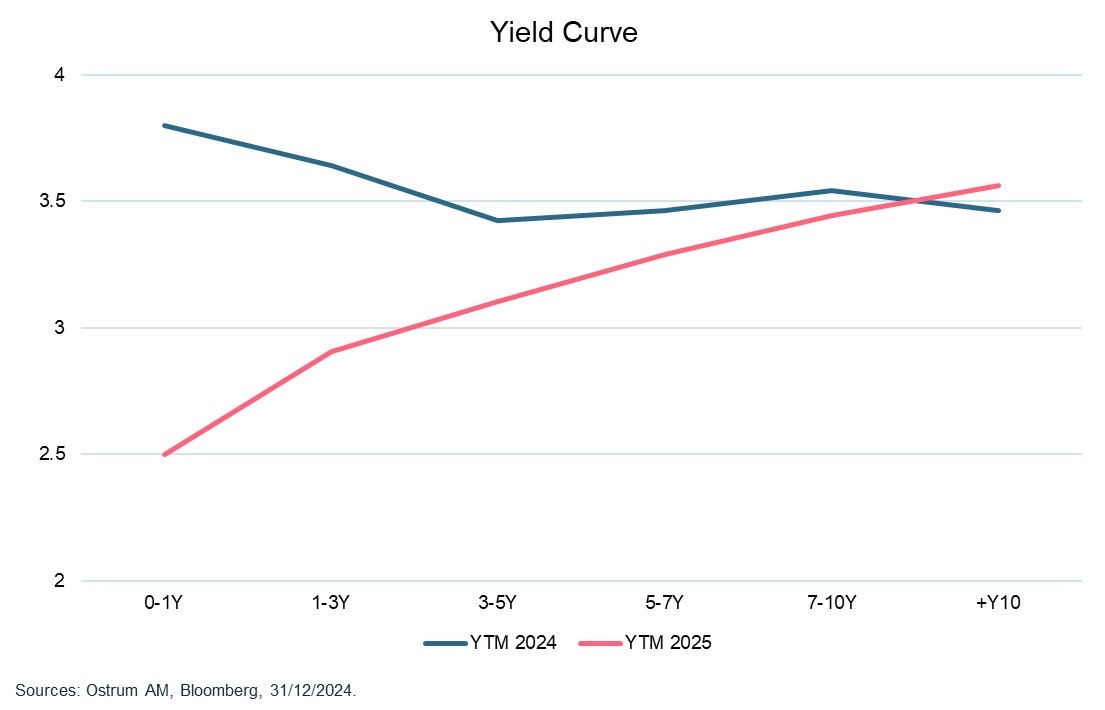

The yield curve is now steepening, with longer rates regaining interest compared to a recent situation where the curve was flat to inverted. As a result, with yields starting to steepen a little, investors are beginning to ‘pick up duration’ by investing in longer maturities to capture a more attractive yield.

Philippe Berthelot, CIO Credit & Money Market, notes: " We are seeing more and more investors ‘straddling the yield curve' i.e. leaving the very short end to increase the maturities of their investments. In the current environment of yield curve normalisation, we think this is appropriate.

However, given the high volatility of interest rate expectations, we think investments in intermediate maturities, between 1 and 3 years, seem the most appropriate in terms of returns/risks”. As a result, investors are still prioritising money market solutions but are gradually following the steepening of yields with slightly longer investments.

In conclusion, given the solid fundamentals of issuers, weak growth in the euro area but which should be supported by more accommodative monetary policies as well as bearish technical factors, credit seems to be an asset class that could still be preferred by investors.

With high interest rate volatility, geopolitical instability and a possible resurgence of inflation following the uncertainty surrounding Trump's election and his programme deemed inflationary, we still prefer short-term solutions as we enter 2025, but with a possible and gradual increase in duration over the coming months and years.