In 2023, money market funds experienced a significant increase, benefiting from a backdrop of rising interest rates and inflation. Investors are reassessing their approach to liquidity, with a 21% increase in assets under management, followed by an 11% rise in 2024. As the prospect of rate cuts looms, the sustainability of these attractive yields remains uncertain.

Investors are starting to view cash in a different light and allocations are changing as a result.

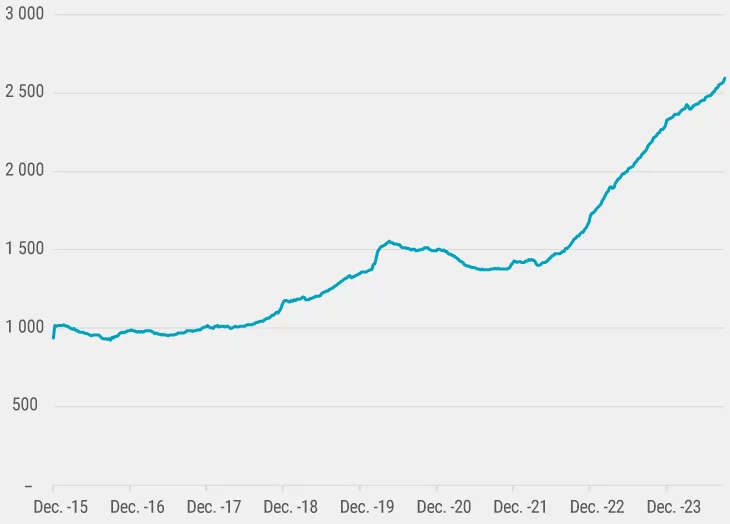

2023 was a great year for money market funds. Catalyzed by the return of inflation and its corollary, the dramatic rise in interest rates, in a volatile environment for government bonds, money market outstandings rose by 21% (+€115 billion). That trend has continued in 2024, albeit more slowly, with an 11% increase since the start of the year (to end July) (+€72 billion)1.

As investors look forward to the prospects of the start of an interest rate cutting cycle, the question is swiftly becoming where do money market funds go from here? And the answers are not as clear cut as in previous cycles.

Money market funds still offer “a gross yield of 3.5%2, low volatility and low interest rate risk”, according to Fairouz Yahiaoui, money market fund manager at Ostrum Asset Management, an affiliate of Natixis Investment Managers. She expects yields to remain above 3% until the end of this year3.

A changing asset class

“The weight of money market and ultra short-term bond funds in customer portfolios peaked in late 2023, at around 16%, even exceeding the level reached at the time of the pandemic. It may have fallen in 2024, but the attractiveness of cash and investor interest remain”, notes Julien Dauchez, Head of Advisory and Portfolio Consulting at Natixis Investment Managers Solutions, pointing out that over and above the arithmetical growth in assets under management, the market is witnessing a genuine transformation of the asset class from something of a last resort when better options were unavailable, to a strategic building block of asset allocation.

The first reason for this is that it is no longer the preserve of institutional investors, the asset class is increasingly popular with retail investors.

ICI Retail Money Market Fund Assets $bn, (10.08.2024)

Source: Bloomberg, DS - 2024

Investors' use of cash has also changed. “Inflation has caused a simultaneous double bear market in government bonds and in equities, making the former lose their safe-haven status. The asset class back then that combines the attributes of protection and diversification was cash. Cash has become a cushion of protection investors were looking for, providing a welcome diversification.”, Dauchez says. “10 years ago, cash, money-market and short-dated bond funds played a residual role in clients' allocations. The paradigm changed completely in 2022 with the re-correlation of bonds and equities. Cash has since become an asset class in its own right.”

The third factor shaping investor use of the asset class, Dauchez says, is the growing of private assets such as private equity and private debt with wealth managers. The ability to take advantages of opportunities as they arise and, importantly, manage one’s cash flows to take cope with capital calls is becoming an increasingly important consideration for many investors. Matching capital calls and distributions require a larger and more active allocation to cash-like instruments from the outset.

A shifting profile

Not all money market funds are equal, however, especially in the current environment, where market uncertainty remains high. “High quality of credit is vital in the current environment to minimize credit risk. That is why we spend so much time focusing on issuer selection”, Yahiaoui says. “Our in-house credit research team comprises 22 analysts on three continents, covering over 500 issuers eligible for the money market investment universe. It provides a forward-looking view of each issuer for the coming years, which external rating agencies do not offer, as they are limited to past data. This view is decisive at the issue selection stage, especially in an uncertain macroeconomic and geopolitical environment. It's important to be able to anticipate a potential rating change, for example,” she adds.

Another way to protect against rising interest rates is to index one’s portfolio to variable rates, or to limit the maturity of your portfolio.

ESG can also be used to reduce risk, Yahiaoui says: “We've seen a correlation between companies' ESG best practices and their resilience. in our money market funds,” explains Fairouz Yahiaoui at Ostrum, whose entire money market range is SRI-labeled.

And, of course, she adds, for those investors willing to take on a little more risk, with a view to increasing the potential return, there is also the option of credit short-term funds.

1 source: Broadridge

2 source: Bloomberg, Ostrum as at 8 October 2024

3 source: Ostrum, Perspectives, September 2024, page 5