The coming year is likely to see significant volatility in some asset classes. For insurers willing to take a sophisticated approach to the Solvency Capital Requirements, this will be an opportunity to secure yield and boost returns.

Highlights

- At the start of 2025, insurers face significant market volatility and uncertainties, including potential political changes in the U.S. and Europe, as well as China’s economic stimulus measures. Successfully navigating these challenges will require insurers to be agile in their asset allocation strategies.

- Ostrum Asset Management (Ostrum AM) advocates for a balanced approach to Solvency Capital Requirements (SCR), emphasizing that while SCR is essential, focusing solely on its reduction may lead to lower returns. Instead, they propose using SCR as a guideline to optimise investment returns while remaining compliant.

- 2025 already presents various opportunities across asset classes, including a decline in Central bank’s rates that may favour longer-term investments, potential volatility in European sovereign debt, and an expected increase in dividends from European equities. Insurers are encouraged to capitalise on market fluctuations to enhance their yield and overall returns.

Insurers begin 2025 by facing several significant unknowns. Navigating this environment will require the ability to react nimbly and to turn market volatility into an opportunity.

The uncertainties ahead include the arrival of Donald Trump as the 47th US President. Trump has made clear that tariffs will be a pillar of his trade policy, but the precise nature of those tariffs is unclear. While China is the focus of his concern, there will be impacts across global economies, including for European companies with exports to the US.

Europe, meanwhile, is facing its own challenges with France facing political instability and Germany holding elections in the first quarter of the year. China itself is preparing a stimulus package to spark its domestic economy. The exact nature and scale of that stimulus is also as yet unknown but given the sheer scale of the Chinese economy the effects could be significant.

For insurers, the question of asset allocations in this uncertain and potentially volatile environment is paramount.

SCR – how it affects asset class allocations

Given the importance of regulation, many insurers and their advisers may be tempted to make Solvency Capital Requirement (SCR) their primary concern and attempt from the outset to optimise their SCR. Ostrum AM, an affiliate of the Natixis group, believe it’s only the first step.

“Making SCR optimisation the principal aim of an allocation strategy tends in only one direction – to reduce SCR. This in turn will tend to reduce returns, which is contrary to the fundamental objective of managing an investment portfolio in any business” explains Rémi Lamaud, Insurance solutions expert at Ostrum AM.

SCR is of course a core constraint on allocations, but it should not be the principal guiding factor.

“Each insurance client who comes to Ostrum AM has an established SCR with which they are broadly comfortable. But the most effective strategy is not to attempt to optimise (typically reduce) this SCR, but to use it as a parameter and then aim to optimise returns. In other words, analysing SCR consumption is only step one in Ostrum AM’s process to build allocations for their insurance clients,” says Rémi Lamaud.

There is not one allocation that will suit every insurer, but it is important to consider whether reducing SCR for its own sake is desirable if it leads to reduced returns. “The vital question we ask is whether improved returns can be achieved within the SCR parameters suitable for that insurer” Audoli specifies.

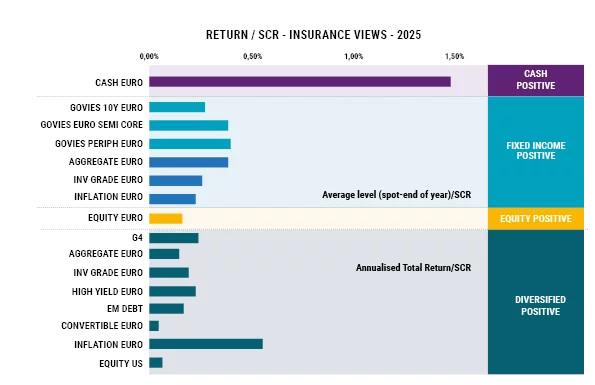

Ostrum AM monitors all assets classes, from sovereign bonds through investment grade and high yield bonds to equities and illiquid assets through a Return / SCR perspective. This grid is then submitted to simulations according to Ostrum AM’s views to assess how Return and SCR could change. By aligning this with an insurer’s SCR parameters, the team creates a global map of opportunities, identifying where allocations can be adjusted, thus remaining within the SCR range appropriate for the insurer while also ensuring optimised returns.

Source: Ostrum AM, as of December 2024

The outcome is tailored to each insurer, their SCR starting point and their accounting methodology. The exact allocation will thus differ between clients.

While the details will vary, Ostrum AM sees several broad opportunities in 2025 that should be considered as part of an allocation strategy.

Opportunities in 2025

The most significant factor in fixed income over the coming 12 months will naturally be the path of interest rates. “By the end of 2025, we expect the European Central Bank deposit rate to have dropped to 2.25% and the US Federal Reserve rate to be cut to 3.5%. This decline in rates will make 2025 a good period in which to deploy cash into longer term investment,” anticipates Xavier-André Audoli, Head of Insurance Multi Assets at Ostrum AM.

But within this general trend insurers may face significant volatility on bond, notably in Europe and particularly in French sovereign debt. There may also be opportunities in peripheral European sovereign debt. Given the equal status of all EU member state debt under SCR, this is a market in which the active pursuit of yield comes at no spread cost in terms of capital requirements.

“In corporate investment grade debt, we expect 2025 to see little change, but we do expect to see a rise in spreads on high yield but not enough to offset the carry effect,” adds Audoli.

Considering the expected volatility in the fixed income space, market timing will be crucial to improve the book yield while optimising the SCR and accelerate the accretion of the yield of the portfolio.

“Finally, we expect to see an increase, of less than 10%, in total return (including dividends) from European equities and sees no reasons for concern over equity valuations. The dividend season in Europe centres on Q2 and thus market timing and market volatility will be a factor. Potential Drawdowns in equity in early 2025 should be an opportunity to buy and secure potentially attractive levels from upcoming dividends,” explains Lamaud.

According to Ostrum AM’s team, the environment is likely to change in the second half of the year and there should be opportunities to adjust allocations between US and European equities. There is likely to be less European uncertainty if potential political upheavals in France and Germany have been resolved. At the same time there will be much greater clarity on China’s stimulus measures and the practical reality of the Trump presidency.

A year to focus on returns

Optimising returns in 2025 will involve grasping the opportunities that volatility creates and securing superior yield in both fixed income and in equities. In this environment, more than ever focusing on simply optimising SCR may not be the most effective strategy.

The Ostrum AM approach of mapping yield potential against capital requirements aims instead to optimise performance within the constraints of SCR. “It may sound like a small distinction, but it is one we believe will be the most effective in the volatile months ahead and one that could make a significant difference to returns” concludes Audoli.