Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum’s views on the economy, strategy and markets.

The cio letter

A Christmas Spirit in the Markets Despite Clouds on the Horizon

The emergence of U.S. tariff threats has triggered notable volatility across markets. Concurrently, Chinese authorities have announced initial retaliatory measures, including restrictions on rare earth metal exports. From a macroeconomic perspective, the growth gap persists in the fourth quarter, with the U.S. economy nearing its potential while the Eurozone experiences a slowdown. Chinese policymakers are expected to bolster support next year to build on the early signs of cyclical recovery.

Inflation, excluding energy, remains entrenched above central banks' comfort zones. Monetary easing is gaining momentum, as the ECB implements another 25-bp cut, while the BoC adjusts rates down by 50 bps in response to deteriorating employment figures. The Fed is engaged in a gradual easing phase, towards 4% by March, a move that could stoke inflationary expectations. Meanwhile, the PBoC has announced additional easing, while the BoJ stands as the sole institution contemplating a hike.

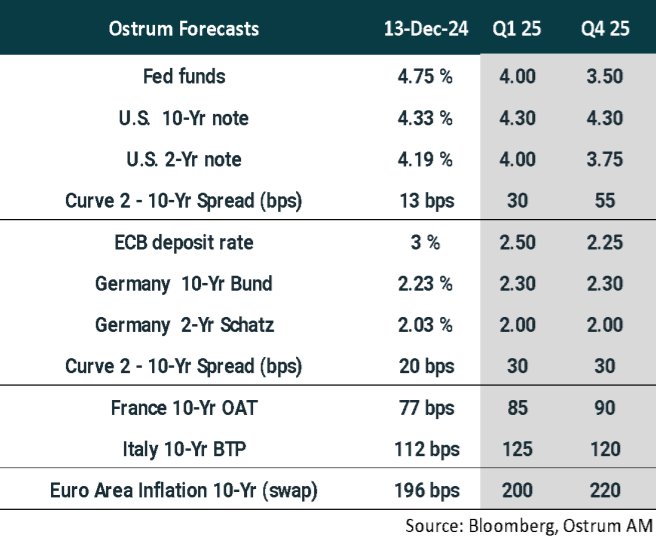

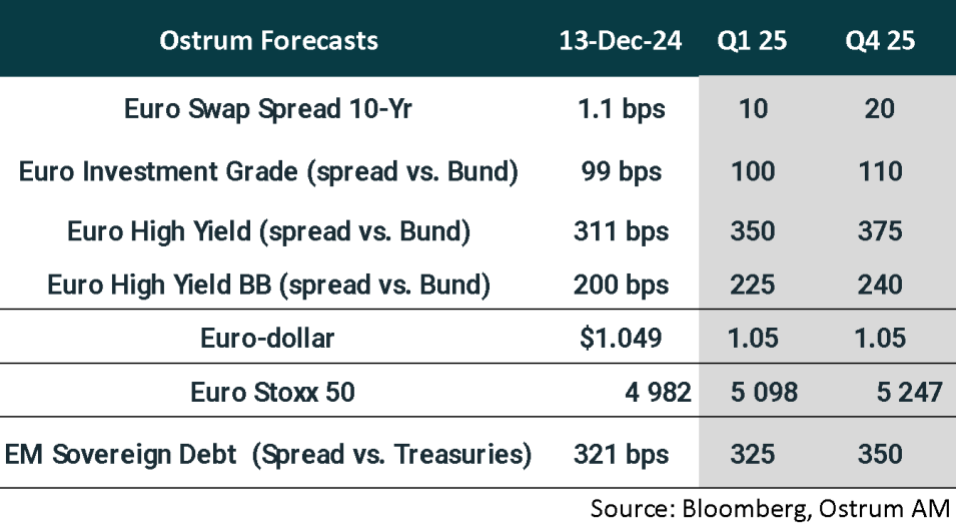

In the markets, we anticipate that 10-year Treasury yields will hover about 4.30%, while Bund yields are projected to reach 2.30% in the first quarter. Sovereign bond issuance will increase at the start of the year. The ECB's acceleration of QT will likely keep swap spreads under pressure in the short term. The French spread represents a source of fragility, particularly as sovereign spreads have significantly narrowed.

In credit markets, where volatility is lower, investment-grade bonds are increasingly attractive. The high-yield sector continues to benefit from favorable technical factors and a low default rate. European equities are expected to see slight gains in early 2025. However, U.S. equity valuations remain elevated, with the bulk of earnings growth concentrated in the largest technology stocks.

Economic Views

THREE THEMES FOR THE MARKETS

-

Monetary policy

Central banks are expected to continue cutting their key interest rates in 2025. The Fed is set to ease its monetary policy, bringing its rates down to 3.5%, which is close to the neutral level. Meanwhile, the ECB has lowered its deposit rate by 25 bps to 3%, aligning with the upper bound of its neutral rate range. As a result, the ECB's monetary policy no longer needs to be considered "restrictive." In China, the PBOC has indicated it will intensify its monetary easing efforts to support domestic demand.

-

Inflation

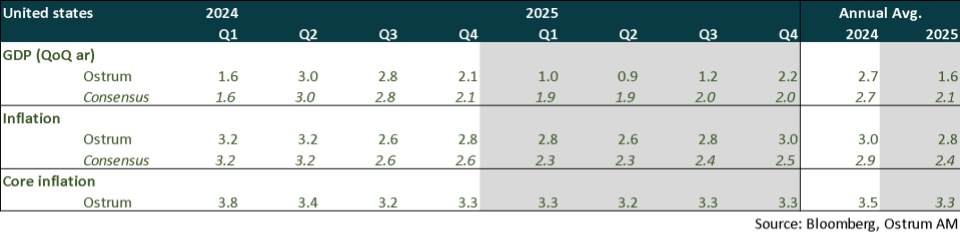

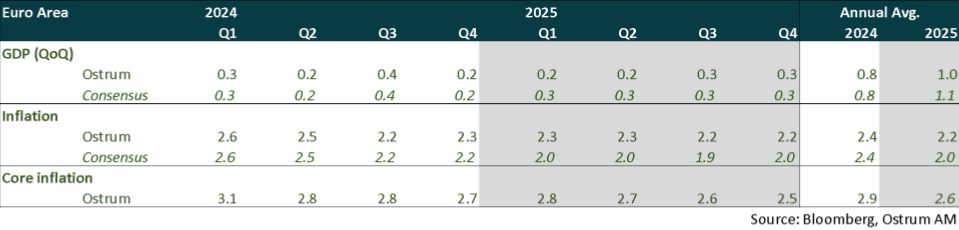

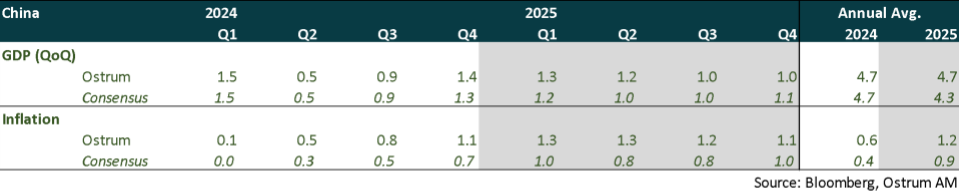

The risk of divergence between U.S. inflation and that of the rest of the world is increasing. In the United States, inflation stood at 2.7% in November, with core inflation remaining unchanged at 3.3%. Tariffs pose the primary risk to the outlook for U.S. inflation. In the Eurozone, inflation rose to 2.3% in November, primarily due to unfavorable base effects on energy prices. Core inflation remained stable at 2.7%. In China, inflation was recorded at a mere 0.2% in November, attributed to declining food prices.

-

Growth

U.S. economic activity remains robust as the year ends. However, the imposition of new tariffs is causing concern among American businesses, as highlighted in the latest Beige Book. In the Eurozone, uncertainty surrounding growth is significant. Germany is in recession due to challenges facing its automotive sector. Meanwhile, surveys are deteriorating rapidly in France amid political instability. In China, economic activity continues to be driven by exports, while the real estate sector is showing signs of stabilization. However, domestic demand remains weak.

ECONOMY: UNITED STATES

- Domestic Demand: Consumption is spontaneously decelerating from the high levels seen in 2024, particularly in durable goods, leading to some inventory destocking. Both international and domestic uncertainty regarding economic policy are weighing on equipment investment, which is also constrained by potential retaliatory measures from other countries. Wage tensions are re-emerging, profitability is declining, and restructuring efforts are becoming apparent.

- Fiscal Policy: Consumption is strengthening as the year-end approaches, coinciding with the expiration of the TCJA on December 31. There is uncertainty surrounding unused credits from the IRA, the reduction of corporate tax rates, and federal layoffs based on decisions from the Department of the Treasury.

- Inflation: Certain tariffs are being raised, particularly on imports from China. Imports are increasing ahead of the implementation date. Inflation is projected to rise by an additional 0.3%, reflecting the stronger contribution from import prices. Housing continues to be a significant source of inflation.

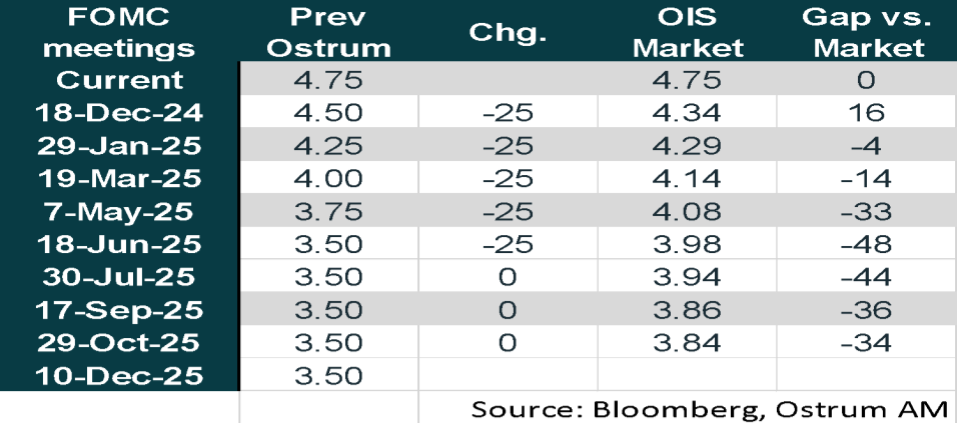

- Monetary Policy: The Federal Reserve is lowering its rate to 3.5% despite inflation concerns, prioritizing employment. Unemployment is rising, alongside labor shortages in construction and services, exacerbated by a slowdown in immigration.

ECONOMY: EURO AREA

- Growth and Inflation: More than the tariffs themselves, euro area growth is expected to be significantly affected by increasing uncertainty, which will weigh on investment, employment, and household spending. This impact could partly offset the rise in real household incomes and the rate cuts. Divergence within the euro area is likely to persist, with very moderate growth in France and Germany contrasting sharply with the robust performance of Spain.

- Fiscal policy is unlikely to provide support for growth. Countries under EDP, such as France and Italy, will need to take measures to reduce imbalances. Political uncertainty in France and a high public deficit are expected to lead to a downgrade of France's credit rating. There is a possibility of increased spending in Germany following the snap elections in February.

- Foreign Policy: The election of Donald Trump also raises the risk of U.S. disengagement from military aid to Ukraine. This situation is accelerating discussions within the EU about issuing European bonds to finance defense.

- European Policy: The impending escalation of trade tensions makes it even more urgent for Europe to adopt decisive measures collectively to bridge the productivity and competitiveness gap with the United States. Massive investments will be necessary, along with progress on the capital markets union.

ECONOMY: CHINA

- Economic Activity: Economic activity remained driven by exports in November, reflecting expectations among international companies of impending tariff impositions. The real estate market shows signs of stabilization, particularly in Tier 1 cities. However, additional measures such as the renovation of urban villages and the conversion of unsold inventory into social housing will be necessary to achieve lasting stability in the sector.

- China has responded to the latest U.S. technological sanctions by banning its exports of gallium and germanium—accounting for 98% of global production—two critical minerals for the U.S. defense sector. This serves as a serious warning; China is prepared to confront Donald Trump. In addition to its dominance in global manufacturing, China also leads in rare earth supply chains, heightening the risk of disruptions to global production chains and increasing inflationary pressures.

- In this environment of heightened uncertainty, the Chinese government is expected to bolster support measures to stimulate domestic demand. We anticipate further interest rate cuts and reductions in the required reserve ratio for banks to alleviate liquidity pressures.

Monetary Policy

Monetary policies will cease to be restrictive

- THE FED WILL FOCUS MORE ON ITS MAXIMUM EMPLOYMENT OBJECTIVE

The Fed is very likely to lower its rates for the third consecutive time during the meeting on December 18, bringing the Fed Funds rate to the range of [4.25% - 4.50%]. It is expected to continue reducing rates thereafter to remove the restrictive stance of its monetary policy. The Fed will focus more on its second objective, that of maximum employment, in order to avoid a significant slowdown in the labor market due to the anticipated moderation in growth. We anticipate four rate cuts of 25 basis points in 2025, bringing the Fed Funds rate to the range of [3.25% - 3.50%] by June. This is the upper limit of the Fed's neutral rate estimates. The central bank is likely to end its balance sheet reduction before March 2025. With Donald Trump arriving in the White House, the Fed will need to firmly resist any attempts to challenge its independence in order to preserve its credibility. - THE ECB KEEPS THE DOOR OPEN FOR FURTHER RATE CUTS

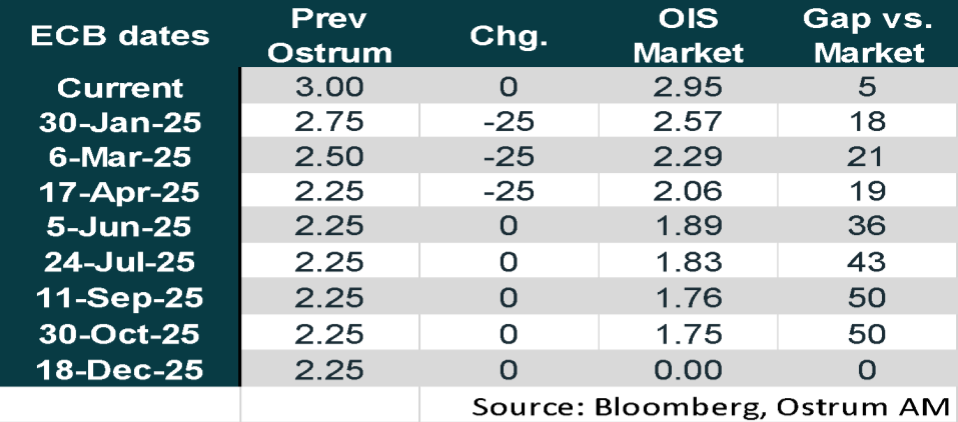

The ECB carried out its fourth rate cut of 25 basis points on December 12, bringing the deposit rate down to 3%. Growth forecasts have been revised downwards (1.1% in 2025, 1.4% in 2026, and 1.3% in 2027), as have inflation forecasts for 2025 (2.1% in 2025, 1.9% in 2026, and 2.1% in 2027). The ECB has kept the door open for further rate cuts to ensure that monetary policy is no longer restrictive and allows for a sustainable stabilization of inflation at the 2% target. We anticipate three rate cuts in 2025, bringing the deposit rate down to 2.25% by April. At the same time, the reduction in the size of the balance sheet will accelerate, as starting in January, the ECB will no longer reinvest the proceeds from the PEPP. Without a moderation in the pace of quantitative tightening (QT), the ECB's balance sheet would shrink by a minimum of €850 billion over two years.

Market views

Asset classes

- U.S. Rates: The Federal Funds rate is expected to converge towards the neutral rate, which will be raised to 3.50%. Budgetary risks will keep the 10-year Treasury yield around 4.30%.

- European Rates: The neutral rate is estimated by most ECB members to be between 1.25% and 3%. The Bund is projected to hover around 2.30% by year-end, reflecting a persistent accommodative bias followed by a potential steepening of the yield curve, with stabilization expected next year.

- Sovereign Spreads: Risk premiums will continue to incorporate the likely downgrade of France's credit risk. Mid-year will be tense due to the risk of dissolution. The BTP-Bund spread remains supported by local savings and an improvement in the deficit outlook (in terms of Maastricht criteria) for 2025.

- Eurozone Inflation: Long-term inflation expectations appear well anchored, but the anticipated steepening of the yield curve will result in a rise in breakeven inflation rates.

- Euro Credit: Credit markets are nearing equilibrium. The high-yield premium is insufficient, even with a default rate below the historical average. A compression in spreads is still awaited.

- Currency: Carry trades and growth differentials continue to support the dollar, which remains overvalued. We anticipate the euro will be around $1.05 by 2025.

- Emerging Market Debt: Emerging market debt has already become more expensive but stands to benefit from monetary easing in the United States.