Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum’s views on the economy, strategy and markets.

The cio letter

The Elephant in the Room

Donald Trump will assume office on January 20, and his influence over financial markets is set to amplify, as his rhetoric appears increasingly unchecked. The Trump administration's overt political interference with allied nations, including Canada, Germany, and the United Kingdom, along with its controversial statements regarding Panama and Greenland, represents a new source of risk. German elections are scheduled for February, Justin Trudeau has resigned, and Keir Starmer faces significant challenges.

Paradoxically, uncertainty surrounding the effects of international tensions and the anticipated increase in tariffs has bolstered American consumption and accelerated Chinese exports to the U.S. as the year draws to a close. The bilateral trade surplus for China has reached record highs, while the eurozone grapples with Germany entering recession for a second consecutive year. In France, the Bayrou government is already easing its budget consolidation efforts. China anticipates improvement as it awaits Trump's initial decisions, although the significant rise in crude oil prices poses an additional risk.

Long-term interest rates have risen sharply since the beginning of the year. Current levels are attractive, given that central banks—except for the Bank of Japan—continue to lower rates. Despite a heavy primary market in January, credit remains a safe haven, less sensitive to macroeconomic data and political tensions than interest rates and equities. Stock markets are likely to be buffeted by political volatility and uncertainty from the Federal Reserve. Initial reports from American banks are reassuring, but valuations leave little room for error among major players. European equities receive some support from the weakness of the euro.

Economic Views

THREE THEMES FOR THE MARKETS

-

Monetary policy

Central banks are expected to lower their benchmark rates in 2025, yet recent data may compel the Fed to temper its approach towards monetary neutrality. Meanwhile, the ECB is likely to continue easing rates by 25 bps at each meeting until reaching 2.25%. The BoE, on the other hand, grapples with persistently high domestic inflation. The PBoC has signaled a commitment to intensifying its monetary easing to bolster domestic demand. Conversely, the BoJ is expected to cautiously raise its rates.

-

Inflation

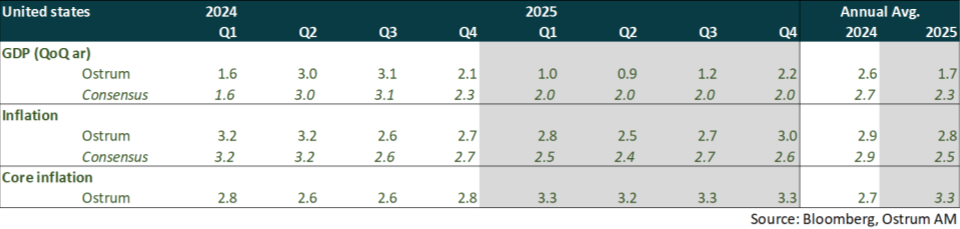

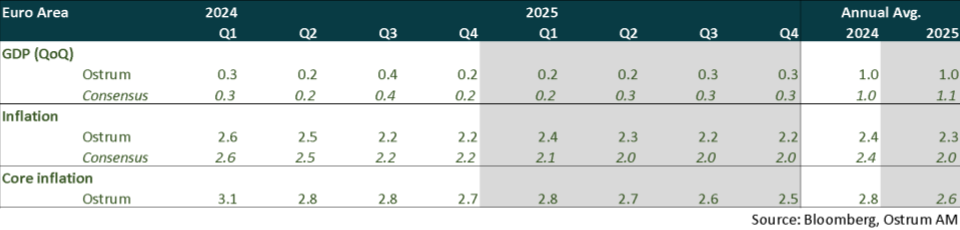

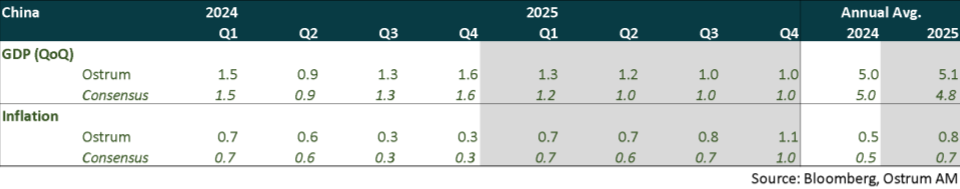

Global disinflation will face significant challenges from tariffs and a resurgence in energy prices. In the United States, inflation rose to 2.9% in December, while core inflation moderated to 3.2%. The long-term impact of tariffs remains uncertain. In the euro area, inflation climbed to 2.4% in December, driven by adverse base effects on energy prices, with core inflation remaining stable at around 2.7% since spring. Meanwhile, inflation in China remains nearly nonexistent.

-

Growth

Growth continues to exceed potential in the fourth quarter, with consumers likely having anticipated the impact of tariffs, while employment remains robust. In the euro area, uncertainty surrounding growth is pronounced, with Germany facing a second consecutive year of recession in 2024. Surveys indicate a deterioration in France, driven by political instability. Meanwhile, in China, activity is buoyed by exports, and the real estate sector is stabilizing. However, domestic demand remains fragile, awaiting a forthcoming fiscal support plan.

ECONOMY: UNITED STATES

- Domestic demand has sustained growth above potential in 2024. However, consumption is expected to decelerate from the elevated levels of 2024, particularly in durable goods spending, leading to some destocking. Both international and domestic uncertainties regarding economic policy are likely to weigh on equipment investment, which is further constrained by the potential for retaliatory measures from other countries.

- The labor market continues its normalization, with a slowdown in hiring observed, yet layoffs remain minimal at this stage. Immigration policy may exacerbate labor shortages, while wage pressures are anticipated to impact profitability, with restructurings emerging throughout the year. Controversy surrounds H1B visas, with Elon Musk advocating for them against the prevailing Republican consensus.

- The budget vote is expected in April, with the extension of the Tax Cuts and Jobs Act (TCJA) being a priority. Significant uncertainty persists regarding the potential reallocation of unspent funds from the Inflation Reduction Act (IRA) and the possibility of a reduction in corporate tax rates. The leeway for cutting federal expenditures is quite limited.

- Inflation remains persistent, with customs tariffs likely to be increased specifically on China. The inflation realized will reflect a stronger contribution from import prices. Housing continues to be the primary internal source of inflation, despite elevated long-term interest rates.

ECONOMY: EURO AREA

- The acceleration of growth in the 3rd quarter proved to be short-lived. Surveys and available data signal a slowdown in the 4th quarter and the persistence of weak growth into early 2025. The election of Donald Trump and fears of 20% tariffs are weighing heavily on growth prospects.

- Estimates from the Peterson Institute and the LSE indicate that the impact of these tariffs on growth and inflation in the euro area is expected to be relatively limited. Germany is likely to be the most affected, as the U.S. is its primary export destination, with the automotive sector particularly vulnerable.

- More than the tariffs themselves, growth is likely to be more significantly impacted by rising uncertainty, prompting business leaders to adopt a cautious stance that could dampen investment. This decline in investment is expected to partially offset the positive impact on consumption from rising real incomes. Wages, while slowing, are anticipated to outpace inflation. The ongoing rate cuts by the ECB should reduce borrowing costs and benefit real estate investment.

- The budgetary policy will not be a support for growth. France is experiencing a political crisis while it must take swift measures to reduce its budget deficit, the largest in the eurozone. There is a risk of a motion of censure for the fourth government in a year and a potential new dissolution in June. There is also the possibility of increased spending in Germany after the elections.

ECONOMY: CHINA

- China is poised to meet its growth target of 5%, buoyed by a rebound in activity in the 4th quarter linked to stimulus measures. Supportive measures for the real estate sector have revived transactions, though construction remains subdued, reflecting the Chinese authorities' intent to stabilize the sector at a low point.

- In 2025, the Year of the Snake, China is expected to bolster its domestic demand in a bid to insulate itself from Donald Trump's tariff policies. The yuan will not serve as a weapon against U.S. tariffs; instead, China is likely to leverage control over its exports of rare earths and high-value intermediate goods, such as lithium battery cathodes, as a form of retaliation.

- Monetary policy is set to remain accommodative to facilitate the stabilization of the real estate sector and support corporate investment. Furthermore, low interest rates will be essential to underpin its "New Productivity" initiative, which replaces the "Made in China 2025" program that has already achieved its goals.

- The initiative to exchange "hidden debt" among local governments is expected to create fiscal room and support Chinese growth. Additionally, the expansion of the BRICS to ten countries as of January 1 presents China with an opportunity to establish an alternative monetary system to the dollar.

Monetary Policy

Monetary policies are approaching the threshold of neutrality

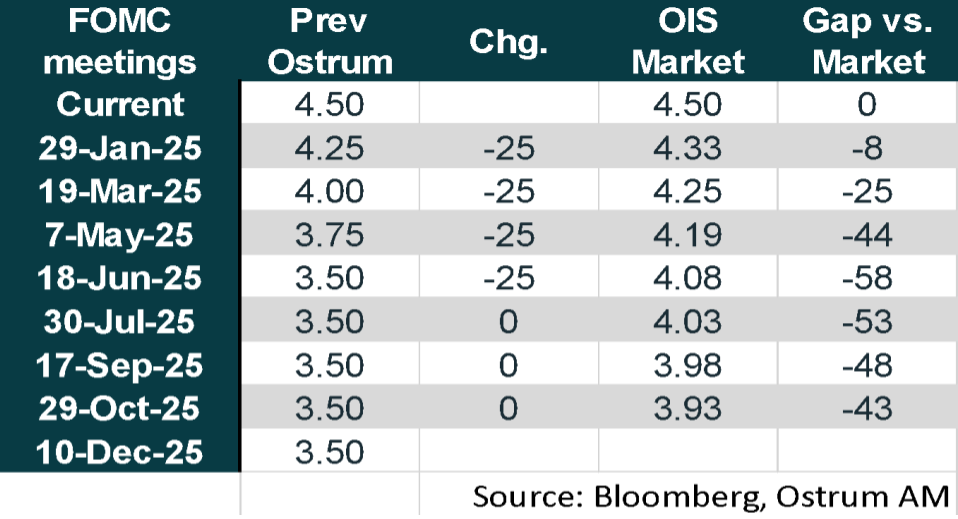

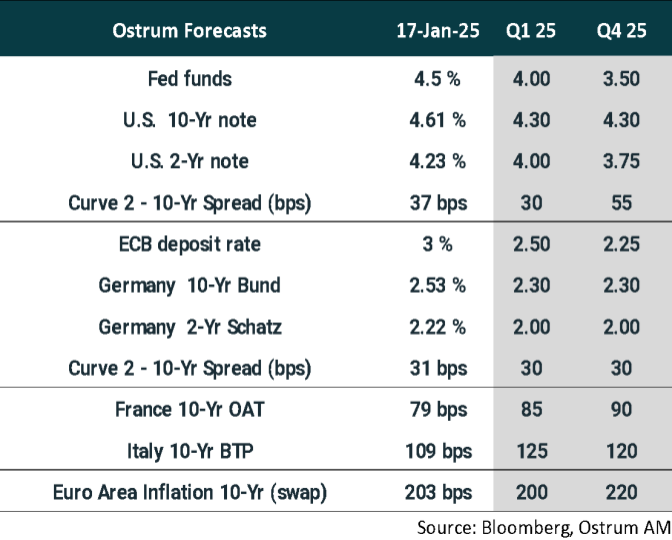

- THE FED WILL FOCUS MORE ON ITS MAXIMUM EMPLOYMENT OBJECTIVE

The Fed lowered its rates by 25 basis points during the meeting on December 18, bringing the federal funds rate to the range of [4.25% - 4.50%], totaling a reduction of 100 basis points since September. FOMC members revised down the expected number of rate cuts for 2025 to 2, compared to the previously anticipated 4, due to an upward revision of inflation expectations. We maintain our forecast of 4 rate cuts in 2025 for two reasons. The first is the expected slowdown in growth, which should lead the Fed to place more emphasis on its maximum employment objective. The second concerns the ongoing tensions in banking liquidity, which supports the case for monetary easing. Furthermore, the central bank will likely end its balance sheet reduction before March 2025. With Donald Trump arriving at the White House, it will need to firmly resist any attempts to challenge its independence in order to preserve its credibility. - THE ECB KEEPS THE DOOR OPEN FOR FURTHER RATE CUTS

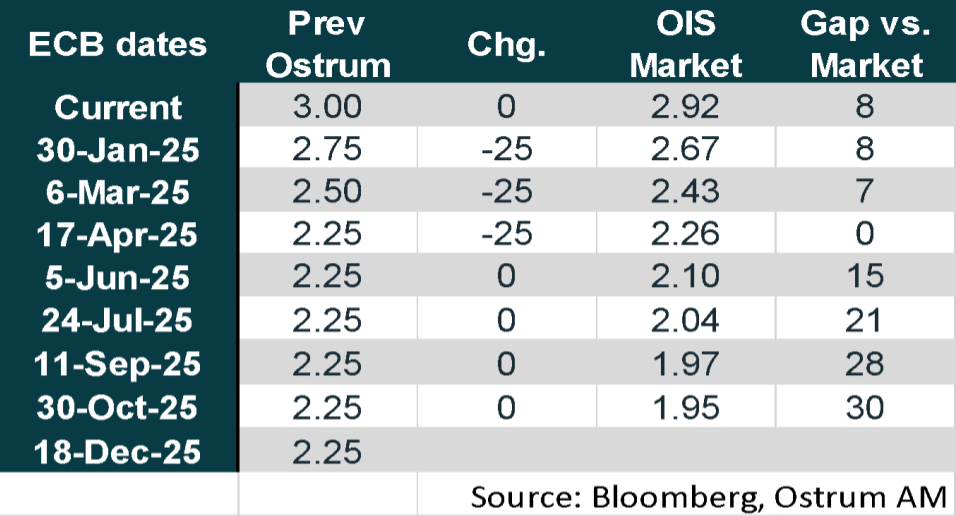

The ECB carried out its fourth rate cut of 25 basis points on December 12, bringing the deposit rate down to 3%. Growth forecasts have been revised downwards (1.1% in 2025, 1.4% in 2026, and 1.3% in 2027), as have inflation forecasts for 2025 (2.1% in 2025, 1.9% in 2026, and 2.1% in 2027). The ECB has kept the door open for further rate cuts to ensure that monetary policy is no longer restrictive and allows for a sustainable stabilization of inflation at the 2% target. We anticipate three rate cuts in 2025, bringing the deposit rate down to 2.25% by April. The reduction in the size of the balance sheet will simultaneously accelerate, as the ECB has not been reinvesting the proceeds from the Pandemic Emergency Purchase Programme (PEPP) since January.

Market views

Asset classes

- U.S. Rates: The Federal Funds rate is expected to converge towards the neutral rate, which will be raised to 3.50%. Budgetary risks will keep the 10-year Treasury yield around 4.30%.

- European Rates: The neutral rate is estimated by most ECB members to be between 1.25% and 3%. The Bund is projected to hover around 2.30% by year-end, reflecting a persistent accommodative bias followed by a potential steepening of the yield curve, with stabilization expected next year.

- Sovereign Spreads: Risk premiums will continue to incorporate the likely downgrade of France's credit risk. Mid-year will be tense due to the risk of dissolution. The BTP-Bund spread remains supported by local savings and an improvement in the deficit outlook (in terms of Maastricht criteria) for 2025.

- Eurozone Inflation: Long-term inflation expectations appear well anchored, but the anticipated steepening of the yield curve will result in a rise in breakeven inflation rates.

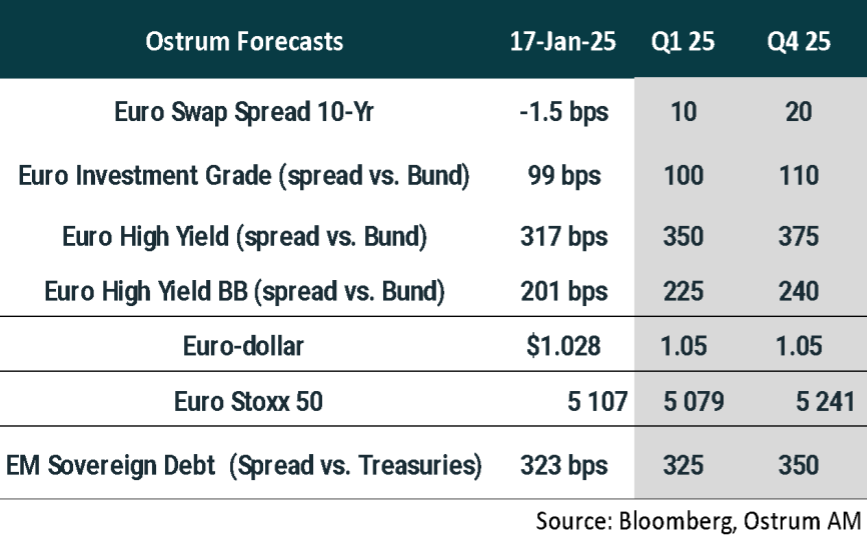

- Euro Credit: IG credit spreads are nearing their fair value levels, although the premium for high-yield bonds proving insufficient despite a default rate that remains below average. Market participants are still awaiting a compression in spreads.

- Exchange Rates: Tariff policies continue to support the dollar, although it appears to be overvalued. We anticipate that the euro will trade around $1.05 in 2025.

- Emerging Market Debt: Emerging market debt is currently expensive but stands to benefit from the monetary easing in the United States.