Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum’s views on the economy, strategy and markets.

The CIO Letter

The specter of protectionism

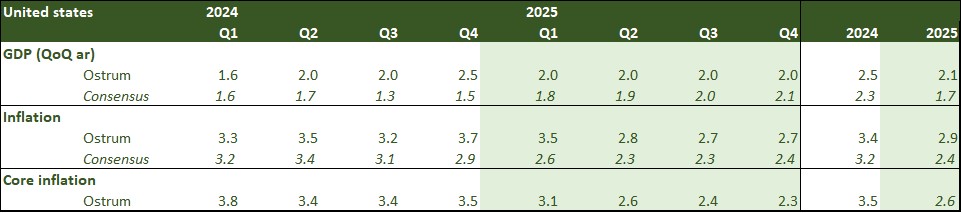

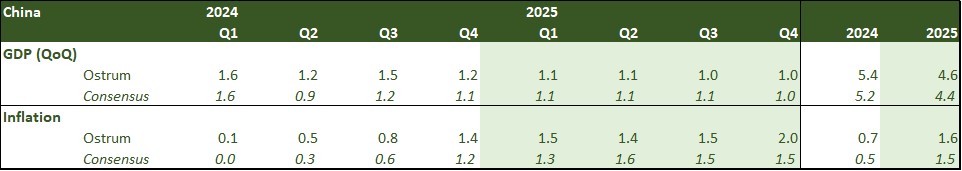

Global growth seems increasingly uneven. In the United States, the limited 1.6% growth in the first quarter hides strong domestic demand and persistent inflationary pressures. Activity is picking up in Europe after a prolonged period of stagnation. Disinflation and employment suggest a consolidation of this nascent recovery over the coming quarters. In China, the absence of inflation reflects sluggish household consumption. A refocus on industrial policy is driving the rebound in exports, fueled by the weakness of the yuan. China's mercantilist strategy exposes it to American, and potentially European, protectionism. Joe Biden has thus raised tariffs on Chinese products related to the energy transition, including electric vehicles.

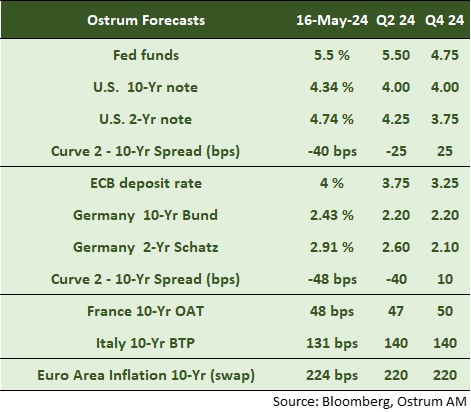

Despite its rhetorical caution regarding inflation, the Fed is already easing its quantitative policy. The resulting leeway implies an additional $360 billion in Treasury reinvestments in 2024. The ECB is signaling an initial rate cut in June, with the BoE to follow in the summer. Only the BoJ appears constrained to a more restrictive policy due to the yen's resilience to interventions in the foreign exchange market.

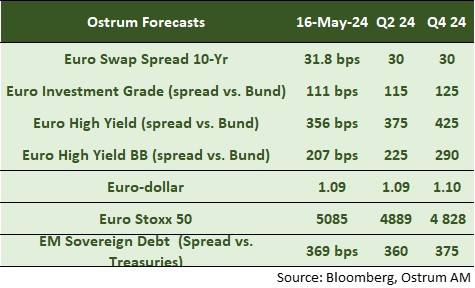

This monetary environment provides support for the bond market and, consequently, for risky assets. U.S. stocks have resumed their upward trajectory after a favorable earnings season. Reduced volatility argues for carry positions despite tight spreads in both investment-grade and high-yield credit, notwithstanding the return of specific risks in recent months.

Economic Views

Three themes for the markets

-

Monetary policy

The Fed is giving itself time before lowering rates due to persistent inflation. However, the bias remains for monetary easing. Monetary policy will become less restrictive from June with the reduction of QT. During the April meeting, the ECB pre-announced a reduction in key rates in June. In China, the bias of monetary policy remains accommodative to support the recovery of activity. In emerging markets, rate cuts continue gradually.

-

Inflation

After an initial phase of rapid disinflation, the second phase is proving to be slower, due in part to wage pressures. In the United States, inflation is slow to return to the target. It decreased slightly to 3.4% in April, with the underlying index at 3.6%. In the euro area, inflation stabilized at 2.4% in April. The underlying index decelerated to 2.7%. Inflation in the services sector moderated to 3.7% after 5 months at 4%. In China, inflation remains almost non-existent, at 0.3% in April, reflecting weak domestic demand.

-

Growth

The activity rebound is led by services, whilst the outlook remains uncertain in manufacturing. In the United States, growth was slightly disappointing in Q1, notably due to the negative surprise in oil exports. Consumption and private investment (excluding inventories) remained very strong. After 5 quarters of flat, or even slightly negative growth, the euro area GDP bounced back in the first quarter. The recovery is expected to strengthen throughout the rest of the year. In China, growth surprised positively in Q1, thanks to net exports.

Key macroeconomic signposts : United States

- The U.S. economic growth slowed to 1.6% in the first quarter. However, private consumption and investment (excluding stocks) remained robust. Petroleum product exports declined in March, resulting in a negative contribution to the trade balance (-0.9 percentage points between January and March). The housing sector surged by 13.9%, but there was an unexpected drop in military spending (-0.6%).

- The federal deficit is expected to reach around $1.6 trillion in 2024. Tax revenues saw a rebound in April, particularly from capital gains taxation. A $95 billion package for military aid (to Ukraine, Israel, and Taiwan) was approved.

- Financial crisis risks remain contained. The NYCB incident is seen as a reflection of Signature Bank and not a precursor to a banking crisis.

- Household balance sheets remain healthy, but there is a concern about the rise in credit card defaults, with annual interest expenses exceeding one trillion dollars.

- The unemployment rate remains below its equilibrium level (4-4.5%). The Fed does not anticipate a significant increase. Immigration has contributed to growth, and a halt to immigration would have stagflationary implications.

- Inflation is on an uncertain trajectory, stabilizing around 3% (CPI). The housing and other services sectors are not compatible with a 2% inflation target.

Key macroeconomic signposts : Euro area

- After 5 quarters of flat or slightly negative growth, the Eurozone's GDP rebounded significantly in the first quarter.

- This is primarily linked to Germany, which is returning to growth after a sharp contraction in Q4. However, caution remains necessary as German household consumption has contracted again.

- Growth has strengthened in France and Italy and remained dynamic in Spain.

- Surveys of business leaders indicate a strengthening recovery linked to the services sector and peripheral countries, particularly Spain.

- Households are expected to benefit from an increase in real income as wages are projected to grow at a faster pace than inflation. Coupled with a robust labor market, this will support consumption.

- Domestic demand is also expected to benefit from a less restrictive monetary policy, and exports from a strengthening global trade.

- However, fiscal policy will be a drag on growth. After being suspended since 2020, budgetary rules were reinstated in January and a reform was adopted. France is seeking to reduce its spending after the budgetary slippage of 2023.

- Inflation is expected to continue moderating, but at a more measured pace. It will no longer benefit from the strong negative contribution of energy prices, as governments will cease measures to contain the rise in energy prices, and wages are expected to continue growing at a solid pace. In a context of low productivity, the margins of companies have an essential role to play.

Key macroeconomic signposts : China

- The growth in China is no longer a concern, as evidenced by the strong rebound in GDP growth in Q1 at 5.3% YoY, dispelling fears of missing the 5% target.

- Investor sentiment has significantly improved, as seen in the recovery of the Chinese stock markets.

- Concerns, particularly from the United States, now focus on overcapacity.

- We believe that China has a comparative advantage in the electric vehicle and solar energy sectors, explaining its low production costs. China is increasing its foreign direct investments to produce abroad, which will help reduce overcapacity. The real issue remains the excess savings reflecting underconsumption in China.

- The Politburo aims to accelerate support measures for the real estate sector, particularly by addressing unsold inventories.

- The Ministry of Finance has also announced the issuance of the first tranche of special government bonds (1 trillion yuan, approximately $138 billion). These bonds have long maturities (20, 30, and 50 years) with specific purposes, including financing long-term projects such as in real estate. This move is expected to alleviate financial pressure on local governments.

- The dollar-yuan exchange rate is approaching the lower tolerance limit of the PBoC, reviving concerns of yuan devaluation. The PBoC has restrained the depreciation of its currency against the dollar by maintaining a stable central parity rate. Additionally, China does not have an issue with exports. A yuan devaluation would lead to a transfer of income from consumers to the industrial sector, further weakening domestic consumption, which is not the intended outcome.

- We continue to favor a reduction in reserve requirement ratios in the latter part of the year to support the recovery.

Monetary Policy

ECB to cut rates in June, before the Fed

- The FED gives itself a little more time before cutting rates

During the May 1 meeting, the Fed revised its communication, indicating "a lack of further progress" in achieving the 2% inflation target. Jerome Powell stated that the central bank would need more time to become confident that inflation would sustainably return to the 2% target. However, he ruled out a potential rate hike to address higher-than-expected inflation. The accommodative bias remains in place. The Fed is making its monetary policy less restrictive by reducing the pace of its balance sheet contraction ($60 billion per month compared to the previous $95 billion) starting in June. We anticipate three Fed rate cuts in 2024, with the first expected in September. - The ECB has almost pre-announced a rate cut in June

The ECB left its rates unchanged for the 5th consecutive time in April. In its statement, released after the meeting, a passage was added opening the way to a rate cut in June if the data published by then further strengthens its confidence in the return of inflation towards the 2% target. The ECB emphasized that its decisions were data-dependent and that it did not pre-commit to a trajectory concerning interest rates. The central bank should lower its rates in June, supported by the slowdown in service sector inflation in April and following the spring wage negotiation outcomes. We anticipate 3 rate cuts over the year. At the same time, the contraction of the balance sheet will accelerate from July, with the ECB reinvesting only half of the maturing PEPP (at an average monthly pace of 7.5 billion euros), to end it in late 2024.

Market views

Asset classes

- US Rates: The Fed seems determined to ease its policy despite the uncertainty created by inflation regarding the timing of the first rate cut. The reduction of the QT is a first step. The T-note is expected to decrease towards 4%.

- European Rates: The Bund (2.43%) moves in synch with US rates, despite an expected rate cut by the ECB in June. Our year-end forecast stands at 2.20%. The yield curve is expected to normalize.

- Sovereign Spreads: Sovereign spreads have held up against the decisions of rating agencies in a challenging budgetary context.

- Eurozone Inflation: Breakeven rates are generally stable.

- Euro Credit: Swap spreads are above 30 bps; collateral scarcity has eased due to quantitative tightening. Investment grade credit presents relatively rich valuations but the low volatility environment favors carry strategies.

- Exchange Rate: The euro is hovering around $1.08 but remains within a narrow range.

- Equities: The season of strong earnings has reassured the markets. Multiples, above 13x, should partially offset the gradual erosion of margins.

- Emerging Debt: The increase in spreads is attributable to the return of Venezuela to the index and is not significant.