Opportunities and challenges

Donald Trump's tariffs acting as market movers at the beginning of the year. Additionally, DeepSeek may lead to a repricing of American technology stocks, rekindling risk aversion among investors.

Regarding external sovereign debt, the correlation with US equity markets has remained strong over the past three years. The uncertainties raised by DeepSeek may lead to a widening of spreads. The sovereign "Investment Grade" spread (123 bps) remained high compared to its U.S. counterpart in 2024, offering potential for tightening in this environment of high uncertainty. Sovereign "High Yield" performed well in 2024, benefiting from positive sentiment towards risky assets. However, we remain cautious at the beginning of the year and favor countries that will implement reforms to return to growth, or Ukraine, which would benefit from a diplomatic resolution. In local debt, we favor Asia, particularly the short parts of the yield curves, as we believe that central banks have the room to lower their key rates to boost domestic demand in this Trumpian environment. The stabilization of the yuan against the dollar also provides a stability anchor for Asian currencies. Thus, we favor South Korea, where political instability has deteriorated growth prospects, prompting the central bank to lower its key rates.

Emerging market equities are the asset class with the most attractive valuations, but geopolitical risk is expected to limit their performance potential. Nevertheless, we believe that Brazilian stocks offer opportunities with their attractive valuation, trading at more than 6 times estimated earnings compared to 11.7 for the MSCI EM index. The Chinese stock market could be the surprise of 2025, driven by technology sector.

Resilience and Challenges

While each new year is accompanied by a set of uncertainties, 2025 is poised to reach new heights with the return of D. Trump to power. This second term resembles more of a regime shift. Tariffs, the strength of the dollar, and US interest rates are crystallizing investor concerns. One prevailing conviction is that the dichotomy between local emerging market debt and international debt (denominated in USD) is expected to remain pronounced in favor of the latter, as long as investors continue to favor the US dollar.

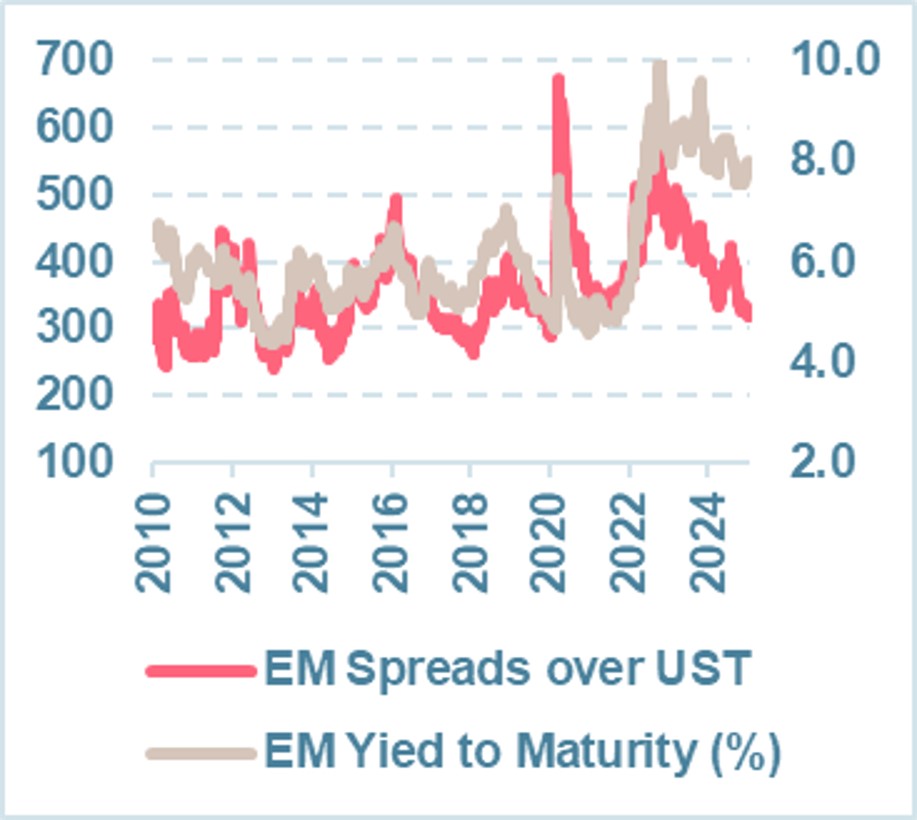

However, an often-overlooked and underestimated characteristic is that financing for sovereign will predominantly occur through their local markets. Net issuance of USD-denominated debt is expected to remain low, thereby providing additional comfort for this external debt. Historically low risk premiums (approx. 325 basis points) reflect a significant reduction in default risks following the shocks from COVID-19. More importantly, it is the average yields (7.9% in USD for an average rating of BB+/BBB-) of international debt that continue to attract investors. They remain high on a historical basis.

This represents a highly attractive carry within a diversified portfolio. To observe increased inflows into emerging market funds and further compress risk premiums, it will likely necessitate additional interest rate cuts by the Federal Reserve.

Sources: JP Morgan, Ostrum AM, 21/01/2025

Wait-and-see attitude

After being strongly negative, emerging market equity fundamentals have improved in recent months. Our fundamental equity models now classify emerging markets as neutral, and so do our Market Tension Indicators, which combine local sentiment, volatility and trend analysis. However, relative to developed stocks, the emerging zone remains behind in our models, justifying a wait-and-see attitude on the asset class. We identify several headwinds.

First, we expect volatility to rise because of a revaluation of political, trade and monetary risk. Even if the timing is far from being obvious, we cannot avoid tough tariff negotiations, especially between China and the US, but not only. China’s market share in some strategic industrial sectors (electric vehicles, electronic components, AI) has increased strongly, strengthening its bargaining power, but at the same time, China appears to be weaker today than it was in 2018, penalized by the management of its real estate bubble, the lack of a sustainable relay from the private consumption, the delicate control of its public debt and the protection of its currency.

Secondly, the good performance of the US economy, if it continues to be reflected in a strong contribution from services, the absence of sustainable industrial relay and a persistent manufacturing weakness in Europe, could prolong the US dollar’s appreciation and penalize emerging market equities. As of today, the conditions for a sustainable and homogeneous recovery in the global manufacturing and commodity cycle do not yet appear to warrant a sustainable return of investor risk appetite in emerging markets.

Third, except for India, emerging market financial conditions remain tight and do not support the asset class, while fundamentals remain fragile. Finally, in terms of positioning, while it is true that speculative positions have fallen sharply in the short term and could justify a technical recovery, there is still nothing to come on the long term.

Points of view - 1 question, 3 experts: Trump 2.0: Implications for emerging markets