Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Axel Botte’s and Zouhoure Bousbih’s podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Rare Earths: China Opens a New Front in the Tech War

- In response to the strictest export restrictions on electronic chips ever imposed by the United States, China has banned export licenses for gallium, germanium, and antimony to the U.S.;

- China holds a monopoly on rare earth supplies, accounting for 85% to 95% of the global production of refined materials;

- This is not China’s first act of pressure; in 2010, it temporarily suspended exports to Japan due to a maritime dispute, causing rare earth prices to soar by over 500%;

- Since 2010, the United States and other countries have resumed their rare earth production and sought to diversify their supplies, but this remains insufficient to compete with China, which has flooded the world with low-cost rare earths;

- This recent pressure tactic serves as a warning of an escalation risk that could have serious consequences for global supply chains.

Market review: Christmas Cheer on Markets as Barnier Government Falls

- United States: Contradictory signals with 227k jobs added while unemployment rises to 4.2%;

- OAT spreads are tightening despite Barnier’s government fall amidst the promise of a budget;

- T-Note yields stabilize around 4.15-4.20%;

- Positive momentum in risky assets ahead of central bank meetings.

Axel Botte’s and Zouhoure Bousbih’s podcast

- Review of the week – Financial markets, US employment;

- Theme – Rare Earths: China Opens a New Front in the Tech War.

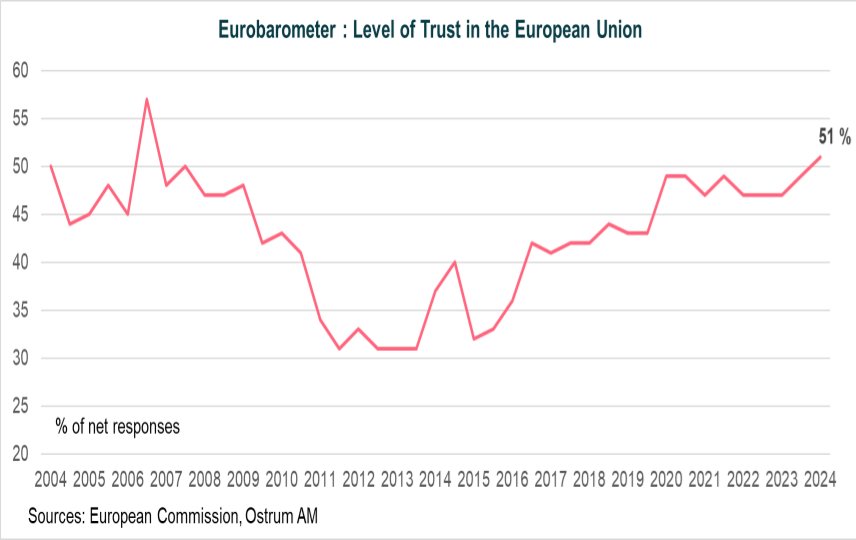

Chart of the week

Citizen trust in the EU is at its highest level since 2007 (51%), according to the Eurobarometer from the European Commission. This rate is higher than the trust they have in their national parliaments (37%) and their governments (33%). Is the European Commission trying to send us a message?

Figure of the week

331

This is the number of French deputies who voted for the motion of censure against the Barnier government, which lasted just 3 months, a record under the 5th French Republic.