Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Axel Botte’s and Zouhoure Bousbih’s podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Is China on the verge of entering a new era of consumption?

- China is finally tackling its high savings rate (42% of GDP), which is linked to an inadequate social protection system and income inequalities between rural and urban areas stemming from the "Hukou" system;

- The Chinese government has unveiled a 30-point plan aimed at stimulating domestic consumption, which is considered crucial for alleviating external pressures and facilitating the country's structural transition;

- The plan seeks to enhance household incomes and reduce financial burdens by improving social welfare and expanding the service sector to foster "new consumption";

- Reforms have notably accelerated in the realms of social protection and the dismantling of the "Hukou" system;

- For the first time, artificial intelligence (AI) is positioned at the center of the consumption strategy, emphasizing emerging technologies such as autonomous driving and robotics that have the potential to transform consumer behavior.

Market review: The Fed Confronts Uncertainty

- The Fed forecasts slower growth and higher inflation in 2025;

- The Fed keeps rates unchanged but reduces QT;

- Bond market volatility eases as Bund yields fall below 2.80%;

- Credit spreads and equity markets stabilize.

(Listen to) Axel Botte’s and Zouhoure Bousbih’s podcast:

- Review of the week – Calmer Financial Markets, FOMC, and European Surveys;

- Theme – Is China on the verge of entering a new era of consumption?

Chart of the week

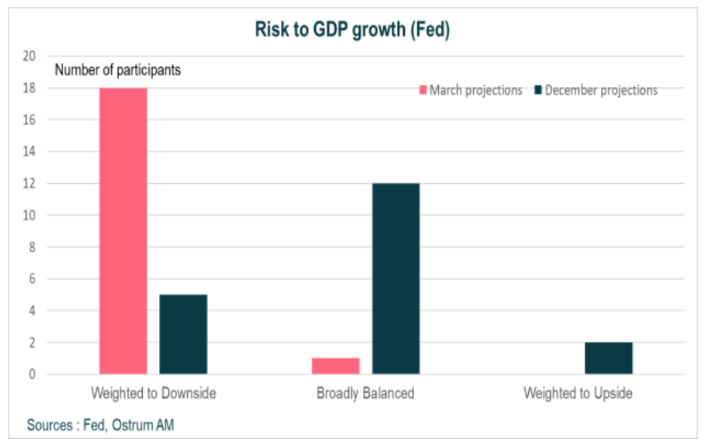

During the FOMC meeting on March 19, members clearly mentioned the significant uncertainty induced by the chaotic approach of the new U.S. administration regarding growth and inflation.

As a result, the downside risks to growth have increased considerably since the December FOMC meeting. The Fed has also significantly revised its GDP growth forecast down to 1.7%, compared to the previous estimate of 2.1% in December. Its inflation forecasts have also risen by 2 basis points to 2.7%.

The Fed clearly indicates that its next move will likely be a rate cut, possibly as early as June.

Figure of the week

350

The central bank of Turkey implemented a cumulative increase of 350 basis points in its key interest rates to defend its currency following the arrest of the main opposition candidate for the 2028 presidential election.