Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to Aline Goupil-Raguénès’ and Zouhoure Bousbih’s podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Trump: A wake-up call for Europe

- The abrupt shift of the United States regarding its allies in terms of NATO, Ukraine and their rapprochement with Russia threatens European security;

- This constitutes a wake-up call, forcing Europeans to act quickly to ensure their own defense;

- Germany has announced a reform of the debt brake and a large investment plan for infrastructure;

- The European Commission has proposed the ReArm Europe plan, which could mobilize up to 800 billion euros. It is primarily based on the member states, providing them with some flexibility, and includes a loan facility of 150 billion euros;

- This is an essential first step. Europe must equip itself to ensure its own defense. Other measures are forthcoming, such as potentially European defense bonds.

Market review: There are weeks where decades happen

- Donald Trump implements tariffs on steel and aluminum;

- United States: Consumer confidence plunges further;

- Spreads: Credit begins to feel the impact of high rates;

- Equities: U.S. markets decline, Europe down 1%.

(Listen to) Aline Goupil-Raguénès’ and Zouhoure Bousbih’s podcast:

- Review of the week – Impact on American Consumer Confidence;

- Theme – Trump: A wake-up call for Europe

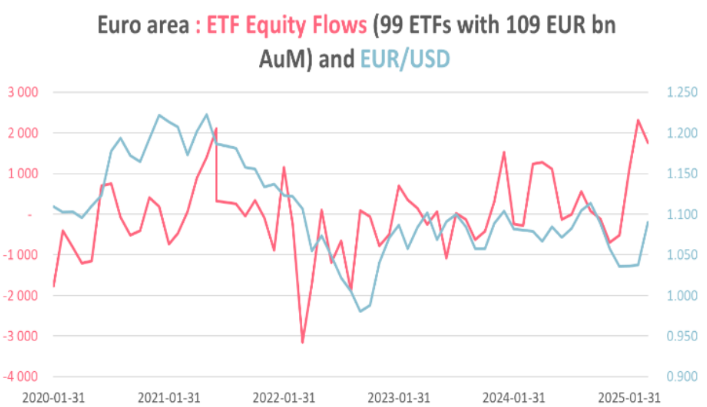

Chart of the week

Net capital flows into the European equity market have increased significantly since the beginning of the year. This has been accompanied by a sharp decline in net flows into the U.S. equity market. This reflects investors' concerns about American growth, which is threatened by the consequences of rising tariffs, cuts in public sector jobs, and a shift in immigration policy. This contrasts with the large-scale measures announced by Germany and the European Commission aimed at significantly increasing spending on defense and infrastructure, which will support growth. The result has been an appreciation of the euro against the dollar.

Figure of the week

3,000

The price of gold reached over $3,000 per ounce for the first time during trading on Friday morning. The yellow metal is playing its role as a safe haven amid the trade war waged by the United States against all of its trading

partners.