Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Axel Botte’s and Aline Goupil-Raguénès’ podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: The French spread under threat of the adoption of a no-confidence vote

- Political uncertainty in France has significantly increased in recent days with the risk of the adoption of a no-confidence vote against the government, which could occur as soon as Wednesday, December 4th;

- This generates concerns about the government’s ability to reduce its public deficit, which is set to be the highest among Eurozone countries (projected at 6.1% in 2024);

- The French spread has thus reached its highest level since 2012, during the sovereign debt crisis, and the 10-year yield is at the same level as the Greek 10-year yield;

- If a no-confidence vote is adopted, either this week or later, the French spread is expected to reach 100 basis points, and French stocks are likely to underperform more compared to the rest of the Eurozone;

- The floor level of the spread should now be closer to 80 basis points, given the prolonged risk of political instability, as long as the National Assembly remains deeply divided, limiting the government’s ability to reduce its public deficit.

Market review: Risk-free rates plunge

- U.S. growth confirmed at 2.8 % in Q3 2024;

- OAT spreads briefly hit 90 bp as risk-free bond yields plunge;

- Credit spreads broadly stable whilst high yield spreads widen;

- The yen strengthens as BoJ rate hike looms.

Axel Botte’s and Aline Goupil-Raguénès’ podcast

- Review of the week – Financial markets, inflation? US economic environment (real estate);

- Theme – The French spread under threat of the adoption of a no-confidence vote.

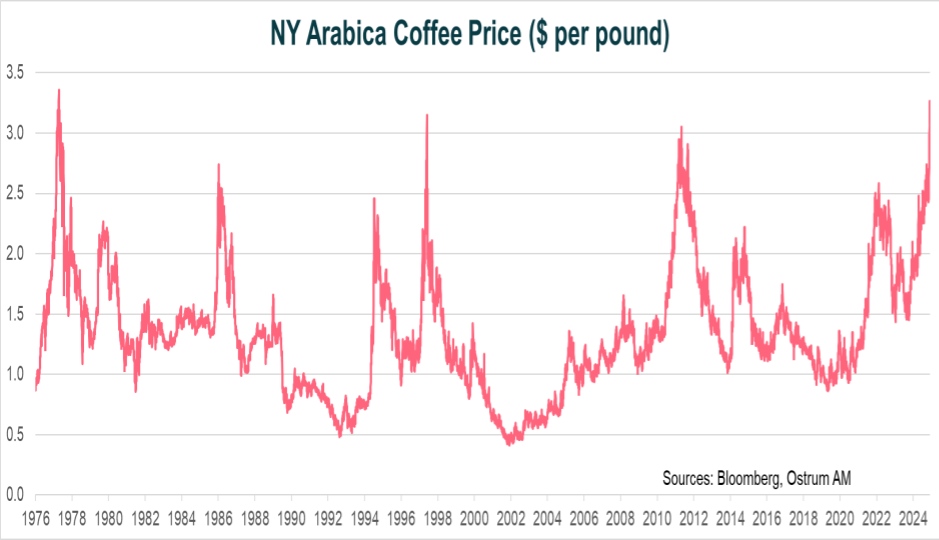

Chart of the week

The price of arabica coffee, quoted in New York, has reached its highest level since 1977. It has increased by 70% since the beginning of the year, reaching $3.20. This dramatic rise is mainly linked to weather conditions in Brazil. After experiencing an unprecedented drought between August and September, Brazil was hit by heavy rains in October. These weather conditions have raised concerns about coffee supply and have heavily impacted arabica prices. The uncertainty regarding the implementation date of the EU’s deforestation regulation has also contributed to the significant price increase. This regulation will ban imports of agricultural products sourced from deforested plantations.

Figure of the week

4

Debt-for-nature swaps could reach a record amount of $4 billion in 2024. This process allows emerging economies to cancel a portion of their external debt in exchange for national investments in nature conservation.