Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Axel Botte’s and Aline Goupil-Raguénès’ podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Natural gas prices in Europe are expected to remain high in 2025, despite the energy emergency declared by Donald Trump

- The price of natural gas in Europe has significantly increased to return to the levels of October 2023, at €50/MWh;

- It is expected to remain high in 2025 due to a more significant decline in reserves compared to the last five years and the cessation of Russian gas supplies transiting through Ukraine;

- Competition between the EU and Asia for liquefied natural gas shipments is therefore expected to intensify;

- The energy emergency declared by Donald Trump will not change this: the increase in production and export capacities will take time before becoming operational;

- The United States has become the largest supplier of LNG to the EU. Further increasing this dependence is not desirable given the potential risks to energy security.

Market review: Upbeat stock markets

- U.S. Tariff Hike Remains on Hold;

- Fed and ECB Meetings This Week;

- Long-Term Rates Stabilizing;

- European Stocks Up 6.5% Year-to-Date.

Axel Botte’s and Aline Goupil-Raguénès’ podcast

- Review of the week – Deepseek shakes things up, benefiting long-term rates;

- Theme – Natural gas prices in Europe are likely to stay elevated in 2025.

Chart of the week

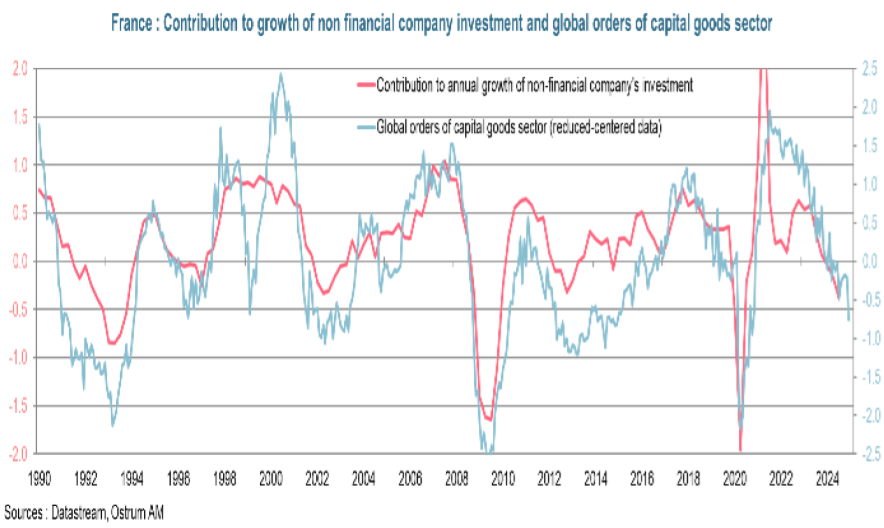

The latest monthly survey from INSEE revealed a significant decline in overall orders in the capital goods sector in January (blue curve). The index has fallen well below its long-term average (0 on the graph). This sharp decline suggests a more pronounced contraction in investment by non-financial corporations, whose contribution to France's annual growth is represented in pink. The quarterly survey from INSEE also indicated that companies in the capital goods sector plan to reduce their investments by 8.6% over the next three months. This reflects the weak cyclical dynamics and the marked increase in political uncertainty since this summer, following the dissolution of the National Assembly and the election of Donald Trump.

Figure of the week

2.243

In the United States, the issuance of Treasury Inflation-Protected Securities (TIPS) came in at a rate of 2.243%: the highest since January 2009. This reflects robust growth, an increase in the term premium related to budgetary concerns, and a reduced presence of the Fed in the bond market.