Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to Axel Botte’s podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Three major risks for 2025

- In 2024, the U.S. stock market just recorded its fourth year of 20%+ return in the past six years. A handful of stocks, the Magnificent 7, now represent about a third of the market capitalization of the S&P 500.

- This situation of extreme concentration draws comparisons to the TMT bubble, which burst in 2000 causing large losses for lenders, a credit crunch and tipping the economy into a recession.

- Trump's goals of weakening the dollar to reduce the U.S. trade deficit while maintaining the dollar's privilege seem very complicated to achieve. However, the critical question for 2025 will revolve around China's choice.

- In France, the risk is an escalation of the political crisis leading President Emmanuel Macron to resign. This would create a real shockwave in the financial markets, with a high risk of recession and an intervention by the ECB to ensure the transmission of monetary policy.

Market review

The review will resume next week.

Axel Botte’s podcast

- Review of the week – Financial markets;

- Theme – Three risks for 2025.

Chart of the week

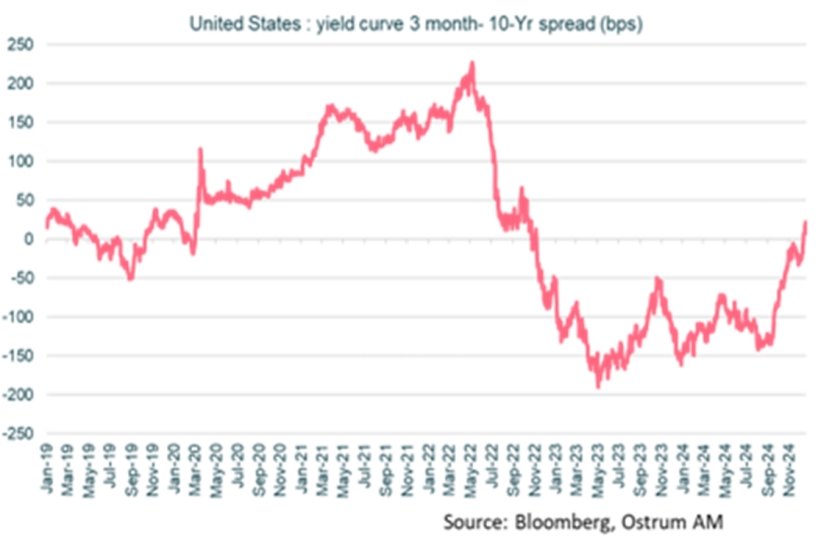

One of the most closely watched financial indicators is the U.S. yield curve. The spread typically foreshadows shifts in the economic cycle and inflation risks.

While market participants have increasingly focused on the 2-10 year spread, economists have long favored the 3-month to 10-year spread, which is seen as a more representative gauge of monetary policy transmission to the real economy. This spread has turned positive for the first time since 2022. A rapid steepening of the curve is generally associated with an impending recession.

Figure of the week

827

827 billion dollars: this represents the contraction in the Fed’s balance sheet in 2024. The Fed’s total assets have shrunk to 6.89 trillion dollars at the end of last year.