Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to Axel Botte’s podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Will the Treasury rally be sustained?

- U.S. imposed trade tariffs have hit consumer and business confidence. Domestic demand is moderating as the trade deficit swelled in December-January. A growth scare is taking shape in the U.S. markets;

- The U.S. GDP for Q1 2025 could be quite downbeat. Data is surprising on the downside. Tariff hikes are seen as a transient price shock as opposed to a long-lasting inflation push;

- Treasury yields have fallen sharply from a high of 4.79% in January to around 4.20% now;

- Investor surveys suggest net long positioning is back and intensified once yields fell below the 4.50% threshold. The Fed may end QT fairly soon which would add to Treasury buying pressure. There is also scope for further short covering flows;

- The news flow could push 10-Yr yields towards 4% before investors question valuations again.

Market review: There are weeks where decades happen

- EU Pledges €800 Billion for Defense as Germany Commits Additional €500 Billion for Infrastructure;

- Interest Rates: Bunds sell off by 30 bps on Wednesday, marking a significant volatility event;

- Spreads: Credit and sovereign spreads holding firm amidst the volatility in risk-free rates;

- Equities: U.S. tech plummets, while European markets remain stable, buoyed by banking and cyclicals.

Axel Botte’s podcast

- Review of the week – The Bund Crash;

- Theme – Will the Treasury rally be sustained?

Chart of the week

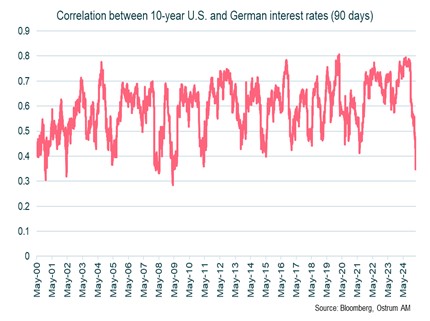

The correlation between 10-year U.S. and German interest rates is exceptionally low and quite unusual. It is in a way the financial translation of American isolationism.

This reflects the German budgetary revolution, which is expected to result in more issuances, putting pressure on the long end of the sovereign bond yield curve.

This decoupling should support the European currency against the greenback.

Figure of the week

500

Germany has announced a large special off-budget fund for infrastructure, amounting to 500 billion euros over 10 years (11% of GDP), as well as a reform of the debt brake, aimed particularly at increasing military spending. These measures must be approved by the outgoing Parliament before March 25.