Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to Axel Botte’s podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Hawkish Fed mindful of liquidity risks amid debt ceiling challenges

- The Federal Reserve maintained interest rates at 4.50% in January due to inflation concerns, while discussions at the FOMC meeting indicated a potential slowdown in quantitative tightening (QT) amid debt ceiling uncertainties;

- Despite a hawkish tone from Chair Jerome Powell, the Fed is considering adjusting the pace of QT to avoid adverse effects on economic activity and inflation resulting from fluctuations in bank reserves;

- The Fed's operational guidelines involve rolling over a portion of its Treasury securities and MBS, with significant maturities of nearly $400 billion due between April and August 2025, coinciding with potential debt ceiling issues;

- Upon a debt-ceiling deal, bank reserves could shrink fast as the Treasury replenishes its cash buffer leading to liquidity challenges in the financial system;

- Slowing QT could lead to a flatter yield curve, providing the Treasury with greater flexibility to manage federal debt. The Fed's future bond reinvestments may focus on shorter maturities to mitigate interest rate risk.

Market review: Is the U.S. Consumer on the Brink?

- United States: Consumer confidence erodes as spending plunges in January;

- Eurozone: Inflation is expected to retreat to 2.2% in February;

- Flight to safety: The 10-year Treasury note hovers near 4.25%;

- Risky assets: The credit market resists the Nasdaq's 7% decline this week.

Axel Botte’s podcast

- Review of the week – The United States’ tariff threat and massive trade deficit, inflation in the eurozone;

- Theme – The Fed's QT mentioned in the January FOMC meeting minutes.

Chart of the week

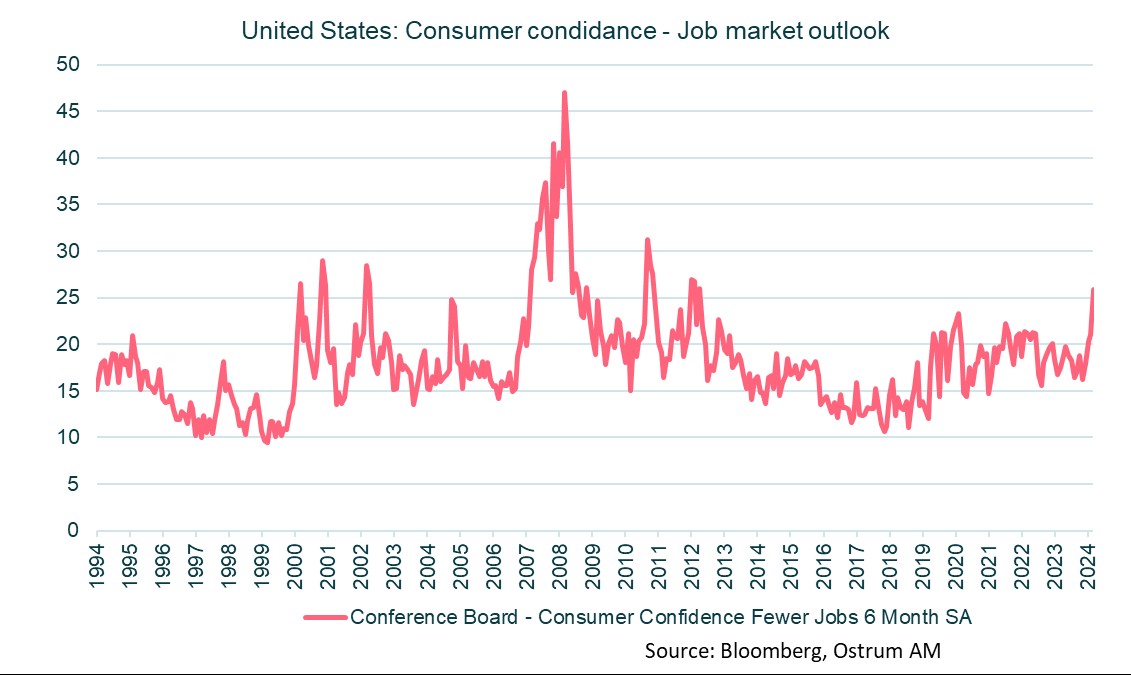

According to a survey conducted by the Conference Board, U.S. households' perceptions of the labor market have significantly deteriorated since Donald Trump took office.

More than 25% of households believe that job availability will decline over the next six months, marking the highest proportion since 2013 when the U.S. job market was still in a sluggish recovery following the Great Financial Crisis of 2008-2009.

The highly publicized layoffs from the Department of Government Enterprises (DOGE) resonate throughout the population, as a notable shift in unemployment claims is already being observed in the Washington, D.C. area.

Figure of the week

0.9

This reflects the level of harmonized inflation in France for February 2025, according to INSEE. The decline in electricity prices, which have dropped by 5.7% year-on-year, significantly contributes to the overall deceleration of consumer prices.