Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Axel Botte’s and Zouhoure Bousbih’s podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: The Fed vs. Donald Trump

- The Fed has cut interest rates a second time this year to 4.75%. Further rate reductions and the end of QT should be implemented in the coming months.

- The Fed believes that its current policy stance is restrictive but strong domestic demand growth and somewhat elevated inflation could be seen as evidence of the contrary. There is also considerable uncertainty regarding the level of the neutral rate.

- Inflation is top of mind for US households. The Fed’s inflation targeting framework is out of synch with the people’s experience with prices. Donald Trump will use every opportunity to attack the Fed’s inflation record, even as his trade and fiscal policies are likely to spur inflation.

- For now, rates will keep falling towards 4% by March, and then 3.75% as the neutral rate debate heats up. But the Fed’s job will be harder under a Trump presidency.

Market review: Red sweep, US equities all green

- Markets reacted to the election outcome with gains in US equities, higher yields and a stronger dollar.

- China unveils a CNY 10 trillion plan to restructure local government plan.

- European equities underperformed, as markets expect further cuts by the ECB.

- Euro swap spreads continue to narrow.

Axel Botte’s and Zouhoure Bousbih’s podcast :

- Review of the week – Financial markets;

- Theme – Trump’s policies – impact assessments.

Chart of the week

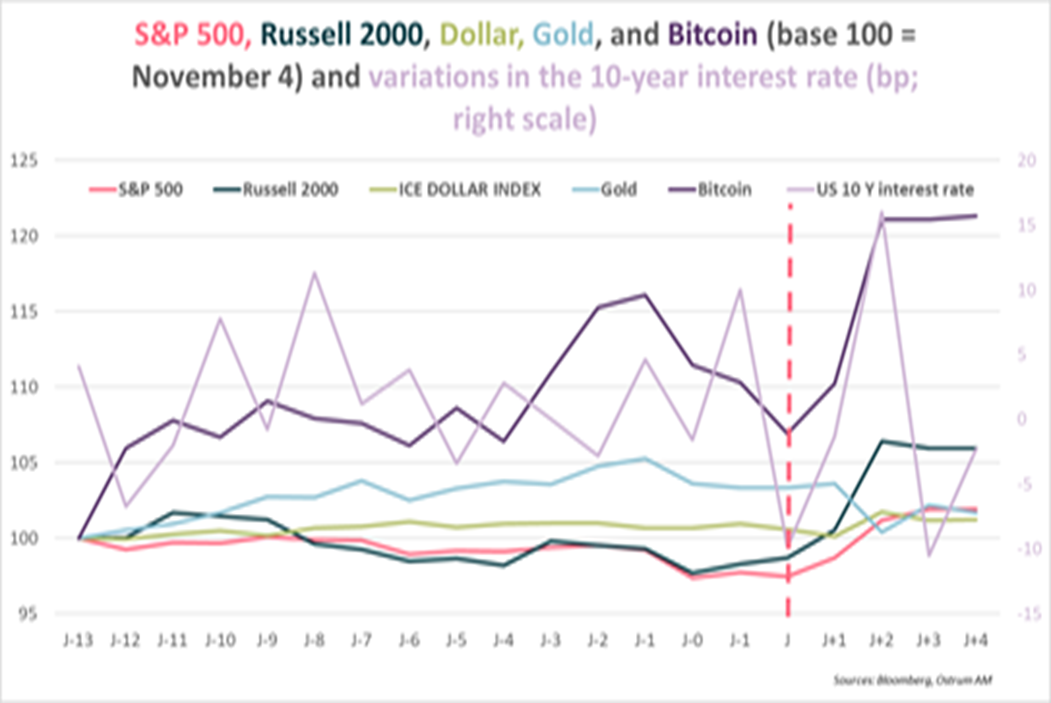

The knee-jerk reaction of financial markets to Donald Trump’s win at the Presidential elections was in line with expectations.

Promises of corporate tax cuts sparked a rally in equities, and a sizeable outperformance of the Russell 2000 index. Long-term bond yields increased as the public deficits are unlikely to be curbed under Trump, though investors bought bonds back after a strong 30-Yr bond auction.

Tariffs on foreign-made goods contribute to a stronger dollar. In crypto markets, the rise in Bitcoin prices reflects the alleged support of Donald Trump to the industry. Gold in turn weakened moirroring the stronger dollar.

Figure of the week

10

China approved a 10 trillion yuan package for local authorities to bring off balance-sheet debt onto the books. Local debt resolution is a critical aspect of policy support.