Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to Axel Botte's podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Summer highlights

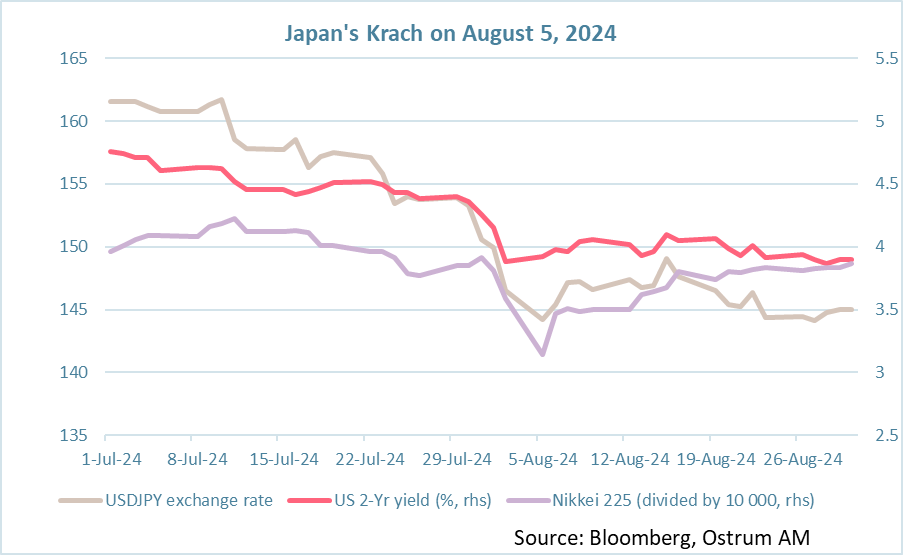

- The markets were highly volatile due to the rise in interest rates in Japan and the resurgence of, perhaps exaggerated, fears of an imminent recession in the United States.

- The initial crash, with a 12% drop in the Nikkei on August 5th, quickly subsided without causing significant collateral damage. Short yen positions unwinding accompanied the BoJ's decision and continue to be a source of volatility. The BoJ will proceed cautiously with further rate hikes.

- The message from the Fed at Jackson Hole unequivocally foreshadows monetary easing in the coming months. Other central banks are accelerating their pace, such as the Riksbank. The RBNZ also surprised the markets by making an initial rate cut.

- The volatility of interest rates and exchange rates did not prevent a strong rebound in equities to the 2024 highs and a new tightening of credit spreads. Swap spreads and sovereign spreads have decreased. The iTraxx Crossover has significantly dropped below 300 basis points.

Market review:

The review will resume next week

Chart of the week

A new cross-market equilibrium. The gradual appreciation of the yen throughout the month of July accelerated with the decision of the BoJ to raise its rate. At the same time, an accommodative Fed and disappointing employment statistics in the United States amplified downward pressure on the Japanese stock market, which plummeted by 12% on August 5th. The new equilibrium for the yen is around 145 to the dollar, compared to 155-160 previously. The stabilization of equities is also traceable to the significant adjustment in the US 2-year yield, confirming the imminent monetary easing in the United States. The 2-year yield is now hovering around 3.90%, compared to approximately 4.40% before the Japanese crash.

Figure of the week

29

The number of women in governor roles rose to 29 this year from 23 last year, though that left the share of female leaders at just 16 percent of the world’s 185 central banks.