Every month, find out all about the sustainable market bonds news in our newsletter "MySustainableCorner".

This month in a nutshell

- The European Investment Bank (EIB) issued, at the beginning of April 2025, its first climate-aligned bond (CAB) aligned with the European Union’s Green Bonds Standards. First entity to issue a green bond in 2007, the EIB has continuously improved its sustainable bonds frameworks to align them with the most stringent market standards. The main purpose of this new issue will be to finance projects related to climate change mitigation, mainly in Europe but also in South America, Africa and Asia.

- Slovenia is set to issue its first Sustainability-Linked Bond (SLB) in June. Its interest rate will be linked to its greenhouse gas reduction targets by 2030: if the reduction exceeds 45%, the coupon will decrease; if it is between 35% and 45%, it will remain stable; and if it is below 35%, it will increase. Slovenia would thus be the first European sovereign state to offer a coupon reduction mechanism linked to sustainability.

- ING is the first global bank to have its climate target for reducing GHG emissions in its client portfolio validated by the Science Based Target Initative (SBTI), aligning with the 1.5°C goal of the Paris Agreement. This is a positive advancement in a context where the NZBA (Net Zero Banking Alliance) has relaxed its climate requirements, shifting from a 1.5°C target to a broader goal of well below 2°C.

- Co-led by Osapiens, Info Durable and Agefi, a working group has highlighted the common perception of ESG regulation as a constraint for businesses. However, this perspective also encourages companies to rethink their overall strategy. By integrating ESG criteria into their operations, they realize that it can become a strategic transformation lever, fostering innovation and long-term competitiveness.

Figure of the month

+1.54

In 2024, a record global temperature of +1.54 °C compared to the pre-industrial era

Chart of the month

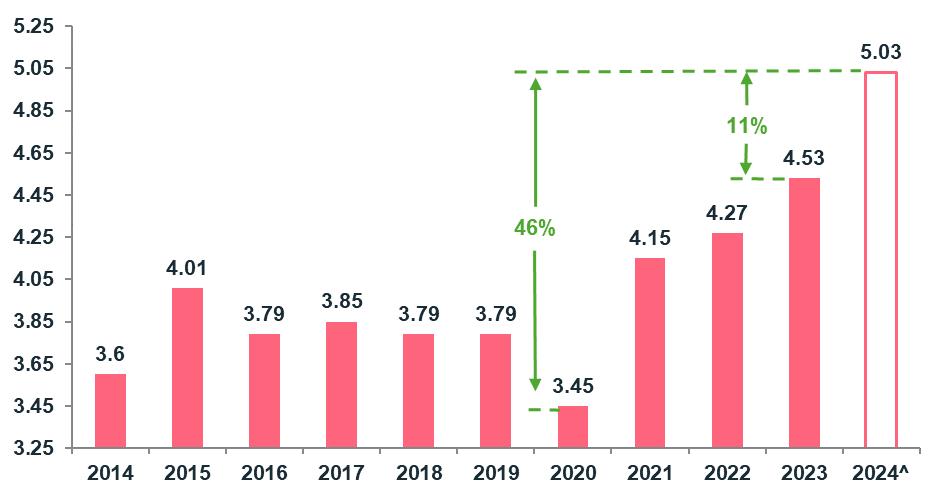

Stoxx 600 average total CEO compensation

The average remuneration of European CEOs has increased by 47% since 2020, raising crucial questions about governance (transparency, alignment of interests) and social issues (wage inequalities, reputational concerns).

Source: Ostrum AM, Bloomberg Intelligence, March 2025