Every month, find out all about the sustainable market bonds news in our newsletter "MySustainableCorner".

This month in a nutshell

- On February 26, the European Commission proposed an "Omnibus" legislation aimed at significantly reducing three key texts of green finance, including CSRD. This legislation, which requires companies to report ESG information annually, entails a major change in its scope. The European Commission estimates that approximately 80% of the 42,500 companies initially submitted to the legislation would be exempt, with the sustainability reporting obligation applying only to companies with more than 1,000 employees and a turnover exceeding €50M.

- On February 20, France adopted a ban on per- and polyfluoroalkyl substances (PFAS) in non-essential products, in a law described as ‘one of the most ambitious’ worldwide. This reflects the growing concern about these substances, often referred to as "forever chemicals" due to their persistence in the environment and human body. Ostrum AM’s full report “Confronting PFAS: An in-depth review of risks, regulations and corporate strategies” on https://www.ostrum.com/en/our-csr-and-esg-publications.

- “Orange bonds”, a new sustainable debt instrument inspired by the United Nations' Sustainable Development Goal No. 5, aim to promote gender equality and the economic empowerment of women. Designed to complement market standards, such as the ICMA principles, they could generate $28bn in growth for the global economy by 2025, according to the Orange Movement.

- A study by Epsor (a French company specialising in employee savings and retirement management) on the new SRI label reform analyzed 816 funds, of which 24% were labeled as SRI. It reveals a 10% reduction in carbon footprint, reaching 629 tons of CO2 per million euros invested. The labeled funds achieved an average score of 68.2/100, higher than that of unlabled funds (59.3/100). The reform represents an important step toward more sustainable finance, providing investors with tools for environmentally friendly solutions.

Figure of the month

$10Tr

ESG debt has surpassed $10Tr, driven by increased investor demand and growing ambitions for energy transition

Chart of the month

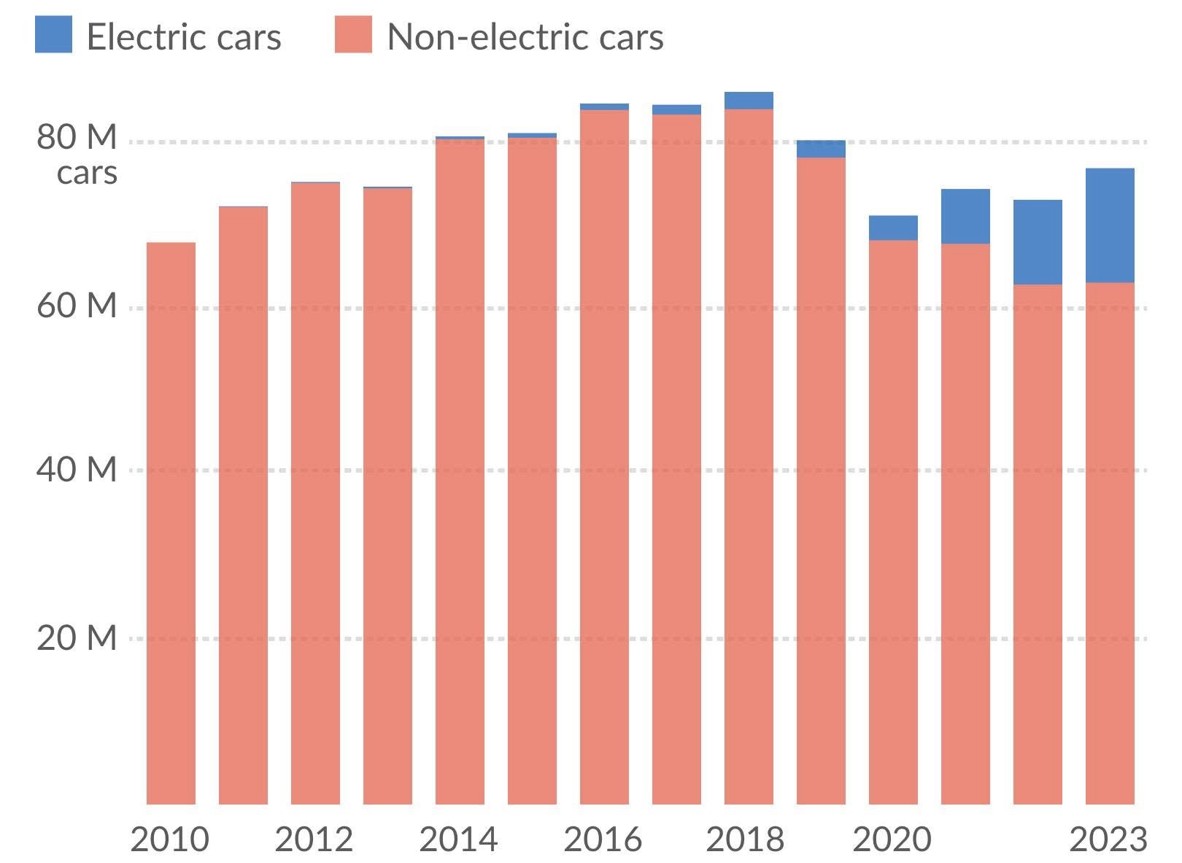

Global sales of combustion engine cars peaked in 2018

To decarbonize road transport, it is essential to shift from gasoline and diesel vehicles to electric and low-carbon alternatives. This transition is already underway, with a decline in sales of combustion engine cars since their peak in 2018. At the same time, sales of electric vehicles are experiencing significant growth.

Source: International Energy Agency/ Global EV Outlook 2024