Every month, find out all about the sustainable market bonds news in our newsletter "MySustainableCorner".

This month in a nutshell

- The Science Based Targets Network (SBTN) recently announced that GSK, Holcim, and Kering are the first companies to adopt science-based targets for nature. This initiative marks a significant turning point in corporate commitment to sustainability, initially focusing on critical issues such as freshwater and land. These targets aim to align corporate actions with environmental needs and contribute to biodiversity preservation.

- Local authorities (regions, departments, municipalities) play a key role in sustainable development by financing projects. The Walloon region has implemented local strategies, and a 2050 vision focused on three aspects: living in Wallonia, living in the world, and living beyond 2050. At the end of November 2024, the issuer launched its second social bond to finance education, employment, affordable housing, and access to essential services.

- The transport sector accounts for approximately 15% of global greenhouse gas (GHG) emissions, prompting companies to take action to reduce their environmental impact. In this context, IHO, a German manufacturer of parts for machinery and vehicles, offers solutions for the transition to a low-carbon economy. This year, the company issued a Sustainability-linked bond with the goal of reducing its GHG emissions by 75% for scopes 1 and 2, and by 25% for scope 3 by 2030.

- Deutsche Bank announced that it has raised €500 million through its first social bond, the proceeds of which are intended to support the bank's sustainable asset portfolio. This portfolio finances sectors such as affordable housing and access to essential services for the elderly or vulnerable individuals.

Figure of the month

1.7

Global sustainable-debt issuance is on a record pace, surpassing the $1.7 trillion mark so far in 2024

Chart of the month

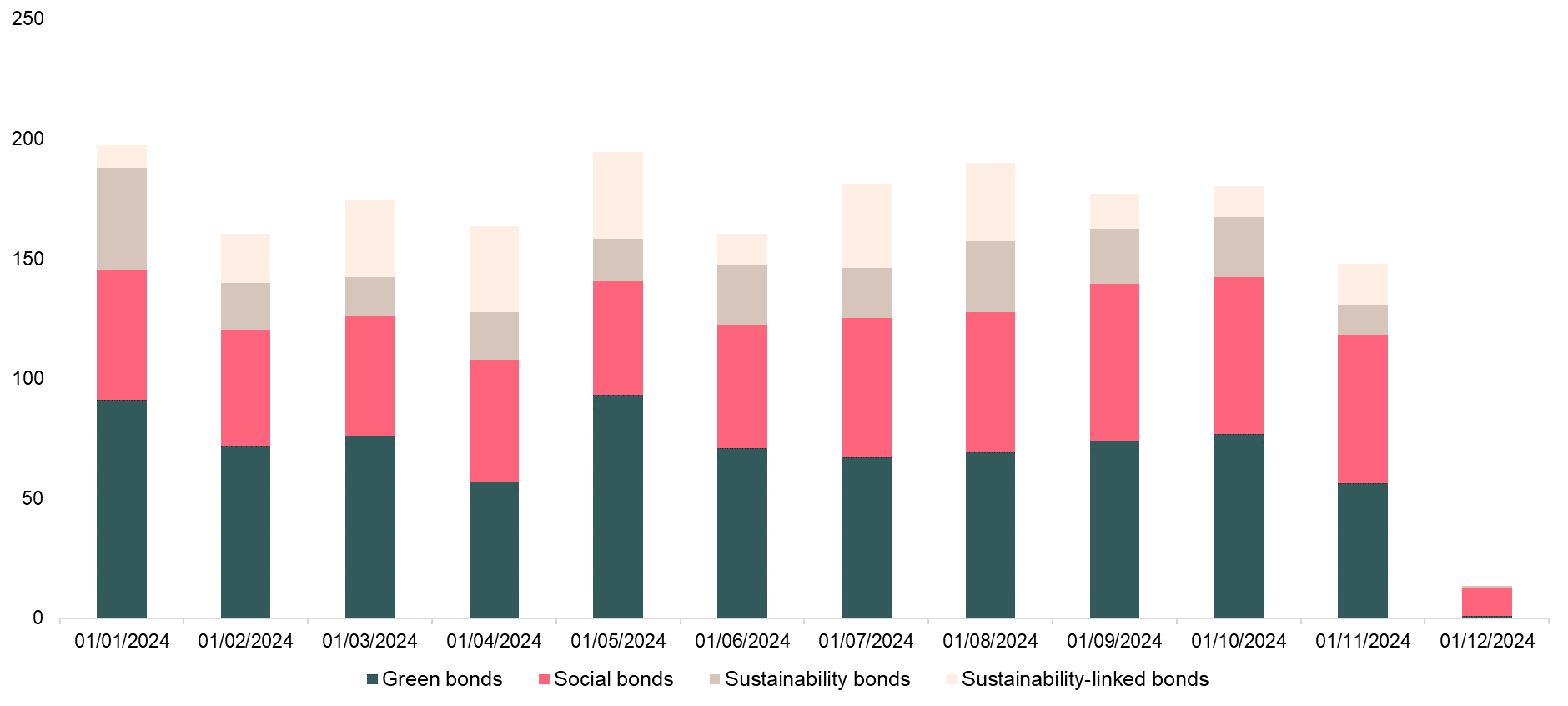

Sustainable debt issuance year-to-date in Bn €

Sustainable issuances in 2024 are expected to set new records, surpassing those of 2021. A linear distribution of issuances is observed, and the gap between social and green bonds is narrowing, indicating a growing harmonization between these two types of financing.

Source: Ostrum AM, Bloomberg, November 2024