Every month, find out all about the sustainable market bonds news in our newsletter

"MySustainableCorner".

This month in a nutshell

- It is encouraging to see that 190 countries adopted a global biodiversity framework at COP15, with a focus on nature protection. The reallocation of fossil subsidies to biodiversity is an important step to increase funding for biodiversity, thus showing a commitment to sustainable investment and the preservation of the ecosphere.

Although the United States has not adopted this agreement, it is possible that it will participate in similar initiatives in the future. - The market for responsible financing instruments has recently undergone a significant evolution with the introduction of "sustainable commercial papers", which are short-term debt securities issued by companies or government entities to finance their short-term cash flow needs.

These funds are intended for green or social projects or assets. "Sustainable commercial papers" have short maturities (from a few days to a year) and are considered “low risk” due to the issuer’s solvency.

For example, EDF recently issued "green commercial papers" to finance assets related to nuclear, renewable energies and the electricity distribution network. - On June 13, 2024, the city of Paris issued a new sustainable bond to finance environmental and social projects such as clean transportation, energy efficiency, renewable energy, climate change adaptation, access to education, health and social housing.

This funding is part of Paris' goal to become a carbon-neutral, resilient and inclusive city, using 100% renewable energy by 2050.

Figure of the month

2023 Responsible Investment: an increase of 5.8% compared to 2022

Source: AFG (Association Française de la Gestion financière), April 2024

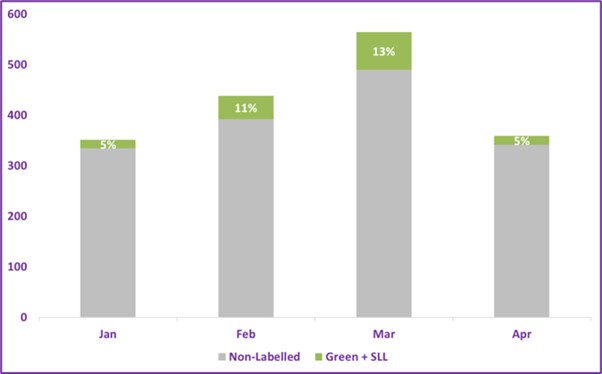

Chart of the month

Global lending volumes 2024 YTD ($bn), with sustainable lending as a % of total

The percentage of sustainable loans compared to total loans varies each month, ranging between 5% and 13%. While these amounts seem modest, they could increase for the remainder of 2024..

Source: Dealogic, May 2024