Every month, find out all about the sustainable market bonds news in our newsletter "MySustainableCorner".

This month in a nutshell

- BPCE launches its first social bond with profit-sharing coupon in partnership with Natixis CIB, amounting to €400 million for the benefit of the Robert-Debré Institute for Child Brain Health. This amount will be allocated to finance ESG projects and assets in the healthcare sector, directly impacting the well-being of children and their families. In total, the Robert-Debré Institute for Child Brain Health will receive €2.79 million in donations over a 10-year period.

- Donald Trump's election could hinder energy transition, with rising tariffs leading to inflation in renewable energy and increasing tensions against ESG potentially slowing down sustainable initiatives. Nevertheless, the Inflation Reduction Act (IRA) is expected to remain in effect, continuing to support transition projects and generate jobs.

- Saur stands out as a pioneer in the water sector with the issuance of a blue bond (€500 million), reinforcing its status as a leader in sustainable finance supporting the water transition. This unique initiative highlights Saur's strong commitment to the preservation of natural resources.

- COP29 took place from November 11 to 22, 2024, in Baku, Azerbaijan. It concluded with an agreement that is largely viewed as disappointing for developing countries. In Baku, developed nations pledged to increase their financial support for the most vulnerable countries facing climate change, committing to provide $300 billion annually starting in 2035, a figure that remains significantly short of the anticipated $1 trillion.

- The European Commission has announced funding for 85 innovative projects aiming for carbon neutrality, with a total budget of €4.8 billion, supported by grants from the Innovation Fund (fully financed by the EU Emissions Trading System).

Figure of the month

5%

By 2030, data centers could account for 5% of global energy consumption if no corrective measures are implemented

Chart of the month

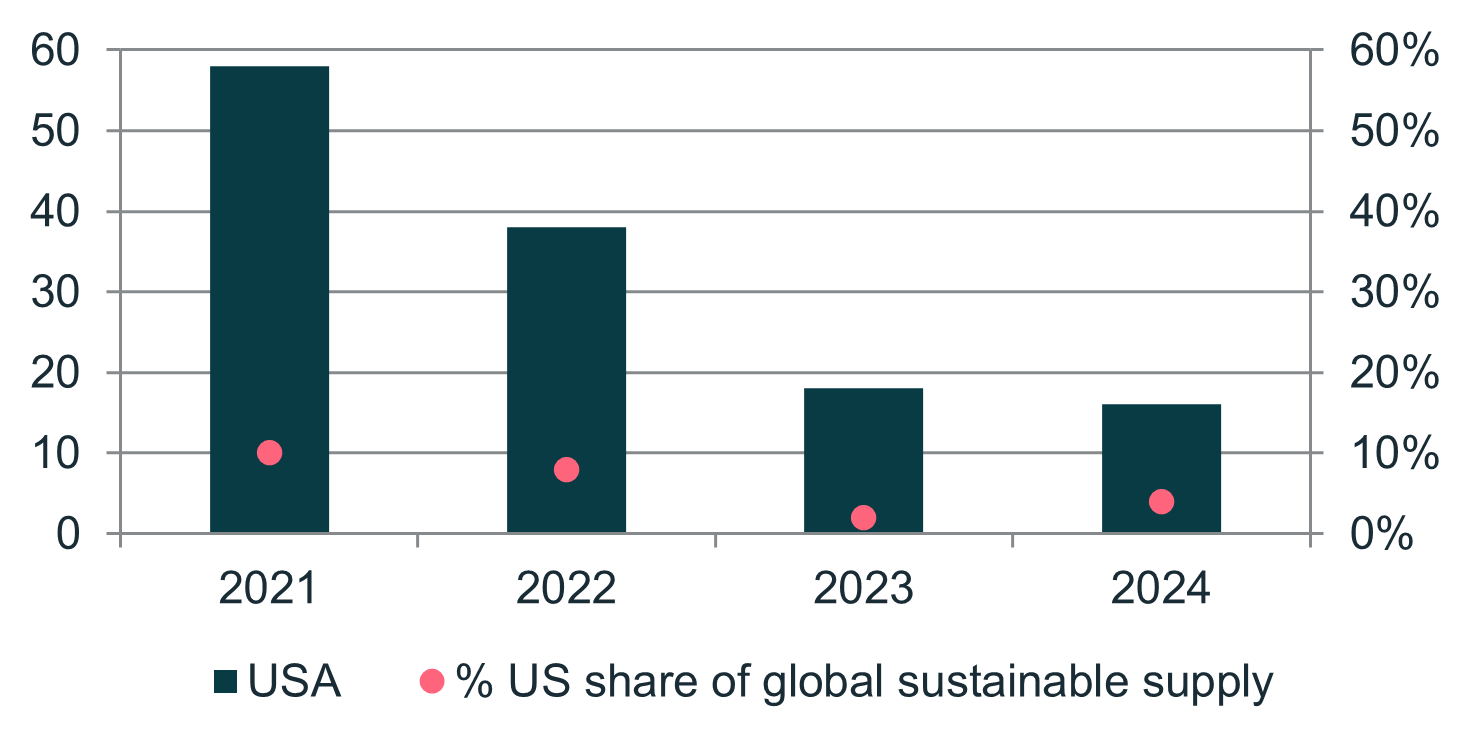

Sustainable bond issuance in the United States (in € billion) and global share (%)

The decline of U.S. sustainable bonds emissions, both in absolute terms and as a share of global emissions, raises concerns in the context of a tightening anti-ESG sentiment across the Atlantic.

Source : Bloomberg