Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum AM's views on the economy, strategy and markets.

The cio letter

The Decline of the American Empire?

The economic policy of Donald Trump remains a focal point of concern for investors. The uncertainty and financial volatility it engenders are unlikely to dissipate in the short term. Canada and China are indeed retaliating, triggering an escalation of tariffs. The first tangible signs of a pronounced slowdown have emerged in the United States, leading to a significant downturn on Wall Street and a depreciation of the dollar. The Federal Reserve appears indecisive regarding its policy direction, opting for a form of status quo by default. Concurrently, in response to Trump's threats of NATO disengagement, Europe has no choice but to bolster its defense capabilities. In a moment reminiscent of Draghi's "Whatever it takes," Germany is embarking on a fiscal revolution, announcing large scale defense and infrastructure spending packages. This has resulted in a 30-bp rise in the Bund in a single session. The European Central Bank will not impede the implementation of these budgetary plans and continues its course of rate easing.

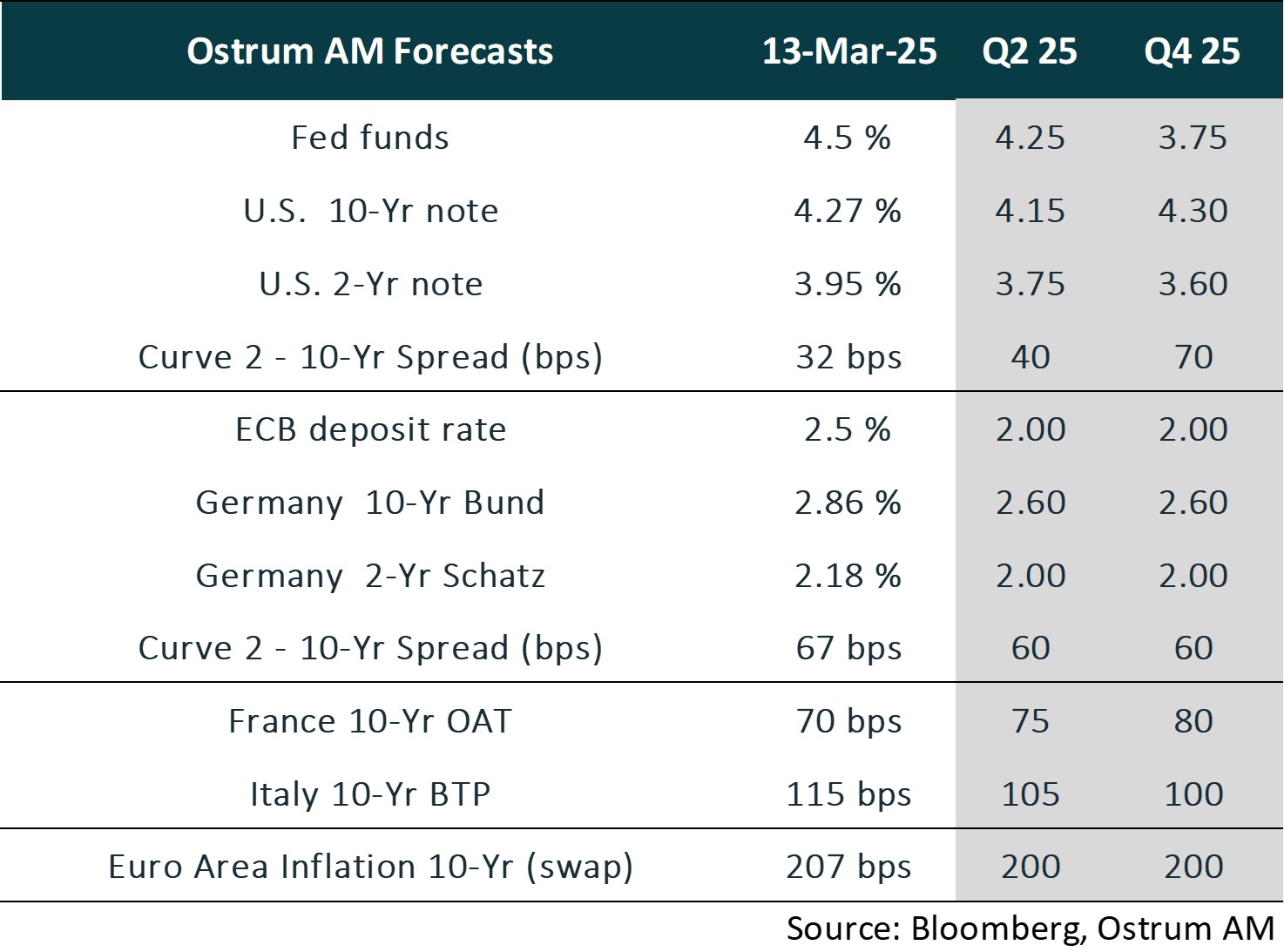

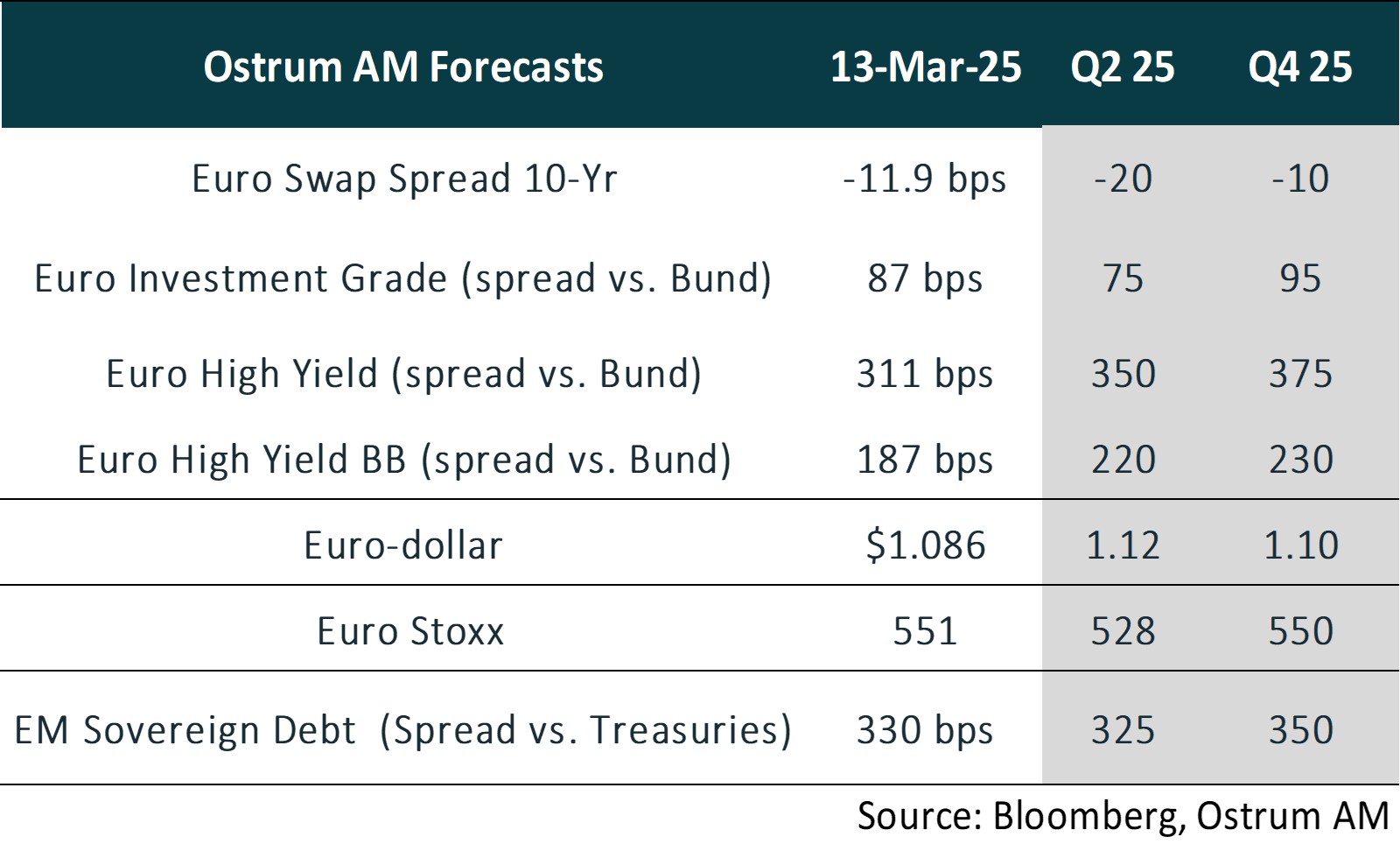

The divergent movements between the Bund and the Treasury note are likely to persist. The Treasury note is expected to benefit from the cessation of the Fed's quantitative tightening, followed by rate cuts enabled by the gradual deterioration of the labor market. The yield on the 10-year U.S. Treasury is projected to remain close to 4%. Tensions surrounding the Bund seem to have no impact on sovereign spreads, as local political risks fade despite the Portuguese crisis and budgetary uncertainties in France. Similar to sovereign spreads, credit spreads are expected to remain stable. Valuations in the high-yield sector pose a moderate risk of widening. The downside risk to equities endures, particularly in the United States with the Nasdaq's plunge. Europe is expected to withstand American stock market risks... but only to a certain extent.

Economic Views

THREE THEMES FOR THE MARKETS

-

Monetary policy

The uncertainty surrounding U.S. policies has prompted central banks to adopt a cautious stance. Jerome Powell has indicated that he is awaiting clarity on fiscal policy and the impact of tariffs, suggesting a prolonged status quo for the Fed. The ECB has lowered its deposit rate by 25 bps to 2.50%, indicating that it is approaching neutrality and nearing the end of its rate-cutting cycle. Future decisions will largely depend on developments regarding U.S. tariffs. Meanwhile, the PBOC maintains an accommodative bias, positioning itself to support economic growth amid ongoing challenges.

-

Inflation

The impact of tariffs remains uncertain, but U.S. household price expectations have climbed. Rising costs affect consumer sentiment. Inflation slowed to 2.8% in February on lower transport and recreation prices. In the euro area, inflation stood at 2.4% in February, with service prices increasing by 3.7%. However, the slowdown in wage growth may be more gradual than anticipated by the ECB. In China, inflation fell to -0.7% in February, due to distortions related to the Lunar New Year. The inflation target for 2025 has been set at 2%. It is the first time since 2004 that the target has been adjusted to account for deflationary pressures.

-

Growth

In the US, growth prospects are deteriorating, as evidenced by the downward revision of Q1 GDP by the Atlanta Fed to -2.4%, down from 2.3% at the end of February. This reflects the considerable uncertainty surrounding trade, immigration, and DOGE. The euro area concluded 2024 with an annual growth rate of 0.8%. Q4 GDP was rounded up to 0.2%. The European defense plan is expected to have long-term effects on the region's growth trajectory. In China, the growth target for 2025 remains unchanged at 5%. Authorities wants to revive the private sector, particularly in advanced technology, to restore confidence in the economy.

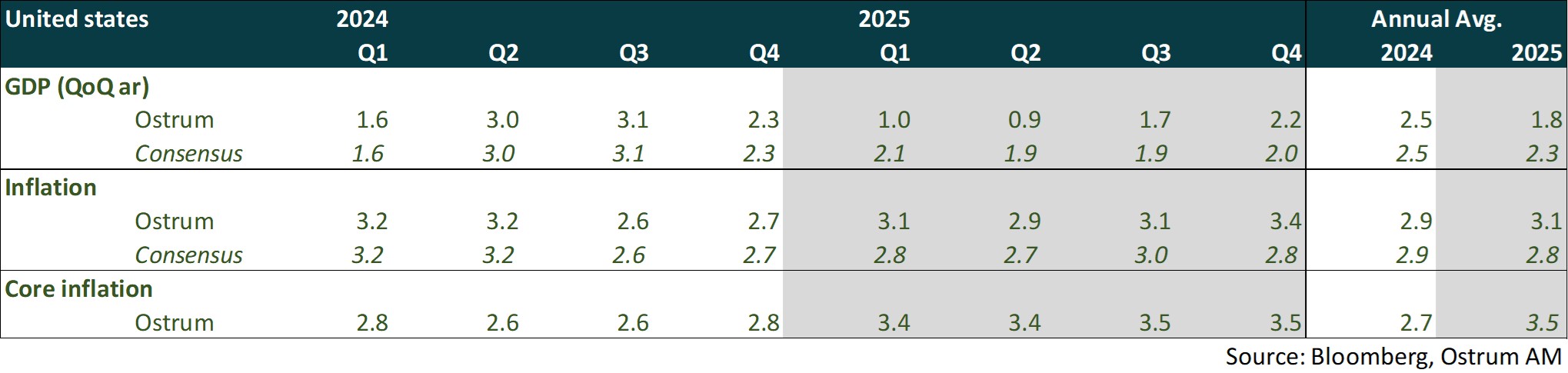

ECONOMY: UNITED STATES

A first semester marked by uncertainty

- Demand: Durable goods consumption is expected to contract in the first half of the year. Productive investment is slowing down. The initial boost in confidence following Trump's election is now reversing. The trade deficit has deteriorated significantly. However, imports are anticipated to moderate in the first half.

- Labor Market: Unemployment is on the rise, accompanied by a decrease in hours worked. Wage pressures and labor shortages, particularly in construction and services, are expected to increase due to a decline in immigration. Job freezes, and even public-sector layoffs, are likely to weigh on consumer confidence.

- Fiscal Policy: The House of Representatives has passed a budget that diverges considerably from the Senate's proposal. The Tax Cuts and Jobs Act (TCJA) is expected to be extended (totaling $4.5 trillion over ten years), while defense spending is projected to rise, funded by reductions in transfer payments (estimated at $2 trillion, including Medicaid?). The deficit is not expected to decrease over the coming years.

- Inflation: Inflation remains above the 2% target. Rents are projected to decelerate in 2025; however, the supply of multi-family housing is expected to become problematic in 2026, likely leading to a rebound in rents next year. Energy costs (particularly electricity imported from Canada) and imported goods subject to tariffs pose upward risks to inflation.

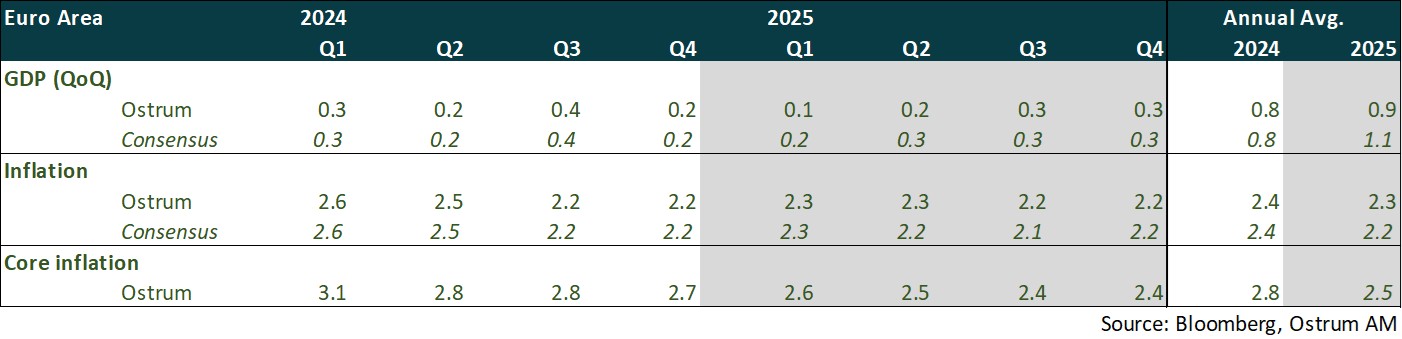

ECONOMY: EURO AREA

Growth is expected to remain very moderate in 2025. Political and geopolitical uncertainty, along with rising U.S. tariffs, should partly offset gains in purchasing power and the ECB's rate cuts. The risks are tilted to the downside. Investments in defense and the German infrastructure plan are expected to have an impact only starting in 2026.

- Domestic Demand: Consumption is expected to strengthen slightly due to gains in purchasing power. Political uncertainty is likely to weigh on business investment, while residential investment should recover somewhat, supported by more attractive financing conditions.

- Labor Market: In a context of heightened uncertainty, business leaders are expected to be more cautious about hiring.

- Foreign Trade: Exports will be impacted by the increase in U.S. tariffs.

- Fiscal Policy: Governments will increase their defense spending following the dramatic shift in U.S. policy. The European Commission has proposed an €800 billion plan primarily based on activating the national safeguard clause of the Stability and Growth Pact for military spending. Germany has announced a reform of the debt brake for military spending and a €500 billion infrastructure plan that still needs to be voted on.

- Inflation: Inflation is expected to moderate but remain above the ECB's target of 2%.

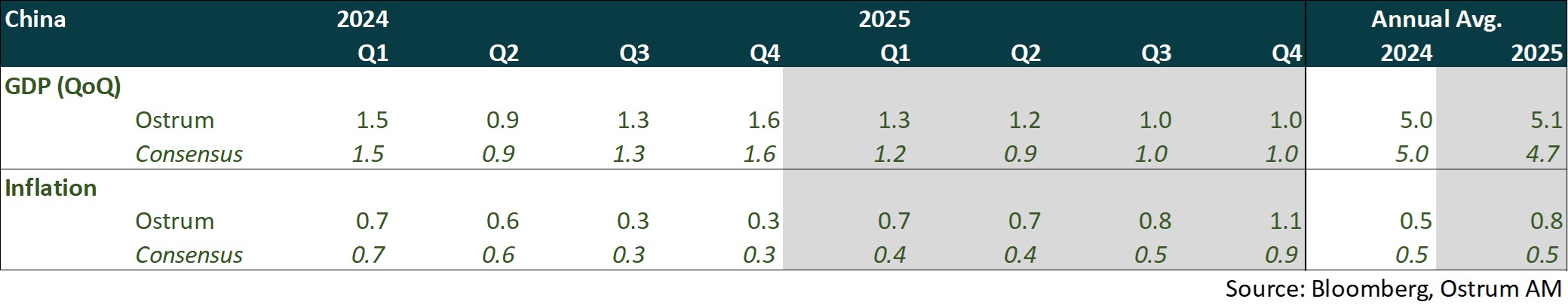

ECONOMY: CHINA

Xi Jinping has shifted towards the private sector in response to internal and external challenges. This could mark a turning point for Chinese growth.

- Economic policy: Rather than favoring a fiscal stimulus plan that would have had short-term effects on Chinese growth, Xi Jinping has opted to encourage the innovative and self-reliant private sector to ensure long-term economic success. The Chinese president is targeting the high-tech sector to increase the country's productivity and address the demographic challenge. In the face of external pressures, reforms are also expected to accelerate, particularly regarding income distribution.

- The National People's Congress on March 5 sat a growth target "around 5%." Lowering the inflation target from 3% to 2% send a positive signal regarding the Chinese authorities' awareness of deflation risks. A focus on consumption has been strengthened, particularly towards the most vulnerable (social security).

- Demand: The private sector accounts for 60% of GDP and 80% of the country's jobs. A rebound in private sector confidence, with a spillover effect on Chinese consumers, poses an upside risk to our scenario. The real estate sector is showing increasingly tangible signs of stabilization. However, this is not enough to restore confidence among Chinese consumers.

- Monetary policy: The PBOC is expected to remain accommodative to support innovative sectors, stabilize the real estate sector, and ensure liquidity in domestic markets.

Monetary Policy

Central banks are becoming more cautious

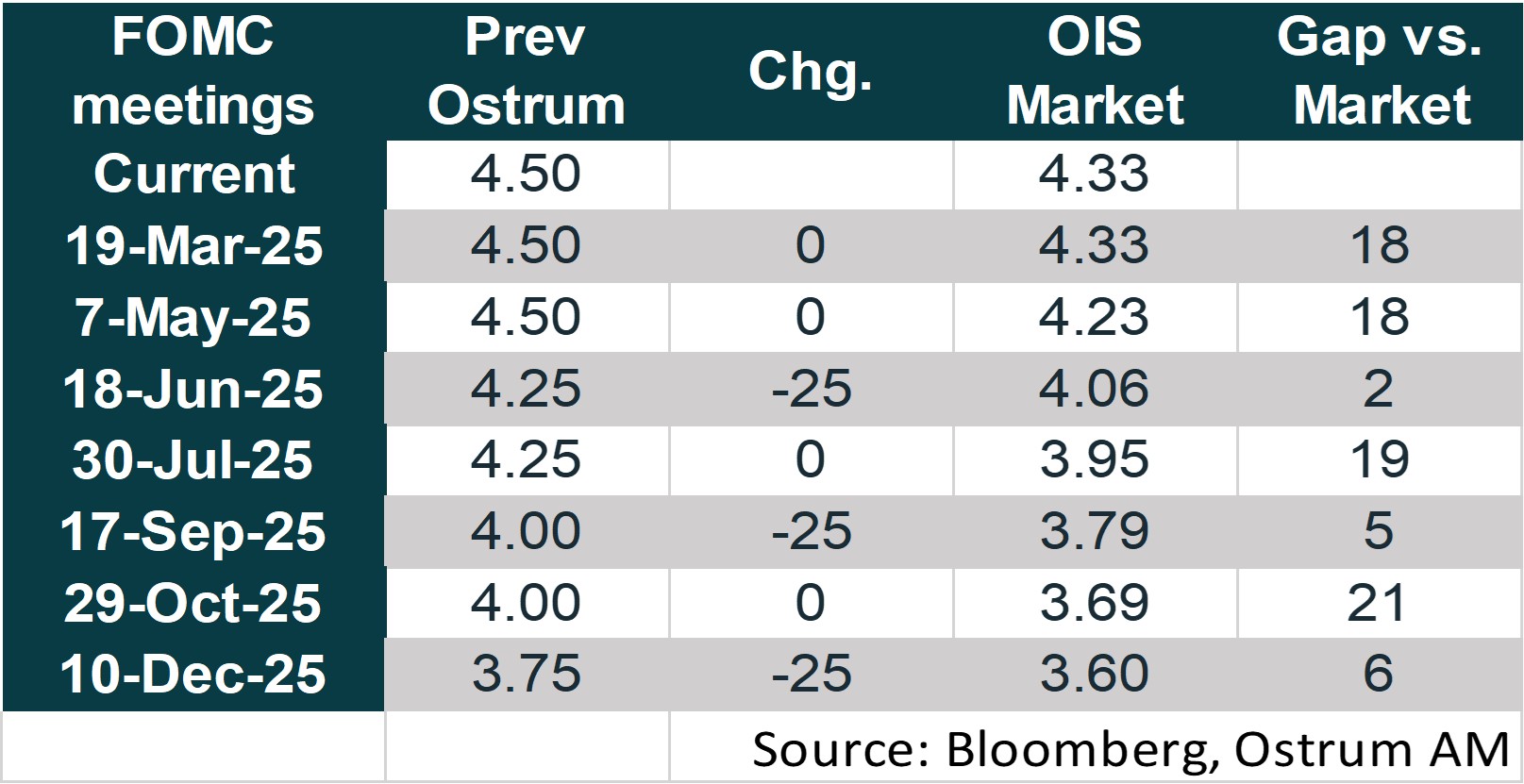

- THE FED IS IN NO HURRY TO LOWER ITS RATES AGAIN

After lowering its rates by a total of 100 basis points in the last three meetings, the Fed kept its rates unchanged in January. Strong growth, a solid labor market, and inflation that is still "somewhat high" were partly responsible for this decision. Additionally, rising uncertainty related to the measures announced and forthcoming by Donald Trump contributed to the Fed's cautious stance. In a speech delivered on March 7, Jerome Powell reiterated that the Fed should not rush to lower its rates and that it was well-positioned to wait and assess the impact—both on growth and inflation—of the measures taken by the White House. Furthermore, the Fed's Minutes revealed that it might slow the pace of balance sheet contraction or even suspend it as long as the debt ceiling issue remains unresolved. We anticipate three rate cuts by the Fed of 25 basis points each in June, September, and December. - ARE WE HEADING TOWARDS A PAUSE IN APRIL?

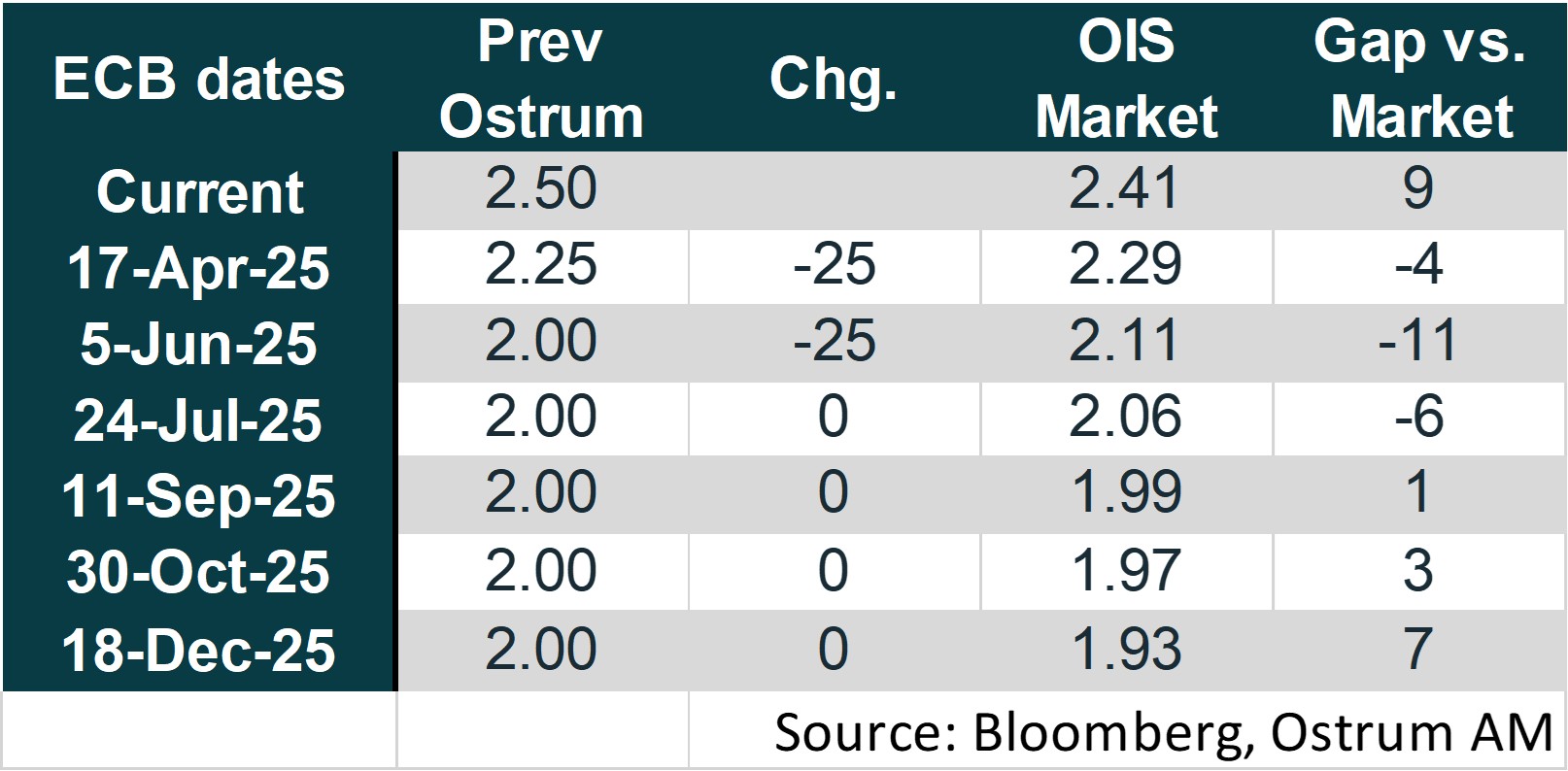

The ECB implemented its sixth interest rate cut of 25 basis points on March 6, bringing the deposit rate down to 2.50%. A change was made to the accompanying statement, indicating that monetary policy is no longer considered "restrictive" but "is becoming meaningfully less restrictive." With the ECB's deposit rate approaching the "neutral" rate, some governors are becoming more cautious before continuing with rate cuts. The April meeting promises to be eventful. The ECB’s growth forecasts have been revised downward for 2025 and 2026, while inflation forecasts have been revised upward for 2025 (2.3% compared to 2.1%). The return to the 2% target has only been postponed to early 2026. We still anticipate two more rate cuts from the ECB, bringing the deposit rate to 2% by June. The ECB will also continue to reduce the size of its balance sheet.

Market views

Asset classes

- U.S. Rates: After a period of status quo, the Fed may resume cutting rates in June pushing 10-Yr yields lower towards 4.15%.

- European Rates: The ECB may cut rates to 2%. The yield on 10-Year Bunds now prices in a more ambitious fiscal policy in Germany.

- Sovereign Spreads: Sovereign spreads have eased despite extreme tensions on Bunds. We expect political risk to recede in France and spreads to hover about 80 bps at year-end. BTPs should benefit from rapid fiscal consolidation in Italy.

- Eurozone Inflation: Long-term inflation expectations appear well anchored. A modest further increase in breakeven inflation rates nevertheless remains likely.

- Euro Credit: IG credit spreads trade on the rich side to their fair value.

- Euro high yield: the yield premium on high-yield bonds should normalize over time. Default rates remain low.

- Exchange Rates: Sentiment towards the euro area is improving. The euro should trade around $1.10 in 2025.

- European equities: After a strong start of the year, equities should trade sideways. PE multiples should stay above 14x.

- Emerging Market Debt: Emerging market debt are trading rich but will benefit from Fed monetary easing.