Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum’s views on the economy, strategy and markets.

The CIO Letter

Biden's withdrawal reshuffles the deck

After the early elections in France and the United Kingdom, US politics is once again at the center of market concerns. Following the attack on Donald Trump, Joe Biden's decision to withdraw from the presidential race is an important change just four months before the election. Kamala Harris is the frontrunner for the Democratic nomination.

Activity moderated in the first half of the year in the United States, while remaining close to potential growth. Eurozone activity is affected by political uncertainty in France, despite a likely favorable effect from the Olympic Games. Chinese growth, mainly driven by exports, disappointed in the second quarter and remains subject to American and European protectionism. Gradual disinflation appears to allow the Fed to start its rate-cutting cycle as early as September. The ECB is expected to continue monetary easing despite inflation inertia. The BoE is also preparing to reduce its rate.

Anticipated monetary support has partly erased political risk premiums. Long-term rates have fallen to around 4.20% in the United States and 2.40% on the Bund, in line with our projections for the third quarter closing. Sovereign spreads have narrowed, but the OAT trades beyond 65 basis points. Credit benefits from shrinking swap spreads. High yield displays some expensiveness, but monetary support and low default rates delay spread normalization. In the stock markets, there is a rotation from American technology to smaller capitalizations. However, the first publications of the second quarter are positive in the United States.

Economic Views

Three themes for the markets

-

Monetary policy

The ECB lowered interest rates in June without further commitment, considering the inflation outlook for 2025. Meanwhile, the Fed is more confident about inflation and is expected to lower its rate in September. Monetary policy is also expected to ease in the UK in August. On the other hand, the BoJ will have to raise its rates if it intends to combat the weakness of the yen. The PBoC continues its regular monetary easing policy.

-

Inflation

After an initial phase of rapid disinflation, the second phase is proving to be slower, due in part to residual wage pressures. In the United States, inflation shows signs of moderation (3% in June), especially in the services sector. In the Eurozone, inflation has stabilized around 2.5%. However, service sector inflation remains close to 4%. The return of inflation to the target in the UK also masks a problematic persistence of tensions in the services sector. China is close to deflation.

-

Growth

In the United States, growth has slightly dipped below potential in the first half of the year. A gradual increase in unemployment goes hand in hand with the slowdown. After sluggish growth in 2023, the eurozone experienced a rebound in activity. However, political uncertainty in France constitutes a hindrance to the recovery. In China, growth remains unbalanced and subject to internal financial and real estate risks.

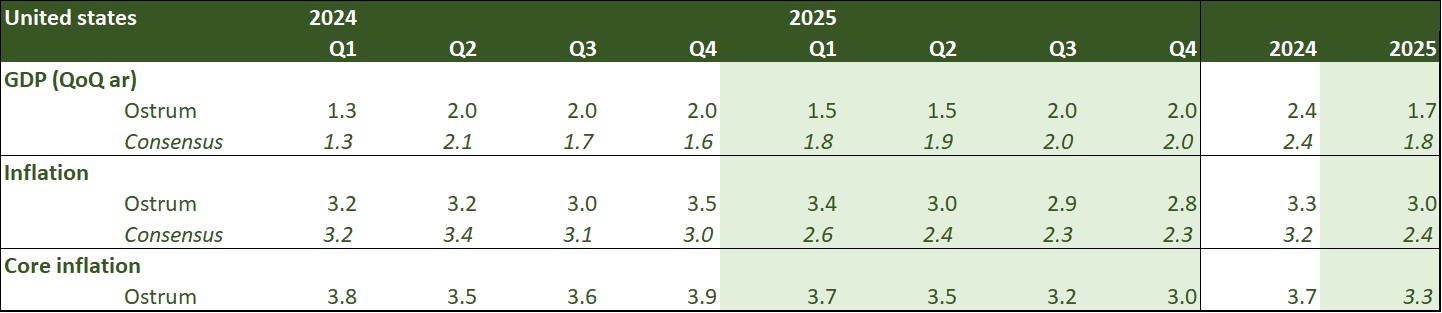

Key macroeconomic signposts : United States

- Our scenario is close to the consensus, with a temporary slowdown in the first half of 2025.

- U.S. growth stood at 1.4% in the first quarter. Consumption has slowed, including in the services sector. Business investment is ultimately more sustained, and housing has surged by 16%. The trade balance subtracts 0.7 percentage points from growth.

- The second quarter is expected to be slightly better, with a slight rebound in household consumption. Housing is likely to experience a downturn from Q1. Stock contribution should increase significantly.

- The federal deficit is expected to rise to $1.9 trillion in 2024. Tax revenues are well-oriented, but non-discretionary spending and interest costs are growing rapidly.

- Financial crisis risks remain contained. Household balance sheets are healthy.

- The unemployment rate is gradually rising (4.1% in June). The Fed is expected to place more emphasis on employment going forward.

- Disinflation remains slow, with a CPI at 3%. There is a slight improvement in the prices of services excluding housing and energy.

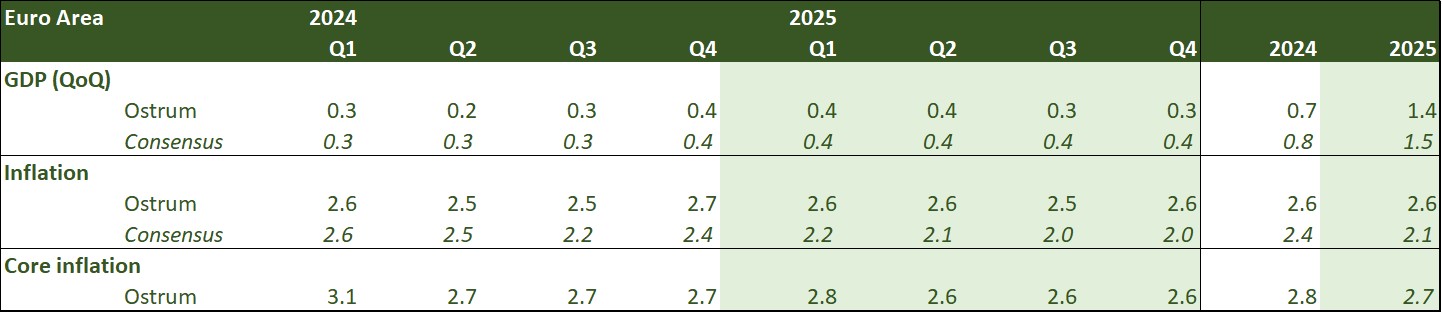

Key macroeconomic signposts : Euro area

- A slow recovery began in the first quarter after 5 quarters of flat or slightly negative growth. The rebound affected all major economies, including Germany, which returned to growth after a sharp contraction in Q4. This was linked to exports and residential investment, while consumption decreased.

- The Eurozone's recovery is tied to external trade, offsetting the negative contribution of domestic demand and inventories.

- Business surveys became more mixed in June. This does not undermine the recovery momentum, which is expected to strengthen somewhat in the second half of the year.

- It will be driven by household consumption, as they benefit from increased purchasing power. Domestic demand should also benefit from a less restrictive monetary policy.

- However, fiscal policy will be a drag on growth. The European Commission has proposed a procedure for excessive deficit against France, Italy, and Belgium, among others. Budgetary adjustment measures need to be taken as political uncertainty dominates in France following early legislative elections.

- After an initial phase of rapid disinflation, the second phase is proving to be slower. This reflects wage pressures, the end of the very favorable base effect on energy prices, and the cessation of measures to contain price increases. In a context of low productivity, business margins have an essential role to play in continuing disinflation.

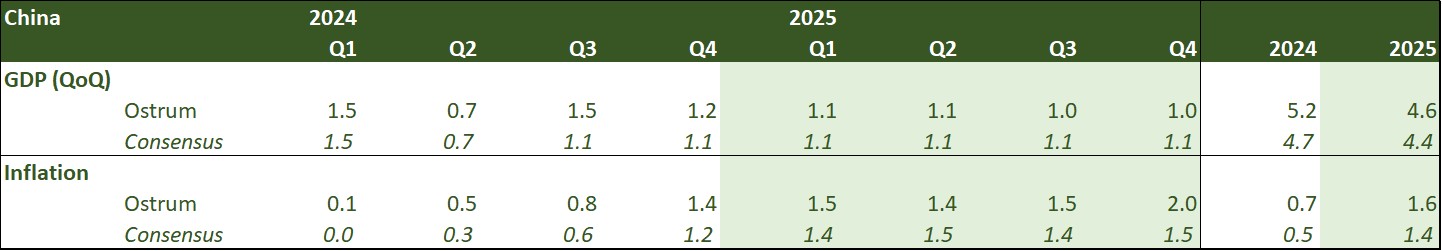

Key macroeconomic signposts : China

- A two-speed recovery. Chinese activity continues to be driven by exports, while consumption remains penalized by the real estate crisis.

- The real estate sector shows timid signs of stabilization. Authorities are expected to increase their support to quickly stabilize the sector at a low point.

- The governor of the PBoC announced a new monetary policy framework. The goal is to converge towards international standards such as that of the Fed.

- The framework includes: 1/ Simplification of the PBoC's main interest rates. The 7-day reverse repo rate, a short-term rate, is expected to be the central bank's main interest rate. – 2/ Gradual negotiation of government bonds to control the sovereign yield curve and better coordinate monetary and fiscal policy. – 3/ Regulatory and statistical changes, such as the inclusion of household deposits in the M1 monetary aggregate, currently included in M2, to converge towards international standards.

- The PBoC remains determined to control the depreciation of its currency against the dollar by using the yuan's central parity rate.

- China has indicated it will increase its customs duties on European agricultural products, particularly from Spain and Italy, in retaliation for the European Union's 38% tariff increase on its electric vehicles.

- Shortly after the Third Plenum, where no concrete measures to support demand were announced, the PBoC lowered its rates to support the economy.

Monetary Policy

The monetary policies are going to become less restrictive

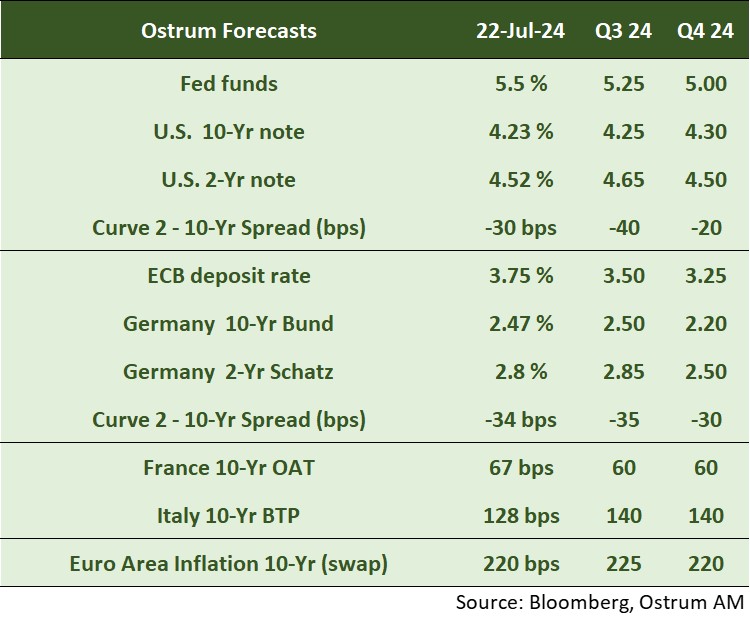

- Towards a Fed rate cut in September

During his testimony before Congress, Jerome Powell indicated that the Fed considered the risks to its dual mandate of price stability and maximum employment as more balanced. The labor market is fully normalized and the Fed needs more "good data" to be more confident in terms of price stability. The lower-than-expected inflation (CPI) in June is undeniably reassuring for the Fed. J. Powell also mentioned in an interview that the last three inflation figures made him slightly more confident, paving the way for a rate cut in September. Additionally, the Fed has been making its monetary policy less restrictive since June through the reduction of the size of its balance sheet. We anticipate a rate cut in September, followed by a second one in December. - The ECB is making its monetary policy slightly less restrictive

During the meeting on July 18th, the ECB kept its rates unchanged after lowering them in June. Christine Lagarde did not provide indications on what the Central Bank would decide in September, stating that the question was "wide open" and would depend on the available data. The statement indicated that domestic price pressures remain high, particularly related to wages, while also noting that businesses were tending to absorb some of the wage cost increases through their margins. We anticipate a second rate cut by the ECB in September, followed by a third in December. Since July, the ECB has been reinvesting only half of the PEPP (at an average pace of 7.5 billion euros per month) and will put an end to it by the end of 2024.

Market views

Asset classes

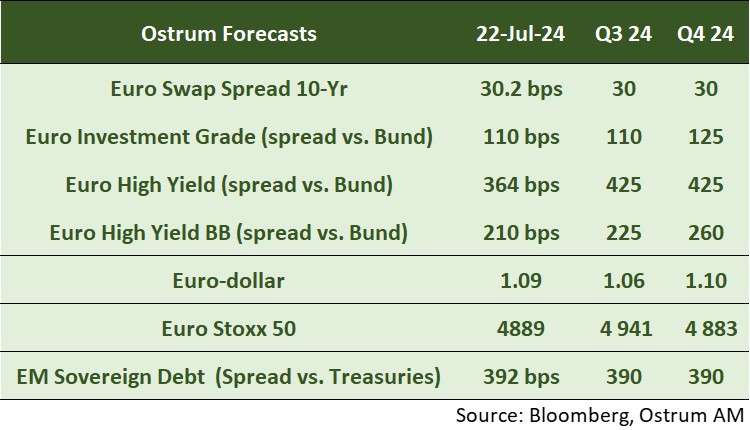

- US Rates: The Fed is expected to cut its rate twice in the second half of the year. Monetary easing will keep the T-note below 4.30%.

- European Rates: The Bund is trading around 2.50%, despite an initial rate cut by the ECB. However, the German 10-year bond is expected to fall to around 2.20% by the end of the year.

- Sovereign Spreads: The volatility of spreads has decreased on the OAT despite persistent political uncertainty.

- Eurozone Inflation: Breakeven rates are generally stable, despite some upward surprises on inflation.

- Euro Credit: Spreads are expected to remain stable around 110 basis points against the Bund. High yield valuations are tighter, and spreads are expected to widen.

- Exchange Rates: The euro, subject to political risk, is expected to remain weak in the short term.

- Stocks: The gradual normalization of margins and a compression of multiples imply a return of the Euro Stoxx 50 towards 4,900.

- Emerging Debt: Stability is expected to prevail in the third quarter.