Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum’s views on the economy, strategy and markets.

The cio letter

Reflation times in China

Chinese authorities appear to be finally acknowledging the impact of the real estate crisis on growth. The PBoC has announced a series of measures aimed at revitalizing credit and risk-taking in the equity market, while fiscal measures are expected to amount to 2 or 3 percentage points of GDP. A rebound in domestic demand could be a game changer for global growth and inflation, through a rebound in commodity prices. Meanwhile, the tensions in the Middle East have caused oil prices to rebound to close to $80 per barrel. Furthermore, monetary easing is accelerating in developed countries. The Fed is likely to keep lowering rates despite a solid economy, and the ECB is taking advantage of inflation below 2% to bring forward rate cuts. The Chinese reflation comes at a critical time, as the outcome of the presidential election will be crucial for international relations, both commercially and militarily.

In this reflation context, the rebound of 10-year note yields towards 4% presents opportunities. The Bund seems close to its equilibrium value around 2.25%. French fiscal risk continues to put pressure on OATs, but sovereign spreads have been generally stable. Credit spreads help mitigate the high volatility in interest rates, ensuring that investment grade remains attractive despite tighter valuations. High yield may appear somewhat expensive, but the low default rate still provides support. European equities, lacking a real trend for the past six months, are expected to end the year close to current levels. The decline in revenues is offset by high margins and multiples. However, some sectors, such as the automotive industry, are showing significant signs of stress.

Economic Views

THREE THEMES FOR THE MARKETS

-

Monetary policy

The ECB cut interest rates by 25 bp in September. It looks ready to accelerate easing with further cuts in October and December. The Fed may lower rates by 25 bps at each of the next two meetings. The BoE will cut rates again in November on slower wage gains and service inflation. Bailey alluded too more aggressive easing. The PBoC is taking broad easing measures whilst the BoJ is under pressure from the incoming PM Ishiba to delay hikes.

-

Inflation

Global inflation is slowing but upside risks from stimulus and oil prices warrant caution. In the United States, inflation keeps falling (2.4% in September), although core CPI inflation remains sticky at 3.3%. In the euro area, inflation has dipped below 2% on lower energy prices. However, service sector inflation is sticky at4%. UK inflation is close to target with service inflation slowly moderating. China’s inflation is still below 1%.

-

Growth

In the United States, GDP growth may hover about 2.5% at an annualized rate in the third quarter. The labor market showed resilience in September. The euro area economy is growing at a slow pace despite some bright spots like Spain. Germany is in a recession but signs of improvement have emerged. In China, far-reaching fiscal and monetary measures may help to revive growth next year.

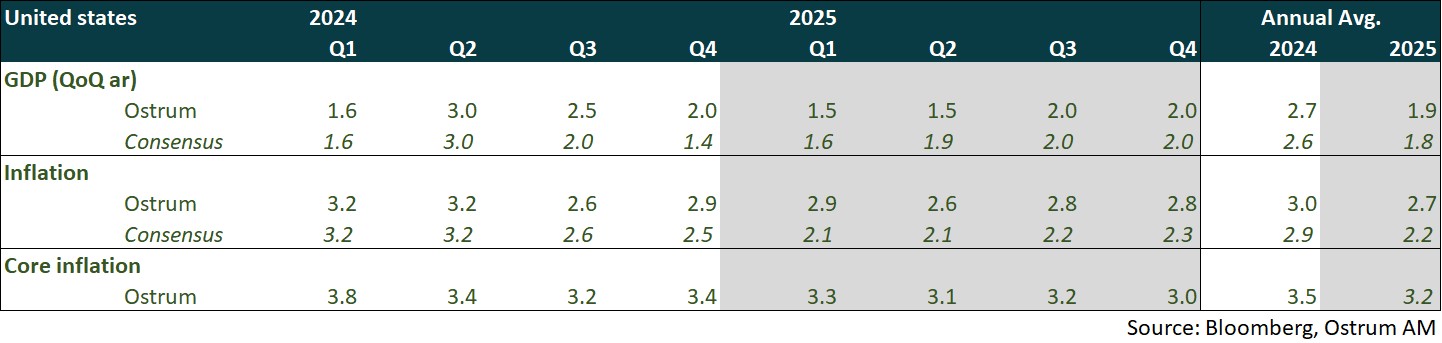

ECONOMY: UNITED STATES

- U.S. growth is projected to be 2.5% between July and September. Household consumption and private investment (excluding inventories) remain robust. The external balance is better than expected. Real estate investment is expected to grow in the third quarter, but housing supply remains insufficient. Public spending supports economic activity.

- The federal deficit has reached 6% of GDP. The CBO projects deficit stability over the next 10 years. Neither Harris nor Trump has any intention of reducing the deficit. Medicare expenditures (+$102 billion from January to August compared to 2023) and education spending (student debt restructuring program) are exceeding forecasts. Taxes (corporate and individual) are increasing by $300 billion.

- The risks of a financial crisis are low. However, consumer credit quality is deteriorating (credit cards, commercial real estate), but banks continue to lend, especially as interest rates are expected to decline.

- Inflation is gradually decreasing. However, service prices (excluding housing) are decelerating. The rebound in crude oil prices is a concern for Harris. Housing remains the primary issue.

ECONOMY: EURO AREA

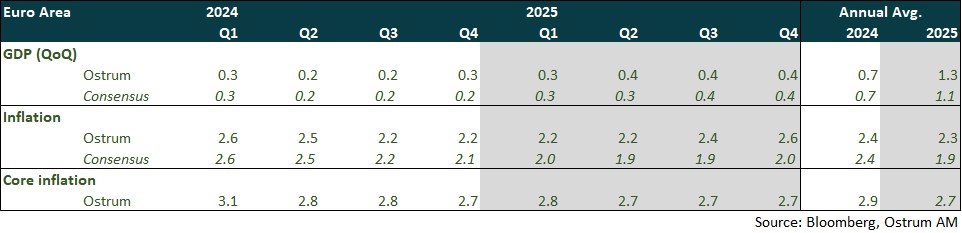

- A slow recovery has begun in the euro area after stagnant growth in 2023.

- The situation is very contrasted. Germany is at risk of experiencing a second consecutive year of recession, hindered by its structural weaknesses. In contrast, growth is robust in Spain, Portugal, and Greece, and continues at a moderate pace in France and Italy.

- The growth of the euro area is expected to remain slow in the second half of the year. The likely contraction of German GDP will contrast with moderate growth in France (with a temporary impact from the Olympics in Q3 and Q4) and Italy, as well as the robustness of other peripheral countries.

- In 2025, activity in the euro area is expected to gradually strengthen with a gradual recovery in household consumption.

- Wages are expected to continue to rise at a faster pace than inflation at least in the first half of the year, in a context of a favorable labor market.

- The impact of the ECB's monetary policy easing will be added.

- Fiscal policy will be a drag on growth. France and Italy are among the countries under excessive deficit procedures. The French government aims to reduce the deficit by 60 billion euros by 2025 and may face a motion of censure.

- After a first phase of rapid disinflation, the second phase is proving to be slower. This reflects wage pressures, the end of the very favorable base effect on energy prices, and the cessation of measures to contain price increases. Inflation in services is expected to remain high due to wage pressures.

ECONOMY: CHINA

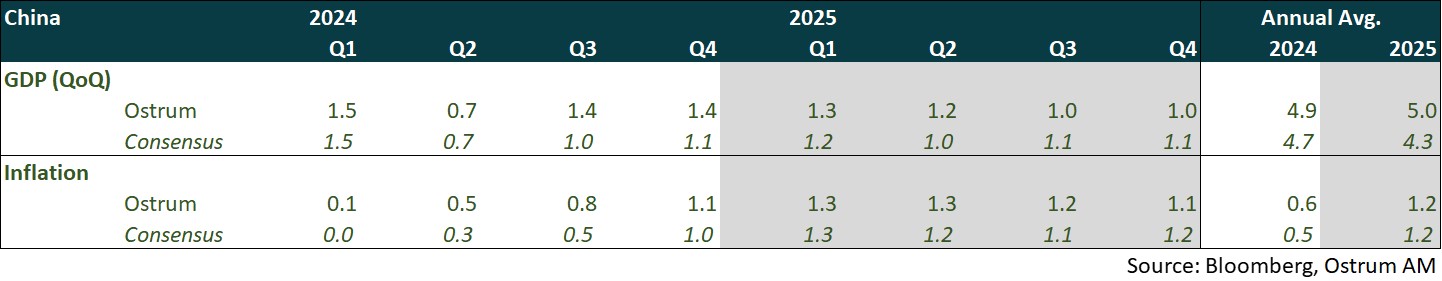

- The stimulus announced at the end of September leads us to revise our growth and inflation forecasts for 2025 upward. The government's pro-growth pivot marks a turning point. The authorities are ready to support growth and achieve their target of 5%.

- The impact of all these measures is expected to fully materialize on domestic demand in 2025 and beyond. Indeed, the stimulus includes both cyclical and structural measures.

- The announced budgetary measures, although details are expected to be published at the end of the month, represent a clear shift toward budgetary support for consumption.

- The 50 bp reduction in interest rates on existing mortgages, along with monetary helicopter drops, should support household consumption. Spending related to the Golden Week already reflects this trend.

- The prospect of further cuts in banks' reserve requirement ratios, as well as bond issuances by the PBOC to financially support local governments in infrastructure projects, should bolster both public and private investment.

- Focus has been placed on structural priorities, including real estate and local government debt, which are the main obstacles to growth.

- Chinese authorities will not hesitate to strengthen their support if necessary.

Monetary Policy

Easing of monetary policy

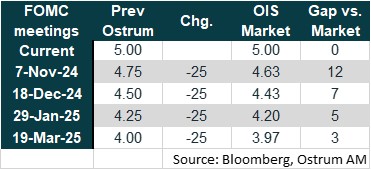

- THE FED HAS STARTED ITS INTEREST RATE CUT CYCLE STRONGLY

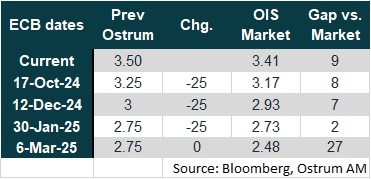

On September 18th, the Fed implemented its first interest rate cut since March 2020, reducing rates by 50 basis points to bring the federal funds rate range to [4.75%-5.00%]. This "recalibration" to make monetary policy less restrictive is motivated by significant progress in inflation amidst a slowing job market. With reassurance on inflation, the Fed is focusing on its second mandate: achieving maximum employment and avoiding a significant slowdown in employment. The members of the monetary policy committee anticipate an average of 50 basis points of rate cuts by the end of the year and 100 basis points in 2025. Additionally, the central bank has been making its monetary policy more accommodative since June through the reduction in the rate of contraction of the size of its balance sheet. We anticipate a rate cut of 25 basis points in November, followed by a second one in December. - GRADUAL DECREASE IN ECB INTEREST RATES

The ECB carried out its second interest rate cut since June on September 12th. The deposit rate was reduced to 3.50% (-25 basis points) and the corridor between the deposit rate and the refinancing rate was reduced to 15 basis points, as announced in March. Since that meeting, ECB members have hinted at a further rate cut as early as the October meeting. The lower-than-expected inflation in September and the delayed positive impact of purchasing power gains on consumption make them more confident in achieving the medium-term inflation target of 2%. We anticipate a rate cut of 25 basis points in October, followed by another in December. Meanwhile, the central bank continues to reduce the size of its balance sheet through repayments of TLTRO, the end of reinvestments from the APP, and partial reinvestment of PEPP redemptions (at an average monthly pace of 7.5 billion euros) to conclude by the end of 2024.

Market views

Asset classes

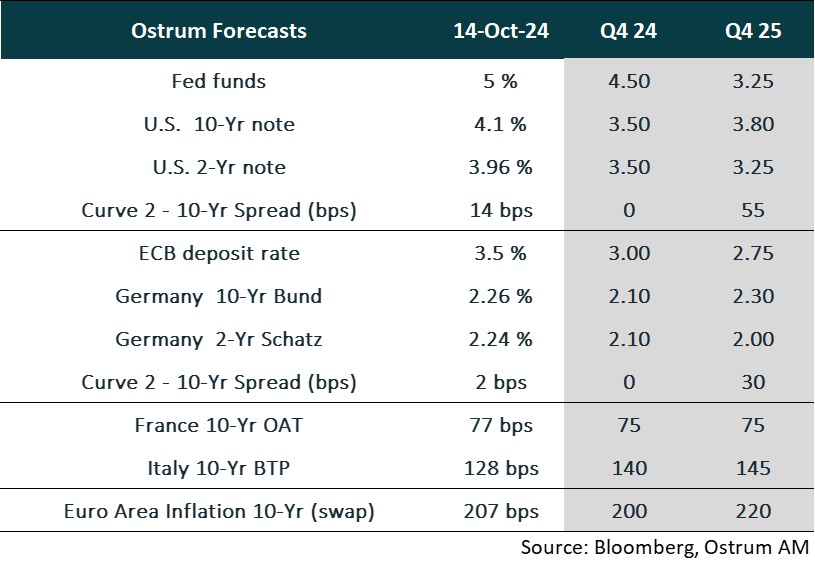

- U.S. Rates: The Federal Reserve has expedited its timeline for rate cuts, aiming to swiftly bring its rate closer to neutral. The 10-year Treasury yield is expected to converge around 3.50% before experiencing a slight uptick in 2025.

- European Rates: The German Bund is projected to follow the U.S. Treasury note, reaching approximately 2.10% by year-end. The steepening of the yield curve is likely to continue.

- Sovereign Spreads: Fiscal policy uncertainties will keep spreads elevated in France and, to a lesser extent, Italy.

- Eurozone Inflation: Breakeven inflation rates remain largely stable, in line with the European Central Bank's target. However, a widening of these rates is anticipated amidst a backdrop of a steepening yield curve.

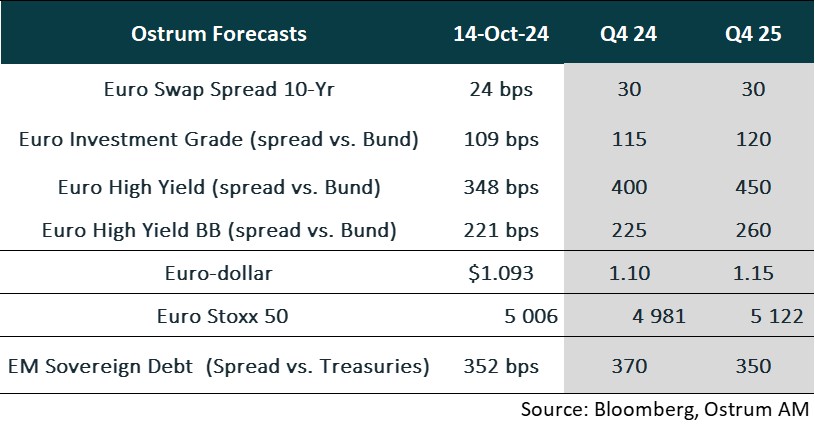

- Euro Credit: Spreads are expected to remain stable around 115 basis points over the Bund. High-yield valuations appear more stretched, with spreads likely to widen, particularly for ratings of B and below.

- Currency: The euro is benefiting from the Fed's rate cuts but is expected to remain stable about $1.10 through year-end before trending towards $1.15 by 2025.

- Equities: Modest sales growth is offset by high margins and rising multiples. An uptick in revenue growth is anticipated to enable the Euro Stoxx 50 index to resume its upward trajectory by 2025.

- Emerging Market Debt: Spreads have tightened quite rapidly so that some profit taking is likely in the short term. Spread narrowing should resume in 2025.