Coming on the heels of 2023, a year that turned out favourable for the financial markets despite a disruptive international environment, 2024 promises to usher in a new era, according to the experts at Ostrum Asset Management (Ostrum AM), an affiliate of Natixis Investment Managers. Investors will thus have to adapt to a new market configuration, one where the lenders have the power, with interest rates set to remain above 2% for a prolonged period.

2024 is shaping up to be a year filled with investment opportunities, served by active management of risks that should in principle be contained but are nevertheless on the rise: duration risks, credit risks and volatility risks, not to mention risks associated with climate change.

In today’s polarised world, where inflation, monetary policies and sovereign ratings all have yet to be stabilised, the experts at Ostrum AM see opportunities arising in 2024.

FIXED INCOME: yields are expected to change course, the short end of the curve to outperform and swap spreads to continue normalising for interest rates.

CREDIT: 10-year high in yields for Investment Grade and High Yield credit, on both sides of the Atlantic, and attractive returns starting with the short-term segment.

EQUITIES: profits expected to dip in Europe during the first half, but also an opportunity to get back into the European equity market amid low valuations. Internationally, extreme valuation gaps are expected to normalise.

MARKETS – a global economy running at three different speeds and risks associated with public finances

According to Axel Botte, Head of Market Strategy, the global economic situation will stay mixed, with the global economy running at three different speeds.

Growth in the United States

Economic activity has proved resilient in the US, fuelled by solid consumer spending and an expansionist monetary policy which offset the Fed’s monetary tightening moves. Job creations have slowed, but the labour market is still in a good place. The US should see growth of around 2% in 2024.

Stagnation in the Eurozone

Meanwhile, the eurozone economy is stagnating, hindered by a lack of consumer spending despite disinflation. Inflation should continue to gradually slow in 2024. Interest rate hikes are significantly slowing credit demand and growth in the eurozone. The decrease in the household savings rate should nevertheless boost it back to its potential by the end of next year. The Eurozone should post average annual growth of 0.5% in 2024, with inflation gradually returning to around 2.5% by year-end.

Structural obstacles in China

China’s growth is still hampered by US sanctions, which have reduced foreign investments and tech transfers, the real estate market and the need to restructure local government debt. Even so, we see an improvement in household consumption on the horizon, which will mitigate the scope of the structural slowdown in China.

Source: Ostrum AM, October 2023

Disinflation dependent on reduced margins

Disinflation is in progress in the Eurozone, but getting back to the 2% target is not a given. Inflation slowed to 2.9% in October versus 4.2% in September, thanks to the energy sector. Core inflation is still high at 4.2%, however, as opposed to 4.5%. According to the ECB, half of the observed acceleration in inflation can be attributed to the improvement in profit margins, especially in the service industry. Wage hikes are likely incompatible with reduced inflation in service prices or a rapid return to the 2% target.

Prices of goods have normalised in the US, however, and becoming moderate in the Eurozone. Meanwhile, China is exporting a little deflation on goods.

Source: Ostrum AM, October 2023

Monetary easing: watch out for market impatience

After 10 consecutive rate hikes (+450 bp overall) aimed at driving the deposit rate to a record high of 4%, the ECB left its rates unchanged on 26 October. Christine Lagarde reiterated that rates need to be kept at this restrictive level for some time in order to combat inflation, expected to stay “too high for too long”.

The market does not believe status quo will be maintained in the first half; hence the upward pressure on bond yields. Rather, the markets see rates declining as from Q2 for both the Fed (US central bank) and the ECB (European Central Bank). As for Ostrum AM, we are not expecting any change before Q2 2024 and are betting on two 25-bp rate cuts in the third and fourth quarters.

Source: Ostrum AM, October 2023

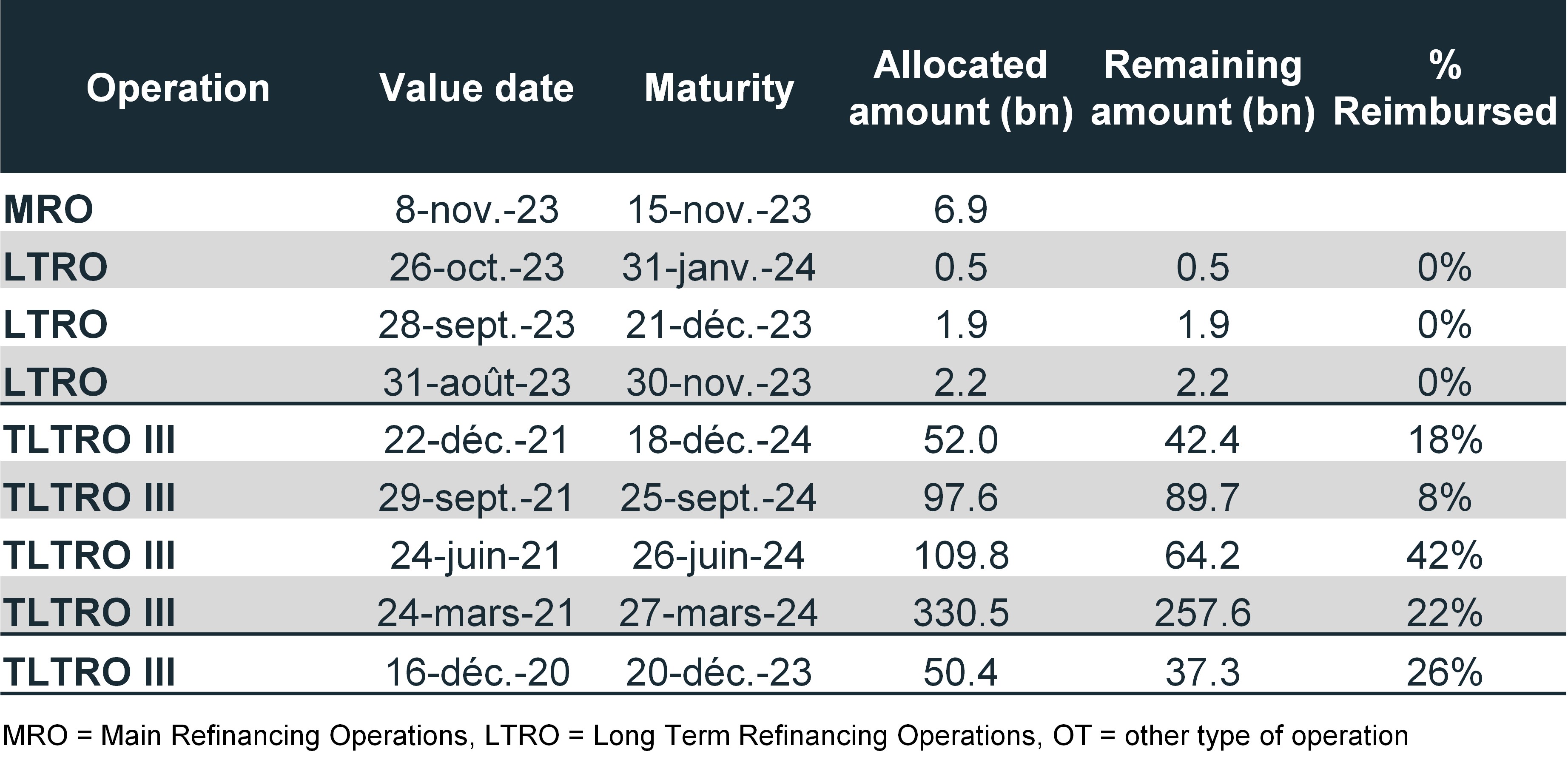

Monetary policy will grow more restrictive through a balance sheet reduction of roughly €850bn in 2024, TLTRO repayments (€500bn) and APP1 instruments (€350bn).

Source: Ostrum AM, BCE, October 2023

The ECB wants to keep the flexibility offered by the PEPP1, with reinvestments to be continued over the course of 2024. The decrease in the liquidity surplus is conducive to higher money market rates, which should approach the level of the deposit rate. The amortisation of the APP1 generates the need for additional financing for borrowers and reconstitutes a bond term premium.

Source: Ostrum AM, BCE, October 2023

Meanwhile, the Fed needs to revisit the idea of interest rate neutrality in 2024. The “neutral” rate will be higher.

Inflation has fallen, but there are risks of seeing it climb again associated with the real estate market. Ultimately, a less cooperative world is taking shape, one with higher inflation. The 2.5% target level will be up for discussion in 2024, limiting the easing of the Fed Funds rate to 50 bp in 2024. The Fed wants to avoid making cuts too early, due to the persistent risks surrounding price stability.

Public finances: a major source of financial risks

Weak growth in Europe, coupled with the massive use of fiscal stimulus in the US, once again raise the question of the sustainability of public debt. Sovereign ratings are under pressure. The US had its rating downgraded first by Fitch (AA+), then by Moody’s (long-term outlook). The federal deficit is sitting at 7% of GDP. Ratings for France (AA) and Italy (BBB-) may be called into question as deficit limits are reintroduced for the eurozone in 2024. This promises to be a key issue during the European elections.

Source: Ostrum AM, Bloomberg, October 2023

1 TLTRO: Targeted longer-term refinancing operations. APP: Asset Purchase Programme. PEPP: Pandemic Emergency Purchase Programme.

FIXED INCOME – A record year for sovereign issues on the horizon

Alexandre Caminade, Head of Core and Liquid Alternative Fixed Income Strategies, stressed that the bond markets delivered a positive performance in 2023, both in terms of sovereigns as well as inflation and aggregates, while nevertheless hovering at below-money market levels.

Source : Ostrum AM, Bloomberg, 07.11.2023

Yields expected to change course

We see a potential for yields to fall in 2024. The 5% levels already observed on the US 10-year (and 3% on the Bund) should not be exceeded. Gradual disinflation and the monetary tightening effect should keep inflation expectations contained.

Source : Ostrum AM, Bloomberg, 07.11.2023

A record year for sovereign issues and normalisation of yield curves

For 2024, the markets will have to deal with an unprecedented rise in net bond issues.

On a global scale, the lion’s share of the increase in net issues in 2024 will come from US treasuries. The US Treasury Department must not only finance a federal deficit to the tune of $1,800 billion while extending its debt, but also convince private-sector investors to take up the baton for the Fed.

Source: Citi.

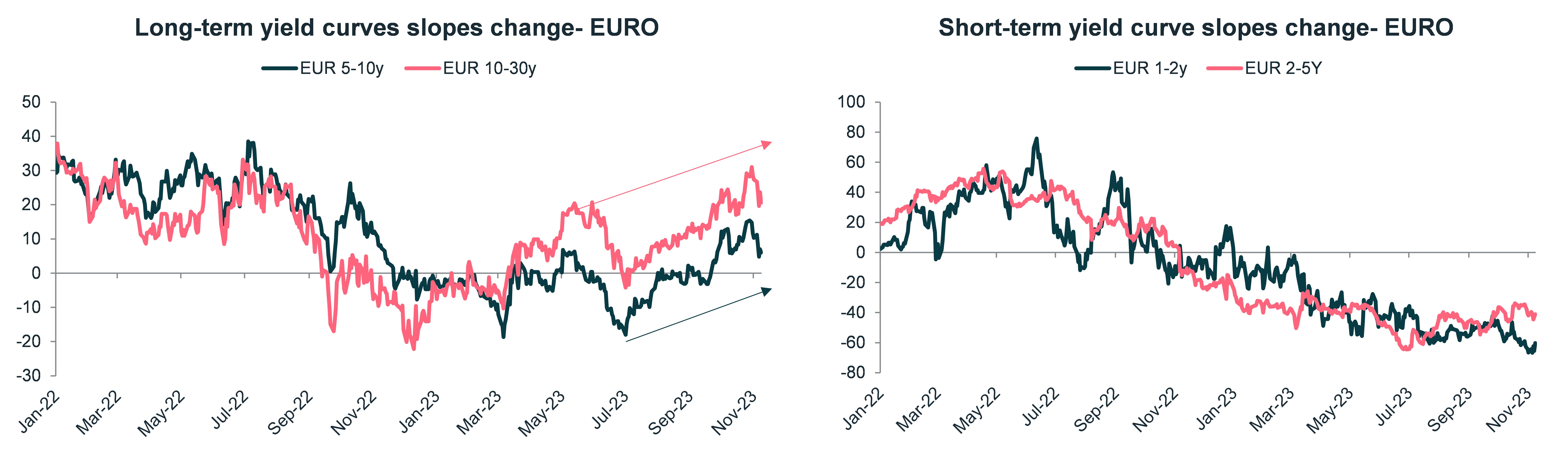

In the US, increased borrowings combined with the easing of Fed rates will likely cause the yield curve to steepen. We have already witnessed the substantial reconstitution of the term premium since the month of September. The long end of the curve should continue to be the most volatile in the first half of the year, followed by a steepening trend at the short end as we get closer to the Fed’s first rate cuts.

Source : Ostrum AM, Bloomberg, 07.11.2023

The increase in net sovereign issues is less pronounced in the eurozone. After 2023’s Public Sector Purchase Programme (PSPP), the question of not reinvesting the Pandemic Emergency Purchase Programme (PEPP) may be raised. In that case, government net funding requirements adjusted for quantitative tightening (QT) should climb by an additional €15bn to €18bn per month. Despite the weight of investment flows, 10-year returns are not expected to top 5% for the T-Note or 3% for the Bund. Inflation expectations appear to be rooted in the disinflation in progress and the past effect of monetary tightening.

Source : Ostrum AM, Bloomberg, Citi, 07.11.2023

The Eurozone curve should be slower to normalise. This is because it is less volatile, with the ECB less inclined to aggressively lower its rates, plus the amount of issues is relatively stable. The long end of the curve is set to remain under pressure due to issues being concentrated in the first half of the year and uncertainty surrounding the quantitative tightening (QT) of the PEPP. The short end should subsequently ease with the prospect of initial ECB rate cuts, but to a lesser extent compared to the US curve.

Source : Ostrum AM, Bloomberg, 07.11.2023

Sovereign spreads expected to rise slightly and swap spreads to normalise

Sovereign spreads should end up increasing somewhat. Italy is in the most fragile position, but other countries (including France) are facing fiscal struggles. Use of household savings protected the Italian BTP in 2023, but the acceleration of quantitative tightening would be bad for the country’s debt.

The Greek spread should benefit from another ratings bump to Investment Grade (by Fitch) after the one decided by S&P.

Source : Ostrum AM, Bloomberg, 07.11.2023

The recent tightening of swap spreads should continue, albeit at a slower pace. The unusually high level of swap spreads can be chalked up to demand for risk protection by banks, high volatility and the scarcity of the Bund on the repo market. These factors should diminish significantly in 2024.

Source : Ostrum AM, Bloomberg, 07.11.2023

CREDIT – 2023: a remarkable year. 2024? Repeat performance!

According to Philippe Berthelot, Head of Credit and Money Market Strategies, 2024 should be another satisfactory year in terms of performances for bond assets, including credit.

Ostrum AM is leaning towards a soft landing for its central scenario, with a 0.5% GDP increase in 2024. Though admittedly low, it still means growth, while inflation is also expected to steadily decrease in the Eurozone.

So where can value be found on the credit market in 2024? Credit should keep 2023 momentum going next year. It remains both attractive and profitable: over 4.3% for EUR-denominated Investment Grade credit and over 7.5% for EUR-denominated High Yield credit.

Credit indicators in green territory

Credit indicators are in green territory, with positive returns, as indicated in the right-hand column of the table. Performance has been robust year-to-date for most bond assets.

Yield on IG and HY credit the highest it’s been in a decade

Investment Grade and High Yield credit bonds offer the highest yield for more than 10 years now, driven by an acceptable level of leverage - though slightly on the rise - and a default rate contained at 3.5%, below its historic 20-year average.

Returns are attractive starting at the short end, given that the credit curve is virtually flat, thus delivering attractive returns from the 1-3 year segment onward. 2024 will be a time for getting back into longer-dated segments, however, in order to take advantage of expected rate cuts.

Returns are attractive starting at the short end, given that the credit curve is virtually flat, thus delivering attractive returns from the 1-3 year segment onward. 2024 will be a time for getting back into longer-dated segments, however, in order to take advantage of expected rate cuts.

Default rates up slightly but expected to remain below their historic average

In credit, we see default rates climbing slightly, starting from near-zero levels, but remaining below their historic 20-year average.

Ostrum AM’s predicted default rate of 3.5% for 2024 confirms the scenario of a weak recession. It is vital to keep track of the default rate as one of the variables that underpins spread levels over the medium/long term. Ostrum AM employs a proprietary top down forecasting model developed by our strategists. Our team of credit analysts also uses a bottom up approach covering an investment universe of some 400 European and UK High Yield issuers (excluding financial companies). For now, this analysis has identified a fairly limited number of issuers (14) liable to default.

Sector views

Based on our prediction of a limited increase in ECB key rates - 50 bp in H2 2024 - and a reduction in swap spreads, we have a positive view of the banking sector. We include the Tier 2 (possibly AT1 as well) subordinated debt segment, which has confirmed its appeal with the impressive success of recent primary market issues.

In corporate bonds, we like the High Beta segment. The vast majority of corporate hybrids have been called by their issuers, meaning very little extension risk has materialised.

We believe High Yield is set to outperform for the third year in a row, but are remaining vigilant nonetheless due to the higher number of distressed issuers. The research conducted by our team of 23 credit analysts is critical to ensuring issuer selection.

Finally, the durable bond market is still going strong in Europe. Green bonds make up 21% of EUR-denominated IG issues and 13% of EUR-denominated HY issues on the primary market. The “greenium” (premium earned on a sustainable bond versus a conventional bond with the same maturity), which previously sat at 5 bp in the EUR-denominated Investment Grade segment, has dwindled to near-zero. It is worth noting that US issues are in free fall (-55%).

In order to manage risks appropriately, good sector diversification is key, as is being highly selective when it comes to issuers given the expanding number of “credit traps”.

EUROPEAN EQUITIES – An opportunity to return to the market in H1

According to Frédéric Leguay, Head of Insurance Equity Strategies, after the recent 6% increase, the European equity markets turned in a double-digit performance in 2023 and offer little upside potential in 2024. European markets are expected to hit a low point in Q2 as the earnings revision process draws to an end. Volatility should end up climbing over the period.

Profits poised to slide in H1, presenting an opportunity to return to the market

Thus far, 2023 has ultimately proved to be a relatively normal year for the equity markets in Europe, with a performance in line with the last 30 years.

That said, there were some surprises in store. We are currently experiencing the worst crisis in the manufacturing sector after those of the Technologies - Media - Telecommunications (TMT) sector, the 2008 crisis and COVID... and yet, stocks sensitive to the economic cycle have outperformed. Of all the sectors in Europe this year, Technology has seen the strongest downward revisions of its projected earnings for 2024, and even so it has considerably outperformed the market.

Source: Ostrum AM, Bloomberg, Morgan Stanley, IBES, Octobre 2023. (*) cyclical stocks defined as belonging to the consumer discretionary, industrial, technology and basic industries sectors. Defensive stocks defined as consumer staples, healthcare, telecommunication services utilities.

In 2024, global GDP growth will continue to slow, particularly in nominal terms, and the likely inversion of restrictive monetary policies will have very little impact. Corporate earnings, already on the decline in 2023, may prove disappointing compared to expectations which we estimate to be about 10% too high, even with inflation still supporting revenue.

This pressure on earnings is not going anywhere, in spite of growing revenues, lower interest rates and a stable dollar. Against this backdrop, the profitability of cyclical, industrial and consumer stocks is the most vulnerable in the short term.

Source: Ostrum AM, Bloomberg, Morgan Stanley, IBES, October 2023

How do valuations look for the European equity markets?

Valuations in Europe have been hurt by the rise in real rates and could grow more expensive as they ease in the second half of 2024.

Though moderate, this valuation level reflects the natural cyclical sensitivity of the market and high margin levels. Although real rates are already expected to ease slightly, we think the valuation is reasonable and could prove attractive for investors capable of expanding their investment horizon. Corrected for the cycle, it offers a high probability of positive returns over three years.

Source: Ostrum AM, Bloomberg, Morgan Stanley, IBES, October 2023

We see the European markets improving slightly in 2024 (performance calculated with dividends reinvested). Our central scenario calls for slight pressure on margins (60 bp) offset by an increase in the multiple to around 13x.

Source: Ostrum AM, Bloomberg, Morgan Stanley, IBES, October 2023

Source: Ostrum AM, Bloomberg, Morgan Stanley, IBES, October 2023

Where can we find value in European equities next year?

In early 2024, we will focus on limited cyclicality to avoid taking too hard a hit from the slowdown in progress. Sectors offering good visibility (healthcare, telephones, current consumption, IT services) should fare better. Staring in Q2, we see investors returning to growth sectors and certain more cycle-sensitive stocks. As for 2023, we do not think investment themes will play a crucial role in the performance of European equity markets..

Source: Ostrum AM, Bloomberg, Morgan Stanley, IBES, October 2023

INTERNATIONAL EQUITIES – Extreme valuation gaps expected to normalise

According to Emmanuel Bourdeix, Head of Quant Strategies, growth on the international equity markets in 2023 has largely been attributable to an expansion of valuation multiples, reflecting a sharp drop in rates.

This trend happened despite persistently high rates, constituting a genuine behavioural shift compared to the correlation that has dominated in recent years, and particularly in 2022 (right-hand chart).

The expansion of valuation multiples has predominantly been seen in the more speculative sectors (semi-conductors, auto, hardware, software), with a record peak in sector concentration in the equity universe.

In terms of contribution to performance, the impact of expanding valuations in the most volatile sector as opposed to less volatile sectors is comparable to the impacts observed before the TMT (Technologies - Media - Telecommunications) bubble burst and the Major Financial Crisis (2008).

This peak of concentration in the markets is linked to a new phase of outperformance in the Cyclical/Growth allocation. After this phase, projected 5-year growth rates for the cyclical/growth and high beta segments are 3 to 5 times higher than their average since 2009, relative to the rest of the market.

Accordingly, in light of the economic downturn, we believe these historic valuation and implicit growth gaps in favour of a single sub-segment of the market will call for attentive risk management in 2024, while providing investors with opportunities liable to stem not only from the Value style catching up significantly, but also – and more importantly – from defensive sectors. Moreover, defensive sectors should be able to better absorb a potential increase in volatility during the year.

Additional notes

Ostrum Asset Management

Asset management company regulated by AMF under n° GP-18000014 – Limited company with a share capital of 50 938 997 €. Trade register n°525 192 753 Paris – VAT: FR 93 525 192 753 – Registered Office: 43, avenue Pierre Mendès-France, 75013 Paris – www.ostrum.com

This document is intended for professional investors, in accordance with MIFID. It may not be used for any purpose other than that for which it was conceived and may not be copied, distributed or communicated to third parties, in part or in whole, without the prior written authorization of Ostrum Asset Management.

None of the information contained in this document should be interpreted as having any contractual value. This document is produced purely for the purposes of providing indicative information. This document consists of a presentation created and prepared by Ostrum Asset Management based on sources it considers to be reliable.

Ostrum Asset Management reserves the right to modify the information presented in this document at any time without notice, which under no circumstances constitutes a commitment from Ostrum Asset Management.

The analyses and opinions referenced herein represent the subjective views of the author(s) as referenced, are as of the date shown and are subject to change without prior notice. There can be no assurance that developments will transpire as may be forecasted in this material. This simulation was carried out for indicative purposes, on the basis of hypothetical investments, and does not constitute a contractual agreement from the part of Ostrum Asset Management.

Ostrum Asset Management will not be held responsible for any decision taken or not taken on the basis of the information contained in this document, nor in the use that a third party might make of the information. Figures mentioned refer to previous years. Past performance does not guarantee future results. Any reference to a ranking, a rating, a label or an award provides no guarantee for future performance and is not constant over time.

Under Ostrum Asset Management’s social responsibility policy, and in accordance with the treaties signed by the French government, the funds directly managed by Ostrum Asset Management do not invest in any company that manufactures, sells, or stocks anti-personnel mines and cluster bombs.

Natixis Investment Managers

This material has been provided for information purposes only to investment service providers or other Professional Clients, Qualified or Institutional Investors and, when required by local regulation, only at their written request. This material must not be used with Retail Investors.

To obtain a summary of investor rights in the official language of your jurisdiction, please consult the legal documentation section of the website (im.natixis.com/intl/intl-fund-documents)

In the E.U.: Provided by Natixis Investment Managers International or one of its branch offices listed below. Natixis Investment Managers International is a portfolio management company authorized by the Autorité des Marchés Financiers (French Financial Markets Authority - AMF) under no. GP 90-009, and a public limited company (société anonyme) registered in the Paris Trade and Companies Register under no. 329 450 738. Registered office: 43 avenue Pierre Mendès France, 75013 Paris. Germany: Natixis Investment Managers International, Zweigniederlassung Deutschland (Registration number: HRB 129507): Senckenberganlage 21, 60325 Frankfurt am Main.

Italy: Natixis Investment Managers International Succursale Italiana, Registered office: Via San Clemente 1, 20122 Milan, Italy. Netherlands: Natixis Investment Managers International, Nederlands (Registration number 000050438298). Registered office: Stadsplateau 7, 3521AZ Utrecht, the Netherlands.

Spain: Natixis Investment Managers International S.A., Sucursal en España, Serrano n°90, 6th Floor, 28006 Madrid, Spain. Sweden: Natixis Investment Managers International, Nordics Filial (Registration number 516412-8372- Swedish Companies Registration Office). Registered office: Covendrum Stockholm City AB, Kungsgatan 9, 111 43 Stockholm, Box 2376, 103 18 Stockholm, Sweden. Or,

Provided by Natixis Investment Managers S.A. or one of its branch offices listed below. Natixis Investment Managers S.A. is a Luxembourg management company that is authorized by the Commission de Surveillance du Secteur Financier and is incorporated under Luxembourg laws and registered under n. B 115843. Registered office of Natixis Investment Managers S.A.: 2, rue Jean Monnet, L-2180 Luxembourg, Grand Duchy of Luxembourg.

Belgium: Natixis Investment Managers S.A., Belgian Branch, Gare Maritime, Rue Picard 7, Bte 100, 1000 Bruxelles, Belgium.

In Switzerland: Provided for information purposes only by Natixis Investment Managers, Switzerland Sàrl, Rue du Vieux Collège 10, 1204 Geneva, Switzerland or its representative office in Zurich, Schweizergasse 6, 8001 Zürich.

In the British Isles: Provided by Natixis Investment Managers UK Limited which is authorised and regulated by the UK Financial Conduct Authority (register no. 190258) - registered office: Natixis Investment Managers UK Limited, One Carter Lane, London, EC4V 5ER. When permitted, the distribution of this material is intended to be made to persons as described as follows: in the United Kingdom: this material is intended to be communicated to and/or directed at investment professionals and professional investors only; in Ireland: this material is intended to be communicated to and/or directed at professional investors only; in Guernsey: this material is intended to be communicated to and/or directed at only financial services providers which hold a license from the Guernsey Financial Services Commission; in Jersey: this material is intended to be communicated to and/or directed at professional investors only; in the Isle of Man: this material is intended to be communicated to and/or directed at only financial services providers which hold a license from the Isle of Man Financial Services Authority or insurers authorised under section 8 of the Insurance Act 2008.

In the DIFC: Provided in and from the DIFC financial district by Natixis Investment Managers Middle East (DIFC Branch) which is regulated by the DFSA. Related financial products or services are only available to persons who have sufficient financial experience and understanding to participate in financial markets within the DIFC, and qualify as Professional Clients or Market Counterparties as defined by the DFSA. No other Person should act upon this material. Registered office: Unit L10-02, Level 10 ,ICD Brookfield Place, DIFC, PO Box 506752, Dubai, United Arab Emirates

In Japan: Provided by Natixis Investment Managers Japan Co., Ltd. Registration No.: Director-General of the Kanto Local Financial Bureau (kinsho) No.425. Content of Business: The Company conducts investment management business, investment advisory and agency business and Type II Financial Instruments Business as a Financial Instruments Business Operator.

In Taiwan: Provided by Natixis Investment Managers Securities Investment Consulting (Taipei) Co., Ltd., a Securities Investment Consulting Enterprise regulated by the Financial Supervisory Commission of the R.O.C. Registered address: 34F., No. 68, Sec. 5, Zhongxiao East Road, Xinyi Dist., Taipei City 11065, Taiwan (R.O.C.), license number 2020 FSC SICE No. 025, Tel. +886 2 8789 2788.

In Singapore: Provided by Natixis Investment Managers Singapore Limited (NIM Singapore) having office at 5 Shenton Way, #22-05/06, UIC Building, Singapore 068808 (Company Registration No. 199801044D) to distributors and qualified investors for information purpose only. NIM Singapore is regulated by the Monetary Authority of Singapore under a Capital Markets Services Licence to conduct fund management activities and is an exempt financial adviser. Mirova Division (Business Name Registration No.: 53431077W) and Ostrum Division (Business Name Registration No.: 53463468X) are part of NIM Singapore and are not separate legal entities. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

In Hong Kong: Provided by Natixis Investment Managers Hong Kong Limited to professional investors for information purpose only.

In Australia: Provided by Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) and is intended for the general information of financial advisers and wholesale clients only .

In New Zealand: This document is intended for the general information of New Zealand wholesale investors only and does not constitute financial advice. This is not a regulated offer for the purposes of the Financial Markets Conduct Act 2013 (FMCA) and is only available to New Zealand investors who have certified that they meet the requirements in the FMCA for wholesale investors. Natixis Investment Managers Australia Pty Limited is not a registered financial service provider in New Zealand.

In Colombia: Provided by Natixis Investment Managers International Oficina de Representación (Colombia) to professional clients for informational purposes only as permitted under Decree 2555 of 2010. Any products, services or investments referred to herein are rendered exclusively outside of Colombia. This material does not constitute a public offering in Colombia and is addressed to less than 100 specifically identified investors.

In Latin America: Provided by Natixis Investment Managers International.

In Uruguay: Provided by Natixis Investment Managers Uruguay S.A., a duly registered investment advisor, authorised and supervised by the Central Bank of Uruguay. Office: San Lucar 1491, Montevideo, Uruguay, CP 11500. The sale or offer of any units of a fund qualifies as a private placement pursuant to section 2 of Uruguayan law 18,627.

In Mexico: Provided by Natixis IM Mexico, S. de R.L. de C.V., which is not a regulated financial entity, securities intermediary, or an investment manager in terms of the Mexican Securities Market Law (Ley del Mercado de Valores) and is not registered with the Comisión Nacional Bancaria y de Valores (CNBV) or any other Mexican authority. Any products, services or investments referred to herein that require authorization or license are rendered exclusively outside of Mexico. While shares of certain ETFs may be listed in the Sistema Internacional de Cotizaciones (SIC), such listing does not represent a public offering of securities in Mexico, and therefore the accuracy of this information has not been confirmed by the CNBV. Natixis Investment Managers is an entity organized under the laws of France and is not authorized by or registered with the CNBV or any other Mexican authority. Any reference contained herein to “Investment Managers” is made to Natixis Investment Managers and/or any of its investment management subsidiaries, which are also not authorized by or registered with the CNBV or any other Mexican authority.

In Brazil: Provided to a specific identified investment professional for information purposes only by Natixis Investment Managers International. This communication cannot be distributed other than to the identified addressee. Further, this communication should not be construed as a public offer of any securities or any related financial instruments. Natixis Investment Managers International is a portfolio management company authorized by the Autorité des Marchés Financiers (French Financial Markets Authority - AMF) under no. GP 90-009, and a public limited company (société anonyme) registered in the Paris Trade and Companies Register under no. 329 450 738. Registered office: 43 avenue Pierre Mendès France, 75013 Paris.

The above referenced entities are business development units of Natixis Investment Managers, the holding company of a diverse line-up of specialised investment management and distribution entities worldwide. The investment management subsidiaries of Natixis Investment Managers conduct any regulated activities only in and from the jurisdictions in which they are licensed or authorized. Their services and the products they manage are not available to all investors in all jurisdictions. It is the responsibility of each investment service provider to ensure that the offering or sale of fund shares or third party investment services to its clients complies with the relevant national law.

The provision of this material and/or reference to specific securities, sectors, or markets within this material does not constitute investment advice, or a recommendation or an offer to buy or to sell any security, or an offer of any regulated financial activity. Investors should consider the investment objectives, risks and expenses of any investment carefully before investing. The analyses, opinions, and certain of the investment themes and processes referenced herein represent the views of the portfolio manager(s) as of the date indicated. These, as well as the portfolio holdings and characteristics shown, are subject to change. There can be no assurance that developments will transpire as may be forecasted in this material. The analyses and opinions expressed by external third parties are independent and does not necessarily reflect those of Natixis Investment Managers. Past performance information presented is not indicative of future performance.

Although Natixis Investment Managers believes the information provided in this material to be reliable, including that from third party sources, it does not guarantee the accuracy, adequacy, or completeness of such information. This material may not be distributed, published, or reproduced, in whole or in part.

All amounts shown are expressed in USD unless otherwise indicated.

Natixis Investment Managers may decide to terminate its marketing arrangements for this product in accordance with the relevant legislation.