Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Axel Botte’s and Zouhoure Bousbih’s podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Trade War 2.0: China is Ready for Divorce with the United States

- China’s dependence on foreign trade and the United States has significantly decreased following the trade war 1.0;

- China has diversified its trading partners and massively increased its outbound direct investments, making it less vulnerable to the additional 10% U.S. tariffs;

- Chinese companies have compensated for the loss of American demand by increasing their investments abroad to be closer to their end markets;

- China’s retaliatory measures adopt a multidimensional approach beyond tariffs and are creating leverage for a broader deal;

- The yuan is no longer a weapon to counter U.S. tariffs.

Market review: Trump-proof markets

- U.S. job growth solid despite downward employment revisions to 2024 data;

- The Fed sees neutral rates between 1.75-2.25% range;

- Lower bond yields, flatter curves and widespread narrowing in spreads;

- Equities keep trading higher with a rebound in China Tech stocks.

Axel Botte’s and Zouhoure Bousbih’s podcast

- Review of the week – Rise in U.S. swap spreads and gold prices;

- Theme – Trade War 2.0: China is preparing for a break with the United States.

Chart of the week

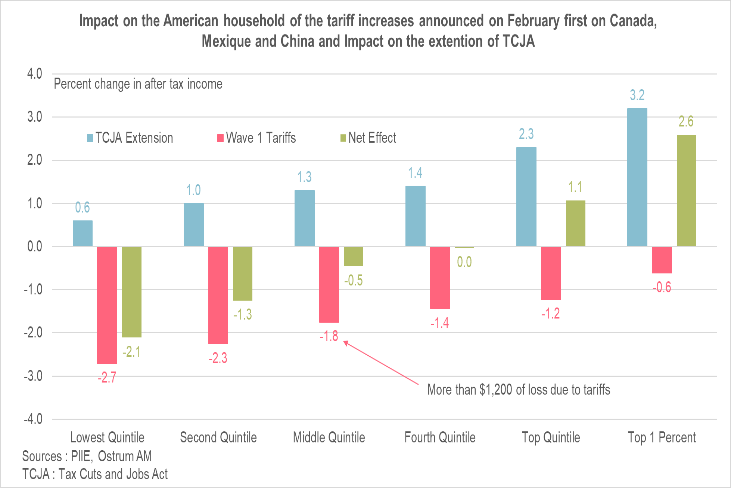

Contrary to what Donald Trump claims, raising tariffs will be negative for the American economy, particularly for households.

A study by the Peterson Institute for International Economics estimates the impact on income from a 25% increase in tariffs on Mexico and Canada (10% on energy products) and 10% on China. This translates to a loss of after-tax income of more than $1,200 for the median household over the course of a year. Households with the lowest incomes are the most affected.

Furthermore, the extension of the tax cuts desired by Trump (under the Tax Cuts and Jobs Act) will not compensate for the negative impact of tariffs for most households. The net effect will be negative, except for the wealthiest households.

Figure of the week

7

This is the number of members of the ECB's monetary policy council whose terms will expire at the end of the year. It is its largest personnel reshuffle since 2019.