Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to Axel Botte’s podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: U.S. equity markets: Deep concerns

- DeepSeek has launched two new AI open-source models which rival leading systems like GPT-4o while significantly reducing costs and resource consumption;

- Democratizing AI development for smaller companies and challenging the reliance on expensive GPUs is a net positive for the economy although incumbents will face uncertain returns on large amounts of AI investments;

- DeepSeek may only be the tip of the iceberg as China catches up with competitors on semiconductors and other advanced technologies;

- U.S. tech stocks initially sold off on the news, but recoup losses within days. The sharp market sell-off was unique as most stocks ended higher on Monday;

- The DeepSeek announcement is a wake-up call for markets and investors will have to rethink tech valuations and the U.S. growth exceptionalism theme. High leverage among equity investors would increase the downside risk to equity markets if investor sentiment worsens.

Market review: Market Shock and Subsequent Calm

- U.S. GDP grows by 2.3% in the fourth quarter, driven by consumer spending;

- The Fed keeps rates unchanged, while the ECB eases as expected;

- The Bund yields drop below 2.50%, with a broad tightening of spreads;

- Equities absorb the DeepSeek shock, with the EuroStoxx 50 rising by 8% in January.

Axel Botte’s podcast

- Review of the week – Markets absorb the DeepSeek shock with easing interest rates;

- Theme – Spotlight on DeepSeek and the U.S. equity market.

Chart of the week

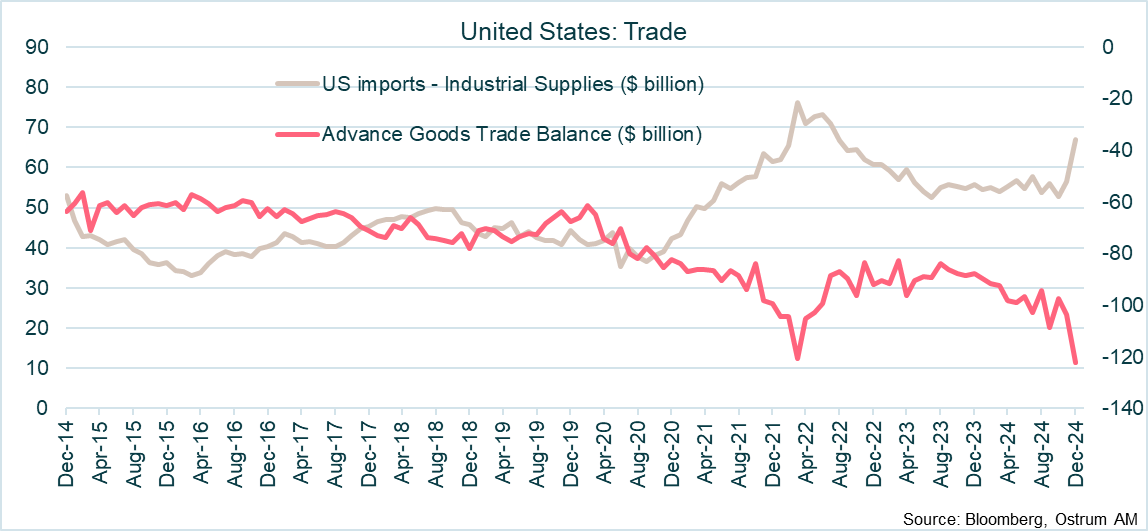

The tariff threat raised by Donald Trump has spurred a surge in import demand towards the end of last year. Companies, anticipating looming trade barriers, significantly ramped up their purchases of foreign intermediate goods.

This spike in imports has negatively impacted the U.S. goods trade balance, which hit a record deficit of $122 billion in December 2024.

Figure of the week

0%

The euro area economy stalled in the 4th quarter of 2024. In Germany and France, GDP contracted by 0.2% and 0.1% respectively whereas Spain maintained high growth at 0.8% in the three months to December.