Quarterly publication / April 2025

Analysis finalised on 18/04/2025 ; data as of 18/04/2024

Document for professional investors in accordance with MIF II.

MARKETS OVERVIEW

ON A KNIFE EDGE

The announcements regarding tariff rates continue to unfold, fueling considerable volatility across financial markets. These tariffs are bound to reduce global trade. The suspension of some tariffs for a 90-day period coincides with an increase of customs duties applicable to China, now at 145%, a fact largely overlooked by the markets in hopes of a favorable outcome in upcoming negotiations. Concurrently, the unpredictability of U.S. economic policy imposes a significant risk premium on dollar-denominated assets. Even Treasuries, recognized as the safest and most liquid asset globally, are not immune to this trend. A sharp rise in long-term rates has compelled Donald Trump to soften his rhetoric. Additionally, the U.S. staggering deficit, which stands at 8% of GDP, exacerbates the vulnerability of the T-note. In this environment, the leveraged loan market has been shut highlighting the risk of credit crunch, which would likely lead to a recession.

Against this backdrop, China is opting for dialogue with Europe and its regional partners rather than negotiations with Washington. Its response is expected to intensify through targeted import and export restrictions. Consequently, global growth will be significantly hampered.

Uncertainty reigns supreme in the financial markets. The emergence of American credit risk this year marks a pivotal shift, benefiting the Bund and the yen as they reclaim their status as safe havens. Central banks continue to pursue easing measures, as the risks to growth overshadow the inflationary impact of U.S. tariffs, especially with oil prices adjusting downwards by $10. Outflows from high-yield funds have brought valuations back around their five-year average. Equity valuation multiples are likely to face pressure amid heightened volatility and operational and margin risks induced by U.S. tariffs. The messages conveyed during quarterly earnings reports will carry particular significance.

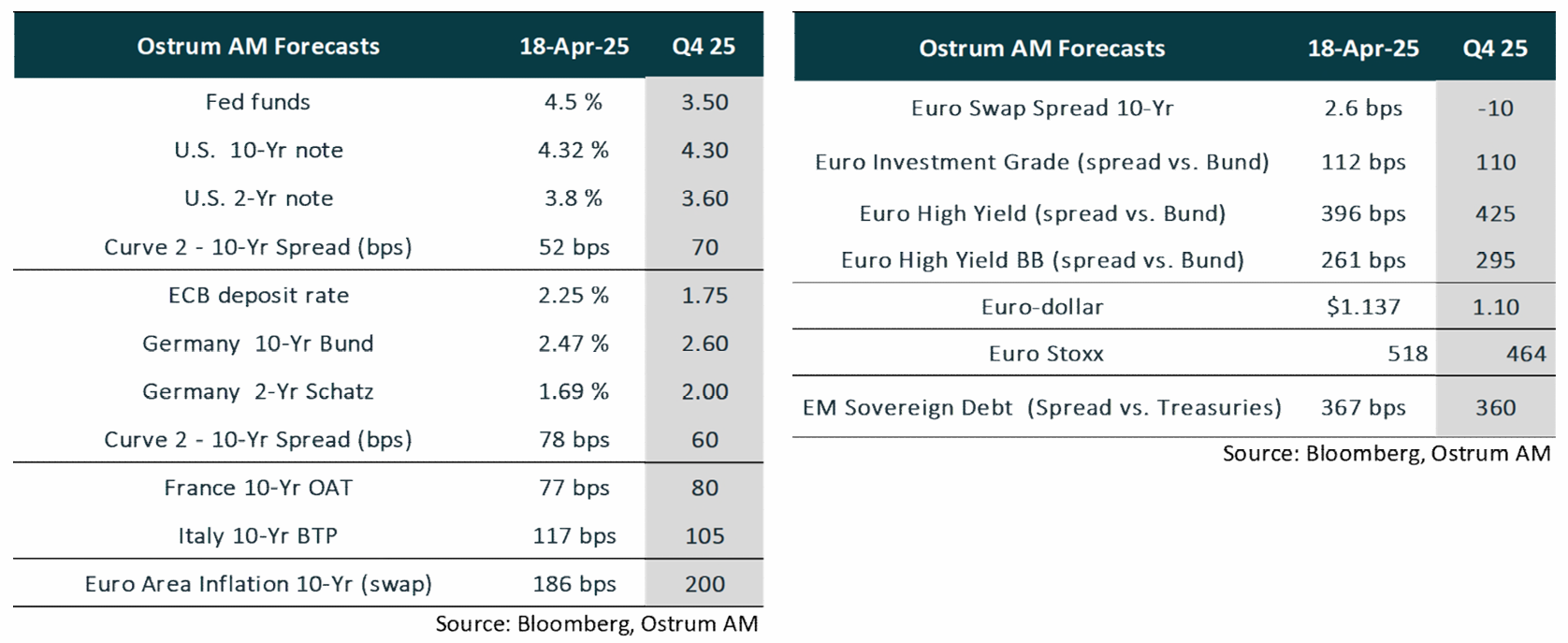

KEY INDICATORS

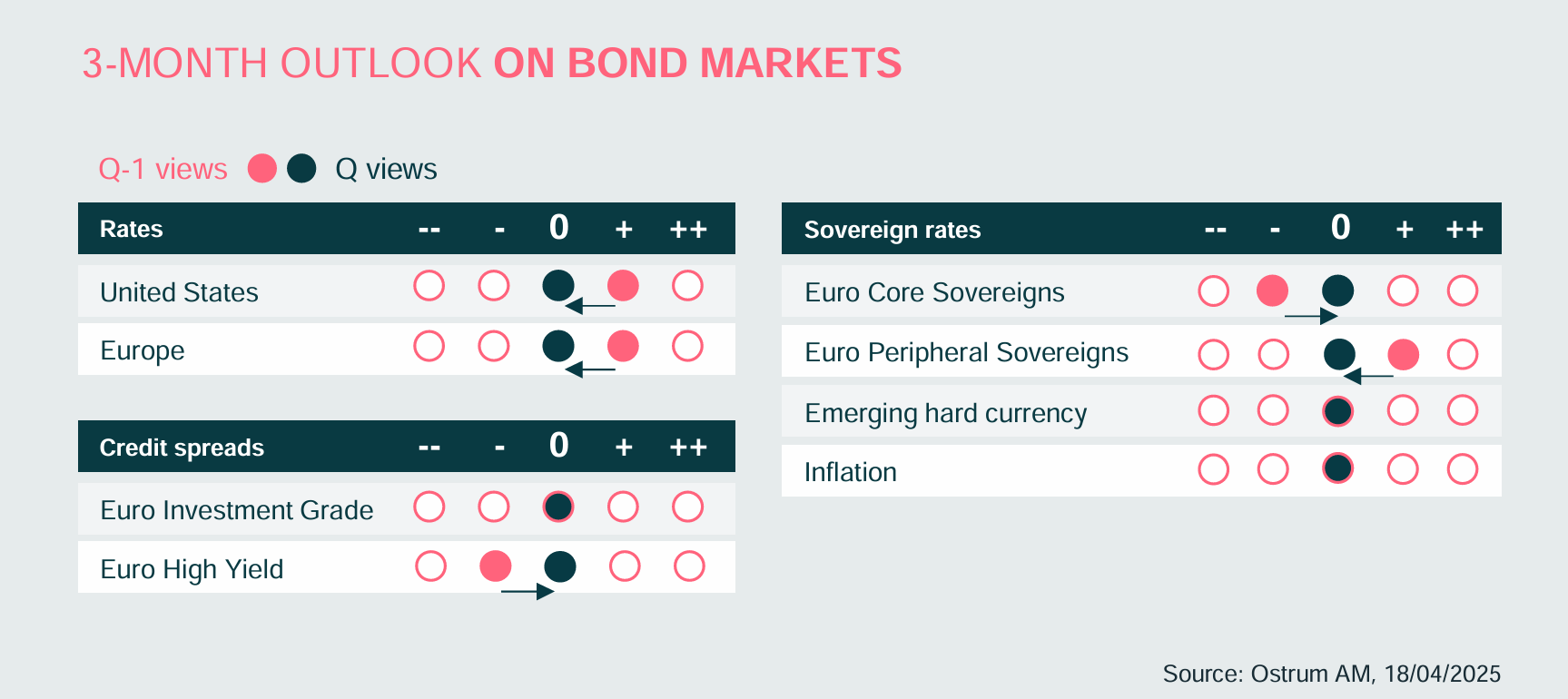

3 MONTH OUTLOOK ON BOND MARKETS

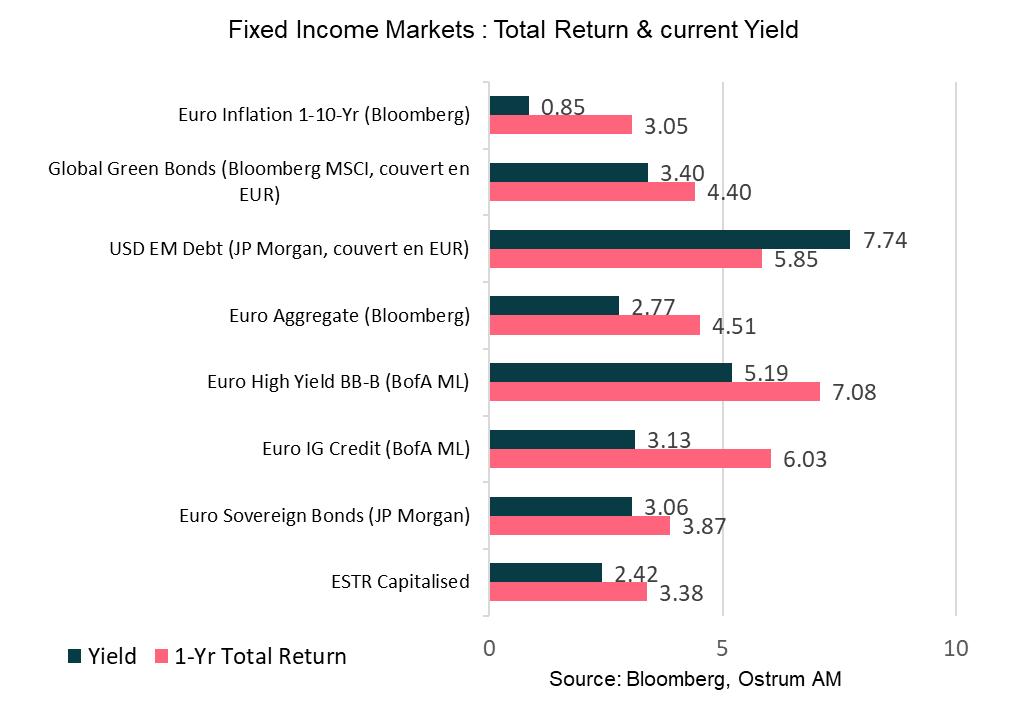

FIXED INCOME RETURNS & PERFORMANCES

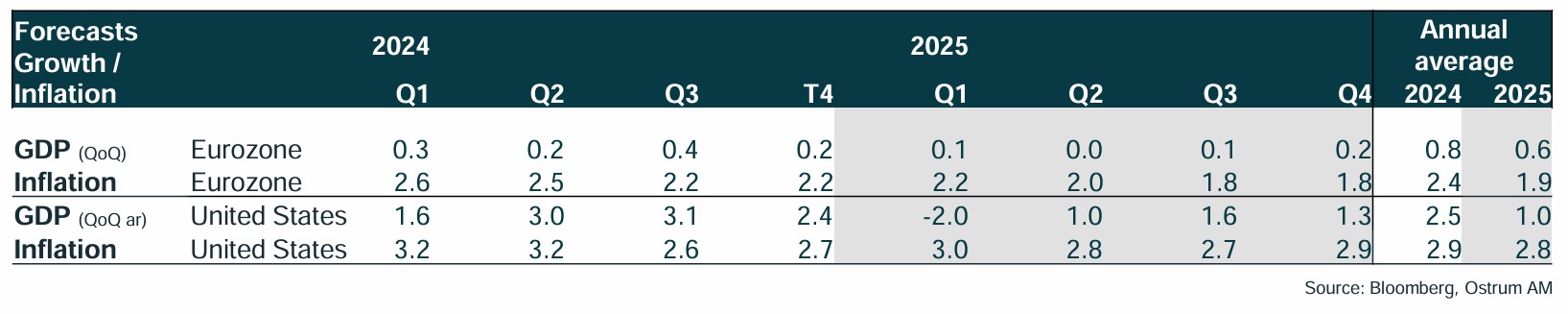

GROWTH & INFLATION

GROWTH

- The trade war initiated by Trump will weigh on global trade and growth, particularly affecting that of the United States. US growth is expected to be below its potential by 2025, with a significant risk of recession in the event of a "credit crunch."

- In the Eurozone, growth will be very weak due to the impact of rising tariffs and increased uncertainty affecting investment, employment, and consumption.

- China, the main target of Trump, will take measures to limit the impact of the prohibitive US tariffs (145%) on its growth.

INFLATION

- The dramatic increase in US tariffs will quickly be reflected in inflation in the US. The impact will be partly offset by the significant drop in oil prices, reflecting fears of a global recession, and a slowdown in demand. US inflation stood at 2.4% in March and 2.8% for core.

- In the Eurozone, inflation was 2.2% in March and 2.4% for core inflation. The suspension of the EU's retaliatory measures for 90 days implies a moderation of inflation in the short term due to reduced demand, falling oil prices, and the appreciation of the euro.

In China, deflation persists with an inflation rate of -0.1% in March.

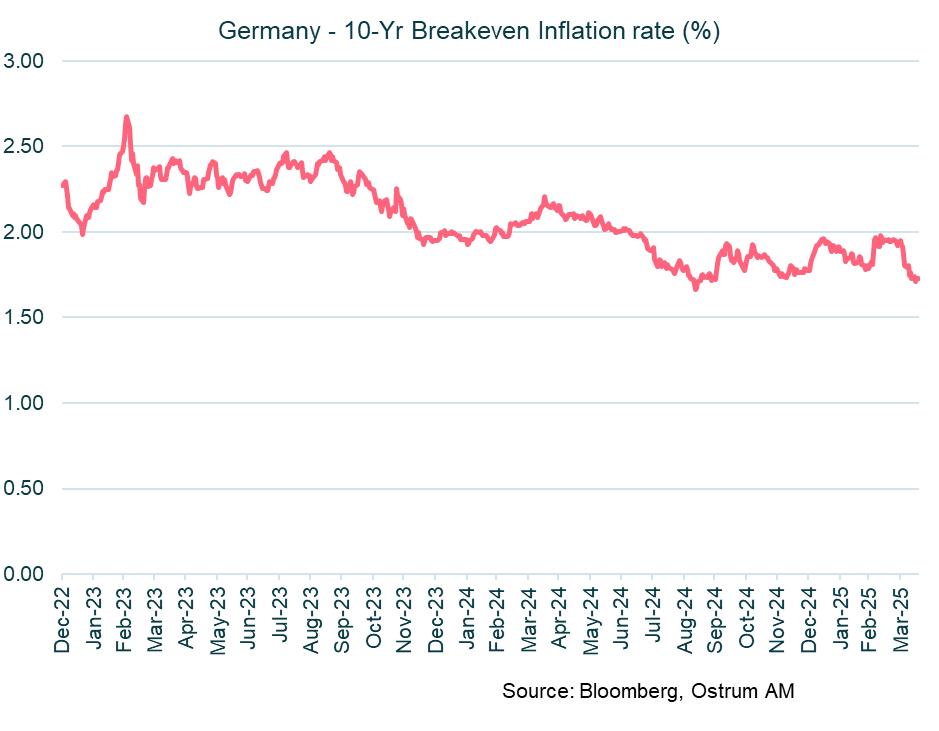

Eurozone inflation: The decline in oil prices has weighed on inflation. However, a moderate increase in breakeven inflation rates is likely.

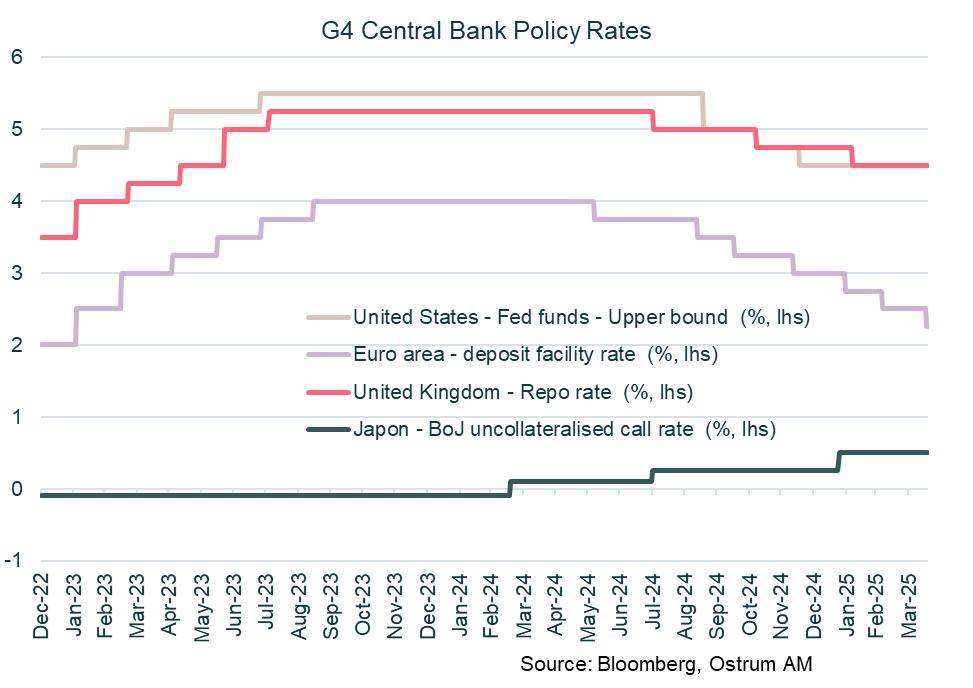

CENTRAL BANKS RATES

MONETARY POLICIES

CENTRAL BANKS ARE PLUNGED INTO THE UNCERTAINTY OF TRUMP’S POLICIES

The Fed is ready to act if necessary

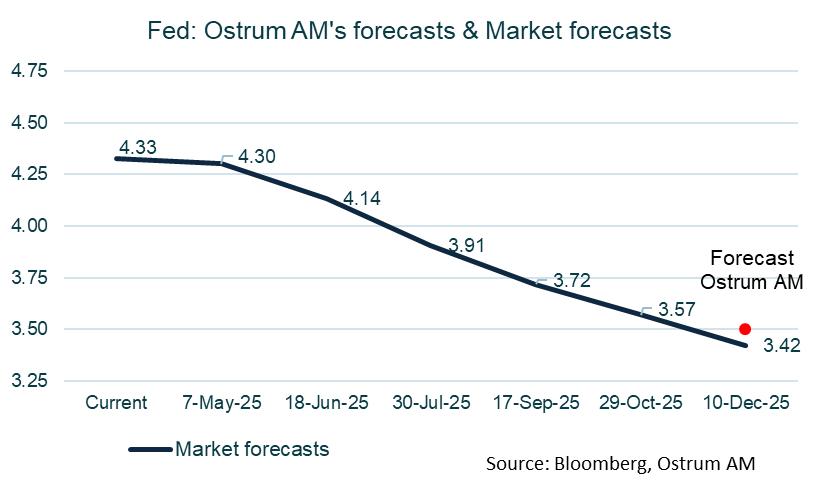

The Fed is in an uncomfortable position. The dramatic increase in US tariffs will lead to higher inflation and a rising unemployment rate due to a significant slowdown in growth. In the face of high uncertainty, Jerome Powell indicated on April 16 that the Fed must keep long-term inflation expectations well anchored. In this context, he believes that the central bank is well-positioned to wait for more visibility on the impact of the policies pursued by the White House on growth and inflation. On April 11, following the turmoil in financial markets, Susan Collins, President of the Boston Fed, stated that the Fed was ready to act if necessary to ensure financial stability. To prevent the US economy from entering a recession, we anticipate a 100 basis point cut in Fed rates by the end of the year. Furthermore, the Fed could slow the pace of balance sheet contraction or even suspend it until the debt ceiling issue is resolved.

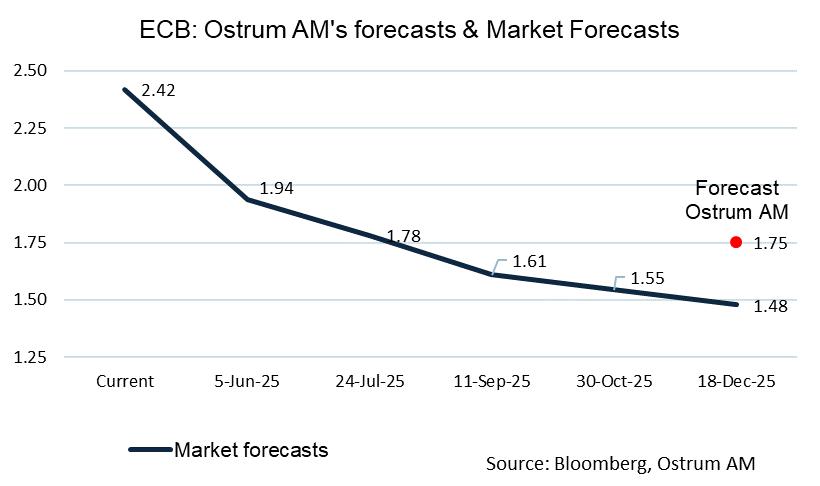

Continuation of rate cuts by the ECB

While some members of the ECB were in favor of taking a pause in the rate-cutting cycle that began last June, the shock to global trade and the increased uncertainty generated by the sharp rise in U.S. tariffs led the ECB to implement its seventh rate cut of 25 basis points on April 17. Christine Lagarde emphasized the numerous downside risks to growth due to the intensification of trade tensions while indicating that the net impact on inflation was highly uncertain. In this context, future monetary policy decisions will rely more than ever on upcoming data. Given the deterioration in growth prospects and the risk of more moderate inflation in the coming months, we anticipate two more rate cuts of 25 basis points by the end of the year. The ECB may also further reduce the pace of its balance sheet contraction and/or conduct additional targeted longer-term refinancing operations (TLTRO).

INTEREST RATES INDICATORS

EURO SOVEREIGN BONDS

- U.S. Rates: after a period of status quo, the Fed is expected to resume easing soon. US long-term rates remain highly volatile due to the uncertainty surrounding growth and inflation.

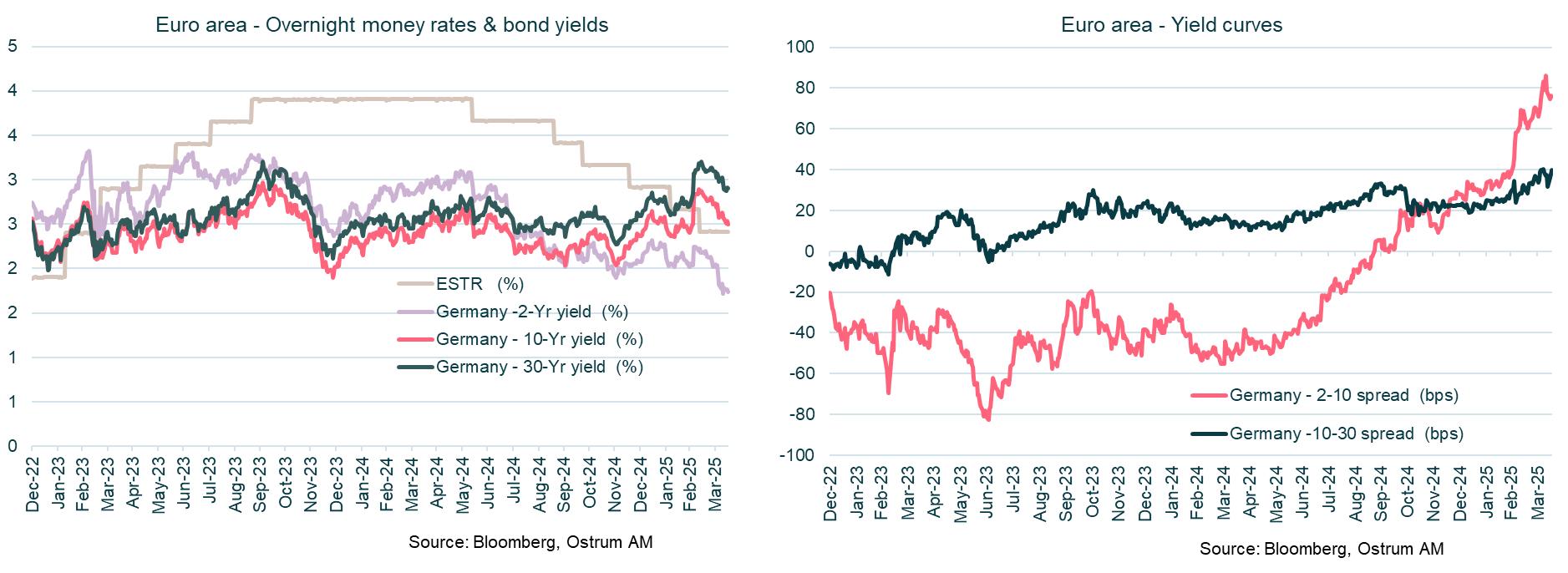

- European Rates: the ECB is expected to cut its rate to 1.75%. The 10-year Bund is stabilising at around 2.50%, impacted on the one hand by the Trump administration's increase in customs duties and on the other by Germany's more ambitious fiscal policy.

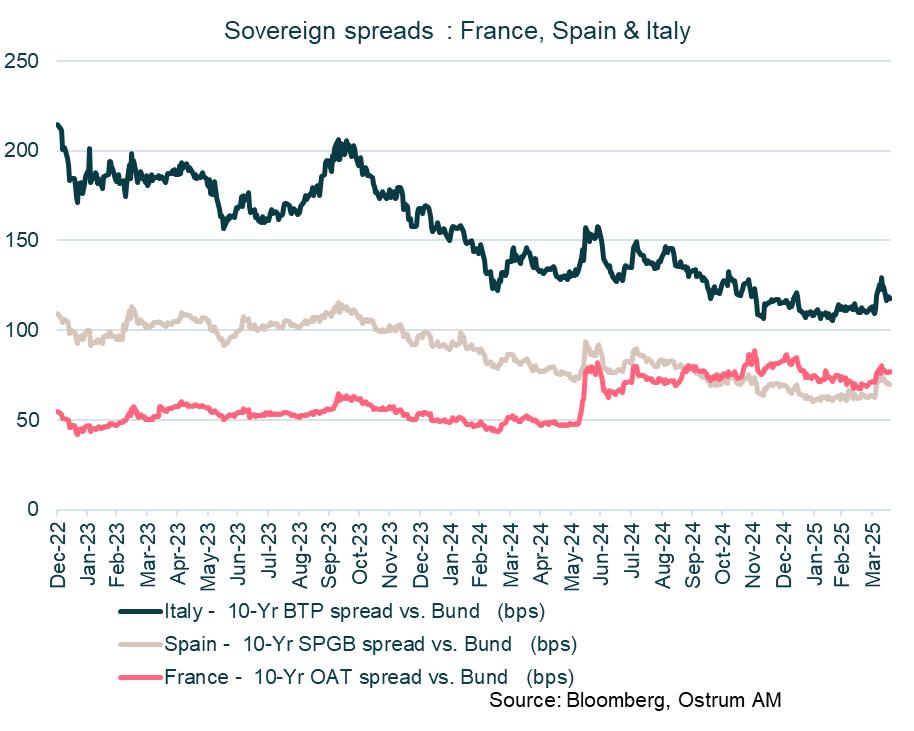

Sovereign Spreads: sovereign spreads eased at the start of the year but have been affected by the increase in market risk since Liberation Day.

- Performance was mixed in the first quarter of 2025 for the eurozone sovereigns, with positive results for short-term strategies (1-3 and 3-5 years) and negative results for longer-term strategies (5-7 years and all-maturity). It is noteworthy that the performances of short-term strategies are equivalent, if not better, than those of short-term credit.

- The period was marked by Germany's announcement to finance infrastructure and defense in March ("debt break"), adding momentum to the steepening of sovereign curves in the eurozone.

- Despite the "debt break," uncertainties regarding tariffs (USA) benefited the Bund (safe haven), leading to slight spread widening against Germany at the end of the quarter.

- In the inflation-linked bond market, breakeven rates (inflation expectations) remain low, indicating that investors perceive more growth risk than inflation risk.

Regarding ratings, most eurozone countries did not see any changes, but notable upgrades concerned the peripheral countries: Greece was upgraded to Investment Grade Baa3 (from Ba1) by Moody’s (14/03), and Portugal was upgraded to A by S&P with a positive outlook.

EMERGING BONDS

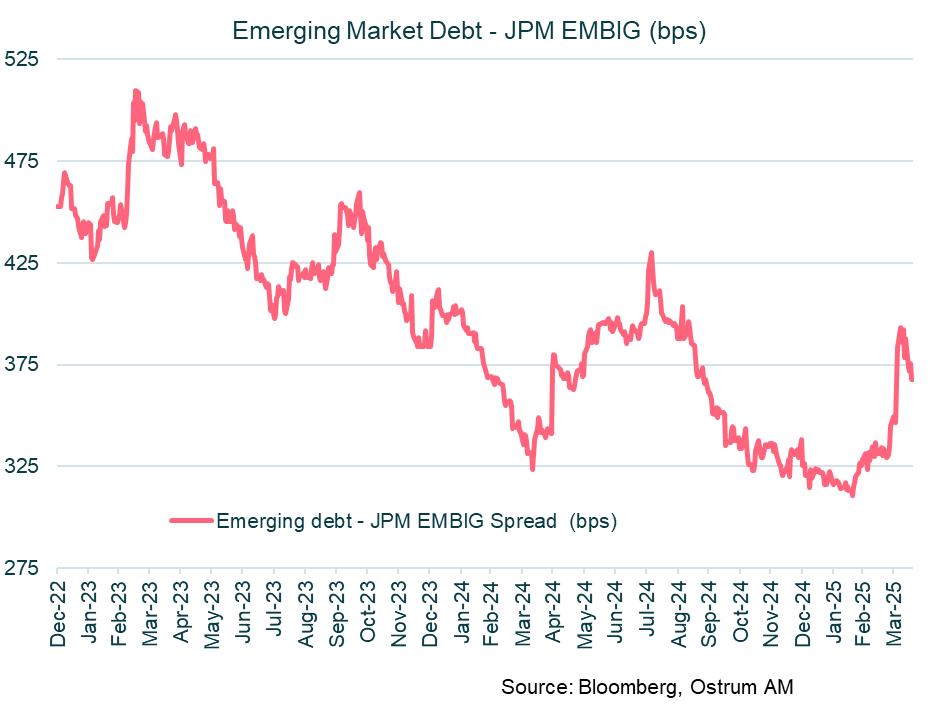

Emerging market spreads are poised to benefit from the Federal Reserve's monetary easing, despite the adverse effects of tariffs.

Mixed Short-Term Returns

- Mixed Short-Term Returns: The JP Morgan EMBI Global Diversified index showed a total return of -0.76% over one month but rebounded to 2.24% in the first quarter of 2025, a sign of volatility in the short term.

- Performance by Maturity: The 5-7 year segment was the best performer, returning 3.10% in Q1 2025, while the 10+ year category underperformed, returning just 2.30%.

- High Yield vs. High Grade: High-yield bonds returned 1.72% in Q1 2025, while high-grade bonds outperformed them by 2.78%, closer to the performance of US sovereign bonds (+3.22%). The different risk profiles of these two segments explain this difference in performance in a volatile environment.

- Comparative U.S. Treasury Performance: U.S. Treasuries outperformed many emerging market bonds with a total return of 3.22% in Q1 2025, highlighting a preference for safer assets amid uncertain market conditions.

CREDIT INDICATORS

EURO INVESTMENT GRADE CREDIT

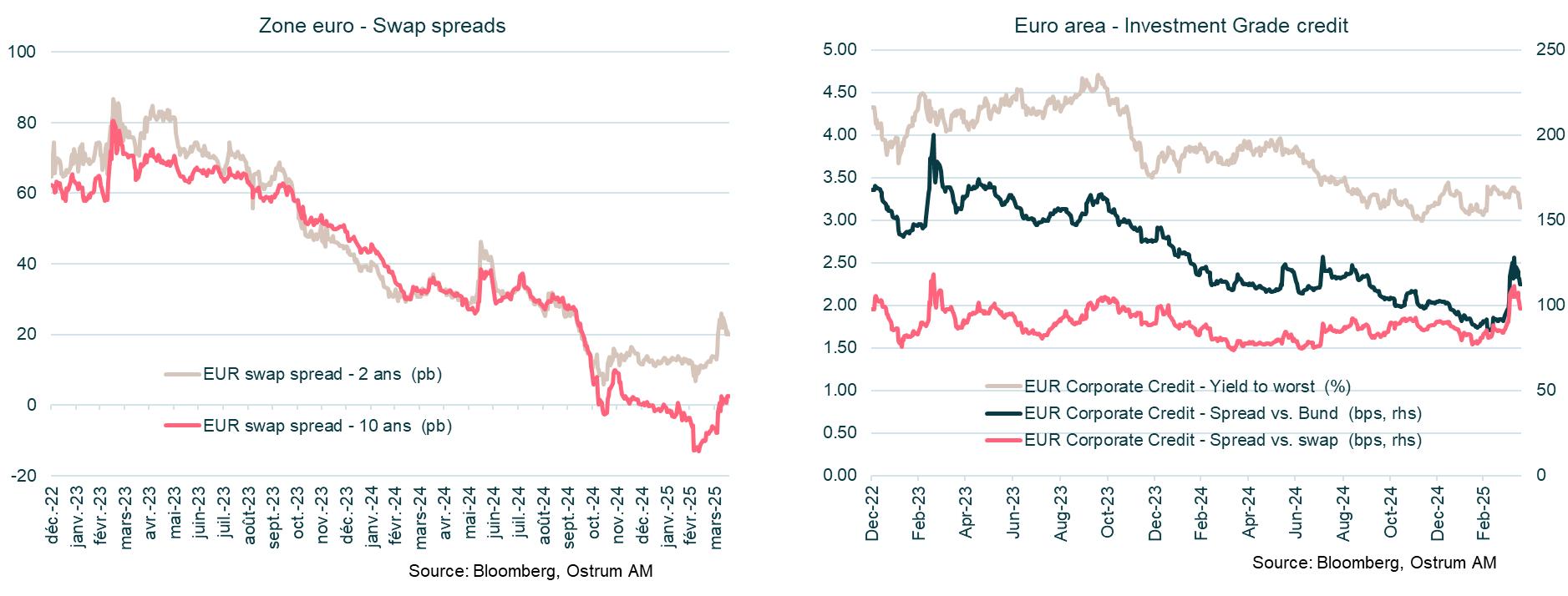

Investment Grade credit spreads are currently tight. In the absence of a recession, a tightening of these spreads is likely.

- Overall performance decline in Q1 2025: The ICE BofA ML Euro Corporate Index saw a performance of 4.67% in 2024, but this significantly dropped to just 0.16% in the first quarter of 2025, indicating a more challenging market environment for corporate bonds (mainly due to rates effect).

- Financial sector resilience: The financial sector performed relatively well, with a performance of 0.43% in Q1 2025, bolstered by subordinated financial bonds returning 0.55%. Financial subordinated bonds did better wth a performance of 0.55%.

- Sector variability in returns: Returns varied widely across sectors, with real estate leading at 8.70% for 2024 but only a marginal gain of 0.01% in Q1 2025. Conversely, leisure and healthcare sectors struggled, reporting returns of -0.64% and -0.47%, respectively, reflecting sector-specific challenges.

- Mixed results for industrials and consumer goods: The industrials sector reported a slight decline with a return of -0.02%, while consumer goods fared worse at -0.29%. This suggests that some traditionally stable sectors are facing headwinds in the current economic climate.

EURO HIGH YIELD CREDIT

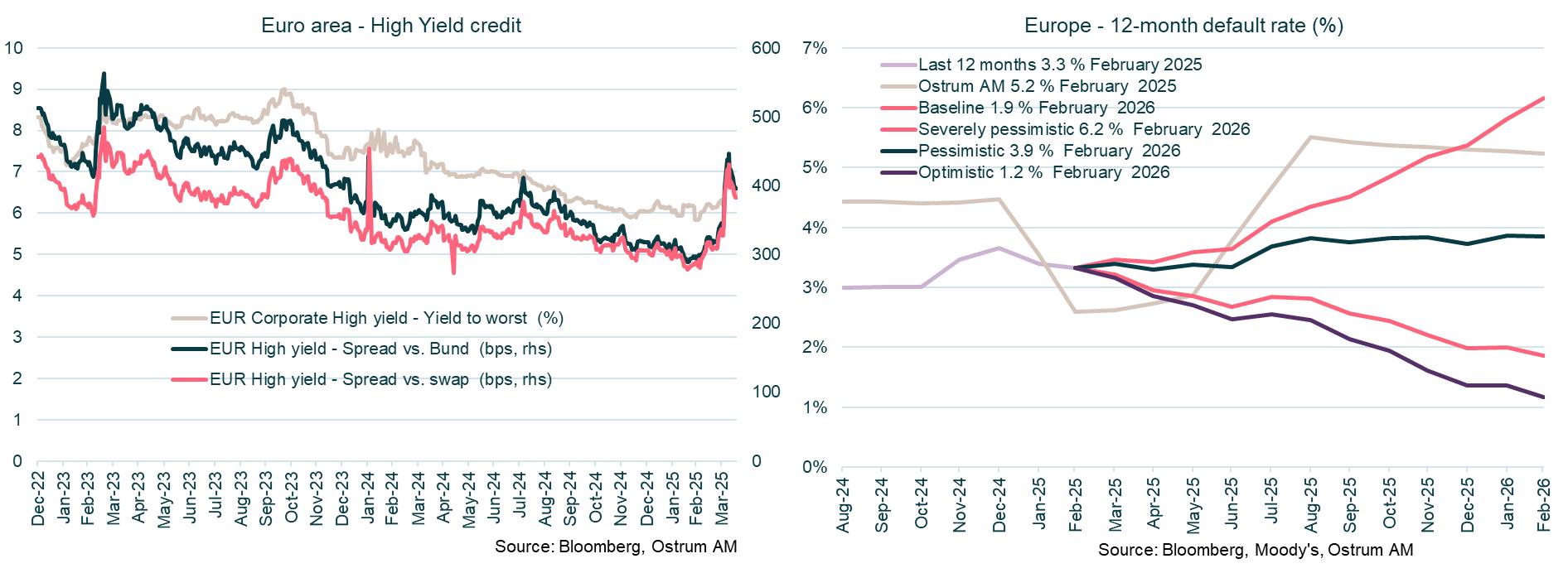

Valuations in the high-yield sector are expected to normalize over the course of the year, with the default rate remaining low.

Moderate Q1 2025 returns

- Strong 2024 performance: The Euro High Yield Index delivered an impressive total return of 8.63% in 2024, showcasing robust market conditions for high-yield bonds during that period.

- Moderate Q1 2025 returns: In the first quarter of 2025, performances were more subdued, with the overall Euro High Yield Index yielding only 0.64%, but outperforming Investment Grade bonds.

- Sector variability: Financial high-yield bonds outperformed other categories with a return of 0.91% in Q1 2025, while non-financial high-yield bonds returned 0.59%. This highlights a divergence in performance between financial and non-financial sectors.

- Fallen angels and floating rate bonds stand out: The Euro Fallen Angel High Yield segment showed a notable return of 1.35% in Q1 2025, while Euro Floating Rate High Yield bonds achieved 1.61%, indicating strong interest in these specific categories amid a highly volatile interest rate environment.

FOCUS ON SUSTAINABLE BONDS

QUARTERLY GRAPH

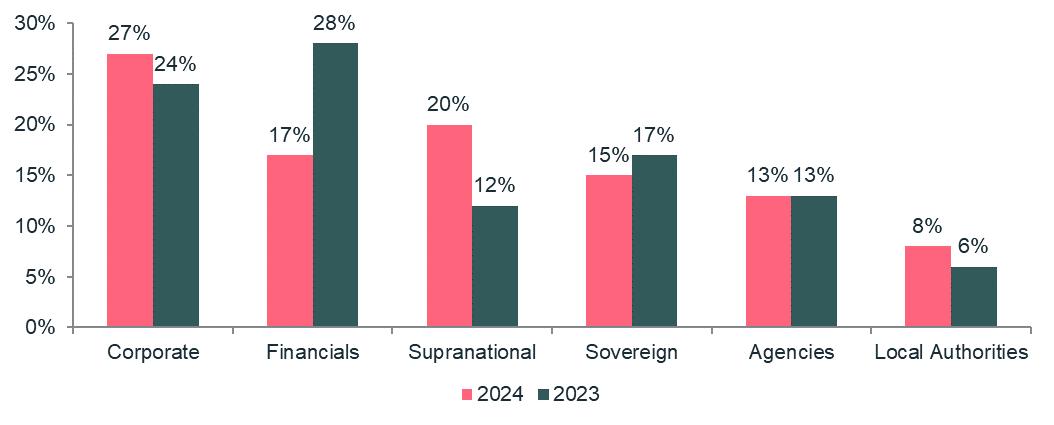

Sustainable bond issuances per sectors

The sustainable bond market experienced significant evolutions between 2023 and 2024, notably on issuer types:

- Increase of Corporate issuers, from 24% to 27% and a more important increase of Supranationals, from 12% to about 20%.

- Drop in Financial issuers from 28% in 2023 to only 17% in 2024.

- The European Union Green Bonds Standard (EU GBS) represent a new standard to harmonize the green bonds market. it provides a framework to help issuers align their green bond projects with activities recognized by the European taxonomy. Since the beginning of 2025, Île-de-France Mobilités and A2A (Italian utility company) have been the first entities to align their green bond issues with this new standard. A2A has issued the first green bond in the new format of the European Union worth €500M with a maturity of 10 years. The funds raised will be fully invested in activities that fully comply with the European taxonomy.

- “Orange bonds”, a new sustainable debt instrument inspired by the United Nations' Sustainable Development Goal No. 5, aim to promote gender equality and the economic empowerment of women. Designed to complement market standards, such as the ICMA principles, they could generate $28bn in growth for the global economy by 2025, according to the Orange Movement.

- In January, the Republic of Italy issued its 5th green bond (20Y maturity and €5Bn for the green tranche), making the government’s outstanding green bonds more that €45Bn as of today. This new issuance has been largely oversubscribed with a demand exceeding about €130Bn.

- Île-de-France Mobilités (IDFM), transportation services in the Paris region, has launched a €1bn European green bond with a 20-year maturity, attracting exceptional interest with demand exceeding €6bn. This bond complies with the EU Green Bond Standard, effective since December 2024. IDFM is actively committed to sustainable mobility, with significant projects such as the modernization of electric trains and the goal of having a fully clean bus fleet by 2029.

- Motability operations issued, in January 2025, a new 12-year social bond in euros to finance vehicles and other transportation systems adapted to disabled people. Since 2021, the group only issued bonds through its “social” framework.

DASHBOARD - OSTRUM AM VIEWS

MACROECONOMIC OUTLOOK • EUROZONE AND UNITED STATES

MARKET VIEWS