Every month, find out all about the sustainable market bonds news in our newsletter "MySustainableCorner".

This month in a nutshell

- Social bonds issued by European financial institutions are still relatively rare in the sustainable bond market. According to Environmental Finance, social bonds issued by financial institutions have reached $88 billion to date, compared to $440 billion of green bonds issued. Investors show a strong appetite for this type of bonds, as evidenced by the recent success of the social bond issued by Deutsche Bank, which was oversubscribed by investors more than 13 times.

- The issuance of sustainable bonds in 2024 – green, social, sustainable, sustainability-linked bonds and transition bonds – exceeded the $500 billion mark (provisional figures from Environmental Finance Data as of early-July 2024). The sustainable bond market reached this milestone in the middle of the year, for the fourth consecutive year: the market is on track to achieve 1 trillion issues by the end of the year.

- The European Central Bank (ECB) sets decarbonization targets for its corporate bond portfolios. For the first time, it aims for near-term reductions in greenhouse gas emissions in its €352 billion ($376 billion) corporate bond portfolio and considers "remedial actions" if they deviate from a strict decarbonization trajectory.

- The Climate Bonds Initiative, the Principles for Responsible Investment (PRI), and the United Nations Environment Programme Finance Initiative (UNEP FI) have announced their collaboration to promote global interoperability and the implementation of sustainable finance taxonomies and other frameworks. The aim is to reach a consensus on the definitions and concepts of taxonomy (among regulators, policymakers, and users), support the development of taxonomies, and provide tools for their implementation.

Figure of the month

Lithium recycling rate, allowing to reduce environmental impact and mining.

Source: CATL (Contemporary Amperex Technology Co.)

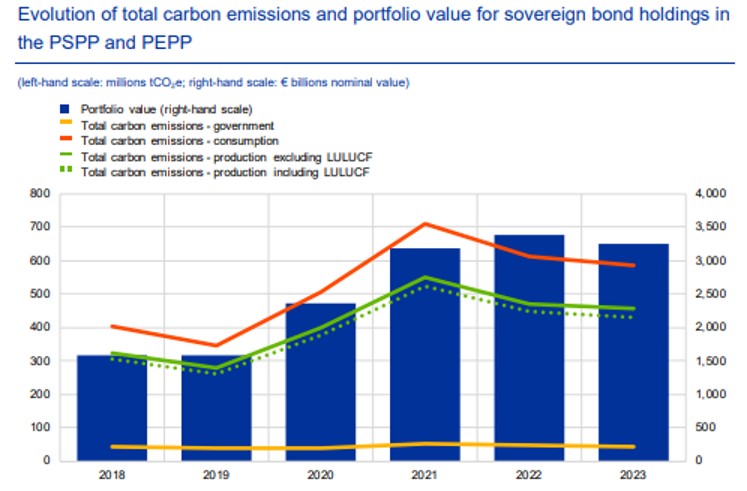

Chart of the month

Evolution of total carbon emissions and portfolio value for sovereign bond holdings in the PSPP and PEPP

In recent years, there has been an improvement in the availability of climate data for sovereign bonds, reflecting a wider market trend towards more comprehensive climate-related reporting.

Source: ISS, Carbon4 Finance, World Bank, Bloomberg, UNFCCC and ECB calculations

PSPP: Public Sector Purchase Programme

PEPP: Pandemic Emergency Purchase Programme

LULUCF: Land-Use, Land Use Change and Forestry